Healthcare consumers are just as likely to factor in convenience as they do cost when deciding where to seek care and from whom, according to a new survey of 4,037 American adults about their attitudes and preferences as patients.

The survey, conducted from April 19-28 by JLL, in many ways confirms the obvious: that older generations seek preventive care more often than younger generations; that insurance coverage is a primary driver for choosing a provider or hospital; and that the quality of service affects the patient experience.

Nearly eight of 10 of the survey’s respondents had received at least one type of non-dental care in the last year. Women, who accounted for 51% of the survey’s respondents, are more likely to receive care overall, but men are more likely to receive emergency care.

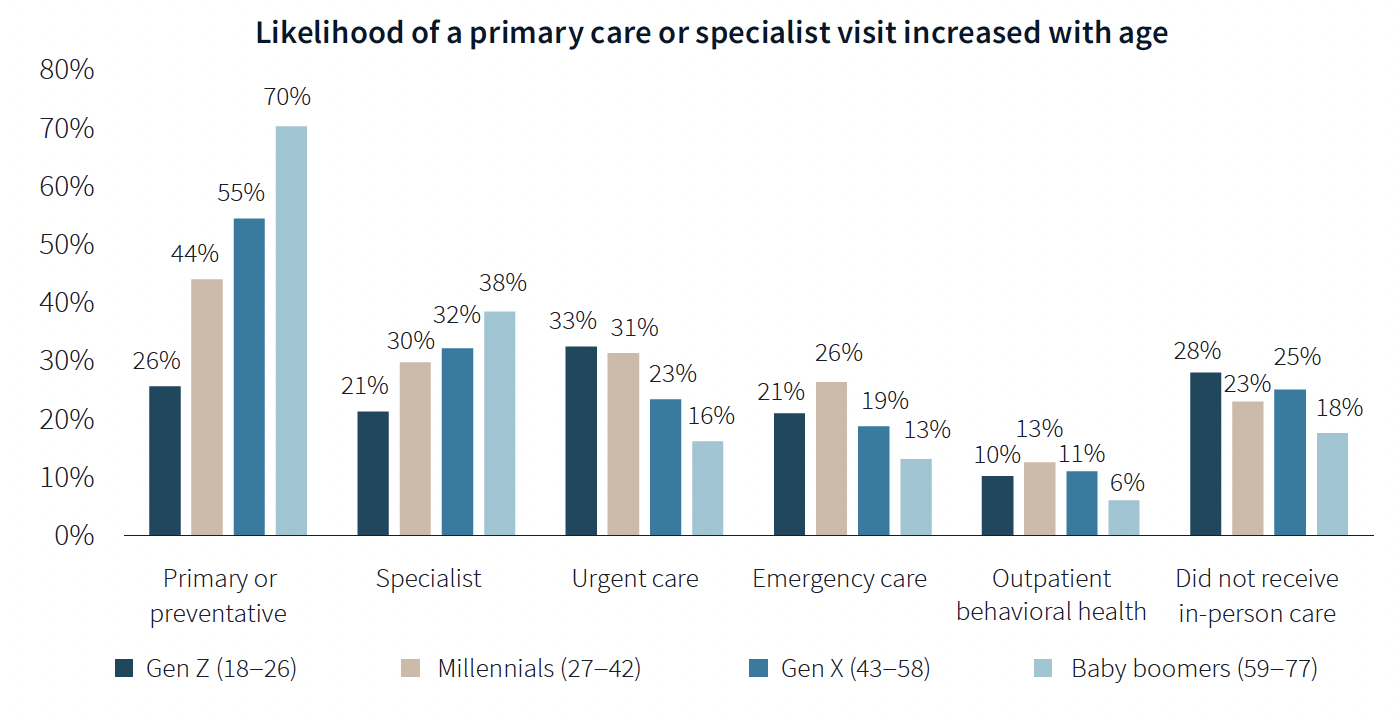

The likelihood of a primary care or specialist visit increases with age: 80% of adults 65 years or older have two or more chronic conditions that require continuous care. More than 70% of Baby Boomers (who accounted for 29% of the survey’s respondents) had received primary or preventive care within the last year, compared to only 26% of Generation Z.

Younger generations are more reactive than preventive in their healthcare decisions, borne out by the survey’s finding that Millennials and Gen Zs (43% of the survey's respondents) are more likely to receive urgent care, emergency care, and outpatient behavioral healthcare than older adults.

Proximity to patients counts

When care is urgently needed, “decision factors are simplified,” the survey states, and location and proximity of care are ranked higher as decision-making factors. But even outside of emergencies, convenience ranks high among factors for patients seeking care.

