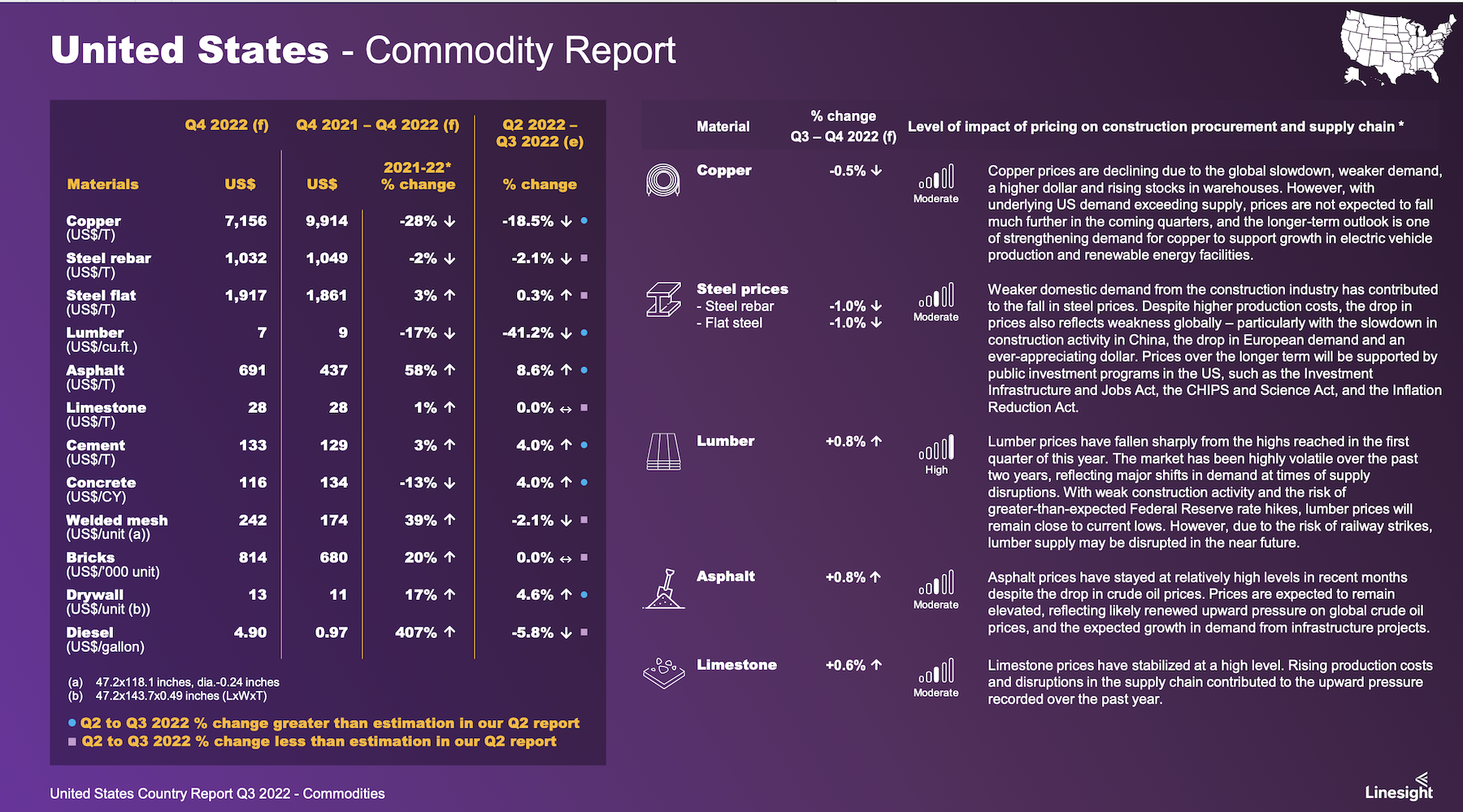

Commercial and institutional construction spending is projected to be down 6.9 percent and 13 percent, respectively, in 2022, impacted by macroeconomic factors that include increasing demand for long-lead equipment, material shortages caused by supply-chain snags and the Russia-Ukraine war, and the instability of costs for fuel and labor.

