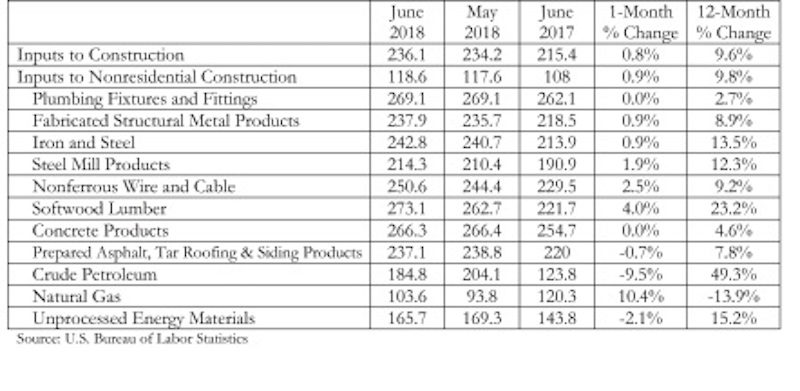

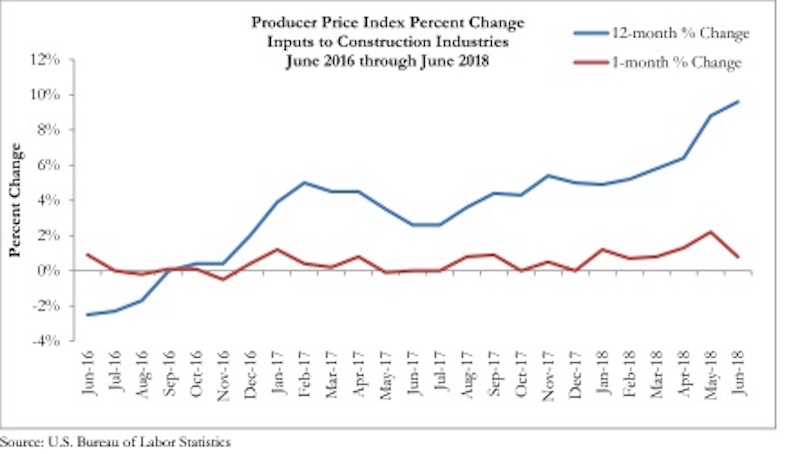

According to an Associated Builders and Contractors analysis of U.S. Bureau of Labor Statistics data released today, construction material prices rose another 0.8% in June and are 9.6% higher than they were at the same time one year ago.

June represents the latest month associated with rapidly rising construction input prices. Nonresidential construction materials prices effectively mirrored overall construction prices by rising 0.9% on a month-over-month basis and 9.8% on a year-over-year basis.

“In general, this emerging state of affairs is unfavorable,” said ABC Chief Economist Anirban Basu. “Rapidly rising materials prices interfere with economic progress in numerous ways, including by making it less likely that a particular development will move forward. They also increase the cost of delivering government-financed infrastructure, raise costs for final consumers such as homeowners, renters and office tenants, and exacerbate overall inflationary pressures, which serves to push nominal borrowing costs higher.

“Materials prices are up roughly 10% in just one year, and certain categories have experienced significant rates of price increase,” said Basu. “Among these are key inputs that appear to have been impacted by evolving policymaking, including the price of crude petroleum, which is up 49% over the past year, iron and steel, which is up nearly 14%, and softwood lumber, up 23%.

“Some contractors may note the similarities between the current period and the period immediately preceding the onset of the global financial crisis,” said Basu. “Materials prices, for instance, were rising rapidly for much of 2006 and 2007 as the economic expansion that began in 2001 reached its final stages. Today’s data will provide further ammunition for policymakers committed to tightening monetary policy and raising short-term interest rates.

“With no end in sight regarding the ongoing tariff spat between the United States and a number of leading trading partners, and with the domestic economy continuing to expand briskly, construction input prices are positioned to increase further going forward, though the current rate of increase appears unsustainable.”

Related Stories

Market Data | Jun 12, 2019

Construction input prices see slight increase in May

Among the 11 subcategories, six saw prices fall last month, with the largest decreases in natural gas.

Market Data | Jun 3, 2019

Nonresidential construction spending up 6.4% year over year in April

Among the 16 sectors tracked by the U.S. Census Bureau, nine experienced an increase in monthly spending, led by water supply and highway and street.

Market Data | Jun 3, 2019

4.1% annual growth in office asking rents above five-year compound annual growth rate

Market has experienced no change in office vacancy rates in three quarters.

