Investors in healthcare buildings view multi-tenant medical offices as their best bets for returns on investments whose financing, to an increasing degree, leans toward cash rather than debt.

Those are some of the findings in a 15-page report that CBRE’s U.S. Healthcare Capital Markets Group has released, based on responses from 80 healthcare real estate investors answering 26 questions. The largest group of respondents (32%) was healthcare real estate developers, followed by healthcare REITs and private capital healthcare investors (27% each).

Nearly one-third (32%) of all respondents say they target transactions that fall between $20 million and $50 million. Another 31% say that their preferred transaction range is $10 million to $20 million. Nearly all of the respondents—96%—are most interested in medical office buildings as the type of building that meets their acquisition criteria. The next preferred building type is ambulatory surgery centers (63%), wellness centers (41%), and assisted living facilities (39%).

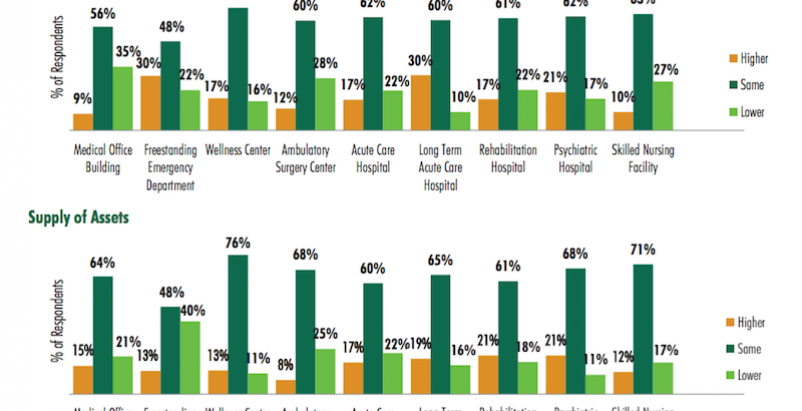

With some notable exceptions, supply (lower row) and demand (upper row) of acqusition properties in the healthcare building sector is expected to be about this same this year as it was in 2015, according to a survey of 80 healthcare real estate investors. Image: CBRE

With some notable exceptions, supply (lower row) and demand (upper row) of acqusition properties in the healthcare building sector is expected to be about this same this year as it was in 2015, according to a survey of 80 healthcare real estate investors. Image: CBRE

The total amount of equity that firms allocated for healthcare real estate investment this year, nearly $14.5 billion, was about 7% less than the $15.5 billion estimate from the 2015 survey. But the 2016 number is still considerably higher than estimates in the years 2011 through 2014, and is actually 132% of the total market transaction volume that traded in the healthcare sector in 2015.

The greatest portion of respondents (29%) says leveraged internal rate of return (IRR) is the investment return measurement they rely on most. However, that’s down from 33% in the 2015 survey. On the other hand, all-cash IRR saw a big jump—to 22% from 12% in 2015—as a relied-upon investment metric.

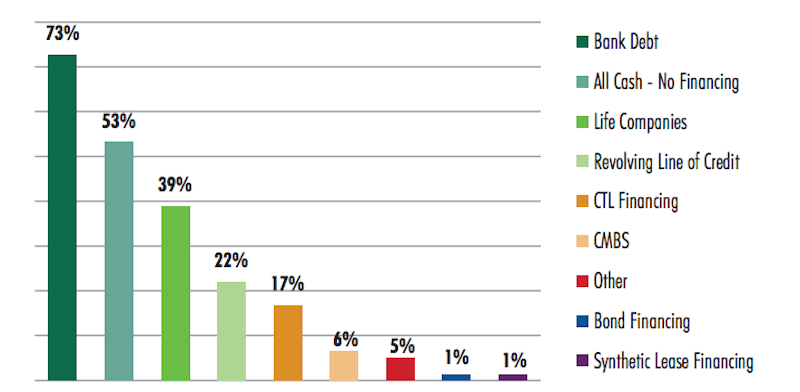

Interestingly, all-cash financing finished second, behind bank debt, as the type of financing the respondents used. Nearly nine of 10 REITs surveyed say they would use all-cash financing, whereas more than three-quarters of the developers would use bank debt to pay for their investments.

Healthcare REITs says they are more disposed to pay cash for acquisitions of medical office buildings, versus developers that lean more thoward bank financing of their deals. Image: CBRE

There’s wide variation in how long respondents hold onto healthcare investments. The greatest number—31%—say 10 years or more. But another 23% say they will hold only an investment for between five and seven years, and the same percentage are holding onto properties for only two and four year.

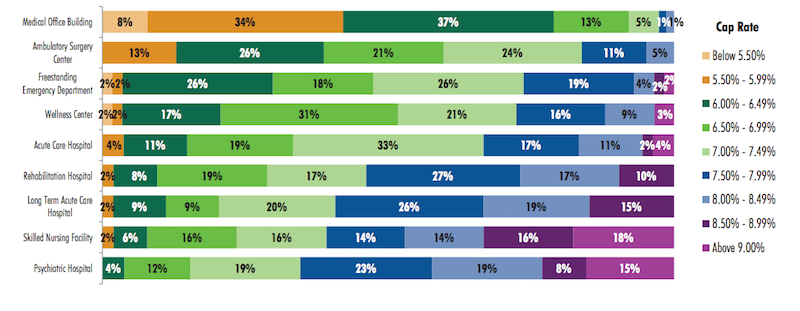

Class A on-campus medical office buildings are the healthcare product type that continues to price most aggressively, vis-à-vis Class A off-campus medical offices, although the differences are narrowing, according to this year’s survey. About 49% of respondents indicate that a market cap rate for Class A on-campus medical offices would be below 6%, compared to 53% who say the cap rate for Class A off-campus product would be below 6.5%.

