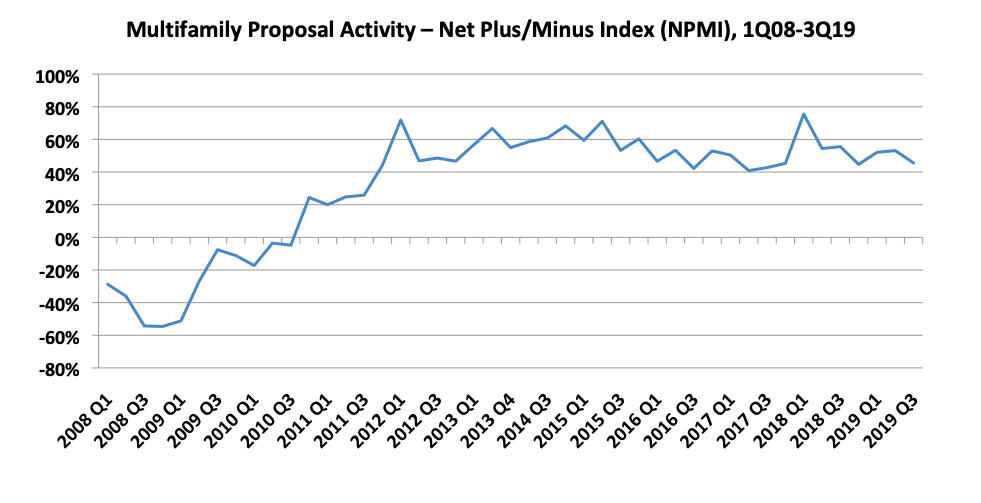

Multifamily housing will remain a robust market for A/E/C companies heading into 2020, according to the most recent results of PSMJ’s Quarterly Market Forecast (QMF) survey. For the third quarter of 2019, the survey found that less than 9% of the nearly 100 respondents doing multifamily work reported a decrease in proposal activity compared with the prior quarter, while more than 54% saw an increase.

The Multifamily market’s third quarter Net Plus/Minus Index (NPMI) of 46% marked the 31st consecutive quarter that the submarket exceeded an NPMI of 40%. The last time it was below that level was the third quarter of 2011.

PSMJ’s NPMI measures the difference between the percentage of firms reporting an increase in proposal activity and those reporting a decrease, quarter over quarter. PSMJ has been using the QMF as a predictor of the A/E/C industry’s health since 2003, tracking 12 major markets and 58 submarkets every three months. The company chose proposal activity to gauge the industry’s long-term outlook because it is among the earliest stages of the project lifecycle. Approximately 200 firms participate in the survey each quarter.

The Senior and Assisted Living submarket also performed well with a third-quarter NPMI of 49%. Only 4 of the 86 responding firms working in the senior care submarket reported declining proposal activity. The Senior/Assisted Living market has also been a consistently stellar performer in the QMF. Its NPMI hasn’t dipped below 50% since the fourth quarter of 2012.

“Multifamily and Senior/Assisted Living have been two of the hottest markets for proposal activity for quite some time, not only among the Housing submarkets, but throughout all 58 submarkets,” says PSMJ’s Greg Hart, a consultant who also oversees the QMF. “It is remarkable that both have seen such steady proposal growth for so long. Very few submarkets have been this consistently strong throughout the 16-year history of our survey.”

Housing (all submarkets) recorded an NPMI of 40% in the third quarter, a potentially noteworthy drop from the 59% recorded in the second quarter. After ranking the second-highest of the 12 major markets measured in the second quarter, Housing fell completely out of the top five in the third quarter. Transportation (49%) and Healthcare (46%) were tops among major markets.

Among the other Housing submarkets, Condominiums recorded a respectable NPMI of 24%, its sixth consecutive quarter in the mid-20% range. Individual single-family homes (15%) and subdivisions (8%) trailed the Housing field in the third quarter, falling markedly from 25% and 23%, respectively, in the second quarter. PSMJ Director and Senior Consultant Dave Burstein, PE, notes that the results are still positive, if potentially troubling in the longer term. He adds that lower mortgage interest rates on the horizon are likely to spur a rebound in the single-family and subdivision subsectors.

PSMJ Resources, Inc., based in Newton, Massachusetts, is a publishing, executive education, and advisory company dedicated to serving architecture, engineering and construction (A/E/C) organizations worldwide.

Related Stories

| Feb 17, 2020

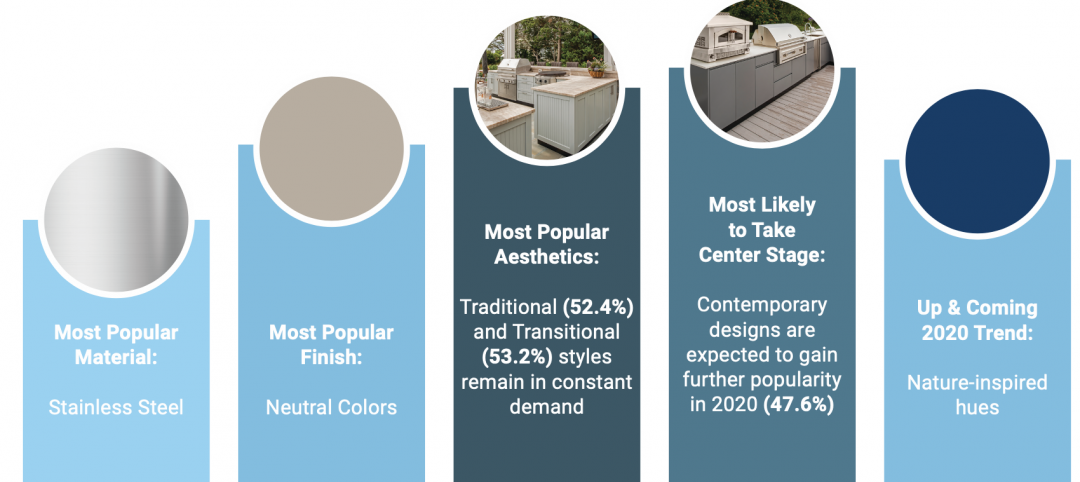

Interior designers weigh in on outdoor kitchens

Designers weigh in on outdoor kitchens

Multifamily Housing | Feb 12, 2020

4 products for your next multifamily project

These new products can help improve any new multifamily project.

Mixed-Use | Feb 7, 2020

Rising to the occasion

Roof deck entertainment spaces are popular amenities that present engineering and code complexities.

Multifamily Housing | Jan 31, 2020

Higher-income renters continue to drive what’s getting built and leased in the multifamily sector

Nearly half of all renters are “cost burdened,” according to the latest Joint Center for Housing Studies report.

Multifamily Housing | Jan 20, 2020

U.S. multifamily market posted solid gains in 2019

Rents grew 3% for the year, according to Yardi Matrix.