That easing of demand has allowed key commodity prices to stabilize, and there is reason for optimism despite uncertainty about the health of the U.S economy that is only expected to expand by 1 percent next year.

This is the perspective of Linesight, a multinational construction consultant, which has released its Third Quarter Commodity Report for the United States. Patrick Ryan, Linesight’s Executive Vice President for the Americas, states that the “medium to long-term outlook remains positive, with [economic] growth expected in the coming years as inflation comes under control.”

The Report focuses on five key commodities:

•Lumber, whose prices have been on a downward trend since the first quarter. Supply-side fragilities have eased, as post-flood mill inventory in British Columbia is rebuilding.

•Cement and aggregates, whose prices have been affected by oil price turbulence. Linesight sees the slowdown in residential construction as easing pressure on this commodity’s demand, although that could also be negated by commercial demand spurred by the Infrastructure Investment and Jobs Act of 2021.

•Concrete blocks and bricks, whose prices are waning along with residential construction demand that is tamped by rising mortgage interest rates.

•Rebar and structural steel, whose prices had flattened during the previous quarter, and whose weakening future demand, especially from China, anticipates falling prices. However, Linesight also cautions that high energy prices continue to drive up steel’s production costs.

•Copper, whose price declines of late have stabilized. Supply disruptions and the lack of investment in new mining operations continue to contribute to production shortfalls, and demand remains “resilient,” especially as the manufacture of electric vehicle batteries expands.

