Our Healthcare Program Solutions team spends much of its time representing owners as they work their way through the execution of major capital programs. Many of our team members have spent time not only on the consulting side of the owner’s team but have worked for some of the clients we serve. In order to deliver superior outcomes to our healthcare clients, we have to know what our clients want. To do this, we spend time communicating with owners and listening to their thoughts on firms and people they hire for support. Based on that feedback, we offer the following three thoughts about what we believe our clients want—for us to collaborate, listen, and understand.

Collaborate

Most owners we partner with want teams that work effectively together to solve problems. As the primary holder of risk on any given project, owners realize there is a cost associated with poor teamwork and constant conflict. Owners do not expect perfection, but they do expect teams to find solutions to the problems we uncover (or create). They want us to learn from difficult situations and not repeat them. Certainly, the typical contract structure is at times an impediment to this way of thinking given that each firm is legally incentivized to protect themselves. With that said, we would argue that teams working together to solve problems, focusing on the greater good of the project, ultimately reduce the risk to their individual firms. In our experience, project teams exhibiting this type of behavior find themselves completing projects that meet their client’s needs.

Listen

Perhaps the most common complaint we hear from our clients is that team members are not listening to what they have to say. It’s virtually impossible to receive high performance marks from the client if you aren’t seen a good listener. One of my favorite quotes by Gene Buckley states, “Don’t try to tell the customer what he wants. If you want to be smart, be smart in the shower. Then get out, go to work and serve the customer!” Practice these simple tasks;

- Don’t interrupt when the client is talking

- Don’t inject yourself into their narrative of the problems they need your help to solve

- Just listen, quietly and intently

- Ask questions to clarify issues so your team has a clear understanding of what they’re being asked to do

- Thoughtfully bring back options and potential solutions

- Listen again, and again

Understand

Healthcare in the United States is complex and fraught with uncertainty. It often seems like the burden of navigating the rules of operating successfully are left to the clients we serve. In our experience, healthcare owners value service providers who understand the world the owner lives in—one who can think about how (or if) we can leverage the design and construction process to address some of these problems. These challenges may not always be conducive to a strict design and construction schedule. A simple example is using major capital projects to help maintain or even improve physician relationships. These key constituents have unique needs and, like all of us, want to be heard and listened to. Find the time and the way to do this. Involve them in your process and go out of your way to accommodate their daily schedule and be responsive to their thoughts.

Conclusion

Spend time considering the issues your client faces. Then, spend time considering how your area of expertise can be leveraged to address and overcome those challenges. Be flexible and willing to do whatever it takes to make the client successful. We have to partner together, no matter what side of the table you sit on.

As always, we welcome your thoughts and ideas on how we can together provide better service to our clients.

Related Stories

Market Data | Nov 15, 2017

Architecture Billings bounce back

Business conditions remain uneven across regions.

Market Data | Nov 14, 2017

U.S. construction starts had three consecutive quarters of positive growth in 2017

ConstructConnect’s quarterly report shows the most significant annual growth in the civil engineering and residential sectors.

Market Data | Nov 3, 2017

New construction starts in 2018 to increase 3% to $765 billion: Dodge report

Dodge Outlook Report predicts deceleration but still growth, reflecting a mixed pattern by project type.

Market Data | Nov 2, 2017

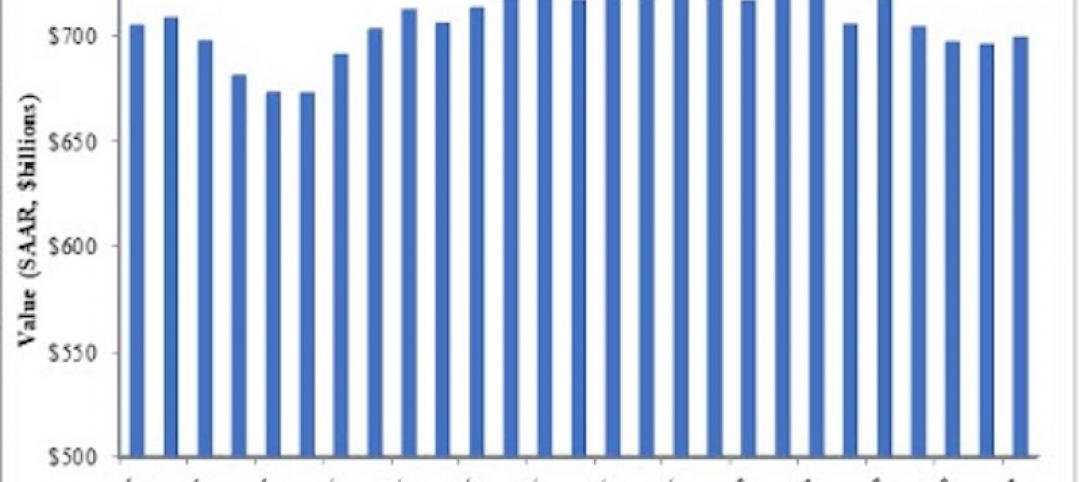

Construction spending up in September; Down on a YOY basis

Nonresidential construction spending is down 2.9% on a year-over-year basis.

Sponsored | Industry Research | Oct 26, 2017

Get clients to pay you faster with these five tips

Here are 5 ways to avoid a cash crunch by doing your part to help clients make their payments on time.

Market Data | Oct 19, 2017

Architecture Billings Index backslides slightly

Business conditions easing in the West.

Industry Research | Oct 9, 2017

AEC website design trends in 2017 – Planning for 2018

A website that’s behind the times is hurting your business.

Industry Research | Oct 3, 2017

Nonresidential construction spending stabilizes in August

Spending on nonresidential construction services is still down on a YOY basis.

Market Data | Sep 21, 2017

Architecture Billings Index continues growth streak

Design services remain in high demand across all regions and in all major sectors.

Market Data | Sep 21, 2017

How brand research delivers competitive advantage

Brand research is a process that firms can use to measure their reputation and visibility in the marketplace.