In the United States alone, an estimated 24 billion sf of gypsum board, nearly 30 billion sf of flooring, and 11.5 billion sf of insulation are sold annually. Even a modest reduction in the carbon footprint associated with these products could contribute substantively to creating a healthier built environment.

Perkins&Will, in collaboration with Healthy Building Network, a nonprofit research organization, has posted online two reports aimed at changing the way AEC firms select sustainable, lower-carbon building materials.

Drywall and flooring’s production and transportation have notable environmental footprints, and the products can emit hazardous chemicals. Insulation releases greenhouse gases throughout its lifecycle, and can contain toxic chemicals that make interior spaces less safe.

One of the reports, titled “Embodied Carbon and Material Health in Gypsum Drywall and Flooring,” identifies key drivers of embodied carbon (EC) by looking at examples of product categories that are specified frequently for building projects. For gypsum drywall, the biggest opportunity to work toward lower carbon is to reduce energy use at the manufacturing site, states the report. To work toward material health, reducing mercury that drywall releases by using natural, rather than synthetic, gypsum is a key driver.

The report asserts that choosing a product type with lower impacts is the greatest opportunity to reduce EC and avoid chemicals of concern in flooring. Plant-derived bio-based flooring such as linoleum, cork, and hardwood tend to be lower in EC and comprise safer base materials. The report also suggests ways to lessen the impact of carpeting and resilient flooring, such as by reducing the impacts associated with carpet fiber production, and increasing the service life of resilient flooring.

Insulation is not one size fits all

The second report, titled “Embodied Carbon and Material Health in Insulation,” translates results from assessment tools into guidance for manufacturers, AEC firms, and green building programs to optimize their decisions and promote and select healthier, low-carbon products.

The research finds that not all insulation can be used for all applications, nor are all insulation types exchangeable for one another. When insulation is normalized by R value (which measures how well the product resists heat), the biggest opportunities to reduce EC and prioritize material health revolve around product choices.

The report also recommends giving preference to insulation manufacturers with established take-back programs, and favoring products with Health Product Declarations or Environmental Product Declarations that are third-party verified. An Appendix in the insulation report provides lists of product types that specifiers should prefer, reduce, or avoid for lower EC and better material health.

“Our research collaboration with Healthy Building Network underscores the importance of industry partnerships in effecting change,” says Leigh Christy, Principal and co-director of Research at Perkins&Will. “These reports give project teams and the industry at large vital information to make informed decisions about materials and products that are good for people and the planet.”

Related Stories

Market Data | May 1, 2017

Nonresidential Fixed Investment surges despite sluggish economic in first quarter

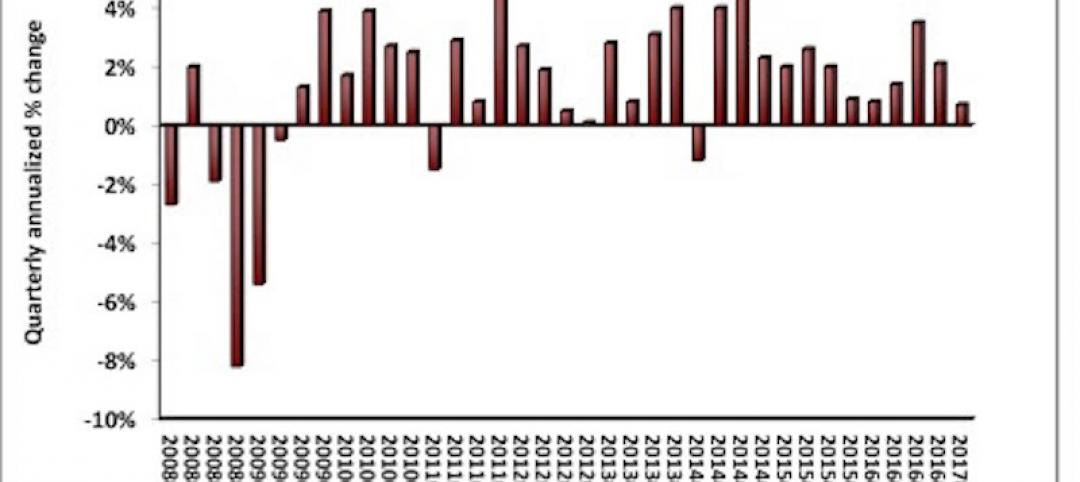

Real gross domestic product (GDP) expanded 0.7 percent on a seasonally adjusted annualized rate during the first three months of the year.

