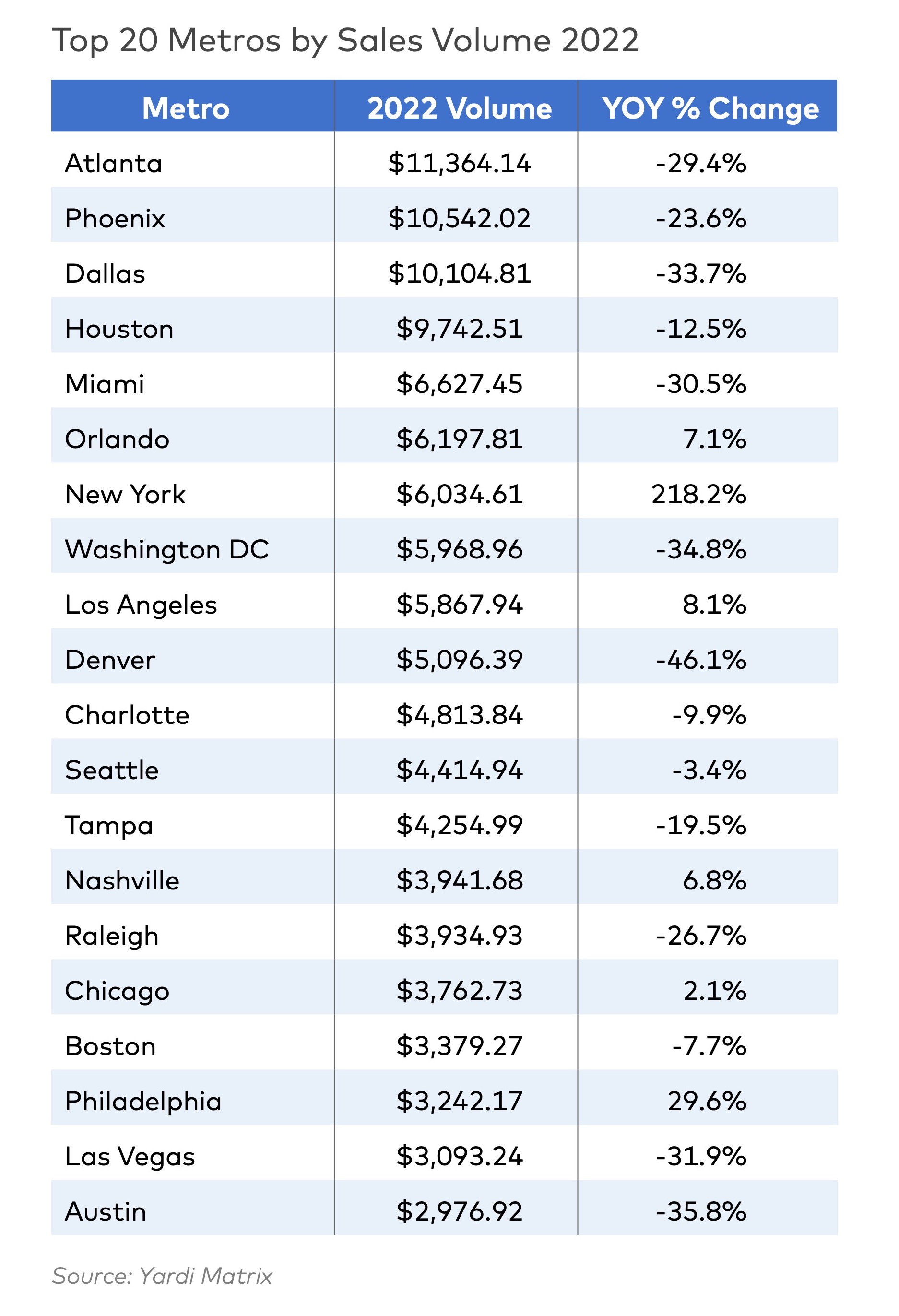

Multifamily housing investors are gravitating toward Sun Belt markets with strong job and population growth, according to new research from Yardi Matrix.

