U.S. architecture firms have experienced a near complete recovery from the Great Recession, which has allowed firm leaders to reinvest profits back into their businesses. These findings, along with an in depth look at topics such as firm billings, staffing, and international work, are covered in The Business of Architecture: 2016 Firm Survey Report.

Key highlights include:

- Net billings at architecture firms were $28.5 billion at the peak of the market in 2008 and had nearly recovered to $28.4 billion by 2015.

- Percentage of firms reporting a financial loss declined sharply in recent years from more than 20% in 2011 to fewer than 10% by 2015.

- Growing profitability has allowed firms to increase their marketing activities and expand into new geographical areas and building types to diversity their design portfolios.

- Renovations made up a large portion of design work with 45% of building design billings coming from work on existing facilities, including 30% from additions to buildings, and the remaining from historic preservation projects.

- Billings in the residential sector topped $7 billion, more than 30% over 2013 levels.

- Modest gains in diversity of profession with women now comprising 31% of architecture staff (up from 28% in 2013) and minorities making up 21% of staff (up from 20% in 2013).

- Use of Building Information Modeling (BIM) software has become standard at larger firms with 96% of firms with 50 or more employees report using it for billable work (compared to 72% of mid-sized firms and 28% of small firms).

- Newer technologies including 3D printing and 4D/5D modeling are reported being used at only 11% and 8% of firms respectively.

- Energy modeling currently has a low adoption rate with 13% of firms using it for billable work, although this share jumps to 59% for large firms.

“In the coming years we expect firms will be adding technological dimensions to their design work through greater utilization of cloud computing, 3D printing and the use of virtual reality software. This should help further efficiencies, minimize waste and project delivery delays, and lead to increased bottom line outcomes for their clients,” says AIA senior director of research, Michele Russo in a press release.

Related Stories

Market Data | Apr 4, 2016

ABC: Nonresidential spending slip in February no cause for alarm

Spending in the nonresidential sector totaled $690.3 billion on a seasonally adjusted, annualized basis in February. The figure is a step back but still significantly higher than one year ago.

Market Data | Mar 30, 2016

10 trends for commercial real estate: JLL report

The report looks at global threats and opportunities, and how CRE firms are managing their expectations for growth.

Market Data | Mar 23, 2016

AIA: Modest expansion for Architecture Billings Index

Business conditions softening most in Midwest in recent months.

Retail Centers | Mar 16, 2016

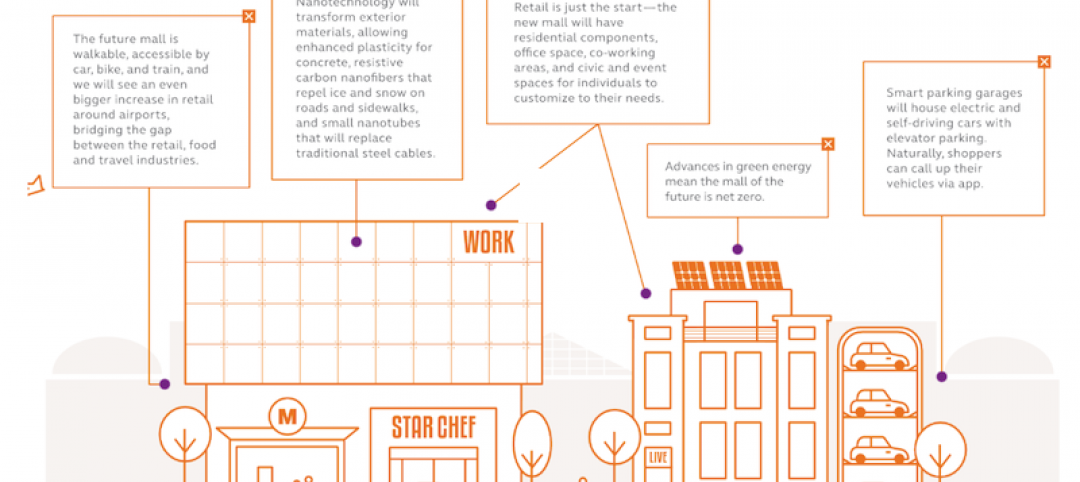

Food and technology will help tomorrow’s malls survive, says CallisonRTKL

CallisonRTKL foresees future retail centers as hubs with live/work/play components.

Market Data | Mar 6, 2016

Real estate execs measure success by how well they manage ‘talent,’ costs, and growth

A new CBRE survey finds more companies leaning toward “smarter” workspaces.

Market Data | Mar 1, 2016

ABC: Nonresidential spending regains momentum in January

Nonresidential construction spending expanded 2.5% on a monthly basis and 12.3% on a yearly basis, totaling $701.9 billion. Spending increased in January in 10 of 16 nonresidential construction sectors.

Market Data | Mar 1, 2016

Leopardo releases 2016 Construction Economics Report

This year’s report shows that spending in 2015 reached the highest level since the Great Recession. Total spending on U.S. construction grew 10.5% to $1.1 trillion, the largest year-over-year gain since 2007.

Market Data | Feb 26, 2016

JLL upbeat about construction through 2016

Its latest report cautions about ongoing cost increases related to finding skilled laborers.

Market Data | Feb 17, 2016

AIA reports slight contraction in Architecture Billings Index

Multifamily residential sector improving after sluggish 2015.

Market Data | Feb 11, 2016

AIA: Continued growth expected in nonresidential construction

The American Institute of Architects’ semi-annual Consensus Construction Forecast indicates a growth of 8% in construction spending in 2016, and 6.7% the following year.