In its latest report, the Census Bureau estimates that annualized starts of structures with five or more units stood at 445,000 in October, up 28.2% over the same month a year earlier. However, multifamily permits were only 5.8% higher.

Could the long-predicted slowdown in the multifamily boom finally be happening? The market researcher Axiometrics looked at its identified supply data and concludes that multifamily deliveries could peak by mid-year 2017.

Over the next three quarters, though, this market sector should continue to thrive. Axiometrics expects deliveries to growth by more than 10%, to 91,957, in the fourth quarter of 2016, and then recede a bit to 91,721 in the first quarter of 2017 (which would still be nearly 49% more than 1Q 2016), and then jump again to 102,617 deliveries in the second quarter of 2017, which would be 48.5% more than 2Q 2016.

Axiometrics estimates that a total of 343,582 new apartment units will come onto the market in 2017, 55.7% of which in the first half of the year.

Axiometrics estimates that 343,582 apartment units will come onto the market next year, more than half in the first six months. Image: Axiometrics

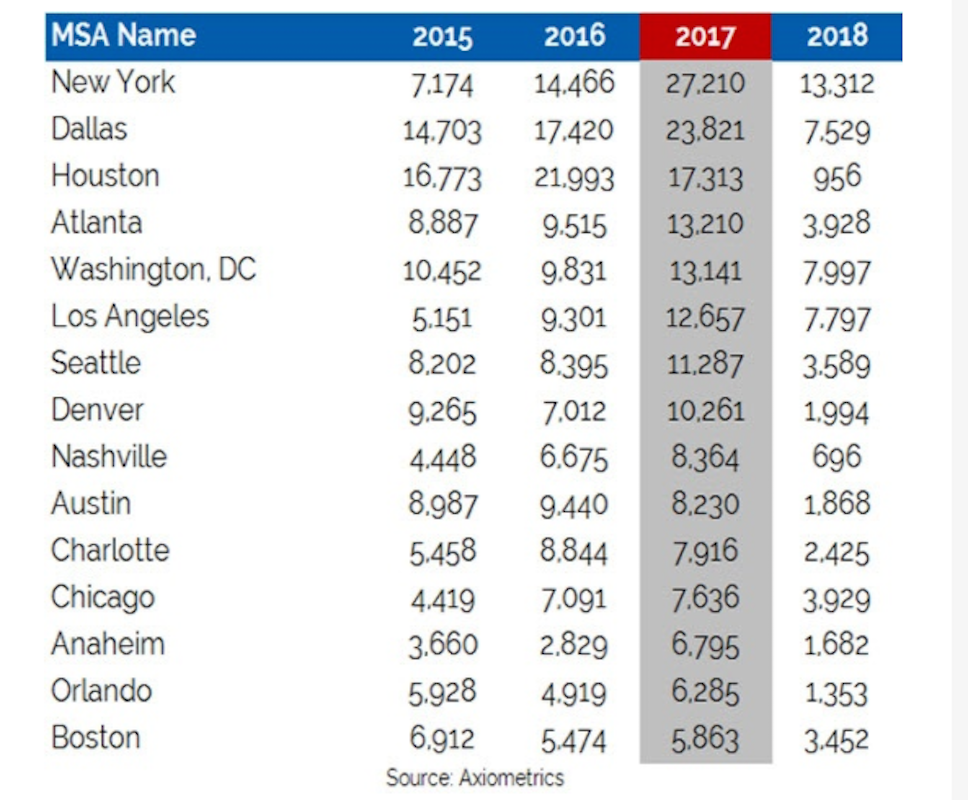

New York is expected to lead the nation in new apartment deliveries next year, with 27,210, representing an 88% leap over 2016 deliveries. (Three of New York’s boroughs—Brooklyn, Queens, and Midtown Manhattan—are among the top 10 submarkets for projected deliveries in 2017.)

Axiometrics points out, though, that New York’s delivery schedule “is a telling example of how construction delays have affected the apartment market.” Those delays are, in part, the result of an ongoing construction labor shortage that other data have shown is expected to continue for at least the next year.

Indeed, New York’s apartment deliveries are expected to fall precipitously in 2018, to 13,312.

Following New York in projected apartment deliveries next year are Dallas (up 36% to 23,821), Houston (which will actually be down 21.2% to 17,313), Atlanta (up 38.8% to 13,210) and Washington D.C. (up 33.7% to 13.141).

All of these metros are expected to see deliveries plummet in 2018, which Houston expected to deliver only 956 new apartment units that year.

The leading metros for multifamily deliveries are all expected to see significant falloffs by 2018. Image: Axiometrics

Axiometrics states that most of new apartments that come onto the market will be absorbed because “the U.S. economy remains in growth mode.” However, by this time next year, apartment deliveries should scale back to more historically normal quarterly levels, in the mid 60,000 units range.

Related Stories

MFPRO+ News | Dec 18, 2023

Berkeley, Calif., raises building height limits in downtown area

Facing a severe housing shortage, the City of Berkeley, Calif., increased the height limits on residential buildings to 12 stories in the area close to the University of California campus.

Sponsored | Multifamily Housing | Dec 13, 2023

Mind the Gap

Incorporating temporary expansion joints on larger construction projects can help avoid serious consequences. Here's why and how.

Giants 400 | Dec 12, 2023

Top 35 Military Facility Construction Firms for 2023

Hensel Phelps, DPR Construction, Walsh Group, and Whiting-Turner top BD+C's ranking of the nation's largest military facility general contractors and construction management (CM) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Dec 12, 2023

Top 50 Military Facility Engineering Firms for 2023

Jacobs, Burns & McDonnell, WSP, and AECOM head BD+C's ranking of the nation's largest military facility engineering and engineering/architecture (EA) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Dec 12, 2023

Top 40 Military Facility Architecture Firms for 2023

Michael Baker International, HDR, Whitman, Requardt & Associates, and Stantec top BD+C's ranking of the nation's largest military facility architecture and architecture/engineering (AE) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report.

Codes and Standards | Dec 11, 2023

Washington state tries new approach to phase out fossil fuels in new construction

After pausing a heat pump mandate earlier this year after a federal court overturned Berkeley, Calif.’s ban on gas appliances in new buildings, Washington state enacted a new code provision that seems poised to achieve the same goal.

MFPRO+ News | Dec 11, 2023

U.S. poorly prepared to house growing number of older adults

The U.S. is ill-prepared to provide adequate housing for the growing ranks of older people, according to a report from Harvard University’s Joint Center for Housing Studies. Over the next decade, the U.S. population older than 75 will increase by 45%, growing from 17 million to nearly 25 million, with many expected to struggle financially.

MFPRO+ News | Dec 7, 2023

7 key predictions for the 2024 multifamily rental housing market

2024 will be the strongest year for new apartment construction in decades, says Apartment List's chief economist.

Codes and Standards | Dec 7, 2023

New York City aims to spur construction of more accessory dwelling units (ADUs)

To address a serious housing shortage, New York City is trying to get more homeowners to build accessory dwelling units (ADUs). The city recently unveiled a program that offers owners of single-family homes up to nearly $400,000 to construct an apartment on their property.

MFPRO+ News | Dec 5, 2023

DOE's Zero Energy Ready Home Multifamily Version 2 released

The U.S. Department of Energy has released Zero Energy Ready Home Multifamily Version 2. The latest version of the certification program increases energy efficiency and performance levels, adds electric readiness, and makes compliance pathways and the certification process more consistent with the ENERGY STAR Multifamily New Construction (ESMFNC) program.