Industry Research | Apr 28, 2017

A/E Industry lacks planning, but still spending large on hiring

The average 200-person A/E Firm is spending $200,000 on hiring, and not budgeting at all.

Architects | Apr 27, 2017

Number of U.S. architects holds steady, while professional mobility increases

New data from NCARB reveals that while the number of architects remains consistent, practitioners are looking to get licensed in multiple states.

Market Data | Apr 6, 2017

Architecture marketing: 5 tools to measure success

We’ve identified five architecture marketing tools that will help your firm evaluate if it’s on the track to more leads, higher growth, and broader brand visibility.

Market Data | Apr 3, 2017

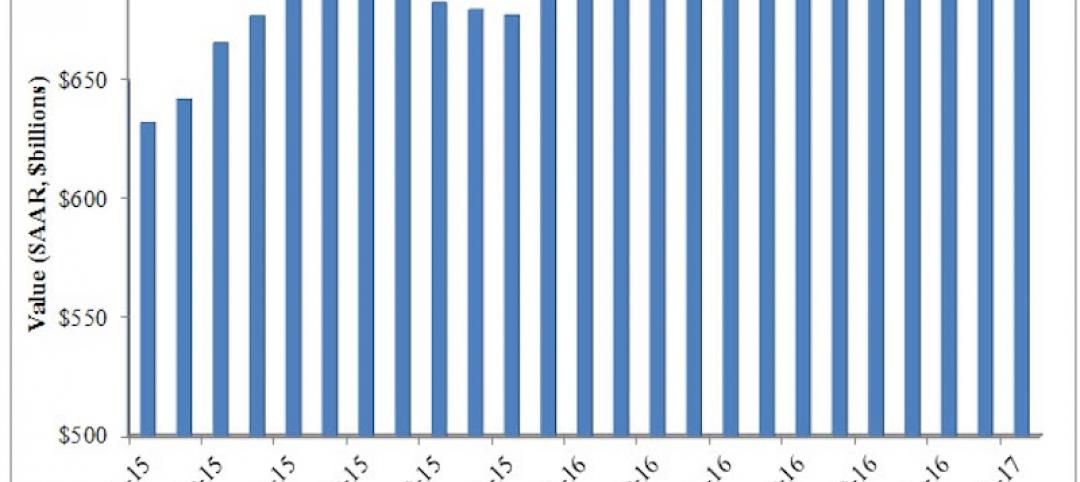

Public nonresidential construction spending rebounds; overall spending unchanged in February

The segment totaled $701.9 billion on a seasonally adjusted annualized rate for the month, marking the seventh consecutive month in which nonresidential spending sat above the $700 billion threshold.