Despite a sharp second-half slowdown, last year’s nationwide $187 billion transaction volume was the second-highest annual total ever. In 2022, multifamily sales volume was paced by Atlanta, Phoenix, Dallas, Houston, Miami, and Orlando, Fla. The Southeast, Southwest, and West regions accounted for $148 billion of sales in 2022, 79% of the total.

The multifamily housing investment market faces significant head winds in 2023 in the form of higher financing costs, rising debt service payments, and a slowdown in rent growth. Even with the current wave of market uncertainty, though, many investors still “view multifamily as a safer place to park capital than other investment products or other commercial property classes such as office or retail,” the research says.

From the Yardi Matri report (download for free):

"Multifamily investors are increasingly favoring markets that not only provide population and job growth but also have less political risk. Large coastal states have more areas subject to rent controls and are more likely to pass new laws that impact investors’ bottom lines. Los Angeles, for example, passed a local ballot initiative last year that will create a new “mansion tax” of 4-5% on property transfers above $5 million. Sharp rent growth has made rent control a nationwide is- sue, even in Florida, where Orange County legis- lators passed a rent control measure. However, a Florida court invalidated the law, which remains on appeal."

"The investment market will start 2023 the way it ended in 2022, with relatively few deals. Buyers are cautious, facing higher financing costs and downgraded projections of future rent growth. Cap rates averaged 5.0% at year-end 2022, up from the low- to mid-4% range at the beginning of the year, per Matrix. Meanwhile, most apartment owners are holding on to properties unless there is a reason to sell, such as a death, the dissolution of a partnership or a capital event like a maturing mortgage that creates a need for restructuring."

"Indeed, the biggest question the market faces is not whether we will see more distressed assets but by how much distress will increase. Banks have become conservative with the prospect of a widely projected economic downturn, so borrow- ers are facing both rising rates and less leverage."

Related Stories

Multifamily Housing | Feb 21, 2021

Multifamily Amenities Survey 2021: Early results show COVID-19 impact on apartment amenities

Survey of multifamily developers, owners, architects, and contractors shows many adjusting their amenities to deal with the impact of the pandemic on property occupiers.

Multifamily Housing | Feb 19, 2021

Former motorcycle factory converted into affordable housing

The Architectural Team designed the project.

Multifamily Housing | Feb 12, 2021

Benefits of a factory-installed ceiling radiation damper explained

Greenheck applications engineer Craig Kulski explains the benefits of a factory-installed ceiling radiation damper.

Multifamily Housing | Feb 10, 2021

The Weekly show, Feb 11, 2021: Advances in fire protection engineering, and installing EV ports in multifamily housing

This week on The Weekly show, BD+C editors speak with AEC industry leaders from Bozzuto Management Company and Goldman Copeland about advice on installing EV ports in multifamily housing, and advances in fire protection engineering.

Multifamily Housing | Feb 10, 2021

10 significant multifamily developments to open in late 2020 and early 2021

Seattle's new twisting condo tower and Rem Koolhaas's first residential building are among 10 notable multifamily housing projects to debut in late 2020 and early 2021.

Multifamily Housing | Feb 8, 2021

Vista Railing Systems expands its senior management team

Chris Dooley and Tom Killy join Vista Railings, the British Columbia manufacturer of commercial/multifamily railings.

Multifamily Housing | Feb 8, 2021

Veterans Village supplies 51 units of supportive housing for U.S. military veterans in Carson, Calif.

Withee Malcolm Architects designed the supportive housing community for developer Thomas Safran & Associates.

Multifamily Housing | Feb 2, 2021

Tahanan supportive housing development brings 145 apartments to San Francisco

David Baker Architects designed the project.

AEC Tech | Jan 28, 2021

The Weekly show, Jan 28, 2021: Generative design tools for feasibility studies, and landscape design trends in the built environment

This week on The Weekly show, BD+C editors speak with AEC industry leaders from Studio-MLA and TestFit about landscape design trends in the built environment, and how AEC teams and real estate developers can improve real estate feasibility studies with real-time generative design.

Multifamily Housing | Jan 27, 2021

2021 multifamily housing outlook: Dallas, Miami, D.C., will lead apartment completions

In its latest outlook report for the multifamily rental market, Yardi Matrix outlined several reasons for hope for a solid recovery for the multifamily housing sector in 2021, especially during the second half of the year.