In the United States alone, an estimated 24 billion sf of gypsum board, nearly 30 billion sf of flooring, and 11.5 billion sf of insulation are sold annually. Even a modest reduction in the carbon footprint associated with these products could contribute substantively to creating a healthier built environment.

Perkins&Will, in collaboration with Healthy Building Network, a nonprofit research organization, has posted online two reports aimed at changing the way AEC firms select sustainable, lower-carbon building materials.

Drywall and flooring’s production and transportation have notable environmental footprints, and the products can emit hazardous chemicals. Insulation releases greenhouse gases throughout its lifecycle, and can contain toxic chemicals that make interior spaces less safe.

One of the reports, titled “Embodied Carbon and Material Health in Gypsum Drywall and Flooring,” identifies key drivers of embodied carbon (EC) by looking at examples of product categories that are specified frequently for building projects. For gypsum drywall, the biggest opportunity to work toward lower carbon is to reduce energy use at the manufacturing site, states the report. To work toward material health, reducing mercury that drywall releases by using natural, rather than synthetic, gypsum is a key driver.

The report asserts that choosing a product type with lower impacts is the greatest opportunity to reduce EC and avoid chemicals of concern in flooring. Plant-derived bio-based flooring such as linoleum, cork, and hardwood tend to be lower in EC and comprise safer base materials. The report also suggests ways to lessen the impact of carpeting and resilient flooring, such as by reducing the impacts associated with carpet fiber production, and increasing the service life of resilient flooring.

Insulation is not one size fits all

The second report, titled “Embodied Carbon and Material Health in Insulation,” translates results from assessment tools into guidance for manufacturers, AEC firms, and green building programs to optimize their decisions and promote and select healthier, low-carbon products.

The research finds that not all insulation can be used for all applications, nor are all insulation types exchangeable for one another. When insulation is normalized by R value (which measures how well the product resists heat), the biggest opportunities to reduce EC and prioritize material health revolve around product choices.

The report also recommends giving preference to insulation manufacturers with established take-back programs, and favoring products with Health Product Declarations or Environmental Product Declarations that are third-party verified. An Appendix in the insulation report provides lists of product types that specifiers should prefer, reduce, or avoid for lower EC and better material health.

“Our research collaboration with Healthy Building Network underscores the importance of industry partnerships in effecting change,” says Leigh Christy, Principal and co-director of Research at Perkins&Will. “These reports give project teams and the industry at large vital information to make informed decisions about materials and products that are good for people and the planet.”

Related Stories

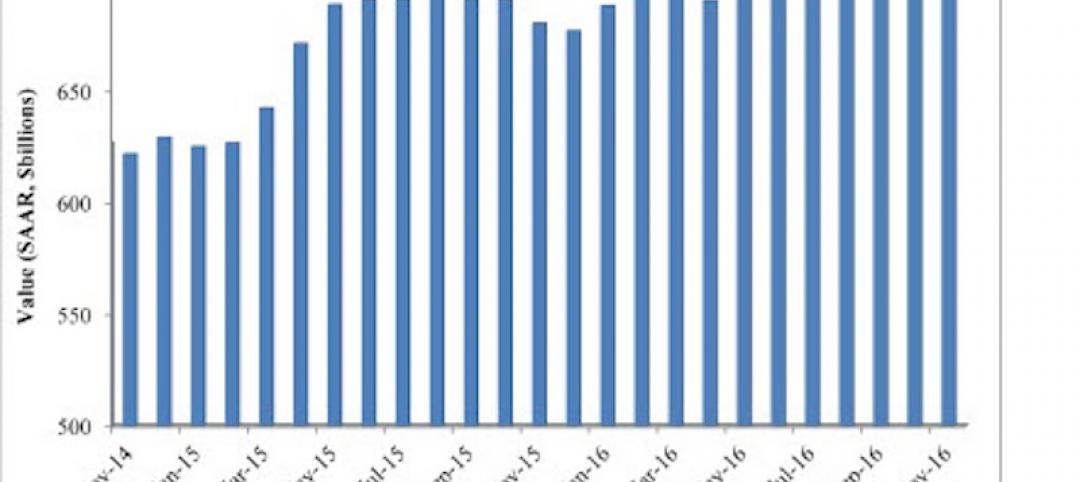

Market Data | Jan 9, 2017

Trump market impact prompts surge in optimism for U.S. engineering firm leaders

The boost in firm leader optimism extends across almost the entire engineering marketplace.

