The Architecture Billings Index (ABI), produced by the AIA Economics & Market Research Group, is a leading economic indicator that provides an approximately nine- to twelve-month glimpse into the future of nonresidential construction spending activity. The diffusion indexes contained in the full report are derived from a monthly “work-on-the-boards” survey that is sent to a panel of AIA member-owned firms.

Participants are asked whether their billings increased, decreased, or stayed the same in the month that just ended as compared to the prior month, and the results are then compiled into the ABI. These monthly results are also seasonally adjusted to allow for comparison to prior months. The monthly ABI index scores are centered around 50, with scores above 50 indicating an aggregate increase in billings, and scores below 50 indicating a decline.

Following a generally positive performance in 2015, the Architecture Billings Index has begun this year modestly dipping back into negative terrain. The AIA reported the January ABI score was 49.6, down slightly from the mark of 51.3 in the previous month. This score reflects a minor decrease in design services (any score above 50 indicates an increase in billings). The new projects inquiry index was 55.3, down from a reading of 60.5 the previous month.

“The fundamentals are mostly sound in the nonresidential design and construction market,” said AIA Chief Economist, Kermit Baker, Hon. AIA, PhD. “January was a rocky month throughout the economy, with falling oil prices, international economic concerns, and with steep declines in stock market valuations in the U.S. and elsewhere. Some of the fallout of this uncertainty may have affected progress on design projects.”

Key January* ABI highlights:

- Regional averages: West (50.8), Northeast (50.4), South (50.3), Midwest (48.9),

- Sector index breakdown: multifamily residential (51.9), commercial / industrial (50.5), institutional (49.9), mixed practice (49.0)

- Project inquiries index: 55.3

- Design contracts index: 50.9

The regional and sector categories are calculated as a 3-month moving average, whereas the national index, design contracts and inquiries are monthly numbers.

* Every January the AIA research department updates the seasonal factors used to calculate the ABI, resulting in a revision of recent ABI values.

Related Stories

Market Data | Apr 3, 2017

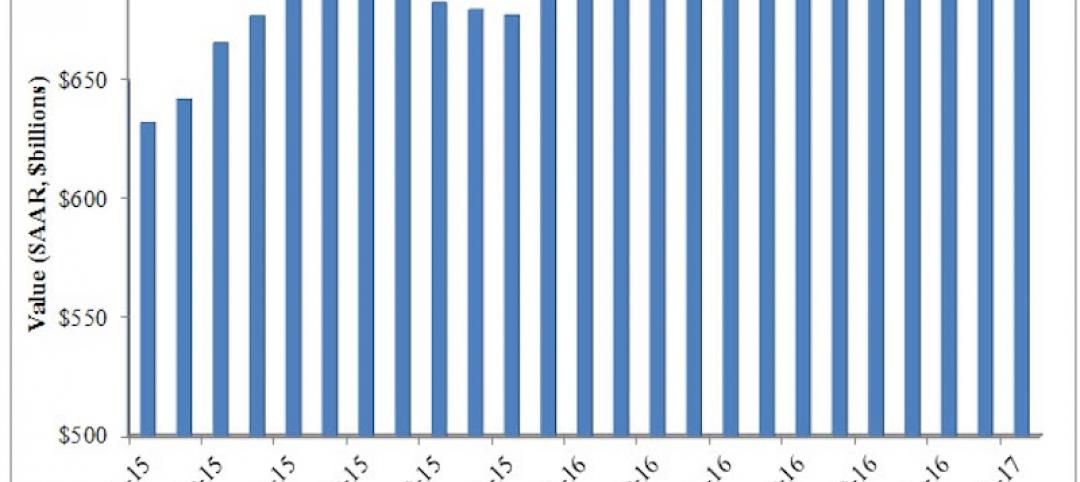

Public nonresidential construction spending rebounds; overall spending unchanged in February

The segment totaled $701.9 billion on a seasonally adjusted annualized rate for the month, marking the seventh consecutive month in which nonresidential spending sat above the $700 billion threshold.

Market Data | Mar 29, 2017

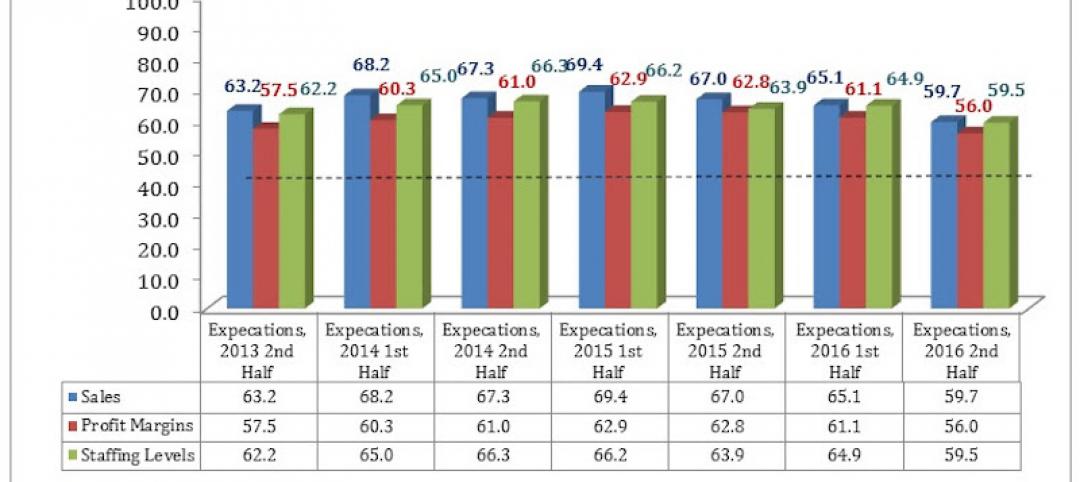

Contractor confidence ends 2016 down but still in positive territory

Although all three diffusion indices in the survey fell by more than five points they remain well above the threshold of 50, which signals that construction activity will continue to be one of the few significant drivers of economic growth.

