In its latest report, the Census Bureau estimates that annualized starts of structures with five or more units stood at 445,000 in October, up 28.2% over the same month a year earlier. However, multifamily permits were only 5.8% higher.

Could the long-predicted slowdown in the multifamily boom finally be happening? The market researcher Axiometrics looked at its identified supply data and concludes that multifamily deliveries could peak by mid-year 2017.

Over the next three quarters, though, this market sector should continue to thrive. Axiometrics expects deliveries to growth by more than 10%, to 91,957, in the fourth quarter of 2016, and then recede a bit to 91,721 in the first quarter of 2017 (which would still be nearly 49% more than 1Q 2016), and then jump again to 102,617 deliveries in the second quarter of 2017, which would be 48.5% more than 2Q 2016.

Axiometrics estimates that a total of 343,582 new apartment units will come onto the market in 2017, 55.7% of which in the first half of the year.

Axiometrics estimates that 343,582 apartment units will come onto the market next year, more than half in the first six months. Image: Axiometrics

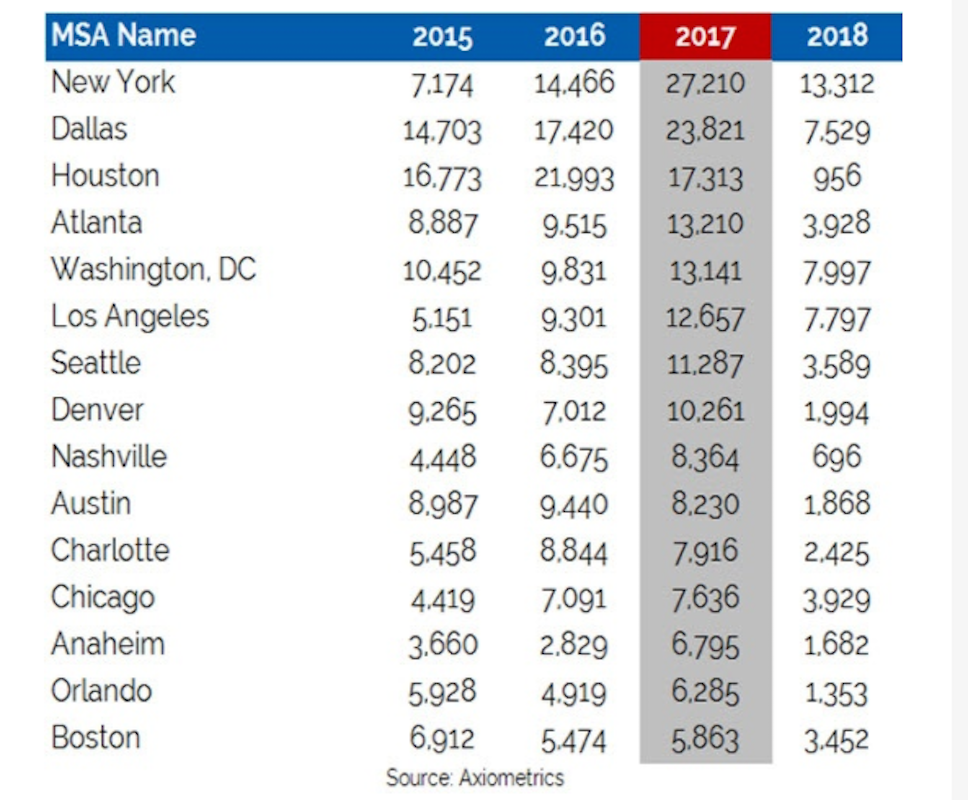

New York is expected to lead the nation in new apartment deliveries next year, with 27,210, representing an 88% leap over 2016 deliveries. (Three of New York’s boroughs—Brooklyn, Queens, and Midtown Manhattan—are among the top 10 submarkets for projected deliveries in 2017.)

Axiometrics points out, though, that New York’s delivery schedule “is a telling example of how construction delays have affected the apartment market.” Those delays are, in part, the result of an ongoing construction labor shortage that other data have shown is expected to continue for at least the next year.

