In its latest report, the Census Bureau estimates that annualized starts of structures with five or more units stood at 445,000 in October, up 28.2% over the same month a year earlier. However, multifamily permits were only 5.8% higher.

Could the long-predicted slowdown in the multifamily boom finally be happening? The market researcher Axiometrics looked at its identified supply data and concludes that multifamily deliveries could peak by mid-year 2017.

Over the next three quarters, though, this market sector should continue to thrive. Axiometrics expects deliveries to growth by more than 10%, to 91,957, in the fourth quarter of 2016, and then recede a bit to 91,721 in the first quarter of 2017 (which would still be nearly 49% more than 1Q 2016), and then jump again to 102,617 deliveries in the second quarter of 2017, which would be 48.5% more than 2Q 2016.

Axiometrics estimates that a total of 343,582 new apartment units will come onto the market in 2017, 55.7% of which in the first half of the year.

Axiometrics estimates that 343,582 apartment units will come onto the market next year, more than half in the first six months. Image: Axiometrics

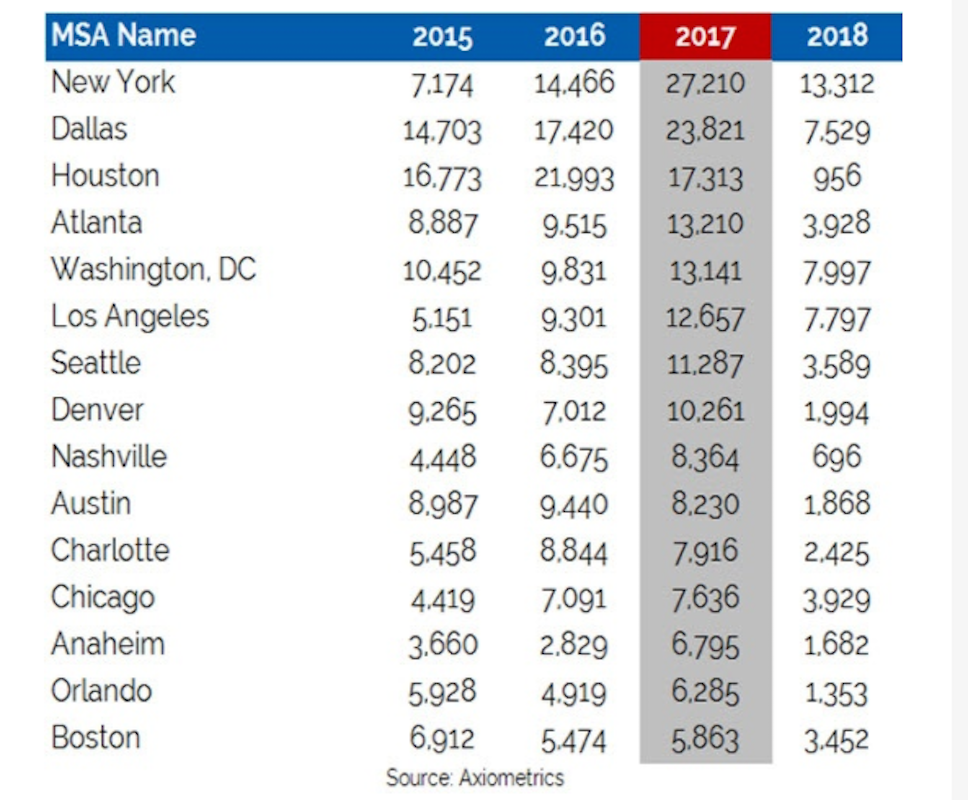

New York is expected to lead the nation in new apartment deliveries next year, with 27,210, representing an 88% leap over 2016 deliveries. (Three of New York’s boroughs—Brooklyn, Queens, and Midtown Manhattan—are among the top 10 submarkets for projected deliveries in 2017.)

