After another year when the growth in multifamily housing exceeded expectations, apartment demand and property values could keep rolling through 2017.

“The forces that have produced the best multifamily market in recent memory remain largely in place,” says John Affleck, apartment research strategist for CoStar Group.

In a recent report from Real Capital Markets, 49% of investors polled said that multifamily remains an ideal investment in commercial real estate, and that the market doesn’t look like it will be slowing down any time soon.

The National Association of Home Builders expects multifamily starts to rise to 384,000 units, or 1,000 above last year’s number. Robert Dietz, NAHB’s chief economist, believes this pace is being driven by demographics and the balance between supply and demand.

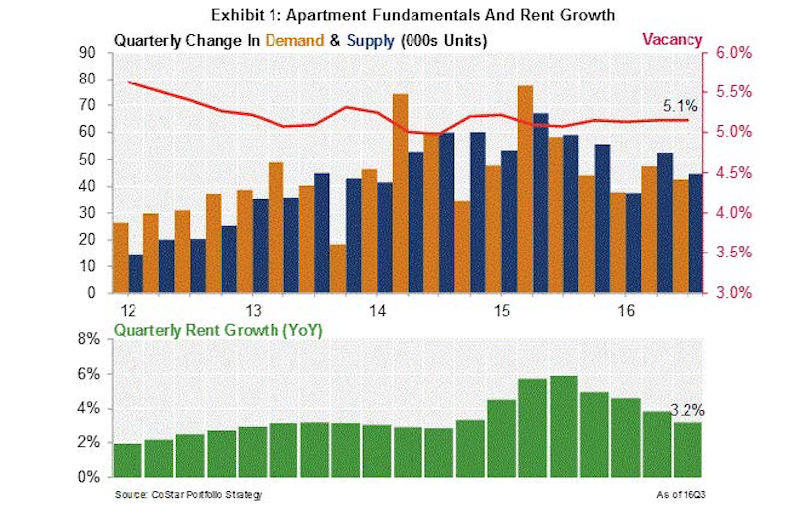

CoStar actually forecasts that sales volumes, units per sale, and price growth of multifamily properties will finally level off this year from record highs. However, CoStar also acknowledges the sector’s momentum, where—through the third quarter of 2016—multifamily had the lowest vacancy rate (5.2%) of all major property types, and had seen rents rise by 3.9%.

Aggressive pricing aside, the sector’s record of steady rent growth and high occupancy with low volatility continue to make apartment properties an ideal defensive asset as the economic cycle extends into a seventh year, Affleck says.

CoStar predicts that the national vacancy rate for multifamily properties will increase to 5.6% this year and to 5.7% in 2018. Rental rate growth should moderate to 2.3% this year and 2.1% next.

Looking at last year's performance, CoStar foresees rent growth slowing and supply still exceeding demand in multifamily. Image: CoStar Portfolio Strategy.

Looking at last year's performance, CoStar foresees rent growth slowing and supply still exceeding demand in multifamily. Image: CoStar Portfolio Strategy.

David Brickman, Executive Vice President and head of Freddic Mac’s multifamily business, foresees a spike in renter households, spurred on by positive job growth and a stable economy. In addition, home prices are on the rise, which might cause renters to further postpone any residential purchases. And aging baby boomers continue to downsize into rental units.

Fannie Mae is a bit more conservative in its estimates about multifamily growth over the next two years. But Kim Betancourt, Fannie’s Director of Economics, doesn’t expect any moderation to be long lasting.

“Considering that rent concessions have declined steadily for nearly seven straight years, and that their current level is now below 1%, it is probably only a question of ‘when’ and not ‘if’ concessions begin to rise again,” Betancourt says.

CoStar’s Affleck sees the “unprecedented propensity to rent, even among the most affluent” as “the chief risk to this cycle,” because higher rents will inevitably coax more renters to consider homeownership, especially if interest rates stay relatively low.

Related Stories

Multifamily Housing | Apr 20, 2023

A solution for sharing solar energy with multifamily tenants

Allume Energy’s SolShare sees lower-income renters as its primary beneficiaries.

Multifamily Housing | Apr 19, 2023

Austin’s historic Rainey Street welcomes a new neighbor: a 48-story mixed-used residential tower

Austin’s historic Rainey Street is welcoming a new neighbor. The Paseo, a 48-story mixed-used residential tower, will bring 557 apartments and two levels of retail to the popular Austin entertainment district, known for houses that have been converted into bungalow bars and restaurants.