Indeed, New York’s apartment deliveries are expected to fall precipitously in 2018, to 13,312.

Following New York in projected apartment deliveries next year are Dallas (up 36% to 23,821), Houston (which will actually be down 21.2% to 17,313), Atlanta (up 38.8% to 13,210) and Washington D.C. (up 33.7% to 13.141).

All of these metros are expected to see deliveries plummet in 2018, which Houston expected to deliver only 956 new apartment units that year.

The leading metros for multifamily deliveries are all expected to see significant falloffs by 2018. Image: Axiometrics

Axiometrics states that most of new apartments that come onto the market will be absorbed because “the U.S. economy remains in growth mode.” However, by this time next year, apartment deliveries should scale back to more historically normal quarterly levels, in the mid 60,000 units range.

Related Stories

Mixed-Use | Jan 29, 2024

12 U.S. markets where entertainment districts are under consideration or construction

The Pomp, a 223-acre district located 10 miles north of Fort Lauderdale, Fla., and The Armory, a 225,000-sf dining and entertainment venue on six acres in St Louis, are among the top entertainment districts in the works across the U.S.

Sponsored | BD+C University Course | Jan 17, 2024

Waterproofing deep foundations for new construction

This continuing education course, by Walter P Moore's Amos Chan, P.E., BECxP, CxA+BE, covers design considerations for below-grade waterproofing for new construction, the types of below-grade systems available, and specific concerns associated with waterproofing deep foundations.

Multifamily Housing | Jan 15, 2024

Multifamily rent growth rate unchanged at 0.3%

The National Multifamily Report by Yardi Matrix highlights the highs and lows of the multifamily market in 2023. Despite strong demand, rent growth remained unchanged at 0.3 percent.

Adaptive Reuse | Jan 12, 2024

Office-to-residential conversions put pressure on curbside management and parking

With many office and commercial buildings being converted to residential use, two important issues—curbside management and parking—are sometimes not given their due attention. Cities need to assess how vehicle storage, bike and bus lanes, and drop-off zones in front of buildings may need to change because of office-to-residential conversions.

MFPRO+ News | Jan 12, 2024

Detroit may tax land more than buildings to spur development of vacant sites

The City of Detroit is considering a revamp of how it taxes property to encourage development of more vacant lots. The land-value tax has rarely been tried in the U.S., but versions of it have been adopted in many other countries.

MFPRO+ News | Jan 12, 2024

As demand rises for EV chargers at multifamily housing properties, options and incentives multiply

As electric vehicle sales continue to increase, more renters are looking for apartments that offer charging options.

Sustainability | Jan 10, 2024

New passive house partnership allows lower cost financing for developers

The new partnership between PACE Equity and Phius allows commercial passive house projects to be automatically eligible for CIRRUS Low Carbon financing.

Giants 400 | Jan 8, 2024

Top 60 Senior Living Facility Construction Firms for 2023

Whiting-Turner, Ryan Companies US, Weis Builders, Suffolk Construction, and W.E. O'Neil Construction top BD+C's ranking of the nation's largest senior living facility general contractors and construction management (CM) firms for 2023, as reported in the 2023 Giants 400 Report.

Giants 400 | Jan 8, 2024

Top 40 Senior Living Facility Engineering Firms for 2023

Kimley-Horn, Olsson, Tetra Tech, EXP, and IMEG head BD+C's ranking of the nation's largest senior living facility engineering and engineering/architecture (EA) firms for 2023, as reported in the 2023 Giants 400 Report.

Giants 400 | Jan 8, 2024

Top 80 Senior Living Facility Architecture Firms for 2023

Perkins Eastman, Hord Coplan Macht, Lantz-Boggio Architects, Ryan Companies US, and Moseley Architects top BD+C's ranking of the nation's largest senior living facility architecture and architecture engineering (AE) firms for 2023, as reported in the 2023 Giants 400 Report.