Market Data | Mar 29, 2017

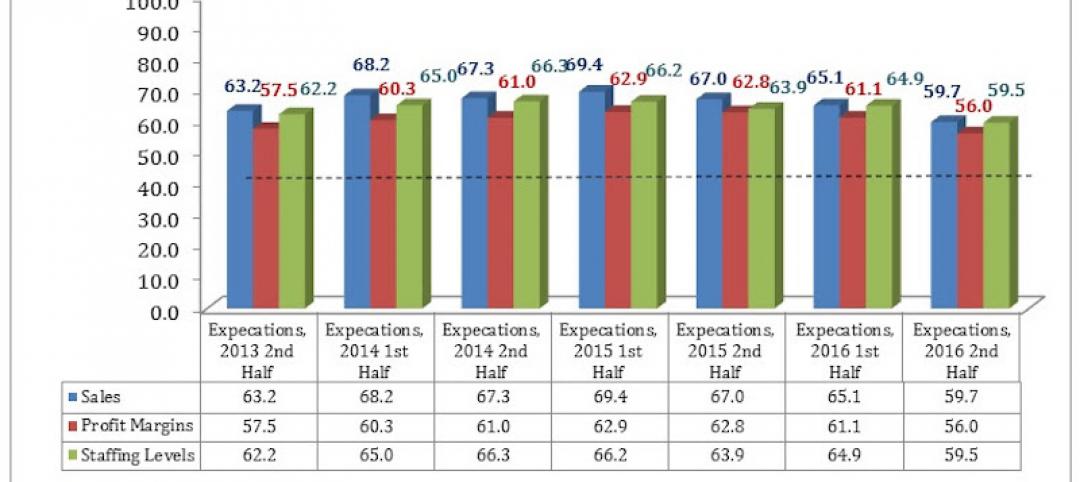

Contractor confidence ends 2016 down but still in positive territory

Although all three diffusion indices in the survey fell by more than five points they remain well above the threshold of 50, which signals that construction activity will continue to be one of the few significant drivers of economic growth.

Industry Research | Mar 24, 2017

The business costs and benefits of restroom maintenance

Businesses that have pleasant, well-maintained restrooms can turn into customer magnets.

Industry Research | Mar 22, 2017

Progress on addressing US infrastructure gap likely to be slow despite calls to action

Due to a lack of bipartisan agreement over funding mechanisms, as well as regulatory hurdles and practical constraints, Moody’s expects additional spending to be modest in 2017 and 2018.

Industry Research | Mar 21, 2017

Staff recruitment and retention is main concern among respondents of State of Senior Living 2017 survey

The survey asks respondents to share their expertise and insights on Baby Boomer expectations, healthcare reform, staff recruitment and retention, for-profit competitive growth, and the needs of middle-income residents.

Industry Research | Mar 14, 2017

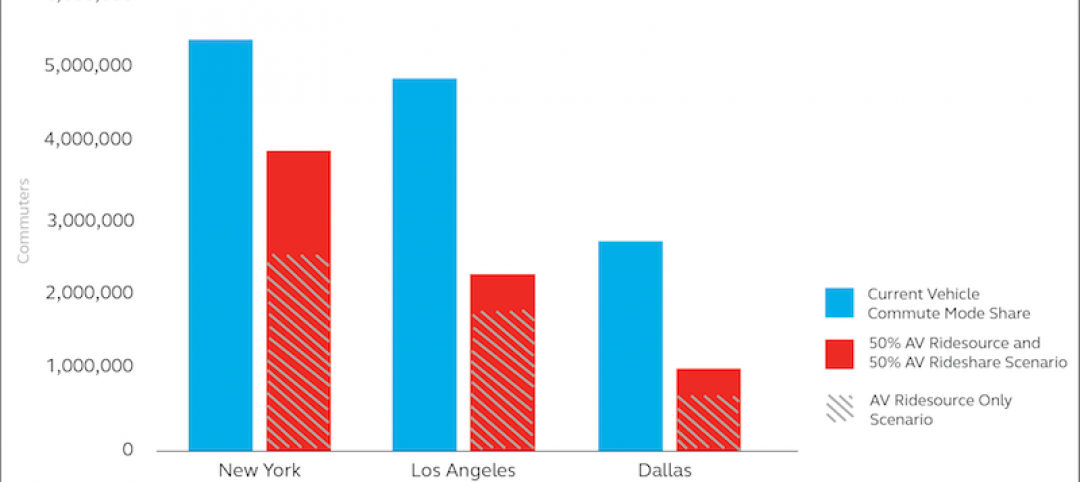

6 ways cities can prepare for a driverless future

A new report estimates 7 million drivers will shift to autonomous vehicles in 3 U.S. cities.