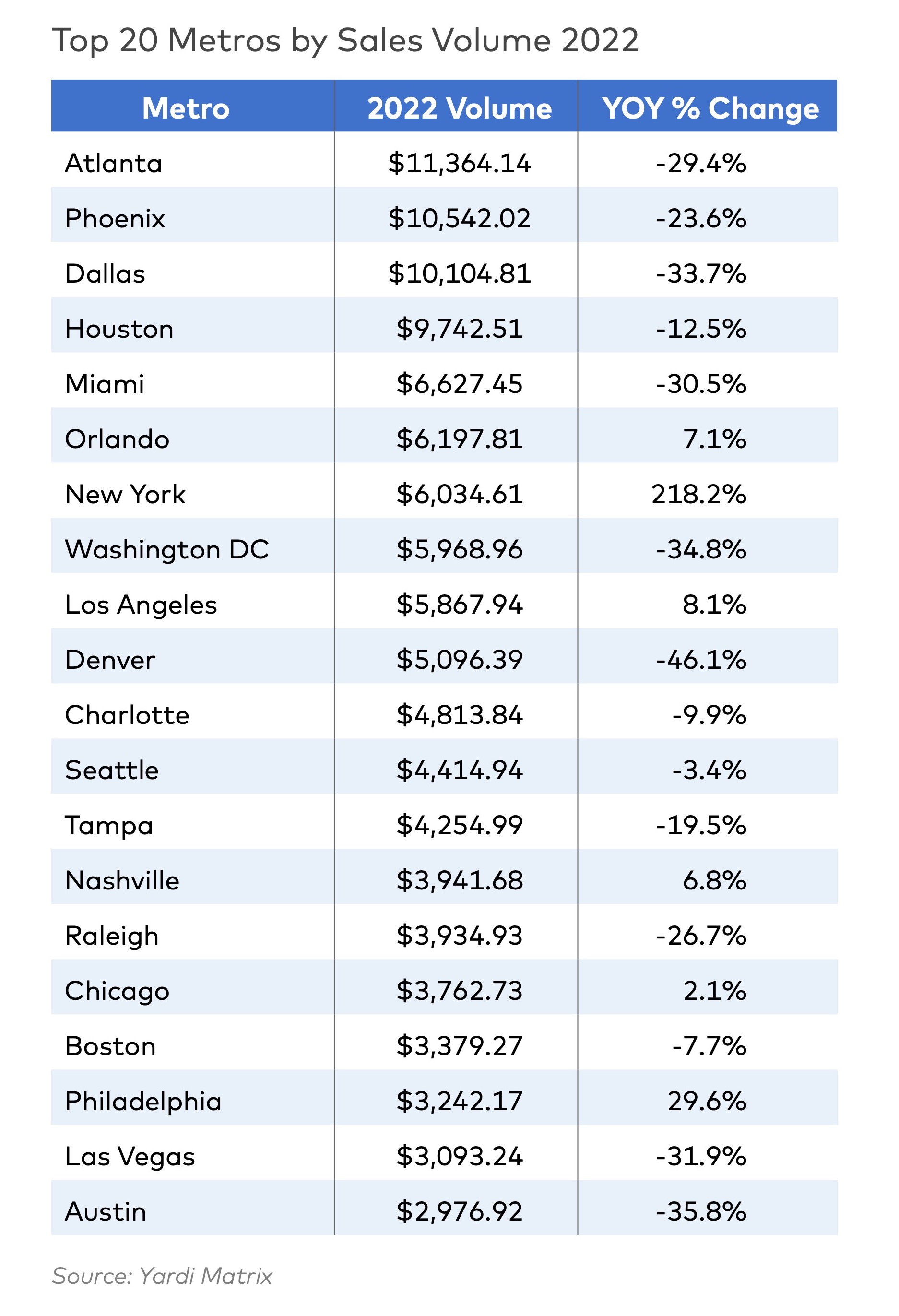

Multifamily housing investors are gravitating toward Sun Belt markets with strong job and population growth, according to new research from Yardi Matrix.

Despite a sharp second-half slowdown, last year’s nationwide $187 billion transaction volume was the second-highest annual total ever. In 2022, multifamily sales volume was paced by Atlanta, Phoenix, Dallas, Houston, Miami, and Orlando, Fla. The Southeast, Southwest, and West regions accounted for $148 billion of sales in 2022, 79% of the total.

