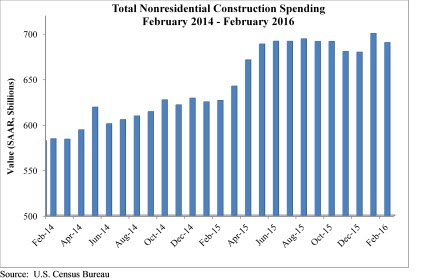

Nonresidential construction spending dipped in February, falling 1.4% on a monthly basis according to analysis of U.S. Census Bureau data released by Associated Builders and Contractors (ABC).

Spending in the nonresidential sector totaled $690.3 billion on a seasonally adjusted, annualized basis in February. While this represents a step back from January's figure of $700.3 billion (revised down from $701.9 billion), it is still 1.5% higher than the level of spending registered in December 2015 and 10.1% higher than February 2015.

"February's weather was particularly harsh in certain parts of the country, including in the economic activity-rich Mid-Atlantic region, and that appears to have had an undue effect on construction spending data," ABC Chief Economist Anirban Basu said. "February data are always difficult to interpret, and the latest nonresidential construction spending figures are no different. Seasonal factors have also made state-level data very difficult to interpret.

"Beyond meteorological considerations, there are other reasons not to be alarmed by February's decline in nonresidential construction spending," Basu said. "Today's positive construction employment report indicates continued economic growth. Moreover, much of the decline in volume was attributable to manufacturing, but the ISM manufacturing index recently crossed the threshold 50 level, indicating that domestic manufacturing is now expanding for the first time in seven months."

Eight of the 16 nonresidential subsectors experienced spending decreases in February, though almost half of the total decline in spending is attributable to the 5.9% decline in manufacturing-related spending.

The following 16 nonresidential construction sectors experienced spending increases in February on a monthly basis:

- Spending in the amusement and recreation category climbed 0.4% from January and is up 13.7% from February 2015.

- Lodging-related spending is up 0.4% for the month and is up 30.1% on a year-ago basis.

- Water supply-related spending expanded 1.9% on a monthly basis and 3.2% on a yearly basis.

- Spending in the office category grew 3.8% from January and is up 25.3% on a year-ago basis.

- Transportation-related spending expanded 0.5% month-over-month and 5.8% year-over-year.

- Health care-related spending expanded 2% from January and is up 3.3% from February 2015.

- Public safety-related spending is up 1.8% for the month, but is down 5.3% for the year.

- Commercial-related construction spending inched 0.1% higher for the month and grew 11% for the year.

Spending in eight of the nonresidential construction subsectors fell in February on a monthly basis:

- Educational-related construction spending fell 2.4% from January, but has expanded 8.5% on a yearly basis.

- Communication-related spending fell 15% month-over-month, but expanded 11.8% year-over-year.

- Spending in the highway and street category fell 2% from January, but is 24.5 higher than one year ago.

- Sewage and waste disposal-related spending fell 2.4% for the month, but is up 2.3% for the year.

- Conservation and development-related spending is 4.6% lower on a monthly basis and 16.8% lower on a year-over-year basis.

- Spending in the religious category fell 4% for the month and is up just 0.7% for the year.

- Manufacturing-related spending fell 5.9% on a monthly basis and is up only 0.8% on a yearly basis.

- Spending in the power category fell 0.6% from January, but is 4.8% higher than one year ago.

Related Stories

Industry Research | Dec 28, 2022

Following a strong year, design and construction firms view 2023 cautiously

The economy and inflation are the biggest concerns for U.S. architecture, construction, and engineering firms in 2023, according to a recent survey of AEC professionals by the editors of Building Design+Construction.

Self-Storage Facilities | Dec 16, 2022

Self-storage development booms in high multifamily construction areas

A 2022 RentCafe analysis finds that self-storage units swelled in conjunction with metros’ growth in apartment complexes.

Market Data | Dec 13, 2022

Contractors' backlog of work reaches three-year high

U.S. construction firms have, on average, 9.2 months of work in the pipeline, according to ABC's latest Construction Backlog Indicator.

Contractors | Dec 6, 2022

Slow payments cost the construction industry $208 billion in 2022

The cost of floating payments for wages and invoices represents $208 billion in excess cost to the construction industry, a 53% increase from 2021, according to a survey by Rabbet, a provider of construction finance software.

Mass Timber | Dec 1, 2022

Cross laminated timber market forecast to more than triple by end of decade

Cross laminated timber (CLT) is gaining acceptance as an eco-friendly building material, a trend that will propel its growth through the end of the 2020s. The CLT market is projected to more than triple from $1.11 billion in 2021 to $3.72 billion by 2030, according to a report from Polaris Market Research.

Market Data | Nov 15, 2022

Construction demand will be a double-edged sword in 2023

Skanska’s latest forecast sees shorter lead times and receding inflation, but the industry isn’t out of the woods yet.

Reconstruction & Renovation | Nov 8, 2022

Renovation work outpaces new construction for first time in two decades

Renovations of older buildings in U.S. cities recently hit a record high as reflected in architecture firm billings, according to the American Institute of Architects (AIA).

Market Data | Nov 3, 2022

Building material prices have become the calm in America’s economic storm

Linesight’s latest quarterly report predicts stability (mostly) through the first half of 2023

Building Team | Nov 1, 2022

Nonresidential construction spending increases slightly in September, says ABC

National nonresidential construction spending was up by 0.5% in September, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau.

Hotel Facilities | Oct 31, 2022

These three hoteliers make up two-thirds of all new hotel development in the U.S.

With a combined 3,523 projects and 400,490 rooms in the pipeline, Marriott, Hilton, and InterContinental dominate the U.S. hotel construction sector.