CBRE's survey finds that the market cap rate that investors target varies considerably by product type in the healthcare sector. Image: CBRE

When discussing their target 10-year IRR for all-cash investments in multi-tenant medical office buildings, 42% of respondents say it falls between 7% and 9.49%. Another 31% say their IRR target for this product type would be between 9.5% and 11.99%. “Respondents indicated a lack of desire for the most aggressively priced product, with only 4% indicating a target all-cash IRR below 7%, compared to 17% in 2015,” CBRE reports.

Single-tenant medical office buildings are pricing the most aggressively, with the largest group of respondents (37%) indicating a cap rate range of 6% to 6.49%, and another 42% indicating a cap rate lower than 5.99% In contrast, more than one quarter of respondents indicates a cap rate of 6% to 6.49% for ambulatory surgery centers, while 31% indicate a cap rate range of 6.5% to 6.99% for wellness centers, and 33% a 7% to 7.49% range for acute care hospitals.

The product types with the least-aggressive pricing, according to the survey’s respondents, are long-term acute care hospitals, skilled nursing facilities, and psychiatric hospitals.

The vast majority of respondents—82%—say their medical office investments this year would make them "net buyers."

Majorities of respondents expect supply of and demand for healthcare sector buildings in general to remain pretty much the same this year as in 2015, with some intriguing collisions: for example 30% of respondents think demand for freestanding emergency departments would be higher even as 40% expect supply of that product type would be lower.

Rents for medical office buildings were up between 2% and 3% for the respondents’ portfolios, and none is predicting much growth beyond that in the next 12 months, which is curious given that 59% of those surveyed say their portfolio’s occupancy rates were higher than the year before.

CBRE’s report touches on a host of other investment topics, including operating expenses, credit ratings, acceptable terms for sale-leasebacks (10 to 14 years appears to be the preferred threshold), and issues revolving around ground lease price floors and structuring.

And when the questions home in on developers specifically, nearly half (48%) of developers who responded predict that development request for proposal (RFP) activity would be similar to last year. The biggest number of developers—36%—says that a lease constant of below 7% was the minimum they would consider for a healthcare development opportunity that met their highest standards of investment. (Nearly half says they’d consider a lease constant below 8% for a new development.)

Most developers (44% of those who responded) prefer at least 50% to 60% of a project to be preleased, and a large majority (82%) of developer-respondents require that 50% to 80% of a project to be preleased before they’d invest.

Related Stories

Reconstruction & Renovation | Mar 28, 2022

Is your firm a reconstruction sector giant?

Is your firm active in the U.S. building reconstruction, renovation, historic preservation, and adaptive reuse markets? We invite you to participate in BD+C's inaugural Reconstruction Market Research Report.

Industry Research | Mar 28, 2022

ABC Construction Backlog Indicator unchanged in February

Associated Builders and Contractors reported today that its Construction Backlog Indicator remained unchanged at 8.0 months in February, according to an ABC member survey conducted Feb. 21 to March 8.

Industry Research | Mar 23, 2022

Architecture Billings Index (ABI) shows the demand for design service continues to grow

Demand for design services in February grew slightly since January, according to a new report today from The American Institute of Architects (AIA).

Industry Research | Mar 17, 2022

Construction input prices rise 2.6% in February, says ABC

Construction input prices increased 2.6% in February compared to the previous month, according to an Associated Builders and Contractors analysis of the U.S. Bureau of Labor Statistics’ Producer Price Index data released today

Museums | Mar 16, 2022

Unpacking the secrets to good museum storage

Museum leaders should focus as much design attention on the archives as the galleries themselves, according to a new white paper by Erin Flynn and Bruce Davis, architects and museum experts with the firm Cooper Robertson.

Codes and Standards | Mar 10, 2022

HOK offers guidance for reducing operational and embodied carbon in labs

Global design firm HOK has released research providing lab owners and developers guidance for reducing operational and embodied carbon to meet net zero goals.

Industry Research | Mar 9, 2022

Survey reveals five ways COVID-19 changed Americans’ impressions of public restrooms and facilities

Upon entering the third year of the pandemic, Americans are not only more sensitive to germs in public restrooms, they now hold higher standards for the cleanliness, condition and technology used in these shared spaces, according to the annual Healthy Handwashing Survey™ from Bradley Corporation conducted in January.

Codes and Standards | Mar 7, 2022

Late payments in the construction industry rose in 2021

Last year was a tough one for contractors when it comes to getting paid on time.

Multifamily Housing | Mar 4, 2022

221,000 renters identify what they want in multifamily housing, post-Covid-19

Fresh data from the 2022 NMHC/Grace Hill Renter Preferences Survey shows how remote work is impacting renters' wants and needs in apartment developments.

Codes and Standards | Mar 4, 2022

Construction industry faces a 650,000 worker shortfall in 2022

The U.S. construction industry must hire an additional 650,000 workers in 2022 to meet the expected demand for labor, according to a model developed by Associated Builders and Contractors.