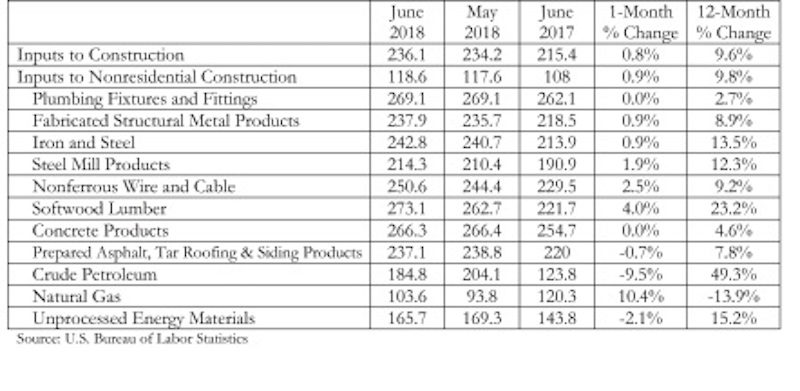

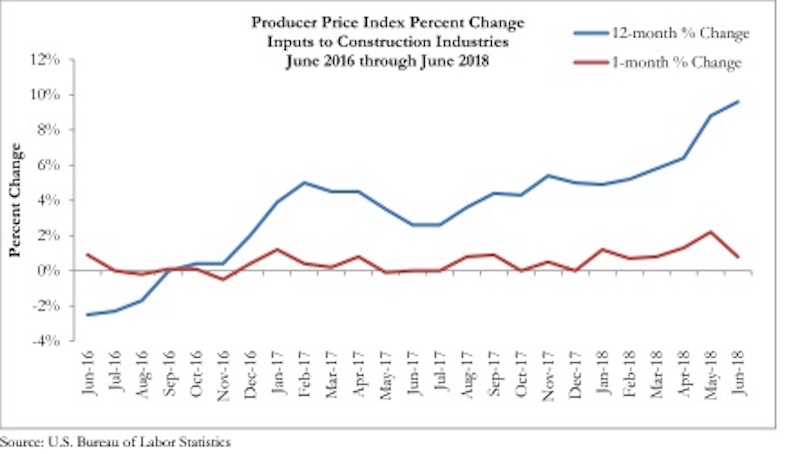

According to an Associated Builders and Contractors analysis of U.S. Bureau of Labor Statistics data released today, construction material prices rose another 0.8% in June and are 9.6% higher than they were at the same time one year ago.

June represents the latest month associated with rapidly rising construction input prices. Nonresidential construction materials prices effectively mirrored overall construction prices by rising 0.9% on a month-over-month basis and 9.8% on a year-over-year basis.

“In general, this emerging state of affairs is unfavorable,” said ABC Chief Economist Anirban Basu. “Rapidly rising materials prices interfere with economic progress in numerous ways, including by making it less likely that a particular development will move forward. They also increase the cost of delivering government-financed infrastructure, raise costs for final consumers such as homeowners, renters and office tenants, and exacerbate overall inflationary pressures, which serves to push nominal borrowing costs higher.

“Materials prices are up roughly 10% in just one year, and certain categories have experienced significant rates of price increase,” said Basu. “Among these are key inputs that appear to have been impacted by evolving policymaking, including the price of crude petroleum, which is up 49% over the past year, iron and steel, which is up nearly 14%, and softwood lumber, up 23%.

“Some contractors may note the similarities between the current period and the period immediately preceding the onset of the global financial crisis,” said Basu. “Materials prices, for instance, were rising rapidly for much of 2006 and 2007 as the economic expansion that began in 2001 reached its final stages. Today’s data will provide further ammunition for policymakers committed to tightening monetary policy and raising short-term interest rates.

“With no end in sight regarding the ongoing tariff spat between the United States and a number of leading trading partners, and with the domestic economy continuing to expand briskly, construction input prices are positioned to increase further going forward, though the current rate of increase appears unsustainable.”

Related Stories

Market Data | Oct 4, 2019

Global construction output growth will decline to 2.7% in 2019

It will be the slowest pace of growth in a decade, according to GlobalData.

Market Data | Oct 2, 2019

Spending on nonresidential construction takes a step back in August

Office, healthcare, and public safety are among the fastest-growing sectors, according to the U.S. Census Bureau's latest report.

Market Data | Sep 27, 2019

The global hotel construction pipeline ascends to new record highs

With the exception of Latin America, all regions of the globe either continued to set record high pipeline counts or have already settled into topping-out formations amidst concerns of a worldwide economic slowdown.

Market Data | Sep 25, 2019

Senate introduces The School Safety Clearinghouse Act

Legislation would create a federally funded and housed informational resource on safer school designs.

Market Data | Sep 18, 2019

Substantial decline in Architecture Billings

August report suggests greatest weakness in design activity in several years.

Market Data | Sep 17, 2019

ABC’s Construction Backlog Indicator inches lower in July

Backlog in the heavy industrial category increased by 2.3 months and now stands at its highest level in the history of the CBI series.

Market Data | Sep 13, 2019

Spending on megaprojects, already on the rise, could spike hard in the coming years

A new FMI report anticipates that megaprojects will account for one-fifth of annual construction spending within the next decade.

Architects | Sep 11, 2019

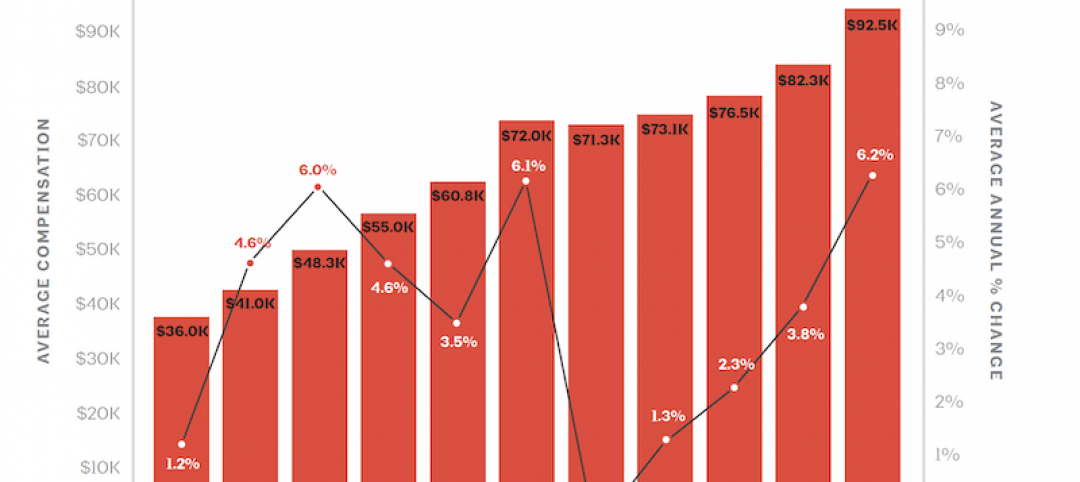

Buoyed by construction activity, architect compensation continues to see healthy gains

The latest AIA report breaks down its survey data by 44 positions and 28 metros.

Market Data | Sep 11, 2019

New 2030 Commitment report findings emphasize need for climate action

Profession must double down on efforts to meet 2030 targets.

Market Data | Sep 10, 2019

Apartment buildings and their residents contribute $3.4 trillion to the national economy

New data show how different aspects of the apartment industry positively impact national, state and local economies.