Analysts at Lodging Econometrics (LE) report that in the third quarter of 2021 the total U.S. construction pipeline stands at 4,837 projects/592,259 rooms, down 8% by projects and 10% by rooms year-over-year (YOY). While project numbers have seen a slight increase over second quarter totals, overall, the construction pipeline remains largely muted due to a reduced inflow of new projects in the pipeline as compared to “pre-COVID levels,” and significant hotel openings during the first half of the year which exited the pipeline. The prolonged effects of the pandemic, above average inflation, rising interest rates, and material shortages and price increases have been and will continue to be key factors in decision-making for developers through the end of the year.

However, many developers really do have a long term positive outlook on hotel development as projects in the early planning stage are up considerably, with 1,978 projects/239,831 rooms, a 27% increase by projects and 25% by rooms YOY and reaching a cyclical peak this quarter. Conversely, projects scheduled to start construction in the next 12 months are down 14% by projects and 15% by rooms YOY, with 1,824 projects/210,189 rooms at the end of the third quarter. Projects under construction were also down in Q3, ending the quarter at 1,035 projects/142,239 rooms. This is largely due to projects that have completed construction and have opened. Presently, inflation and the increasing cost and sourcing of labor and materials, combined with supply chain shortages and delays, continue to be a major variable for hotel development. In response, developers are reworking budgets, revising plans to minimize costs, and adjusting construction start and project opening dates to endure the challenges of a recovering industry.

Though the path to full recovery may be longer than originally expected, two main steppingstones aiding in the recovery have been the recent rise in hotel stock values as well as increases in lending activity. Rebounding hotel stocks and better-than-expected hotel and travel demand throughout the summer season has renewed developer sentiment.

Renovation and conversion pipeline activity remains steady at the end of Q3 ‘21, with conversion projects hitting a cyclical peak, and ending the quarter at 752 projects/79,024 rooms. Combined, renovation and conversion activity accounts for 1,253 projects and 176,305 rooms.

Through the third quarter of 2021, the U.S. opened 665 new hotels with 85,306 rooms with another 221 projects/23,026 rooms anticipated to open by the end of the year, totaling 886 projects/108,332 rooms for 2021. Our research analysts expect an increase in new hotel openings in 2022, with 970 projects accounting for 110,123 rooms forecast to open in 2022 and another 961 projects/111,249 rooms anticipated to open in 2023.

Related Stories

Market Data | Nov 30, 2016

Marcum Commercial Construction Index reports industry outlook has shifted; more change expected

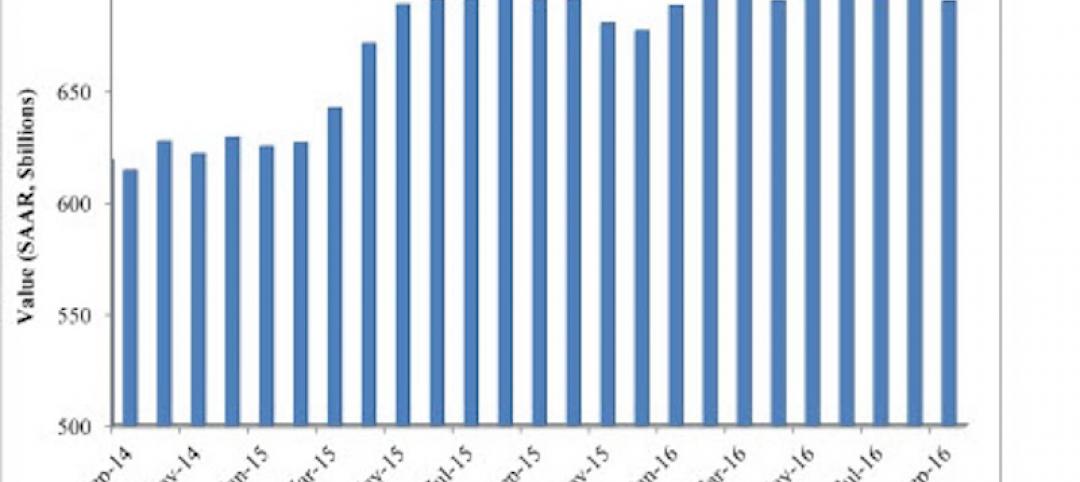

Overall nonresidential construction spending in September totaled $690.5 billion, down a slight 0.7 percent from a year earlier.

Industry Research | Nov 30, 2016

Multifamily millennials: Here is what millennial renters want in 2017

It’s all about technology and convenience when it comes to the things millennial renters value most in a multifamily facility.

Market Data | Nov 29, 2016

It’s not just traditional infrastructure that requires investment

A national survey finds strong support for essential community buildings.

Industry Research | Nov 28, 2016

Building America: The Merit Shop Scorecard

ABC releases state rankings on policies affecting construction industry.

Multifamily Housing | Nov 28, 2016

Axiometrics predicts apartment deliveries will peak by mid 2017

New York is projected to lead the nation next year, thanks to construction delays in 2016

Market Data | Nov 22, 2016

Construction activity will slow next year: JLL

Risk, labor, and technology are impacting what gets built.

Market Data | Nov 17, 2016

Architecture Billings Index rebounds after two down months

Decline in new design contracts suggests volatility in design activity to persist.

Market Data | Nov 11, 2016

Brand marketing: Why the B2B world needs to embrace consumers

The relevance of brand recognition has always been debatable in the B2B universe. With notable exceptions like BASF, few manufacturers or industry groups see value in generating top-of-mind awareness for their products and services with consumers.

Industry Research | Nov 8, 2016

Austin, Texas wins ‘Top City’ in the Emerging Trends in Real Estate outlook

Austin was followed on the list by Dallas/Fort Worth, Texas and Portland, Ore.

Market Data | Nov 2, 2016

Nonresidential construction spending down in September, but August data upwardly revised

The government revised the August nonresidential construction spending estimate from $686.6 billion to $696.6 billion.