It’s late November, which means it is market forecast season for the AEC industry. Construction outlook reports from the American Institute of Architects, Associated Builders and Contractors, ConstructConnect, Dodge Data & Analytics, and FMI are beginning to roll in. And if the early prognostications are any indication, 2018 is shaping up to be a little less rosy for the nonresidential and multifamily construction markets.

Dodge suggests the U.S. construction industry has shifted into a “mature stage of expansion.” The 11-13% annual growth in construction starts we witnessed in 2012-15 will slow to 4% in 2017 and 3% in 2018. ConstructConnect is calling for 2-3% growth in nonresidential building starts between 2018 and 2021. FMI is a bit more bullish: 5% growth in nonresidential construction spending in 2018, then 4-5% in 2019-21.

Despite the tepid outlook by construction economists—and numerous reports throughout 2017 that pointed to a looming growth slowdown for several major building sectors—optimism among AEC professionals has not waned. In fact, it has strengthened, according to a November 2017 survey of 356 architects, engineers, and contractors by Building Design+Construction.

While it has been an erratic and drama-filled first year for the Trump Administration, the vast majority of AEC professionals are not overly concerned that the Trump-led White House will negatively impact their businesses.

Six in 10 survey respondents predict that 2018 will be an “excellent” or “very good” business year for their firm. Barely half (50.3%) felt the same way this time last year, according to BD+C’s 2016 survey. Same for revenue forecasts: 62.0% predict their firm’s revenue will increase next year, and only 6.1% are calling for a drop in revenue. This is a markedly rosier outlook than last year’s, when 55.3% of respondents forecasted revenue growth and 11.5% anticipated a drop.

And while it has been an erratic and drama-filled first year for the Trump Administration—travel ban, Russian election interference probe, border wall financing fiasco, Paris Agreement withdrawal—the vast majority of AEC professionals are not overly concerned that the Trump-led White House will negatively impact their businesses. Just 16.6% of respondents cited “business impacts from the Presidential election” as a top-three concern heading into 2018. This sentiment is a somewhat dramatic turn from the post-election attitude, when nearly a third (31.7%) indicated that Trump was a major concern heading into 2017.

So, what are the top AEC business concerns for 2018? Competition from other firms (54.3%), general economic conditions (43.5%), price increases in materials and services (33.8%), and insufficient capital funding for projects (25.8%) top the list. Trump was at the bottom, along with avoiding benefit reductions, avoiding layoffs, and keeping staff motivated.

When asked about their top business development strategies for the next 12-24 months, respondents most often cited: an increase in marketing/PR efforts (47.4%), selective hires to increase competitiveness (46.3%), investment in technology (44.3%), staff training/education (43.5%), and launching a new service or business opportunity (38.0%). At the bottom: open a new office, strategic acquisition, and acquiring a new service or business opportunity.

Multifamily housing and senior living developments head the list of the hottest sectors heading into 2018, according to survey respondents. Well more than half (57.4%) indicated that the prospects for multifamily work were either “excellent” or “good” for 2018; 55.9% said the same for senior living work. Other strong building sectors: office interior/fitouts (55.2%), healthcare (50.1%), office buildings (44.5%), industrial/warehouses (44.1%), data centers (42.3%), and hotels/hospitality (41.3%). At the bottom of the list: religious/places of worship, sports/recreation, transit facilities, and cultural/performing arts buildings.

