It’s late November, which means it is market forecast season for the AEC industry. Construction outlook reports from the American Institute of Architects, Associated Builders and Contractors, ConstructConnect, Dodge Data & Analytics, and FMI are beginning to roll in. And if the early prognostications are any indication, 2018 is shaping up to be a little less rosy for the nonresidential and multifamily construction markets.

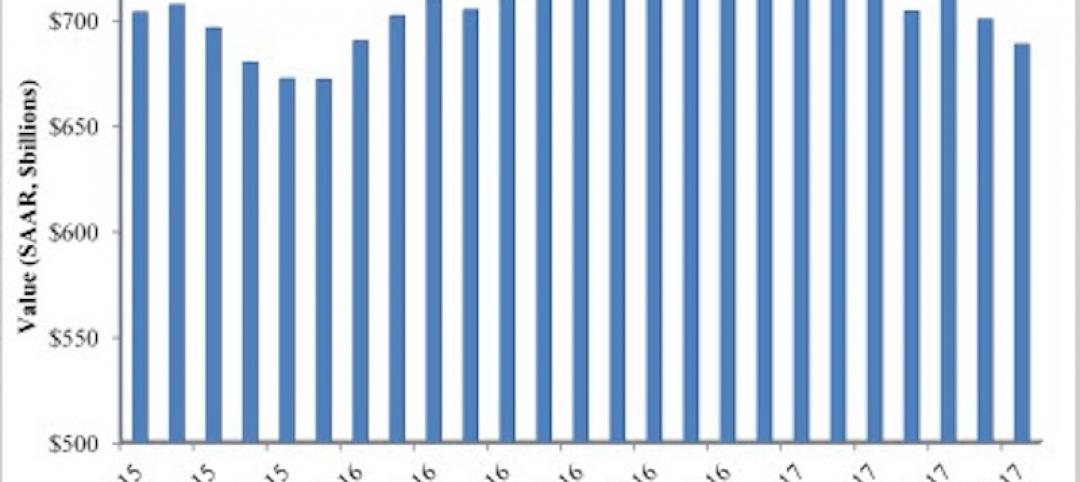

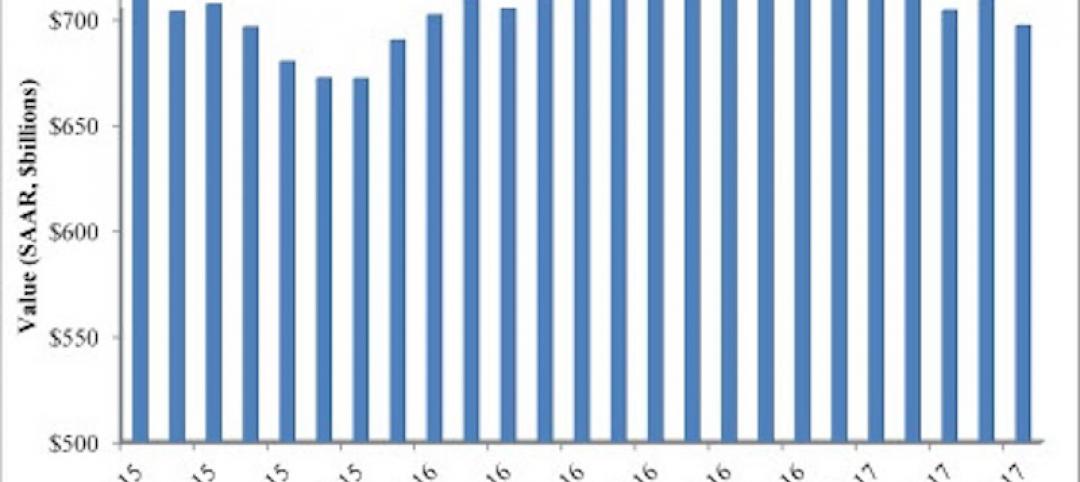

Dodge suggests the U.S. construction industry has shifted into a “mature stage of expansion.” The 11-13% annual growth in construction starts we witnessed in 2012-15 will slow to 4% in 2017 and 3% in 2018. ConstructConnect is calling for 2-3% growth in nonresidential building starts between 2018 and 2021. FMI is a bit more bullish: 5% growth in nonresidential construction spending in 2018, then 4-5% in 2019-21.