Market Data | Jan 5, 2017

Nonresidential spending thrives in strong November spending report

Many construction firms have reported that they remain busy but have become concerned that work could dry up in certain markets in 2017 or 2018, says Anirban Basu, ABC Chief Economist.

Market Data | Dec 13, 2016

ABC predicts modest growth for 2017 nonresidential construction sector; warns of vulnerability for contractor

“The U.S. economy continues to expand amid a weak global economy and, despite risks to the construction industry, nonresidential spending should expand 3.5 percent in 2017,” says ABC Chief Economist Anirban Basu.

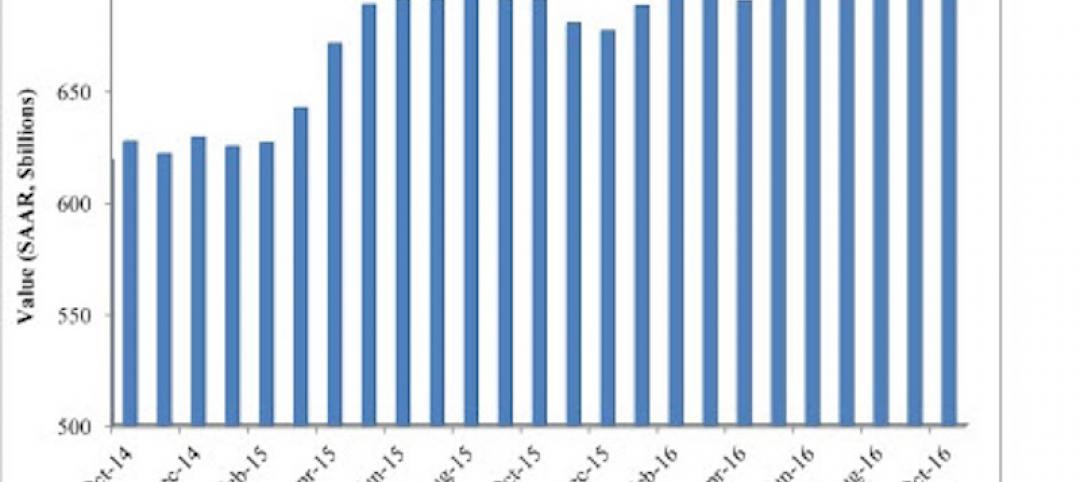

Market Data | Dec 2, 2016

Nonresidential construction spending gains momentum

Nonresidential spending is now 2.6 percent higher than at the same time one year ago.

Market Data | Nov 30, 2016

Marcum Commercial Construction Index reports industry outlook has shifted; more change expected

Overall nonresidential construction spending in September totaled $690.5 billion, down a slight 0.7 percent from a year earlier.

Industry Research | Nov 30, 2016

Multifamily millennials: Here is what millennial renters want in 2017

It’s all about technology and convenience when it comes to the things millennial renters value most in a multifamily facility.

Market Data | Nov 29, 2016

It’s not just traditional infrastructure that requires investment

A national survey finds strong support for essential community buildings.

Industry Research | Nov 28, 2016

Building America: The Merit Shop Scorecard

ABC releases state rankings on policies affecting construction industry.

Market Data | Nov 17, 2016

Architecture Billings Index rebounds after two down months

Decline in new design contracts suggests volatility in design activity to persist.

Industry Research | Nov 8, 2016

Austin, Texas wins ‘Top City’ in the Emerging Trends in Real Estate outlook

Austin was followed on the list by Dallas/Fort Worth, Texas and Portland, Ore.