Driven by sparser availability of warehouses, offices, and retail, the real estate industry is positioned for solid growth this year and next, before tapering off at a still-respectable $500 billion in annual transactions in 2017.

Those predictions highlight Urban Land Institute’s (ULI) latest three-year Real Estate Consensus Forecast, based on the median of forecasts from 46 economists and analysts at 33 leading real estate organizations, who were surveyed from February 27 through March 23.

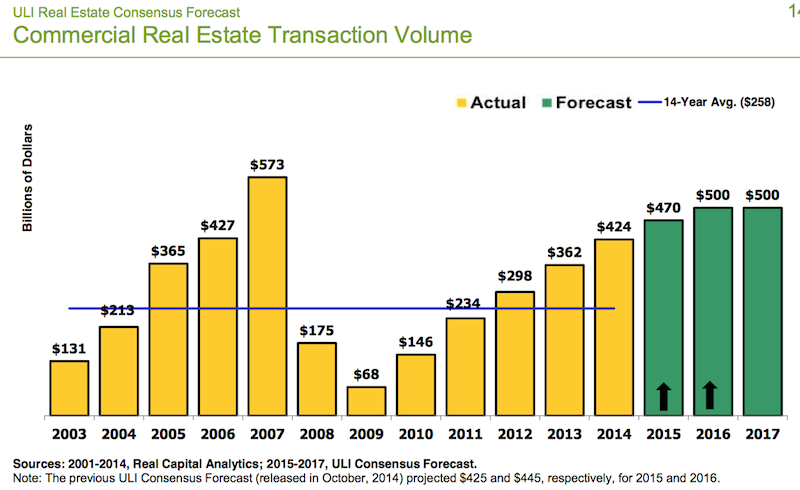

The expert consensus projects an 18% increase, to $470 billion, in commercial real estate transactions for 2015, followed by a 6.4%, to $500 billion, in 2016.

ULI’s forecast is more optimistic for the years 2015 and 2016 than previous forecasts for all indicators except single-family home starts.

The experts’ optimism stems, in part, from their predictions for healthy GDP growth, which they expect to rise by 3% this year and next, and by 2.8% in 2017. If realized, those would be the highest annual growth rates in nine years.

In addition, the U.S. economy has been experiencing its highest rate of job growth in 15 years. “For real estate, it’s really about jobs,” says William Maher, a director with LaSalle Investment Management, who analyzed the results of the survey for ULI.

The Consensus Forecast provides oultooks for specific construction segments:

• Institutional real estate assets are expected to provide total returns across all sectors of 11% in 2015, moderating to 10% in 2016 and 9% in 2017. By property type, returns should be strongest for industrial and office, followed by retail and apartments, in all three years.

• Vacancy rates are expected to decrease modestly for office and retail over all three forecast years. Industrial availability rates and hotel occupancy rate are forecasted to improve modestly in 2015 and 2016 and level off in 2017. Apartment vacancy rates are expected to begin rising slightly to 4.7% in 2015, 5% in 2016, and 5.3% in 2017. The 2017 forecast is just below the 20-year average vacancy rate.

• CRBE estimated that the availability rate for the industrial/warehouse sector declined to 10.3% at the end of 2014, coming in just below the 20-year average for the first time since 2007. ULI Consensus Forecast predicts availability rates will continue to decline in 2015 and 2016, with year-end vacancy rates at 9.8% and 9.6%, respectively, and remain steady in 2017 at 9.6%. Consequently, warehouse rental rate growth should continue, by 4% in 2015, 3.8% in 2016, and 3.1% in 2017, all above the 20-year average growth rate.

• The same pattern can be found in office vacancy rates, which declined for the fourth straight year, to 13.9% in 2014. That pattern is expected to continue through 2017, sparking further appreciation in office rental rates, which according the Consensus Forecast will increase by 4% in 2015 and 4.1% in 2016. Rental rate growth is expected to moderate slightly in 2017 to 3.5%.

• The Consensus foresees improvements in retail availability. And with rents increasing in 2014 for the first time in six years, the Consensus Forecast expects rental rates to sustain this growth, increasing by 2% in 2015, 3% in 2016, and 2.9% 2017.

ULI will release its next Consensus Forecast in October.

Related Stories

Retail Centers | Nov 12, 2020

Concepts’ flagship takes gallery display approach

The streetwear retailer forges its online and brick-and-mortar presence.

AEC Tech | Nov 12, 2020

The Weekly show: Nvidia's Omniverse, AI for construction scheduling, COVID-19 signage

BD+C editors speak with experts from ALICE Technologies, Build Group, Hastings Architecture, Nvidia, and Woods Bagot on the November 12 episode of "The Weekly." The episode is available for viewing on demand.

Warehouses | Nov 9, 2020

Lowe’s rides ecommerce wave by expanding its distribution and delivery capacities

The retail giant will also open four more bulk warehouses, including a 1.2-million-sf DC in Alabama it is building with Clayco.

Retail Centers | Nov 2, 2020

Chick-fil-A introduces modular building program for rebuilding and remodeling existing restaurants

The first location to use this rebuild style reopens on Oct. 15 near Atlanta.

Adaptive Reuse | Oct 26, 2020

Mall property redevelopments could result in dramatic property value drops

Retail conversions to fulfillment centers, apartments, schools, or medical offices could cut values 60% to 90%.

Retail Centers | Sep 17, 2020

The Weekly show: Breaking the rules of retail, and the Household Model for assisted living facilities

This week on The Weekly, BD+C editors spoke with leaders from CallisonRTKL, MBH Architects, and McMillan Pazdan Smith on three topics: breaking the rules of retail, the Household Model for assisted living facility design, and designing labs to address the coronavirus and future health events.

Airports | Sep 10, 2020

The Weekly show: Curtis Fentress, FAIA, on airport design, and how P3s are keeping university projects alive

The September 10 episode of BD+C's "The Weekly" is available for viewing on demand.

Giants 400 | Aug 28, 2020

2020 Giants 400 Report: Ranking the nation's largest architecture, engineering, and construction firms

The 2020 Giants 400 Report features more than 130 rankings across 25 building sectors and specialty categories.

Coronavirus | Aug 25, 2020

Video: 5 building sectors to watch amid COVID-19

RCLCO's Brad Hunter reveals the winners and non-winners of the U.S. real estate market during the coronavirus pandemic.

Retail Centers | Aug 19, 2020

How has shopping changed over the past 100 years? A look at the evolution of retail

From malls and big-box stores to online delivery and mall redevelopment: Here’s how the retail landscape has evolved—and where it’s likely headed.