Despite the tepid outlook by construction economists—and numerous reports throughout 2017 that pointed to a looming growth slowdown for several major building sectors—optimism among AEC professionals has not waned. In fact, it has strengthened, according to a November 2017 survey of 356 architects, engineers, and contractors by Building Design+Construction.

While it has been an erratic and drama-filled first year for the Trump Administration, the vast majority of AEC professionals are not overly concerned that the Trump-led White House will negatively impact their businesses.

Six in 10 survey respondents predict that 2018 will be an “excellent” or “very good” business year for their firm. Barely half (50.3%) felt the same way this time last year, according to BD+C’s 2016 survey. Same for revenue forecasts: 62.0% predict their firm’s revenue will increase next year, and only 6.1% are calling for a drop in revenue. This is a markedly rosier outlook than last year’s, when 55.3% of respondents forecasted revenue growth and 11.5% anticipated a drop.

And while it has been an erratic and drama-filled first year for the Trump Administration—travel ban, Russian election interference probe, border wall financing fiasco, Paris Agreement withdrawal—the vast majority of AEC professionals are not overly concerned that the Trump-led White House will negatively impact their businesses. Just 16.6% of respondents cited “business impacts from the Presidential election” as a top-three concern heading into 2018. This sentiment is a somewhat dramatic turn from the post-election attitude, when nearly a third (31.7%) indicated that Trump was a major concern heading into 2017.

So, what are the top AEC business concerns for 2018? Competition from other firms (54.3%), general economic conditions (43.5%), price increases in materials and services (33.8%), and insufficient capital funding for projects (25.8%) top the list. Trump was at the bottom, along with avoiding benefit reductions, avoiding layoffs, and keeping staff motivated.

When asked about their top business development strategies for the next 12-24 months, respondents most often cited: an increase in marketing/PR efforts (47.4%), selective hires to increase competitiveness (46.3%), investment in technology (44.3%), staff training/education (43.5%), and launching a new service or business opportunity (38.0%). At the bottom: open a new office, strategic acquisition, and acquiring a new service or business opportunity.

Multifamily housing and senior living developments head the list of the hottest sectors heading into 2018, according to survey respondents. Well more than half (57.4%) indicated that the prospects for multifamily work were either “excellent” or “good” for 2018; 55.9% said the same for senior living work. Other strong building sectors: office interior/fitouts (55.2%), healthcare (50.1%), office buildings (44.5%), industrial/warehouses (44.1%), data centers (42.3%), and hotels/hospitality (41.3%). At the bottom of the list: religious/places of worship, sports/recreation, transit facilities, and cultural/performing arts buildings.

Related Stories

Multifamily Housing | Sep 15, 2017

Hurricane Harvey damaged fewer apartments in greater Houston than estimated

As of Sept. 14, 166 properties reported damage to 8,956 units, about 1.4% of the total supply of apartments, according to ApartmentData.com.

High-rise Construction | Sep 8, 2017

CTBUH determines fastest elevators and longest runs in the world in new TBIN Study

When it comes to the tallest skyscrapers in the world, the vertical commute in the building becomes just as important as the horizontal commute through the city.

Multifamily Housing | Sep 5, 2017

Free WiFi, meeting rooms most popular business services amenities in multifamily developments

Complimentary, building-wide WiFi is more or less a given for marketing purposes in the multifamily arena.

Market Data | Sep 5, 2017

Nonresidential construction declines again, public and private sector down in July

Weakness in spending was widespread.

Market Data | Aug 29, 2017

Hidden opportunities emerge from construction industry challenges

JLL’s latest construction report shows stability ahead with tech and innovation leading the way.

Architects | Aug 21, 2017

AIA: Architectural salaries exceed gains in the broader economy

AIA’s latest compensation report finds average compensation for staff positions up 2.8% from early 2015.

Market Data | Aug 17, 2017

Marcum Commercial Construction Index reports second quarter spending increase in commercial and office construction

Spending in all 12 of the remaining nonresidential construction subsectors retreated on both an annualized and monthly basis.

Industry Research | Aug 11, 2017

NCARB releases latest data on architectural education, licensure, and diversity

On average, becoming an architect takes 12.5 years—from the time a student enrolls in school to the moment they receive a license.

Market Data | Aug 4, 2017

U.S. grand total construction starts growth projection revised slightly downward

ConstructConnect’s quarterly report shows courthouses and sports stadiums to end 2017 with a flourish.

Market Data | Aug 2, 2017

Nonresidential Construction Spending falls in June, driven by public sector

June’s weak construction spending report can be largely attributed to the public sector.