There’s no denying that cost is always in the background of any healthcare decision. “Accept my insurance” was the most common factor for choosing a provider among the survey’s respondents. (82% of participants has private insurance, and 81% has public insurance.)

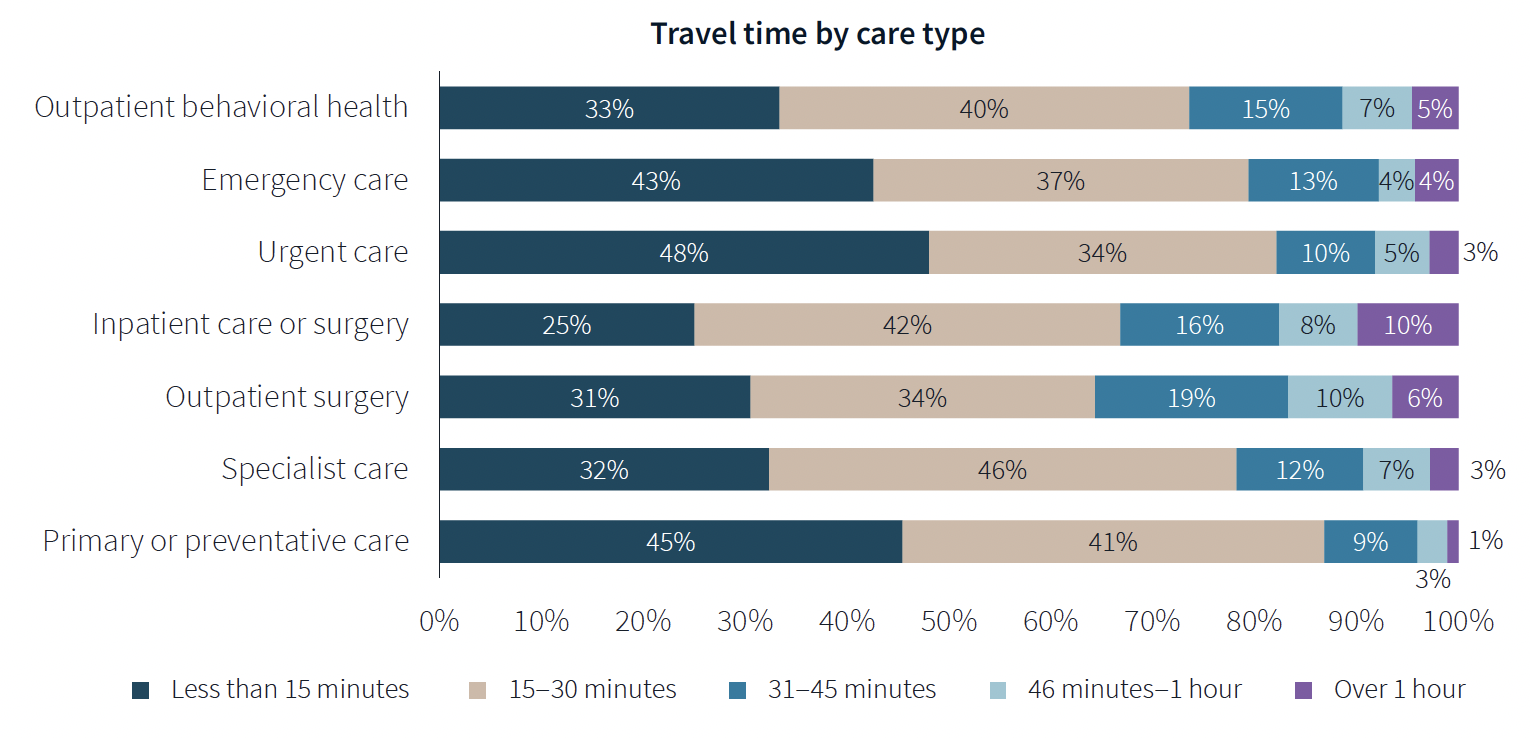

Two-fifths of respondents said they travel less than 15 minutes to receive care, and nearly eight of 10 respondents travel less than 30 minutes. Among those with appointments in standalone medical offices, 85% ranked location as convenience, which the survey suggested indicates the advantages of a dispersed location strategy.

“A strong location strategy can improve reach for health systems and physician practices and potentially improve care outcomes,” JLL writes. “But there is a balance between convenience and cost—health systems need to balance the benefits of being close to their target population with the cost of a new facility or doctors’ time in transit from a local clinic to the hospital.”

Convenience is also key both in location and in being able to navigate to care. Patients want to get to care quickly and get on with their day. Ease of parking and ability to navigate the facility also affected a facility’s net positive score in the survey.

