At the end of the first quarter of 2019, analysts at Lodging Econometrics (LE) reported that the total U.S. construction pipeline continued to expand with 5,647 projects/687,941 rooms, up a strong 7% by projects and 8% by rooms year-over-year (YOY). Pipeline totals are a mere 236 projects, or 4%, shy of the all-time high of 5,883 projects/785,547 rooms reached in the second quarter of 2008. The record should be pierced later in the year. Conversions and renovations are already at record levels.

Projects currently under construction stand at 1,709 projects/227,924 rooms with projects scheduled to start construction in the next 12 months at 2,429 projects/281,395 rooms. Projects in the early planning stage stand at 1,509 projects/178,622 rooms.

The upscale, upper-midscale, and midscale chain scales, all reached record-highs for both projects and rooms. Sixty-six percent of projects in the total pipeline are concentrated in two chain scales: upscale and upper midscale.

Annualized construction starts are at the highest level since 2008. In 2019, LE forecasts a 2.2% supply growth rate with 1,038 new hotels/118,385 rooms expected to open. For 2020, LE anticipates 1,174 new hotel openings and 128,598 rooms.

Hotel operations had a good quarter but mostly from expense improvements. Only 7 of the top 25 markets showed occupancy increases, quarter-over-quarter (QOQ). Only 11 markets had rev-par increases. Overall, U.S. demand growth was up 2.4% while supply was up 2%.

Leading Markets in the U.S. Hotel Construction Pipeline

In the first quarter of 2019, analysts at Lodging Econometrics (LE) report that the top five markets with the largest hotel construction pipelines are New York City with 170 projects/29,247 rooms. Next are Dallas and Los Angeles, both at record highs, with 163 projects/19,689 rooms and 158 projects/25,578 rooms, respectively. Houston follows with 151 projects/15,643 rooms, and Nashville with 116 projects/15,599 rooms.

Markets with the greatest number of projects already under construction are New York with 119 projects/20,068 rooms, Dallas with 48 projects/6,265 rooms, and Los Angeles with 42 projects/6,288 rooms. Houston has 36 projects/4,162 rooms while Nashville, Austin, and San Jose all have 34 projects presently under construction.

Reflective of the increasing pipeline, LE’s forecast for new hotel openings will continue to rise through 2020. In 2019, New York City tops the list with 63 new hotels expected to open with 9,605 rooms, followed by Dallas with 30 projects/3,604 rooms, Houston with 28 projects/3,342 rooms, Austin with 25 projects/2,512 rooms, and Nashville with 23 projects/3,030 rooms. In the 2020 forecast, New York continues to lead with the highest number of new hotels anticipated to open with 44 projects/6,225 rooms followed by Los Angeles with 35 projects/5,140 rooms and Dallas with 33 projects/4,163 rooms.

The number of markets where supply growth is now exceeding demand growth continues to increase. At the first quarter, 18 of the top 25 markets experienced the shift, up from 12 of the top 25 markets at the end of the fourth quarter of 2018.

Markets of concern where new supply is already outpacing demand and future new openings are forecasted to be high are Houston, New York, Dallas, and Los Angeles.

Related Stories

Market Data | Mar 29, 2017

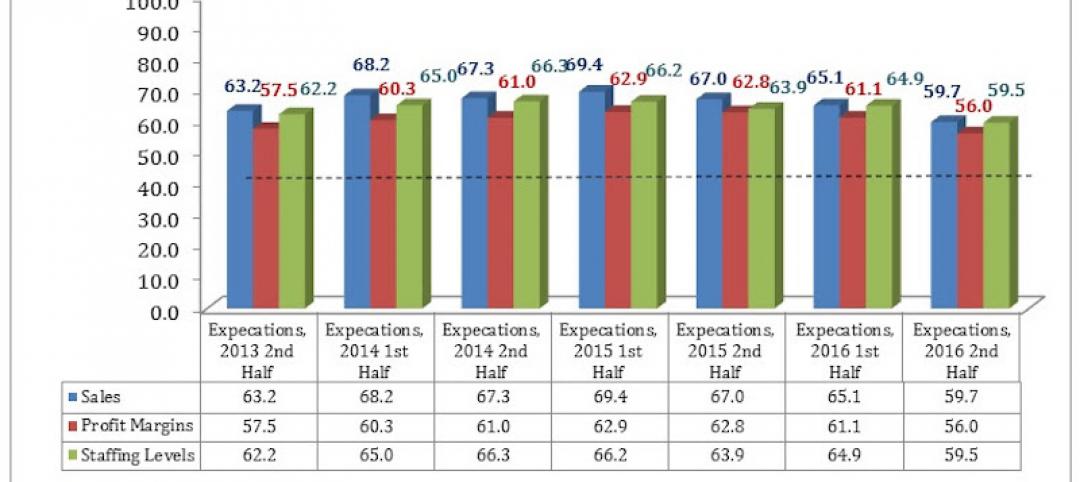

Contractor confidence ends 2016 down but still in positive territory

Although all three diffusion indices in the survey fell by more than five points they remain well above the threshold of 50, which signals that construction activity will continue to be one of the few significant drivers of economic growth.