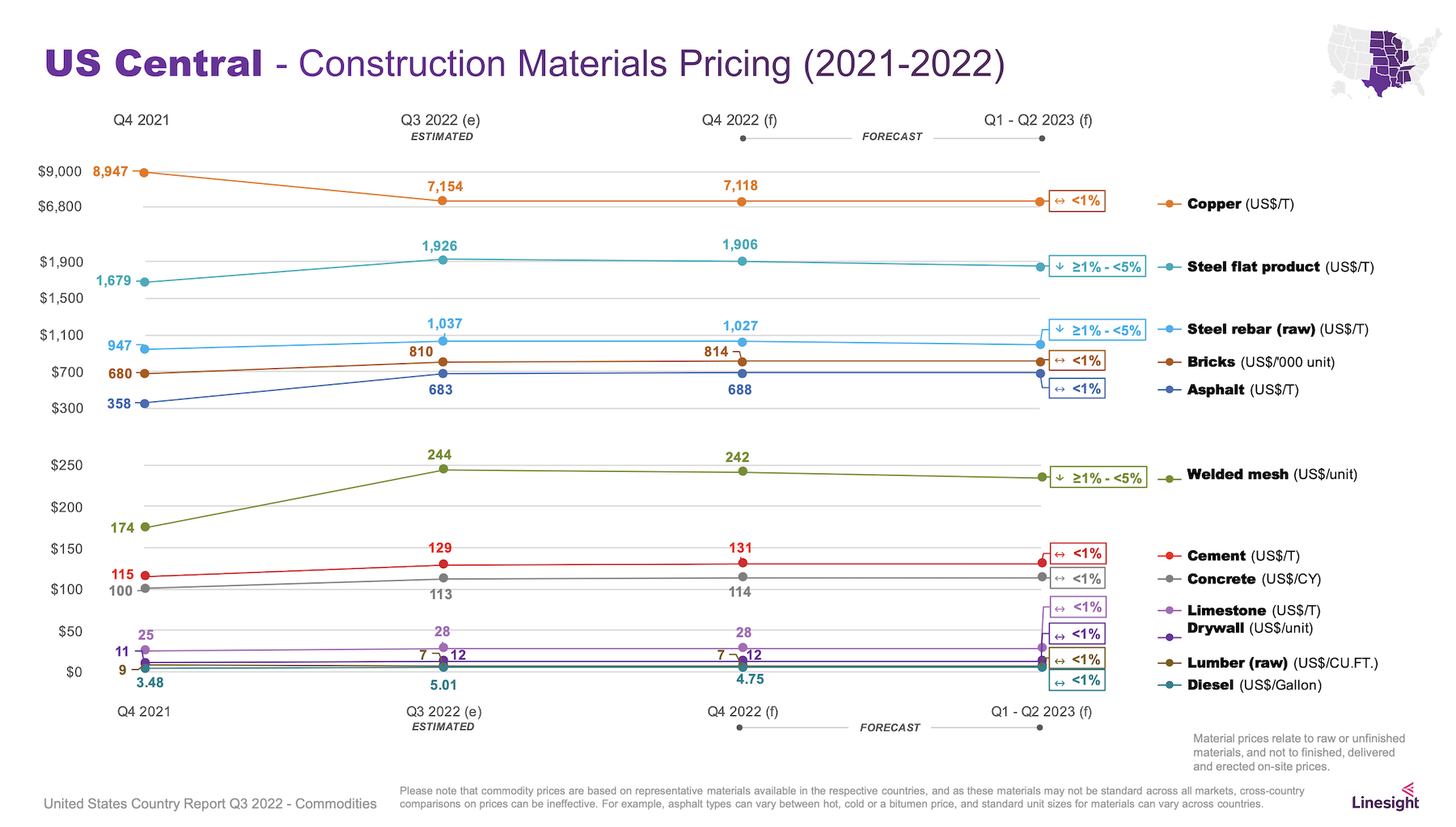

The Report prognosticates as well about pricing for asphalt, limestone, welded mesh, drywall, and diesel fuel. It also forecasts commodity prices by regions of the country, although the geographic variations are, for the most part, marginal.

Perhaps the most important issue right now affecting commodity prices, says Ryan, is mixed data on the economy. Despite two consecutive quarterly declines, “there are positive indicators being recorded to suggest economic resilience in some key areas,” such as the lowest unemployment rate in five decades, and the Federal Reserve’s aggressive actions to curb inflation.

Another bright spot is labor productivity in the U.S., which still outpaces Germany, the United Kingdom, Hong Kong, Taiwan, South Korea, and Japan.

Related Stories

Market Data | Feb 5, 2020

Construction employment increases in 211 out of 358 metro areas from December 2018 to 2019

Dallas-Plano-Irving, Texas and Kansas City have largest gains; New York City and Fairbanks, Alaska lag the most as labor shortages likely kept firms in many areas from adding even more workers.

Market Data | Feb 4, 2020

Construction spending dips in December as nonresidential losses offset housing pickup

Homebuilding strengthens but infrastructure and other nonresidential spending fades in recent months, reversing pattern in early 2019.

Market Data | Feb 4, 2020

IMEG Corp. acquires Clark Engineering

Founded in 1938 in Minneapolis, Clark Engineering has an extensive history of public and private project experience.

Market Data | Jan 30, 2020

U.S. economy expands 2.1% in 4th quarter

Investment in structures contracts.

Market Data | Jan 30, 2020

US construction & real estate industry sees a drop of 30.4% in deal activity in December 2019

A total of 48 deals worth $505.11m were announced in December 2019.

Market Data | Jan 29, 2020

Navigant research report finds global wind capacity value is expected to increase tenfold over the next decade

Wind power is being developed in more countries as well as offshore and onshore.

Market Data | Jan 28, 2020

What eight leading economists predict for nonresidential construction in 2020 and 2021

Public safety, education, and healthcare highlight a market that is entering growth-slowdown mode, but no downturn is projected, according to AIA's latest Consensus Construction Forecast panel.

Market Data | Jan 28, 2020

Los Angeles has the largest hotel construction pipeline in the United States

Los Angeles will have a growth rate of 2.5% with 19 new hotels/2,589 rooms opening.

Market Data | Jan 27, 2020

U.S. hotel construction pipeline finishes 2019 trending upward

Projects under construction continue to rise reaching an all-time high of 1,768 projects.

Market Data | Jan 24, 2020

U.S. Green Building Council releases the top 10 states for LEED

Colorado leads the nation, showing how LEED green buildings support climate action and a better quality of life.