A strong retail sector has helped drive 2016 U.S. construction activity with retail construction projects up 24.4% year-over-year. Overshadowing the good news is a cloud of economic uncertainty that has companies laser-focused on lean budgeting and smart spending decisions.

According to JLL’s latest report on non-residential construction activity, U.S. construction employment grew 4.7% in the first quarter of 2016 over the first quarter of 2015, with many workers engaged on retail projects. Concerns about China’s steep economic deceleration, combined with a drop in U.S. gross domestic product (GDP) from 1.4% in the fourth quarter of 2015 to 0.5% in the first quarter of 2016, have made companies reluctant to invest.

The market for commercial construction remains active for now. The JLL report shows a strong first quarter with steady growth projected for second quarter. The office, industrial and retail sectors are very active as companies continue projects that broke ground a year or two ago. A hint of the economic clouds causing concern comes from a small decline in office construction starts.

“Developers and occupiers are proceeding with caution, but they continue to build and renovate,” explains Todd Burns, President, Project and Development Services, JLL Americas. “However, project sponsors today are thinking more strategically about development versus renovation. The best-managed companies have learned to keep their capital spend within about two% of the plan by starting with a realistic budget, leveraging data and analytical platforms, and putting the right skills together in a centralized project team.”

Key sectors to watch

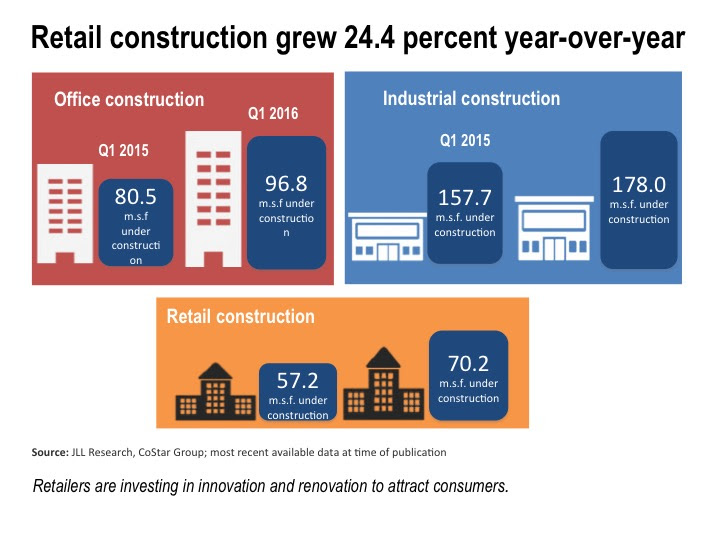

Retail: Retail vacancies continue to decline, and retail has surged ahead of other property types in construction activity. Construction grew 24.4% year over year, from 57.2 million sf in first.

Industrial: Industrial facility deliveries grew year-over-year in Q1 2016, reflecting the continuing strength in demand for modern industrial properties—much of it from retailers and e-commerce companies striving to meet changing consumer demand and service requirements. Construction grew 12.9%, from 157.7 million sf in Q1 2015 to 178 million sf in Q1 2016.

Office: Office building construction grew by 20.2 year-over-year, from 80.5 million sf to 96.8 million sf—but starts declined by 33%, from 20.3 million to 13.6 million, reflecting economic concerns and hesitancy to launch new projects.

Retail innovation and renovation

Much of the retail construction growth in Q1 2016 has come from renovation, rather than new deliveries, as retailers are evolving to meet consumers’ ever-growing expectations for unified online and brick-and-mortar experiences.

“Retailers must innovate quickly to capture the untapped needs and expectations of consumers, who expect the same brand experience whether shopping online or in the brick-and-mortar store,” said Aaron Spiess, co-founder of Big Red Rooster, JLL’s brand experience company. “If retailers wait too long to translate latent customer expectations into new stores or renovation programs, they may find that customers have become entrenched with competing brands and are not going to return.”

Another incentive to renovate, notes Spiess, is a new federal tax break providing “safe harbor” for some remodeling expenses. Eligible retailers and restaurants can reduce 75% of qualifying expenses with the remaining 25% capitalized and depreciated over time.

Key markets to watch

Nashville: The Southeast saw an uptick in office, industrial and retail construction in the last year. Nashville, in particular, has seen rapid construction growth and low vacancy rates as employers take advantage of the city’s low-cost, well-educated workforce.

San Francisco: The Bay area is catching up to New York in of construction costs, driven by high demand and high labor costs. San Francisco is on pace to exceed New York as the U.S.’ most expensive construction market in 2016.

Dallas: As retailers followed population flows to Texas, Dallas has become one of the few markets that experienced retail development growth. Dallas was the most active retail market in Q1, up nearly 80% year over year.

Related Stories

Industry Research | Dec 28, 2022

Following a strong year, design and construction firms view 2023 cautiously

The economy and inflation are the biggest concerns for U.S. architecture, construction, and engineering firms in 2023, according to a recent survey of AEC professionals by the editors of Building Design+Construction.

Self-Storage Facilities | Dec 16, 2022

Self-storage development booms in high multifamily construction areas

A 2022 RentCafe analysis finds that self-storage units swelled in conjunction with metros’ growth in apartment complexes.

Market Data | Dec 13, 2022

Contractors' backlog of work reaches three-year high

U.S. construction firms have, on average, 9.2 months of work in the pipeline, according to ABC's latest Construction Backlog Indicator.

Contractors | Dec 6, 2022

Slow payments cost the construction industry $208 billion in 2022

The cost of floating payments for wages and invoices represents $208 billion in excess cost to the construction industry, a 53% increase from 2021, according to a survey by Rabbet, a provider of construction finance software.

Mass Timber | Dec 1, 2022

Cross laminated timber market forecast to more than triple by end of decade

Cross laminated timber (CLT) is gaining acceptance as an eco-friendly building material, a trend that will propel its growth through the end of the 2020s. The CLT market is projected to more than triple from $1.11 billion in 2021 to $3.72 billion by 2030, according to a report from Polaris Market Research.

Market Data | Nov 15, 2022

Construction demand will be a double-edged sword in 2023

Skanska’s latest forecast sees shorter lead times and receding inflation, but the industry isn’t out of the woods yet.

Reconstruction & Renovation | Nov 8, 2022

Renovation work outpaces new construction for first time in two decades

Renovations of older buildings in U.S. cities recently hit a record high as reflected in architecture firm billings, according to the American Institute of Architects (AIA).

Market Data | Nov 3, 2022

Building material prices have become the calm in America’s economic storm

Linesight’s latest quarterly report predicts stability (mostly) through the first half of 2023

Building Team | Nov 1, 2022

Nonresidential construction spending increases slightly in September, says ABC

National nonresidential construction spending was up by 0.5% in September, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau.

Hotel Facilities | Oct 31, 2022

These three hoteliers make up two-thirds of all new hotel development in the U.S.

With a combined 3,523 projects and 400,490 rooms in the pipeline, Marriott, Hilton, and InterContinental dominate the U.S. hotel construction sector.