Market Data | Mar 24, 2017

These are the most and least innovative states for 2017

Connecticut, Virginia, and Maryland are all in the top 10 most innovative states, but none of them were able to claim the number one spot.

Market Data | Mar 22, 2017

After a strong year, construction industry anxious about Washington’s proposed policy shifts

Impacts on labor and materials costs at issue, according to latest JLL report.

Market Data | Mar 22, 2017

Architecture Billings Index rebounds into positive territory

Business conditions projected to solidify moving into the spring and summer.

Market Data | Mar 15, 2017

ABC's Construction Backlog Indicator fell to end 2016

Contractors in each segment surveyed all saw lower backlog during the fourth quarter, with firms in the heavy industrial segment experiencing the largest drop.

Market Data | Feb 28, 2017

Leopardo’s 2017 Construction Economics Report shows year-over-year construction spending increase of 4.2%

The pace of growth was slower than in 2015, however.

Market Data | Feb 23, 2017

Entering 2017, architecture billings slip modestly

Despite minor slowdown in overall billings, commercial/ industrial and institutional sectors post strongest gains in over 12 months.

Market Data | Feb 16, 2017

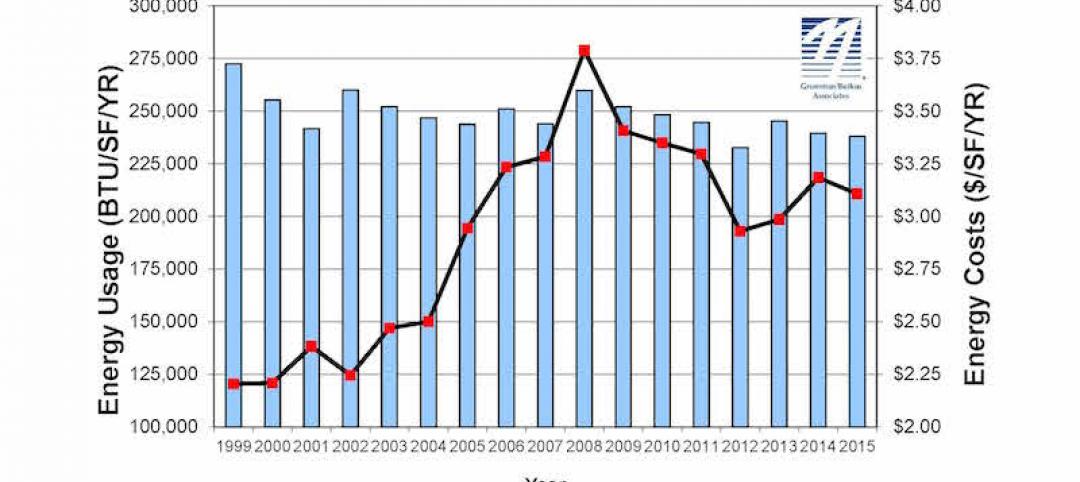

How does your hospital stack up? Grumman/Butkus Associates 2016 Hospital Benchmarking Survey

Report examines electricity, fossil fuel, water/sewer, and carbon footprint.

Market Data | Feb 1, 2017

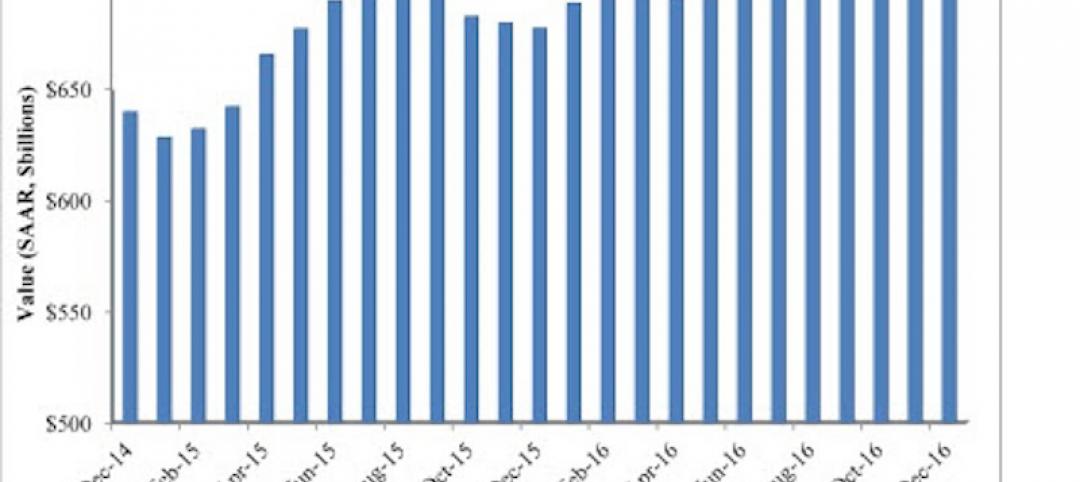

Nonresidential spending falters slightly to end 2016

Nonresidential spending decreased from $713.1 billion in November to $708.2 billion in December.

Market Data | Jan 31, 2017

AIA foresees nonres building spending increasing, but at a slower pace than in 2016

Expects another double-digit growth year for office construction, but a more modest uptick for health-related building.