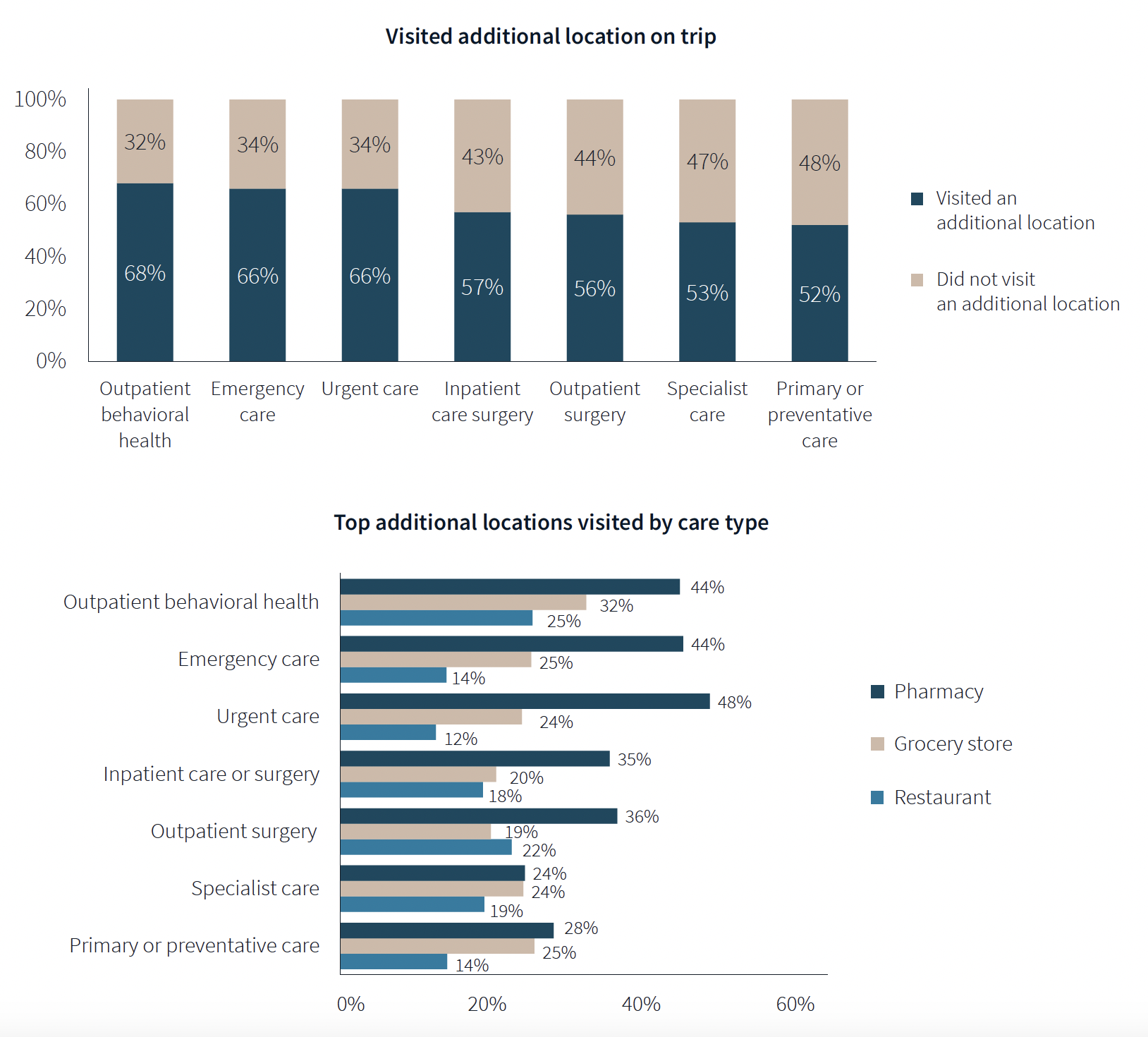

One of the survey’s more revealing findings is that nearly three-fifths of respondents—58%—went to another location—such as a pharmacy, or an urgent clinic—as part of their trip for healthcare.

Word of mouth often defines quality of care

Patients seem to be open to diverse care choices. For example, 29% said they have visited a retail clinic, such as a CVS, and would do so again. Gen Z and Millennials are more likely to frequent retail clinics for their convenient appointment schedules and shorter wait times.

More than two-fifths of respondents—42%—had a telehealth appointment within the last year, which was slightly down from the 45% in JLL’s 2022 survey. This year’s poll also found that 29% of telehealth appointments led to an in-person visit.