Axiometrics points out, though, that New York’s delivery schedule “is a telling example of how construction delays have affected the apartment market.” Those delays are, in part, the result of an ongoing construction labor shortage that other data have shown is expected to continue for at least the next year.

Indeed, New York’s apartment deliveries are expected to fall precipitously in 2018, to 13,312.

Following New York in projected apartment deliveries next year are Dallas (up 36% to 23,821), Houston (which will actually be down 21.2% to 17,313), Atlanta (up 38.8% to 13,210) and Washington D.C. (up 33.7% to 13.141).

All of these metros are expected to see deliveries plummet in 2018, which Houston expected to deliver only 956 new apartment units that year.

The leading metros for multifamily deliveries are all expected to see significant falloffs by 2018. Image: Axiometrics

Axiometrics states that most of new apartments that come onto the market will be absorbed because “the U.S. economy remains in growth mode.” However, by this time next year, apartment deliveries should scale back to more historically normal quarterly levels, in the mid 60,000 units range.

Related Stories

Building Tech | Feb 20, 2024

Construction method featuring LEGO-like bricks wins global innovation award

A new construction method featuring LEGO-like bricks made from a renewable composite material took first place for building innovations at the 2024 JEC Composites Innovation Awards in Paris, France.

Student Housing | Feb 19, 2024

UC Law San Francisco’s newest building provides student housing at below-market rental rates

Located in San Francisco’s Tenderloin and Civic Center neighborhoods, UC Law SF’s newest building helps address the city’s housing crisis by providing student housing at below-market rental rates. The $282 million, 365,000-sf facility at 198 McAllister Street enables students to live on campus while also helping to regenerate the neighborhood.

Multifamily Housing | Feb 16, 2024

5 emerging multifamily trends for 2024

As priorities realign and demographic landscapes transform, multifamily designers and developers find themselves in a continuous state of adaptation to resonate with residents.

MFPRO+ News | Feb 15, 2024

UL Solutions launches indoor environmental quality verification designation for building construction projects

UL Solutions recently launched UL Verified Healthy Building Mark for New Construction, an indoor environmental quality verification designation for building construction projects.

MFPRO+ News | Feb 15, 2024

Nine states pledge to transition to heat pumps for residential HVAC and water heating

Nine states have signed a joint agreement to accelerate the transition to residential building electrification by significantly expanding heat pump sales to meet heating, cooling, and water heating demand. The Memorandum of Understanding was signed by directors of environmental agencies from California, Colorado, Maine, Maryland, Massachusetts, New Jersey, New York, Oregon, and Rhode Island.

MFPRO+ News | Feb 15, 2024

Oregon, California, Maine among states enacting policies to spur construction of missing middle housing

Although the number of new apartment building units recently reached the highest point in nearly 50 years, construction of duplexes, triplexes, and other buildings of from two to nine units made up just 1% of new housing units built in 2022. A few states have recently enacted new laws to spur more construction of these missing middle housing options.

Multifamily Housing | Feb 14, 2024

Multifamily rent remains flat at $1,710 in January

The multifamily market was stable at the start of 2024, despite the pressure of a supply boom in some markets, according to the latest Yardi Matrix National Multifamily Report.

Sustainability | Feb 7, 2024

9 states pledge to accelerate transition to clean residential buildings

States from coast to coast have signed a joint agreement to accelerate the transition to pollution-free residential buildings by significantly expanding heat pump sales to meet heating, cooling, and water heating demand in coming years.

Multifamily Housing | Feb 5, 2024

Wood Partners transfers all property management operations to Greystar

Greystar and Wood have entered into a long-term agreement whereby Greystar will serve as property manager for all current and future Wood developed and owned assets.

Industry Research | Jan 31, 2024

ASID identifies 11 design trends coming in 2024

The Trends Outlook Report by the American Society of Interior Designers (ASID) is the first of a three-part outlook series on interior design. This design trends report demonstrates the importance of connection and authenticity.