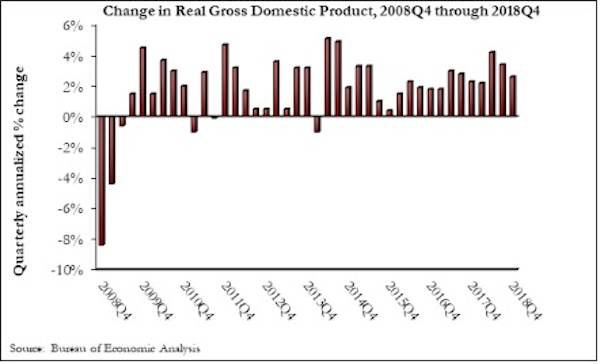

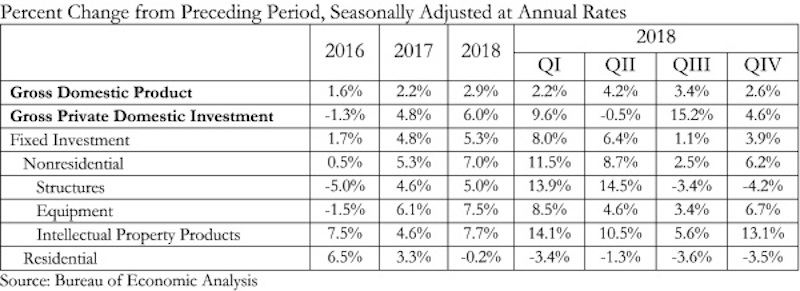

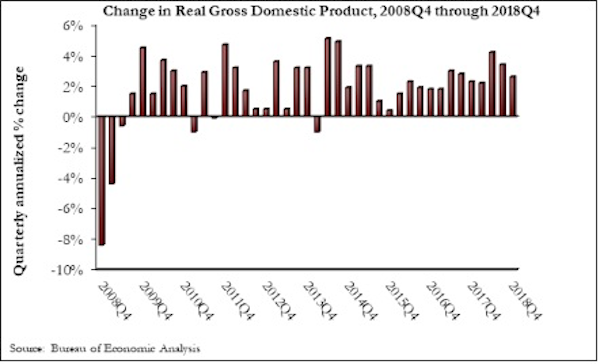

The U.S. economy grew at an annual rate of 2.6% in the fourth quarter of 2018, according to an Associated Builders and Contractors analysis of data published today by the U.S. Bureau of Economic Analysis. Year-over-year GDP growth was 3.1%, while average growth for 2018 was 2.9%.

“Today’s GDP report confirms continued strong investment in nonresidential segments in America,” said ABC Chief Economist Anirban Basu. “Separately, construction spending data show significant expenditures on the construction of data centers, hotel rooms, theme parks and fulfillment centers. These data also indicate stepped up public construction spending in categories such as transportation, education, and water systems. Despite that, today’s GDP release indicated that investment in nonresidential structures actually declined 4.2% on an annualized basis during last year’s fourth quarter. Despite that setback, this form of investment was up by 5% for the entirety of 2018.

“Undoubtedly, some attention will be given to the fact that the U.S. economy expanded by just shy of 3% in 2018,” said Basu. “Unless that figure is revised upward in subsequent releases, it will mean that America has failed to reach the 3% annual threshold since 2005. But while much attention will be given to a perceived shortfall in growth, the fourth quarter figure of 2.6% signifies that the U.S. economy entered this year with substantial momentum. Were it not for a weak residential construction sector, 3% growth would have been attained. Moreover, the data indicate strength in disposable income growth and in business investment.

“It is quite likely that the U.S. economy will expand at around 2% this year,” said Basu. “Though interest rates remain low and hiring is still brisk, a number of leading indicators suggest that the nation’s economy will soften somewhat during the quarters ahead, which can be partly attributed to a weakening global economy. This won’t unduly impact nonresidential construction activity, however, since the pace of activity in this segment tends to lag the overall economy, and strong nonresidential construction spending expected in 2019. Finally, ABC’s Construction Backlog Indicator continues to reflect strong demand for contractors, which have nearly nine months of work lined up.”

Related Stories

Market Data | Jan 31, 2022

Canada's hotel construction pipeline ends 2021 with 262 projects and 35,325 rooms

At the close of 2021, projects under construction stand at 62 projects/8,100 rooms.

Market Data | Jan 27, 2022

Record high counts for franchise companies in the early planning stage at the end of Q4'21

Through year-end 2021, Marriott, Hilton, and IHG branded hotels represented 585 new hotel openings with 73,415 rooms.

Market Data | Jan 27, 2022

Dallas leads as the top market by project count in the U.S. hotel construction pipeline at year-end 2021

The market with the greatest number of projects already in the ground, at the end of the fourth quarter, is New York with 90 projects/14,513 rooms.

Market Data | Jan 26, 2022

2022 construction forecast: Healthcare, retail, industrial sectors to lead ‘healthy rebound’ for nonresidential construction

A panel of construction industry economists forecasts 5.4 percent growth for the nonresidential building sector in 2022, and a 6.1 percent bump in 2023.

Market Data | Jan 24, 2022

U.S. hotel construction pipeline stands at 4,814 projects/581,953 rooms at year-end 2021

Projects scheduled to start construction in the next 12 months stand at 1,821 projects/210,890 rooms at the end of the fourth quarter.

Market Data | Jan 19, 2022

Architecture firms end 2021 on a strong note

December’s Architectural Billings Index (ABI) score of 52.0 was an increase from 51.0 in November.

Market Data | Jan 13, 2022

Materials prices soar 20% in 2021 despite moderating in December

Most contractors in association survey list costs as top concern in 2022.

Market Data | Jan 12, 2022

Construction firms forsee growing demand for most types of projects

Seventy-four percent of firms plan to hire in 2022 despite supply-chain and labor challenges.

Market Data | Jan 7, 2022

Construction adds 22,000 jobs in December

Jobless rate falls to 5% as ongoing nonresidential recovery offsets rare dip in residential total.

Market Data | Jan 6, 2022

Inflation tempers optimism about construction in North America

Rider Levett Bucknall’s latest report cites labor shortages and supply chain snags among causes for cost increases.