More than 40% of respondents ranked “reputation of quality” among the top five factors for choosing care. But where they get their impressions about quality varies.

Referrals play a larger role in specialist, outpatient surgery and inpatient care. Recommendations from friends ranked most highly for behavioral health, given the personal nature of such care, and was ranked in the top five by 31% of respondents. Younger patients, who “have yet to develop brand loyalty,” according to the survey, are more likely to rely on word-of-mouth recommendations than older patients for whom hospital systems’ reps matter more.

Outpatient surgery and primary care ranked highest for provider satisfaction; emergency care ranked lowest. Participants ranked their experiences on 12 aspects of care, and the biggest gap between “promoters” and “detractors” was for the service level of providers. Primary care had the highest net provider score, with 86% of respondents ranking its care as “attentive.”

Some amenities draw patients

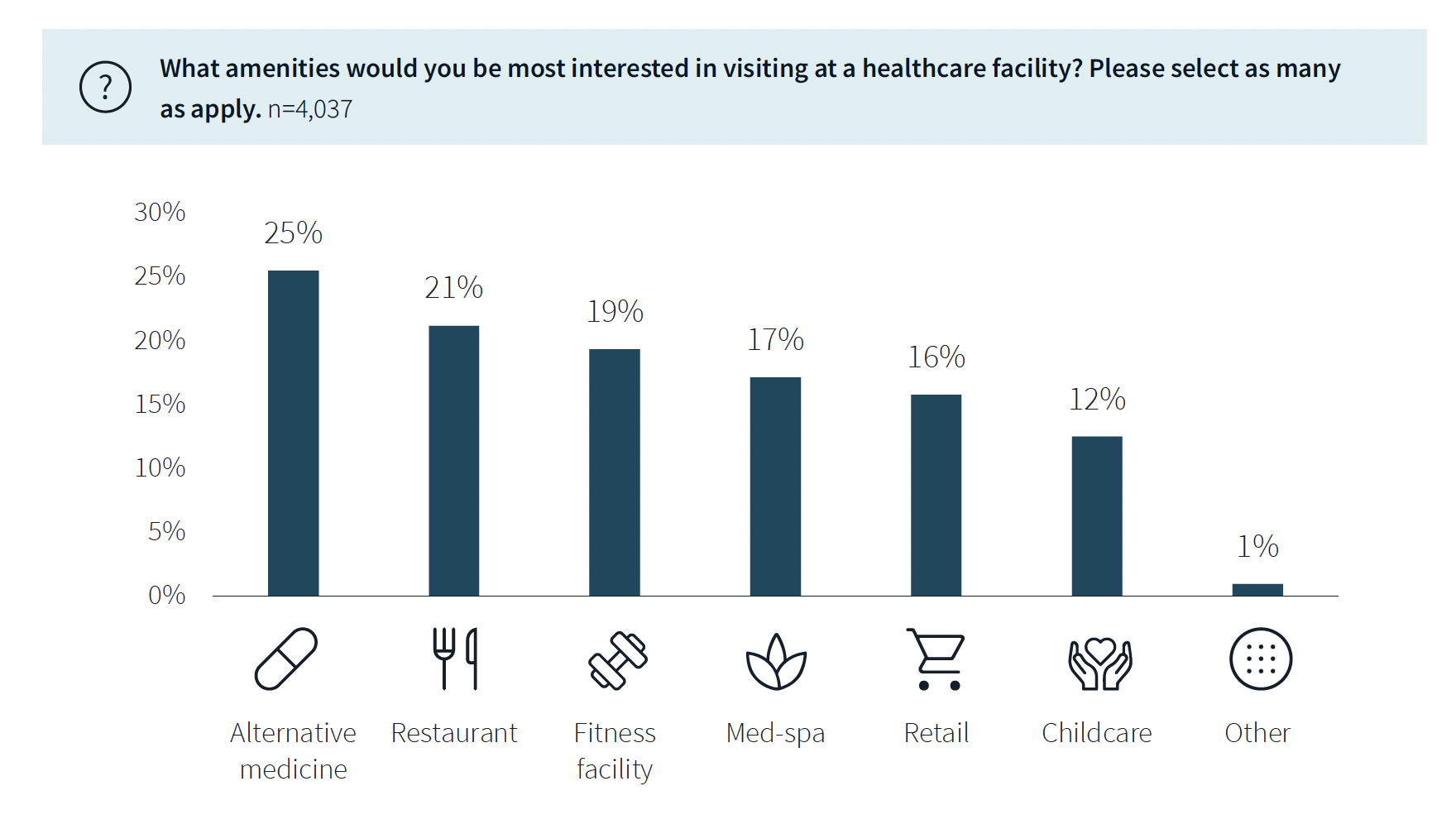

While not a decision-making factor, amenities do attract some patients. Among the survey’s respondents, 63% said they would be interested in visiting a healthcare facility with an additional amenity, such as alternative medicine, a restaurant, fitness center, or spa. (This inclination was more evident among younger respondents.)

