The nation is at the beginning stages of a 20-plus year surge in its older population. By 2035, one in five people in the U.S. will be aged 65 and over, up from one in seven today. By that same year, one in three households will be headed by someone aged 65 or older.

Those projections come from a new report published by the Harvard Joint Center of Housing Studies, which examines the challenges that lie ahead for a country where owners and renters are getting older, more diverse, but also more likely to be struggling with physical and mental infirmities that require regular care.

Will the housing sector be up to meeting the demands of an older population, many of whom prefer to age in their current residences? “A wider array of housing types can offer safer, more affordable, and lower-maintenance homes within existing communities,” the report states.

First, some statistics: The Census Bureau estimates the 65-and-over population will increase by more than 30 million people by 2035 and reach 79 million, with more than half that growth occurring in the next decade. The 80-and-over population alone will double between 2015 and 2035 to 24 million, with 70 percent of that growth occurring from 2025-2035.

The Joint Center projects that this population growth will translate into an increase of nearly 20 million older households, from 29.9 million in 2015 to 49.6 million by 2035. The number of owner households headed by a person aged 65 or over will soar from 24 million in 2015 to 32 million by 2025, and then to 38 million by 2035, an overall increase of 62%. Homeowner households headed by someone aged 80 or over will experience particularly steep growth, more than doubling from nearly 6 million to over 12 million within the next 20 years.

Over these two decades, the sheer growth in the older population will mean the number of renter households will expand from 6 million to more than 11 million households. Overall, the share of renters will increase slightly, from 21% of older households in 2015 to 23% in 2035.

Single-person households will grow slightly more quickly among older adults to total roughly 22 million households in 2035, barely outnumbering the 21 million projected married-couple households age 65 and over.

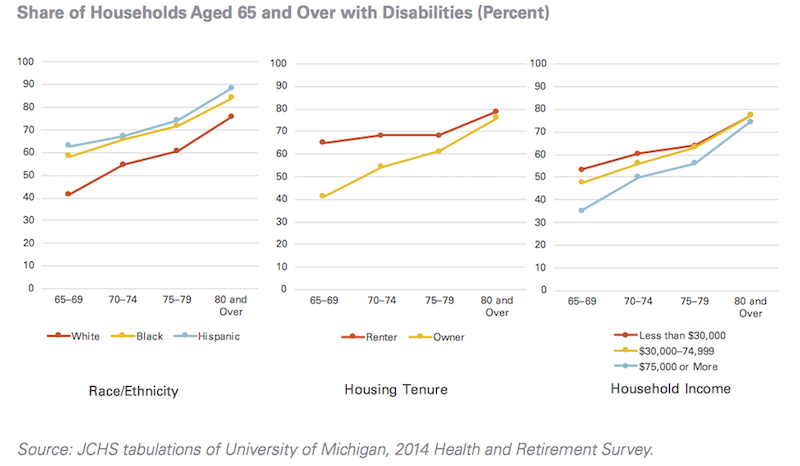

As the population ages, the home is an increasingly important setting for the delivery of long-term care, a trend likely to grow over the next two decades as millions more seek to remain in their current dwellings while coping with disabilities and health challenges.

The home will increasingly become a setting for delivery of long-term care in the U.S., where older householders with a disability will grow by 76% to 31.2 milion by 2035. Image: Joint Center for Housing Studies

The home will increasingly become a setting for delivery of long-term care in the U.S., where older householders with a disability will grow by 76% to 31.2 milion by 2035. Image: Joint Center for Housing Studies

By 2035, older households with a disability will increase by 76 percent to reach 31.2 million. By that time, 17 million older households will include someone with a mobility disability, 12 million with a self-care disability, and 27 million with a household activity disability. Roughly half the anticipated increase of 13.4 million older households with disabilities will occur by 2025, with the remainder in the 2025-2035 decade.

By 2035, 17 million older adult households will have at least one person with a mobility disability, for whom stairs, narrow corridors and doorways, and traditional bathroom layouts will pose challenges to safety and independence. Over five million of these will be renter households. Renters are more likely than owners to have mobility disabilities, but also have less control over modifying their units.

The conundrum is that only 1 percent of the current housing stock offers the key accessibility features that people with disabilities require. And the financial wherewithal of older Americans to install those features or modify their houses themselves will be limited.

More than nine million older homeowners have less than $50,000 in non-housing assets. “Clearly, costs will pose challenges for many who will need to secure paid help to remain in their homes,” says the Joint Center. Renters’ assets are even more meager.

In the future, more women will be eligible for Social Security. But the Social Security Administration’s MINT (Modeling Incomes in the Near Term) model projects the share of all older adults having the means to maintain their pre-retirement lifestyle after they retire falling from 43% today to 39% in 2035. These trends together suggest a future widening in income distributions among older adults.

Households that pay more than half their income for housing costs are projected to reach 8.6 million by 2035. For both owners and renters, the numbers of severely cost-burdened households aged 80 and over will more than double.

In light of these trends and projections, the Joint Center recommends the following actions to ensure housing that provides adequate quality of life for an aging population:

•Increase accessible housing.

•Assist older owners with housing cost burdens.

•Increase subsidies to older renters.

•Strengthen ties between health care and housing.

•Increase public awareness.

•Expand housing options.

Related Stories

Market Data | Nov 27, 2017

Construction's contribution to U.S. economy highest in seven years

Thirty-seven states benefited from the rise in construction activity in their state, while 13 states experienced a reduction in activity.

Market Data | Nov 15, 2017

Architecture Billings bounce back

Business conditions remain uneven across regions.

Market Data | Nov 14, 2017

U.S. construction starts had three consecutive quarters of positive growth in 2017

ConstructConnect’s quarterly report shows the most significant annual growth in the civil engineering and residential sectors.

Market Data | Nov 3, 2017

New construction starts in 2018 to increase 3% to $765 billion: Dodge report

Dodge Outlook Report predicts deceleration but still growth, reflecting a mixed pattern by project type.

Market Data | Nov 2, 2017

Construction spending up in September; Down on a YOY basis

Nonresidential construction spending is down 2.9% on a year-over-year basis.

Market Data | Oct 19, 2017

Architecture Billings Index backslides slightly

Business conditions easing in the West.

Industry Research | Oct 3, 2017

Nonresidential construction spending stabilizes in August

Spending on nonresidential construction services is still down on a YOY basis.

Market Data | Sep 21, 2017

Architecture Billings Index continues growth streak

Design services remain in high demand across all regions and in all major sectors.

Market Data | Sep 21, 2017

How brand research delivers competitive advantage

Brand research is a process that firms can use to measure their reputation and visibility in the marketplace.

Contractors | Sep 19, 2017

Commercial Construction Index finds high optimism in U.S. commercial construction industry

Hurricane recovery efforts expected to heighten concerns about labor scarcities in the south, where two-thirds of contractors already face worker shortages.