Multifamily housing investors are gravitating toward Sun Belt markets with strong job and population growth, according to new research from Yardi Matrix.

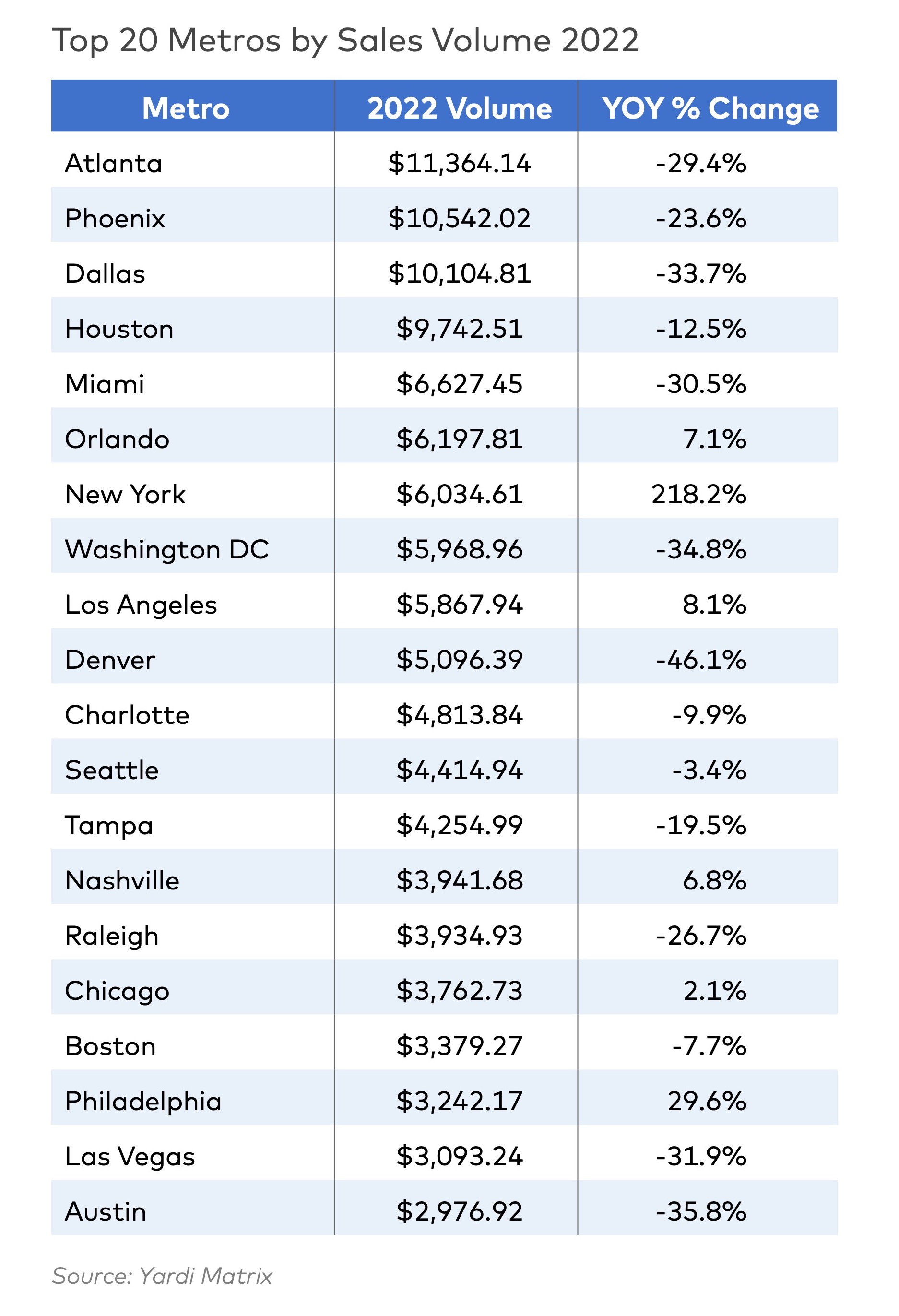

Despite a sharp second-half slowdown, last year’s nationwide $187 billion transaction volume was the second-highest annual total ever. In 2022, multifamily sales volume was paced by Atlanta, Phoenix, Dallas, Houston, Miami, and Orlando, Fla. The Southeast, Southwest, and West regions accounted for $148 billion of sales in 2022, 79% of the total.

The multifamily housing investment market faces significant head winds in 2023 in the form of higher financing costs, rising debt service payments, and a slowdown in rent growth. Even with the current wave of market uncertainty, though, many investors still “view multifamily as a safer place to park capital than other investment products or other commercial property classes such as office or retail,” the research says.

From the Yardi Matri report (download for free):

"Multifamily investors are increasingly favoring markets that not only provide population and job growth but also have less political risk. Large coastal states have more areas subject to rent controls and are more likely to pass new laws that impact investors’ bottom lines. Los Angeles, for example, passed a local ballot initiative last year that will create a new “mansion tax” of 4-5% on property transfers above $5 million. Sharp rent growth has made rent control a nationwide is- sue, even in Florida, where Orange County legis- lators passed a rent control measure. However, a Florida court invalidated the law, which remains on appeal."

"The investment market will start 2023 the way it ended in 2022, with relatively few deals. Buyers are cautious, facing higher financing costs and downgraded projections of future rent growth. Cap rates averaged 5.0% at year-end 2022, up from the low- to mid-4% range at the beginning of the year, per Matrix. Meanwhile, most apartment owners are holding on to properties unless there is a reason to sell, such as a death, the dissolution of a partnership or a capital event like a maturing mortgage that creates a need for restructuring."

"Indeed, the biggest question the market faces is not whether we will see more distressed assets but by how much distress will increase. Banks have become conservative with the prospect of a widely projected economic downturn, so borrow- ers are facing both rising rates and less leverage."

Related Stories

Multifamily Housing | Jun 2, 2021

San Antonio senior living community benefits from HUD 221(d)(4) funding

Cadence McShane Construction Company has completed the construction of Brookwood Senior Apartments, San Antonio, Texas, for repeat client Mission DG.

Multifamily Housing | May 25, 2021

A new condo tower in Brooklyn lets residents swim in the clouds

Brooklyn Point features an infinity pool that’s nearly 700 feet above the street.

Digital Twin | May 24, 2021

Digital twin’s value propositions for the built environment, explained

Ernst & Young’s white paper makes its cases for the technology’s myriad benefits.

Mixed-Use | May 19, 2021

Salt Lake City mixed-use residential community will feature micro units

KTGY is designing the project.

Multifamily Housing | May 18, 2021

Multifamily housing sector sees near record proposal activity in early 2021

The multifamily sector led all housing submarkets, and was third among all 58 submarkets tracked by PSMJ in the first quarter of 2021.

Multifamily Housing | May 13, 2021

Florida’s first LGBTQ+-focused affordable housing project for seniors opens

The project is located on The Pride Center’s five-acre Equality Park campus in Wilton Manors.

Multifamily Housing | May 12, 2021

Affordable mixed-use housing complex completes in South Los Angeles

KFA designed the project.

Mixed-Use | May 7, 2021

Mixed-use development tops out in Brooklyn’s Brownsville neighborhood

The project will bring 160 affordable housing units to the area.

Multifamily Housing | Apr 22, 2021

The Weekly Show, Apr 22, 2021: COVID-19's impact on multifamily amenities

This week on The Weekly show, BD+C's Robert Cassidy speaks with three multifamily design experts about the impact of COVID-19 on apartment and condo amenities, based on the 2021 Multifamily Amenities Survey.