Related Stories

Market Data | May 1, 2017

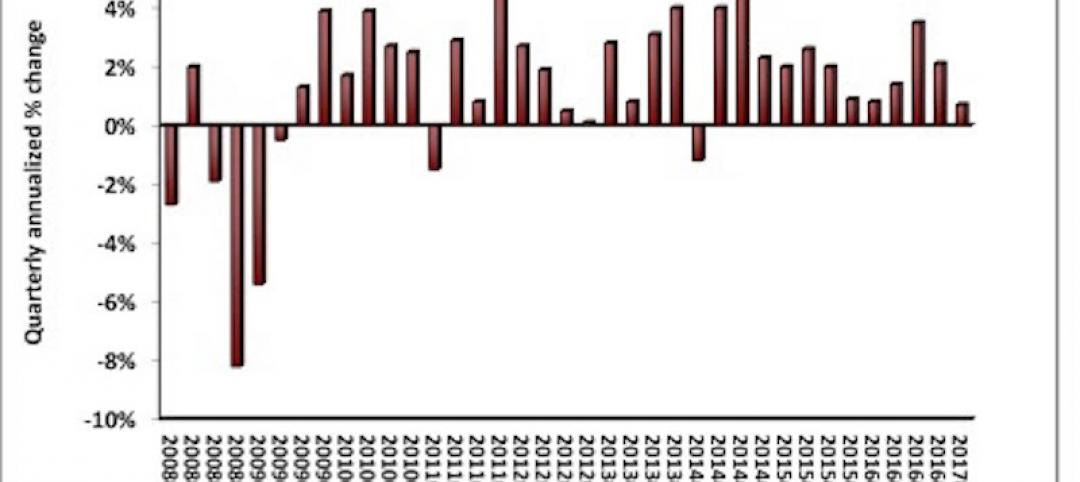

Nonresidential Fixed Investment surges despite sluggish economic in first quarter

Real gross domestic product (GDP) expanded 0.7 percent on a seasonally adjusted annualized rate during the first three months of the year.

Industry Research | Apr 28, 2017

A/E Industry lacks planning, but still spending large on hiring

The average 200-person A/E Firm is spending $200,000 on hiring, and not budgeting at all.

Architects | Apr 27, 2017

Number of U.S. architects holds steady, while professional mobility increases

New data from NCARB reveals that while the number of architects remains consistent, practitioners are looking to get licensed in multiple states.

Market Data | Apr 6, 2017

Architecture marketing: 5 tools to measure success

We’ve identified five architecture marketing tools that will help your firm evaluate if it’s on the track to more leads, higher growth, and broader brand visibility.

Market Data | Apr 3, 2017

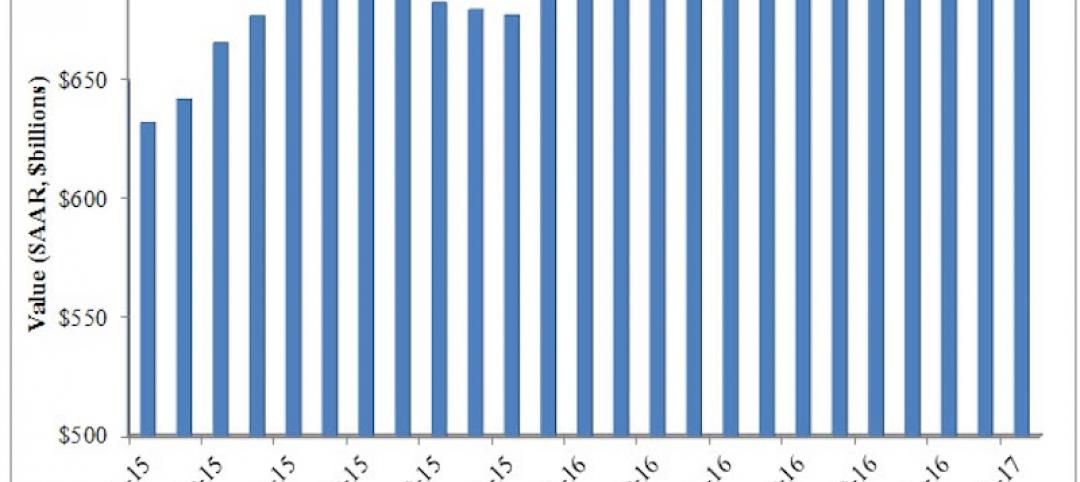

Public nonresidential construction spending rebounds; overall spending unchanged in February

The segment totaled $701.9 billion on a seasonally adjusted annualized rate for the month, marking the seventh consecutive month in which nonresidential spending sat above the $700 billion threshold.