Multifamily Housing | Apr 17, 2023

World's largest multifamily building pursuing ILFI Zero Carbon certification under construction in Washington, D.C.

The Douglass, in Washington, D.C.’s Ward 8, is currently the largest multifamily housing project to pursue Zero Carbon Certification from the International Living Future Institute (ILFI).

Sponsored | Multifamily Housing | Apr 12, 2023

With affordability and innovation for all: Multifamily housing ideas break barriers

With a growing need for multifamily housing solutions at all income levels, the U.S. market is seeing a proliferation of inventive projects. Alongside the creativity is a nascent move toward higher quality, if not always larger unit sizes, with offerings of better amenities both inside and outside today’s latest residential solutions.

Urban Planning | Apr 12, 2023

Watch: Trends in urban design for 2023, with James Corner Field Operations

Isabel Castilla, a Principal Designer with the landscape architecture firm James Corner Field Operations, discusses recent changes in clients' priorities about urban design, with a focus on her firm's recent projects.

Market Data | Apr 11, 2023

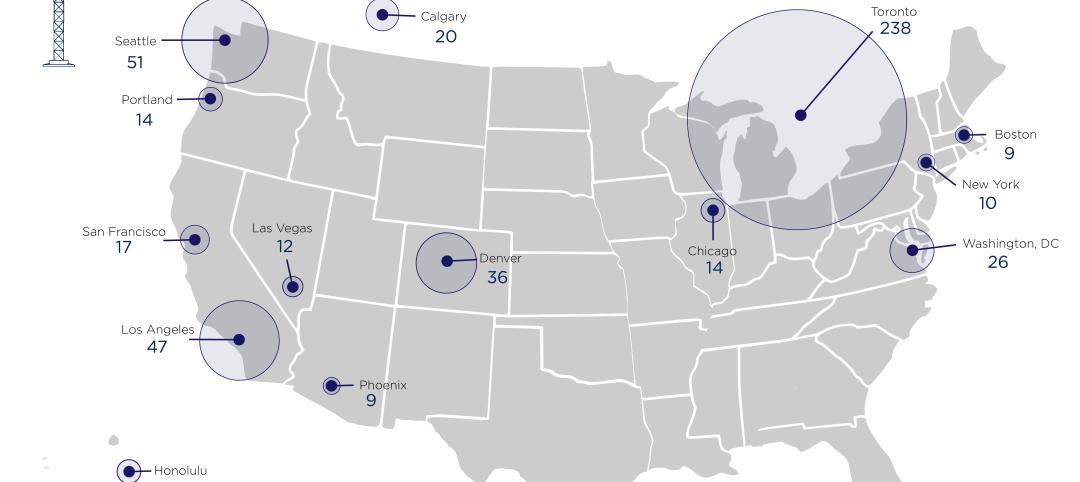

Construction crane count reaches all-time high in Q1 2023

Toronto, Seattle, Los Angeles, and Denver top the list of U.S/Canadian cities with the greatest number of fixed cranes on construction sites, according to Rider Levett Bucknall's RLB Crane Index for North America for Q1 2023.

Contractors | Apr 10, 2023

What makes prefabrication work? Factors every construction project should consider

There are many factors requiring careful consideration when determining whether a project is a good fit for prefabrication. JE Dunn’s Brian Burkett breaks down the most important considerations.

Affordable Housing | Apr 7, 2023

Florida’s affordable housing law expected to fuel multifamily residential projects

Florida Gov. Ron DeSantis recently signed into law affordable housing legislation that includes $711 million for housing programs and tax breaks for developers. The new law will supersede local governments’ zoning, density, and height requirements.

Multifamily Housing | Apr 4, 2023

Acing your multifamily housing amenities for the modern renter

Eighty-seven percent of residents consider amenities when signing or renewing a lease. Here are three essential amenity areas to focus on, according to market research and trends.

Resiliency | Apr 4, 2023

New bill would limit housing sprawl in fire- and flood-prone areas of California

A new bill in the California Assembly would limit housing sprawl in fire- and flood-prone areas across the state. For the last several decades, new housing has spread to more remote areas of the Golden State.