The multifamily housing investment market faces significant head winds in 2023 in the form of higher financing costs, rising debt service payments, and a slowdown in rent growth. Even with the current wave of market uncertainty, though, many investors still “view multifamily as a safer place to park capital than other investment products or other commercial property classes such as office or retail,” the research says.

From the Yardi Matri report (download for free):

"Multifamily investors are increasingly favoring markets that not only provide population and job growth but also have less political risk. Large coastal states have more areas subject to rent controls and are more likely to pass new laws that impact investors’ bottom lines. Los Angeles, for example, passed a local ballot initiative last year that will create a new “mansion tax” of 4-5% on property transfers above $5 million. Sharp rent growth has made rent control a nationwide is- sue, even in Florida, where Orange County legis- lators passed a rent control measure. However, a Florida court invalidated the law, which remains on appeal."

"The investment market will start 2023 the way it ended in 2022, with relatively few deals. Buyers are cautious, facing higher financing costs and downgraded projections of future rent growth. Cap rates averaged 5.0% at year-end 2022, up from the low- to mid-4% range at the beginning of the year, per Matrix. Meanwhile, most apartment owners are holding on to properties unless there is a reason to sell, such as a death, the dissolution of a partnership or a capital event like a maturing mortgage that creates a need for restructuring."

"Indeed, the biggest question the market faces is not whether we will see more distressed assets but by how much distress will increase. Banks have become conservative with the prospect of a widely projected economic downturn, so borrow- ers are facing both rising rates and less leverage."

Related Stories

Multifamily Housing | Jul 8, 2021

As homelessness becomes more visible, building shelters presents opportunities to AEC firms

C.W. Driver Companies and XL Construction have just completed transitional housing projects in California.

Multifamily Housing | Jul 7, 2021

Make sure to get your multifamily amenities mix right

One of the hardest decisions multifamily developers and their design teams have to make is what mix of amenities they’re going to put into each project. A lot of squiggly factors go into that decision: the type of community, the geographic market, local recreation preferences, climate/weather conditions, physical parameters, and of course the budget. The permutations are mind-boggling.

Multifamily Housing | Jun 30, 2021

A post-pandemic ‘new normal’ for apartment buildings

Grimm + Parker’s vision foresees buildings with rentable offices and refrigerated package storage.

Resiliency | Jun 24, 2021

Oceanographer John Englander talks resiliency and buildings [new on HorizonTV]

New on HorizonTV, oceanographer John Englander discusses his latest book, which warns that, regardless of resilience efforts, sea levels will rise by meters in the coming decades. Adaptation, he says, is the key to future building design and construction.

Multifamily Housing | Jun 23, 2021

COVID-19’s impact on multifamily amenities

Multifamily project teams had to scramble to accommodate the overwhelming demand for work-from-home spaces for adults and study spaces for children.

Multifamily Housing | Jun 22, 2021

New apartment community breaks ground in Bethesda

KTGY is designing the project.

Multifamily Housing | Jun 14, 2021

Baccarat Residences Brickell set to rise in Miami

Arquitectonica is designing the project.

Multifamily Housing | Jun 9, 2021

MVE + Partners completes One Museum Square

The luxury apartment community is located in the heart of Los Angeles.

Multifamily Housing | Jun 6, 2021

Multifamily Amenities Survey 2021: Get the latest data on 131 key features for apartments and condos

Download the 2021 Multifamily Amenities Study.

Multifamily Housing | Jun 3, 2021

Student Housing Trends 2021-2022

In this exclusive video interview for HorizonTV, Fred Pierce, CEO of Pierce Education Properties, developer and manager of off-campus student residences, chats with Rob Cassidy, Editor, MULTIFAMILY Design + Construction about student housing during the pandemic and what to expect for on-campus and off-campus housing in Fall 2021 and into 2022.

![Oceanographer John Englander talks resiliency and buildings [new on HorizonTV] Oceanographer John Englander talks resiliency and buildings [new on HorizonTV]](/sites/default/files/styles/list_big/public/Oceanographer%20John%20Englander%20Talks%20Resiliency%20and%20Buildings%20YT%20new_0.jpg?itok=enJ1TWJ8)