Driven by sparser availability of warehouses, offices, and retail, the real estate industry is positioned for solid growth this year and next, before tapering off at a still-respectable $500 billion in annual transactions in 2017.

Those predictions highlight Urban Land Institute’s (ULI) latest three-year Real Estate Consensus Forecast, based on the median of forecasts from 46 economists and analysts at 33 leading real estate organizations, who were surveyed from February 27 through March 23.

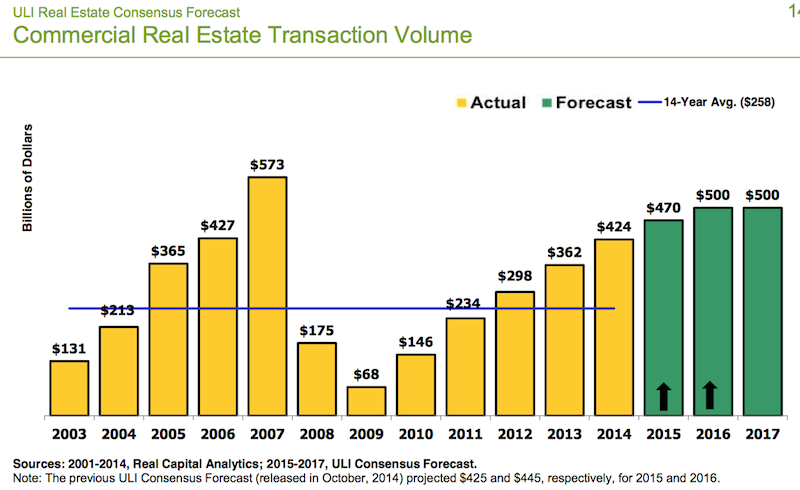

The expert consensus projects an 18% increase, to $470 billion, in commercial real estate transactions for 2015, followed by a 6.4%, to $500 billion, in 2016.

ULI’s forecast is more optimistic for the years 2015 and 2016 than previous forecasts for all indicators except single-family home starts.

The experts’ optimism stems, in part, from their predictions for healthy GDP growth, which they expect to rise by 3% this year and next, and by 2.8% in 2017. If realized, those would be the highest annual growth rates in nine years.

In addition, the U.S. economy has been experiencing its highest rate of job growth in 15 years. “For real estate, it’s really about jobs,” says William Maher, a director with LaSalle Investment Management, who analyzed the results of the survey for ULI.

The Consensus Forecast provides oultooks for specific construction segments:

• Institutional real estate assets are expected to provide total returns across all sectors of 11% in 2015, moderating to 10% in 2016 and 9% in 2017. By property type, returns should be strongest for industrial and office, followed by retail and apartments, in all three years.

• Vacancy rates are expected to decrease modestly for office and retail over all three forecast years. Industrial availability rates and hotel occupancy rate are forecasted to improve modestly in 2015 and 2016 and level off in 2017. Apartment vacancy rates are expected to begin rising slightly to 4.7% in 2015, 5% in 2016, and 5.3% in 2017. The 2017 forecast is just below the 20-year average vacancy rate.

• CRBE estimated that the availability rate for the industrial/warehouse sector declined to 10.3% at the end of 2014, coming in just below the 20-year average for the first time since 2007. ULI Consensus Forecast predicts availability rates will continue to decline in 2015 and 2016, with year-end vacancy rates at 9.8% and 9.6%, respectively, and remain steady in 2017 at 9.6%. Consequently, warehouse rental rate growth should continue, by 4% in 2015, 3.8% in 2016, and 3.1% in 2017, all above the 20-year average growth rate.

• The same pattern can be found in office vacancy rates, which declined for the fourth straight year, to 13.9% in 2014. That pattern is expected to continue through 2017, sparking further appreciation in office rental rates, which according the Consensus Forecast will increase by 4% in 2015 and 4.1% in 2016. Rental rate growth is expected to moderate slightly in 2017 to 3.5%.

• The Consensus foresees improvements in retail availability. And with rents increasing in 2014 for the first time in six years, the Consensus Forecast expects rental rates to sustain this growth, increasing by 2% in 2015, 3% in 2016, and 2.9% 2017.

ULI will release its next Consensus Forecast in October.

Related Stories

Retail Centers | Nov 13, 2019

World’s first drive-thru only restaurant in Australia

FRCH NELSON designed the project.

Giants 400 | Oct 24, 2019

Top 70 Retail Engineering Firms for 2019

Jacobs, Kimley-Horn, Henderson Engineers, and Core States Group head the rankings of the nation's largest retail sector engineering and engineering architecture (EA) firms, as reported in Building Design+Construction's 2019 Giants 300 Report.

Giants 400 | Oct 24, 2019

Top 125 Retail Architecture Firms for 2019

CallisonRTKL, Gensler, MG2, NELSON, and Stantec top the rankings of the nation's largest retail sector architecture and architecture engineering (AE) firms, as reported in Building Design+Construction's 2019 Giants 300 Report.

Healthcare Facilities | Oct 1, 2019

Medical offices are filling space vacated by retail

Healthcare developers and providers like the locations, traffic, and parking these spaces offer.

Retail Centers | Sep 6, 2019

Another well-known retailer files for bankruptcy: Here's the solution to more empty anchor stores

Where can you find the future of retail? At the intersection of experience and instant gratification.

Retail Centers | Sep 3, 2019

Puma’s flagship in North America creates immersive experiences for its sports-focused patrons

Technology and curation allow customers to personalize their product selections.

Retail Centers | Aug 6, 2019

Saving the American mall in 5 steps

CallisonRTKL Vice President Marc Fairbrother explains how struggling American malls can turn it all around.

Retail Centers | Jun 21, 2019

Nation’s largest Nissan facility opens in Houston

A 162,500 SF dealership building set on 16 acres, Central Houston Nissan, in Texas, is being touted as the largest Nissan dealership in the country.

Reconstruction & Renovation | May 22, 2019

Foster + Partners converts historic D.C. library into an Apple store

The building was the city’s first public library.

Retail Centers | Apr 30, 2019

Is this the future of retail? Walmart seems to think so

The retail company recently unveiled its new AI-enabled store in Levittown, N.Y.