The overall quality of facilities, including the comfort of their waiting rooms, can impact a patient’s choice, especially for inpatient, urgent, and emergency care. The survey also found that urban locations have lower favorability rankings for their facilities, signaling room for improvement. (Just under half—48%—of respondents live in the suburbs.)

Related Stories

| Mar 3, 2011

HDR acquires healthcare design-build firm Cooper Medical

HDR, a global architecture, engineering and consulting firm, acquired Cooper Medical, a firm providing integrated design and construction services for healthcare facilities throughout the U.S. The new alliance, HDR Cooper Medical, will provide a full service design and construction delivery model to healthcare clients.

| Mar 1, 2011

New survey shows shifts in hospital construction projects

America’s hospitals and health systems are focusing more on renovation or expansion than new construction, according to a new survey conducted by Health Facilities Management magazine and the American Society for Healthcare Engineering (ASHE). In fact, renovation or expansion accounted for 73% of construction projects at hospitals responding to the survey.

| Feb 22, 2011

HDR Architecture names four healthcare directors

Four senior professionals in HDR Architecture’s healthcare program have been named Healthcare directors.

| Feb 17, 2011

HDR Architecture sponsors national effort to green operating rooms

HDR Architecture, Inc. has joined the group of corporate sponsors of Practice Greenhealth’s Greening the Operating Room Initiative. This sweeping and prescriptive path to green the nation’s operating rooms was launched earlier this year to reduce the environmental footprint of the operating suites in hospitals across the country, which can produce between 20 and 30% of a hospital’s total waste.

| Feb 11, 2011

Iowa surgery center addresses both inpatient and outpatient care

The 12,000-person community of Carroll, Iowa, has a new $28 million surgery center to provide both inpatient and outpatient care. Minneapolis-based healthcare design firm Horty Elving headed up the four-story, 120,000-sf project for St. Anthony’s Regional Hospital. The center’s layout is based on a circular process flow, and includes four 800-sf operating rooms with poured rubber floors to reduce leg fatigue for surgeons and support staff, two substerile rooms between each pair of operating rooms, and two endoscopy rooms adjacent to the outpatient prep and recovery rooms. Recovery rooms are clustered in groups of four. The large family lounge (left) has expansive windows with views of the countryside, and television monitors that display coded information on patient status so loved ones can follow a patient’s progress.

| Feb 11, 2011

Two projects seek to reinvigorate Los Angeles County medical center

HMC Architects designed two new buildings for the Los Angeles County Martin Luther King, Jr., Medical Center as part of a $360 million plan to reinvigorate the campus. The buildings include a 120-bed hospital, which involves renovation of an existing tower and several support buildings, and the construction of a new multi-service ambulatory care center. The new facilities will have large expanses of glass at all waiting and public areas for unobstructed views of downtown Los Angeles. A curved glass entrance canopy will unite the two buildings. When both projects are completed—the hospital in 2012 and the ambulatory care center in 2013—the campus will have added more than 460,000 sf of space. The hospital will seek LEED certification, while the ambulatory care center is targeting LEED Silver.

| Feb 9, 2011

Hospital Construction in the Age of Obamacare

The recession has hurt even the usually vibrant healthcare segment. Nearly three out of four hospital systems have put the brakes on capital projects. We asked five capital expenditure insiders for their advice on how Building Teams can still succeed in this highly competitive sector.

| Jan 31, 2011

Cuningham Group Architecture launches Healthcare studio with Lee Brennan

International design firm Cuningham Group Architecture, P.A. (Cuningham Group) has announced the arrival of Lee Brennan, AIA, as Principal and Leader of its new Healthcare studio. Brennan comes to Cuningham Group with over 30 years of professional experience, 22 of those years in healthcare, encompassing all aspects of project delivery, from strategic planning and programming through design and construction. The firm’s new Healthcare studio will enhance Cuningham Group’s expertise in leisure and entertainment, education, mixed-use/housing and workplace environments.

| Jan 31, 2011

HDR Architecture Releases Evidence-based Design Videos

As a follow-up to its book Evidence-based Design for Healthcare Facilities, HDR Architecture, Inc. has released three video case studies that highlight evidence-based design principles in action.