It’s late November, which means it is market forecast season for the AEC industry. Construction outlook reports from the American Institute of Architects, Associated Builders and Contractors, ConstructConnect, Dodge Data & Analytics, and FMI are beginning to roll in. And if the early prognostications are any indication, 2018 is shaping up to be a little less rosy for the nonresidential and multifamily construction markets.

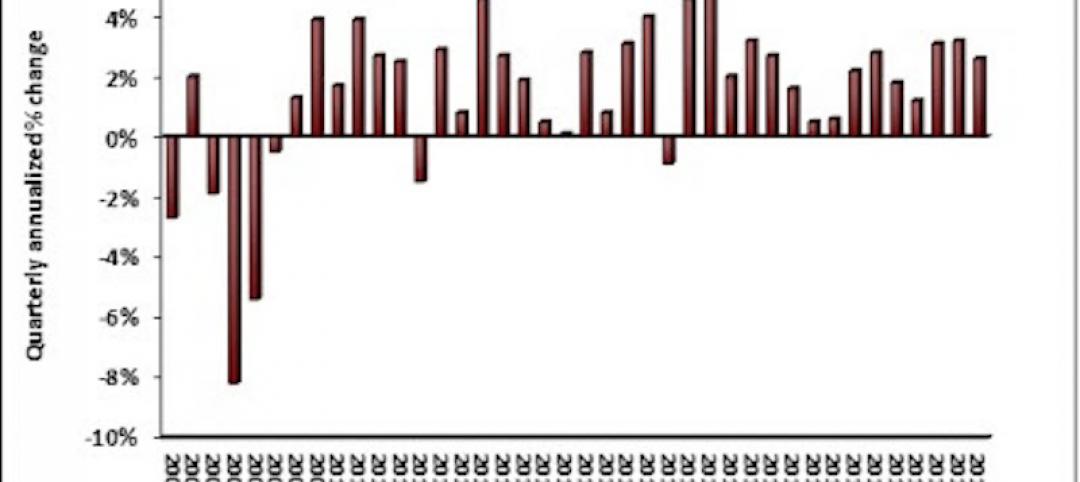

Dodge suggests the U.S. construction industry has shifted into a “mature stage of expansion.” The 11-13% annual growth in construction starts we witnessed in 2012-15 will slow to 4% in 2017 and 3% in 2018. ConstructConnect is calling for 2-3% growth in nonresidential building starts between 2018 and 2021. FMI is a bit more bullish: 5% growth in nonresidential construction spending in 2018, then 4-5% in 2019-21.

Despite the tepid outlook by construction economists—and numerous reports throughout 2017 that pointed to a looming growth slowdown for several major building sectors—optimism among AEC professionals has not waned. In fact, it has strengthened, according to a November 2017 survey of 356 architects, engineers, and contractors by Building Design+Construction.

While it has been an erratic and drama-filled first year for the Trump Administration, the vast majority of AEC professionals are not overly concerned that the Trump-led White House will negatively impact their businesses.

Six in 10 survey respondents predict that 2018 will be an “excellent” or “very good” business year for their firm. Barely half (50.3%) felt the same way this time last year, according to BD+C’s 2016 survey. Same for revenue forecasts: 62.0% predict their firm’s revenue will increase next year, and only 6.1% are calling for a drop in revenue. This is a markedly rosier outlook than last year’s, when 55.3% of respondents forecasted revenue growth and 11.5% anticipated a drop.

And while it has been an erratic and drama-filled first year for the Trump Administration—travel ban, Russian election interference probe, border wall financing fiasco, Paris Agreement withdrawal—the vast majority of AEC professionals are not overly concerned that the Trump-led White House will negatively impact their businesses. Just 16.6% of respondents cited “business impacts from the Presidential election” as a top-three concern heading into 2018. This sentiment is a somewhat dramatic turn from the post-election attitude, when nearly a third (31.7%) indicated that Trump was a major concern heading into 2017.

So, what are the top AEC business concerns for 2018? Competition from other firms (54.3%), general economic conditions (43.5%), price increases in materials and services (33.8%), and insufficient capital funding for projects (25.8%) top the list. Trump was at the bottom, along with avoiding benefit reductions, avoiding layoffs, and keeping staff motivated.

When asked about their top business development strategies for the next 12-24 months, respondents most often cited: an increase in marketing/PR efforts (47.4%), selective hires to increase competitiveness (46.3%), investment in technology (44.3%), staff training/education (43.5%), and launching a new service or business opportunity (38.0%). At the bottom: open a new office, strategic acquisition, and acquiring a new service or business opportunity.

Multifamily housing and senior living developments head the list of the hottest sectors heading into 2018, according to survey respondents. Well more than half (57.4%) indicated that the prospects for multifamily work were either “excellent” or “good” for 2018; 55.9% said the same for senior living work. Other strong building sectors: office interior/fitouts (55.2%), healthcare (50.1%), office buildings (44.5%), industrial/warehouses (44.1%), data centers (42.3%), and hotels/hospitality (41.3%). At the bottom of the list: religious/places of worship, sports/recreation, transit facilities, and cultural/performing arts buildings.

Related Stories

Multifamily Housing | Aug 19, 2019

Top 10 outdoor amenities in multifamily housing for 2019

Top 10 results in the “Outdoor Amenities” category in our Multifamily Design+Construction Amenities Survey 2019.

Multifamily Housing | Aug 12, 2019

Multifamily Amenities 2019: Rethinking the $30,000 cup of coffee

What amenities are “must-have” rather than “nice to have” for the local market? Which amenities will attract the renters or buyers you’re targeting? The 2019 Multifamily Amenities Survey measured 113 amenity choices.

Codes and Standards | Jun 27, 2019

Public restrooms being used for changing clothes, phone conversations, and 'getting away'

About 60% of Americans use a public restroom one to five times a week, according to the latest annual hand washing survey conducted by Bradley Corporation.

Industry Research | Jun 11, 2019

New research suggests individual work spaces increase productivity

The research was conducted by Perkins Eastman and Three H.

Industry Research | Apr 8, 2019

New research finds benefits to hiring architectural services based on qualifications

Government agencies gain by evaluating beyond price, according to a new Dodge survey of government officials.

Office Buildings | Jul 17, 2018

Transwestern report: Office buildings near transit earn 65% higher lease rates

Analysis of 15 major metros shows the average rent in central business districts was $43.48/sf for transit-accessible buildings versus $26.01/sf for car-dependent buildings.

Market Data | May 29, 2018

America’s fastest-growing cities: San Antonio, Phoenix lead population growth

San Antonio added 24,208 people between July 2016 and July 2017, according to U.S. Census Bureau data.

Industry Research | Jan 30, 2018

AIA’s Kermit Baker: Five signs of an impending upturn in construction spending

Tax reform implications and rebuilding from natural disasters are among the reasons AIA’s Chief Economist is optimistic for 2018 and 2019.

Market Data | Jan 30, 2018

AIA Consensus Forecast: 4.0% growth for nonresidential construction spending in 2018

The commercial office and retail sectors will lead the way in 2018, with a strong bounce back for education and healthcare.

Market Data | Jan 29, 2018

Year-end data show economy expanded in 2017; Fixed investment surged in fourth quarter

The economy expanded at an annual rate of 2.6% during the fourth quarter of 2017.