Market Data | Mar 24, 2017

These are the most and least innovative states for 2017

Connecticut, Virginia, and Maryland are all in the top 10 most innovative states, but none of them were able to claim the number one spot.

Market Data | Mar 22, 2017

After a strong year, construction industry anxious about Washington’s proposed policy shifts

Impacts on labor and materials costs at issue, according to latest JLL report.

Market Data | Mar 22, 2017

Architecture Billings Index rebounds into positive territory

Business conditions projected to solidify moving into the spring and summer.

Market Data | Mar 15, 2017

ABC's Construction Backlog Indicator fell to end 2016

Contractors in each segment surveyed all saw lower backlog during the fourth quarter, with firms in the heavy industrial segment experiencing the largest drop.

Market Data | Feb 28, 2017

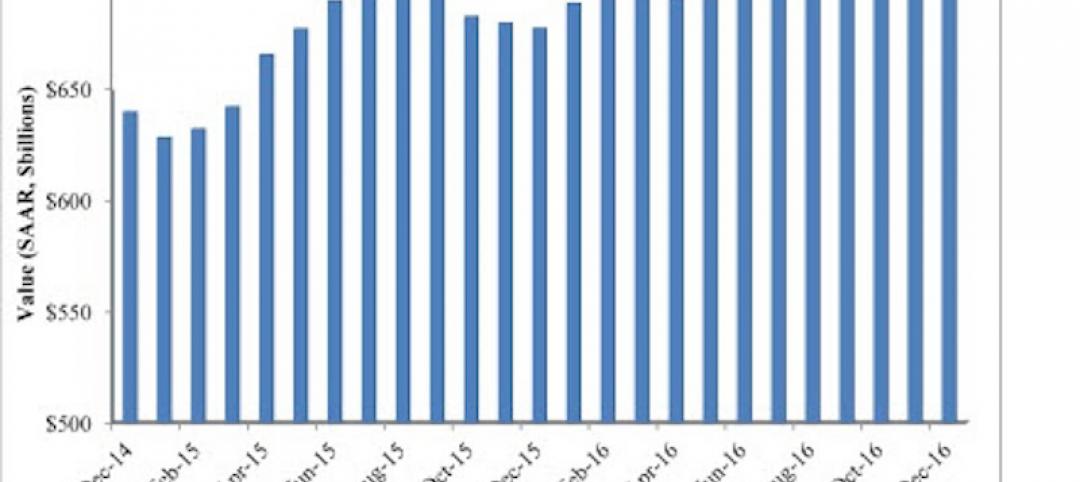

Leopardo’s 2017 Construction Economics Report shows year-over-year construction spending increase of 4.2%

The pace of growth was slower than in 2015, however.

Market Data | Feb 23, 2017

Entering 2017, architecture billings slip modestly

Despite minor slowdown in overall billings, commercial/ industrial and institutional sectors post strongest gains in over 12 months.

Market Data | Feb 16, 2017

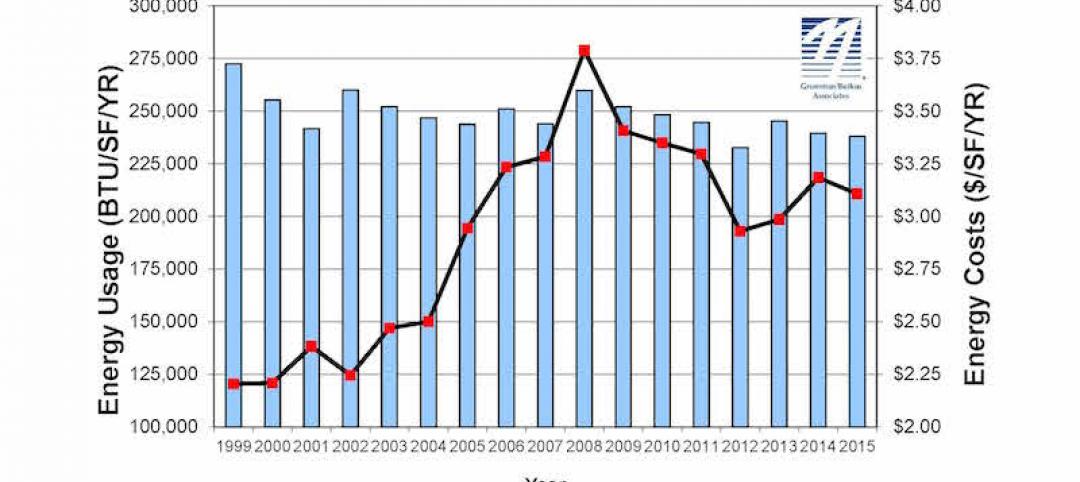

How does your hospital stack up? Grumman/Butkus Associates 2016 Hospital Benchmarking Survey

Report examines electricity, fossil fuel, water/sewer, and carbon footprint.

Market Data | Feb 1, 2017

Nonresidential spending falters slightly to end 2016

Nonresidential spending decreased from $713.1 billion in November to $708.2 billion in December.