Market Data | May 30, 2019

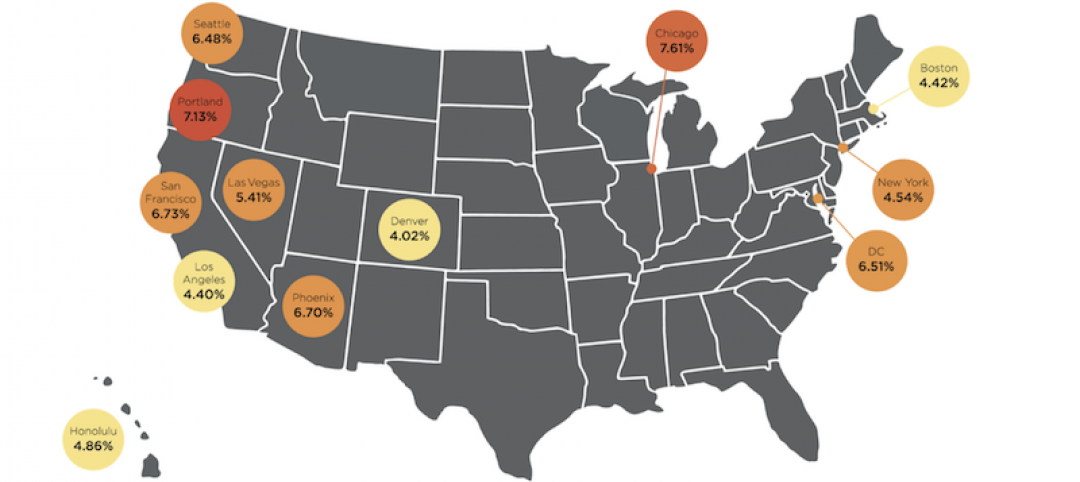

Construction employment increases in 250 out of 358 metros from April 2018 to April 2019

Demand for work is outpacing the supply of workers.

Market Data | May 24, 2019

Construction contractors confidence remains high in March

More than 70% of contractors expect to increase staffing levels over the next six months.

Market Data | May 22, 2019

Slight rebound for architecture billings in April

AIA’s ABI score for April showed a small increase in design services at 50.5 in April.

Market Data | May 9, 2019

The U.S. hotel construction pipeline continues to grow in the first quarter as the economy shows surprising strength

Projects currently under construction stand at 1,709 projects/227,924 rooms.

Market Data | May 9, 2019

Construction input prices continue to rise

Nonresidential input prices rose 0.9% compared to March and are up 2.8% on an annual basis.

Market Data | May 7, 2019

Construction costs in major metros continued to climb last year

Latest Rider Levett Bucknall report estimates rise at more than double the rate of 2018 Growth Domestic Product.

Market Data | Apr 29, 2019

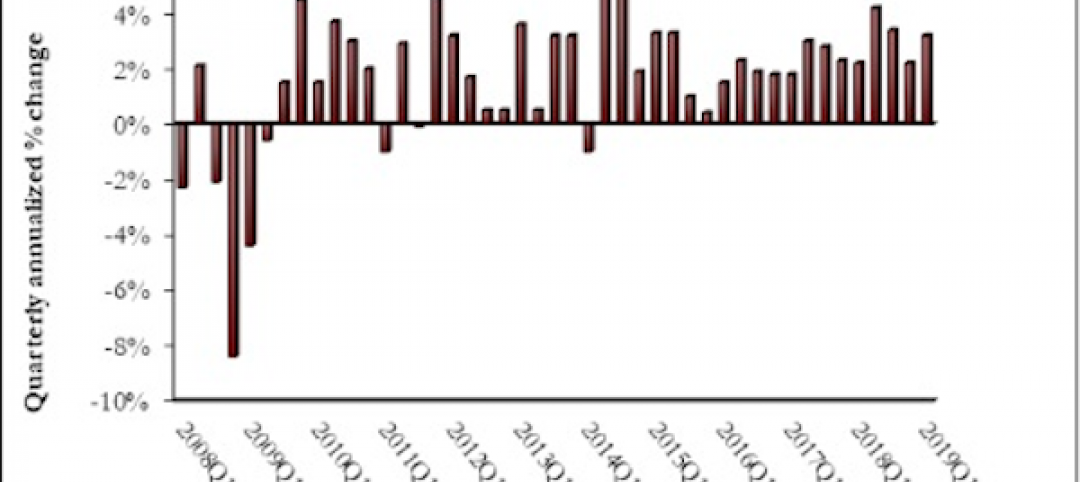

U.S. economic growth crosses 3% threshold to begin the year

Growth was fueled by myriad factors, including personal consumption expenditures, private inventory investment, surprisingly rapid growth in exports, state and local government spending and intellectual property.