Ben Franklin is often attributed as saying only two things are certain in life: death and taxes. While this quote rings true, it can be assumed Franklin didn’t predict some entities would be handed a tax bill of $71 million for property taxes alone, but that is exactly what Manhattan’s GM Building faced in 2016.

According to research conducted by COMMERCIALCafé, the GM Building had the highest property taxes in the country in 2016. Of the top 10 properties with the highest taxes, nine were associated with office buildings, but it is a residential community that takes the second spot on the list. Stuyvesant Town came in behind the General Motors Building, paying $60.5 million for property taxes in 2016.

The Metlife Building, 1345 Avenue of the Americas, and 1221 Avenue of the Americas, all in New York City, round out the top five.

Each property in the top ten resides in New York. In fact, you need to go down the list all the way to number 13 before arriving at a property not in New York, but Illinois. The Illinois entry to the list isn’t what you would expect, either. Not only was the first Illinois building on the list not the Willis Tower, but it wasn’t even a building in Chicago.

The first building on the list not in New York is the Exelon – Byron Nuclear Generating Station in Byron, Ill. The nuclear station paid $36.5 million in property taxes in 2016. Chicago’s Willis Tower doesn’t make an appearance until number 28 on the list, with $28.4 million paid in property taxes.

Minnesota’s Mall of America makes the list as the highest retail property at number 25 with $30 million in 2016 property taxes. Woodfield Mall, in Schaumburg, Ill., is the next closest retail property on the list at number 40 with $24 million paid in 2016.

The New York Marriott Marquis Hotel is the highest hotel on the list, at number 11, with a total of $36.6 million paid in 2016. The next closest was the New York Hilton Midtown Manhattan Hotel at number 39, with a total of $24.3 million.

Some buildings you may expect to see on the list, such as New York’s Chrysler Building or One World Trade Center, are nowhere to be found. This is because these structures, and other landmark buildings (Woolworth Building) are tax exempt. The Port Authority of New York & New Jersey, for example, owns One World Trade Center, so it doesn’t pay property taxes.

To view the entire Top 100 list, click here.

Related Stories

Market Data | Nov 15, 2017

Architecture Billings bounce back

Business conditions remain uneven across regions.

Market Data | Nov 14, 2017

U.S. construction starts had three consecutive quarters of positive growth in 2017

ConstructConnect’s quarterly report shows the most significant annual growth in the civil engineering and residential sectors.

Market Data | Nov 3, 2017

New construction starts in 2018 to increase 3% to $765 billion: Dodge report

Dodge Outlook Report predicts deceleration but still growth, reflecting a mixed pattern by project type.

Market Data | Nov 2, 2017

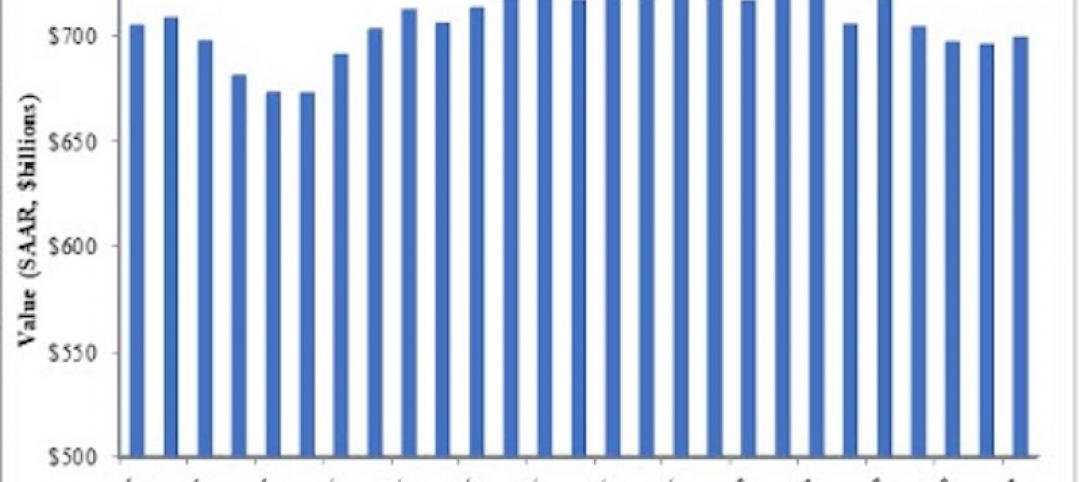

Construction spending up in September; Down on a YOY basis

Nonresidential construction spending is down 2.9% on a year-over-year basis.

Sponsored | Industry Research | Oct 26, 2017

Get clients to pay you faster with these five tips

Here are 5 ways to avoid a cash crunch by doing your part to help clients make their payments on time.

Market Data | Oct 19, 2017

Architecture Billings Index backslides slightly

Business conditions easing in the West.

Industry Research | Oct 9, 2017

AEC website design trends in 2017 – Planning for 2018

A website that’s behind the times is hurting your business.

Industry Research | Oct 3, 2017

Nonresidential construction spending stabilizes in August

Spending on nonresidential construction services is still down on a YOY basis.

Market Data | Sep 21, 2017

Architecture Billings Index continues growth streak

Design services remain in high demand across all regions and in all major sectors.

Market Data | Sep 21, 2017

How brand research delivers competitive advantage

Brand research is a process that firms can use to measure their reputation and visibility in the marketplace.