Market Data | Mar 29, 2017

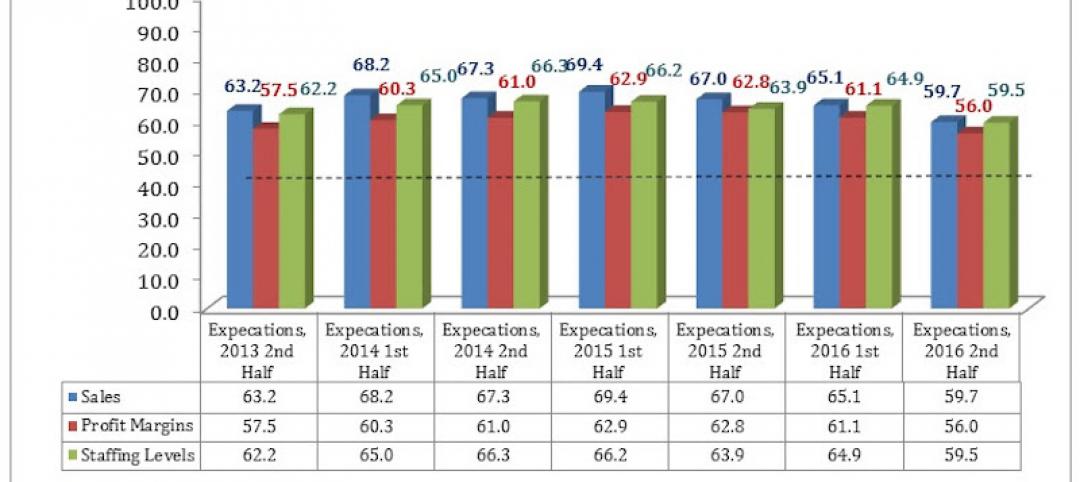

Contractor confidence ends 2016 down but still in positive territory

Although all three diffusion indices in the survey fell by more than five points they remain well above the threshold of 50, which signals that construction activity will continue to be one of the few significant drivers of economic growth.

Industry Research | Mar 24, 2017

The business costs and benefits of restroom maintenance

Businesses that have pleasant, well-maintained restrooms can turn into customer magnets.

Industry Research | Mar 22, 2017

Progress on addressing US infrastructure gap likely to be slow despite calls to action

Due to a lack of bipartisan agreement over funding mechanisms, as well as regulatory hurdles and practical constraints, Moody’s expects additional spending to be modest in 2017 and 2018.

Industry Research | Mar 21, 2017

Staff recruitment and retention is main concern among respondents of State of Senior Living 2017 survey

The survey asks respondents to share their expertise and insights on Baby Boomer expectations, healthcare reform, staff recruitment and retention, for-profit competitive growth, and the needs of middle-income residents.

Industry Research | Mar 14, 2017

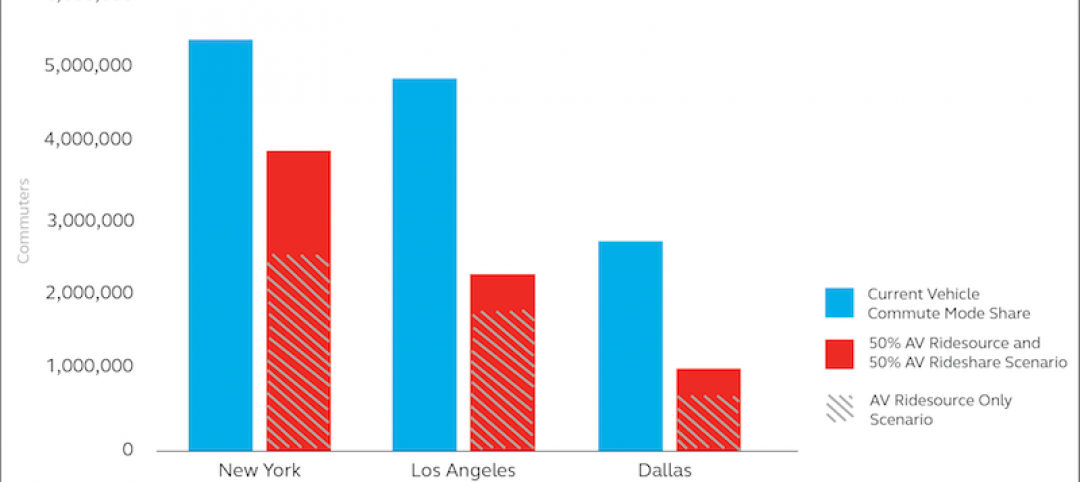

6 ways cities can prepare for a driverless future

A new report estimates 7 million drivers will shift to autonomous vehicles in 3 U.S. cities.