After another year when the growth in multifamily housing exceeded expectations, apartment demand and property values could keep rolling through 2017.

“The forces that have produced the best multifamily market in recent memory remain largely in place,” says John Affleck, apartment research strategist for CoStar Group.

In a recent report from Real Capital Markets, 49% of investors polled said that multifamily remains an ideal investment in commercial real estate, and that the market doesn’t look like it will be slowing down any time soon.

The National Association of Home Builders expects multifamily starts to rise to 384,000 units, or 1,000 above last year’s number. Robert Dietz, NAHB’s chief economist, believes this pace is being driven by demographics and the balance between supply and demand.

CoStar actually forecasts that sales volumes, units per sale, and price growth of multifamily properties will finally level off this year from record highs. However, CoStar also acknowledges the sector’s momentum, where—through the third quarter of 2016—multifamily had the lowest vacancy rate (5.2%) of all major property types, and had seen rents rise by 3.9%.

Aggressive pricing aside, the sector’s record of steady rent growth and high occupancy with low volatility continue to make apartment properties an ideal defensive asset as the economic cycle extends into a seventh year, Affleck says.

CoStar predicts that the national vacancy rate for multifamily properties will increase to 5.6% this year and to 5.7% in 2018. Rental rate growth should moderate to 2.3% this year and 2.1% next.

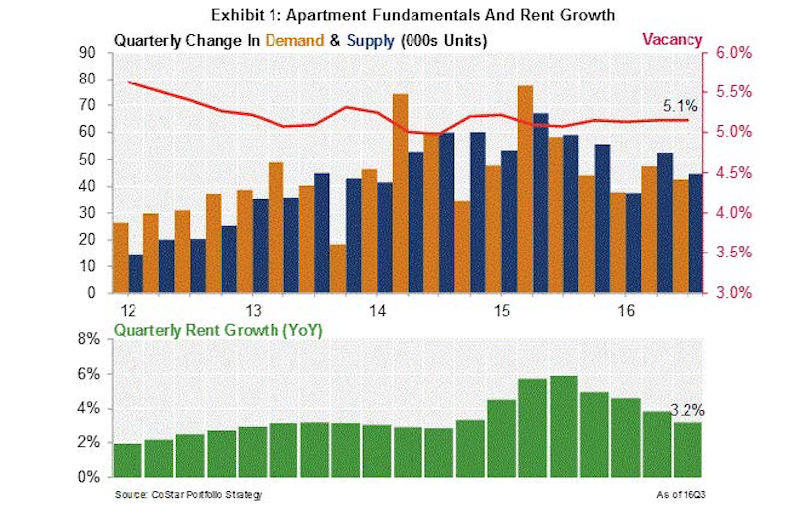

Looking at last year's performance, CoStar foresees rent growth slowing and supply still exceeding demand in multifamily. Image: CoStar Portfolio Strategy.

Looking at last year's performance, CoStar foresees rent growth slowing and supply still exceeding demand in multifamily. Image: CoStar Portfolio Strategy.

David Brickman, Executive Vice President and head of Freddic Mac’s multifamily business, foresees a spike in renter households, spurred on by positive job growth and a stable economy. In addition, home prices are on the rise, which might cause renters to further postpone any residential purchases. And aging baby boomers continue to downsize into rental units.

Fannie Mae is a bit more conservative in its estimates about multifamily growth over the next two years. But Kim Betancourt, Fannie’s Director of Economics, doesn’t expect any moderation to be long lasting.

“Considering that rent concessions have declined steadily for nearly seven straight years, and that their current level is now below 1%, it is probably only a question of ‘when’ and not ‘if’ concessions begin to rise again,” Betancourt says.

CoStar’s Affleck sees the “unprecedented propensity to rent, even among the most affluent” as “the chief risk to this cycle,” because higher rents will inevitably coax more renters to consider homeownership, especially if interest rates stay relatively low.

Related Stories

Multifamily Housing | Mar 31, 2023

EV charging stations in multifamily housing

Ryan Gram, PE, EV Charging Practice Leader at engineering firm Kimley-Horn, provides expert advice about the "business side" of installing EV charging stations in apartment and mixed-use communities. Gram speaks with BD+C Executive Editor Robert Cassidy.

Multifamily Housing | Mar 24, 2023

Washington state House passes bill banning single-family zoning

The Washington state House of Representatives recently passed a bill that would legalize duplexes or fourplexes in almost every neighborhood of every city in the state.

Multifamily Housing | Mar 24, 2023

Momentum building for green retrofits in New York City co-ops, condos

Many New York City co-op and condo boards had been resistant to the idea of approving green retrofits and energy-efficiency upgrades, but that reluctance might be in retreat.

Legislation | Mar 24, 2023

New York lawmakers set sights on unsafe lithium-ion batteries used in electric bikes and scooters

Lawmakers in New York City and statewide have moved to quell the growing number of fires caused by lithium-ion batteries used in electric bikes and scooters.

Multifamily Housing | Mar 24, 2023

Multifamily developers offering new car-free projects in car-centric cities

Cities in the South and Southwest have eased zoning rules with parking space mandates in recent years to allow developers to build new housing with less parking.

Multifamily Housing | Mar 24, 2023

Coastal multifamily developers, owners expect huge jump in insurance costs

In Texas and Florida, where Hurricane Ian caused $50 billion in damage last year, insurance costs are nearly 50% higher than in 2022.

Multifamily Housing | Mar 24, 2023

Average size of new apartments dropped sharply in 2022

The average size of new apartments in 2022 dropped sharply in 2022, as tracked by RentCafe. Across the U.S., the average new apartment size was 887 sf, down 30 sf from 2021, which was the largest year-over-year decrease.

Geothermal Technology | Mar 22, 2023

Lendlease secures grants for New York’s largest geothermal residential building

Lendlease and joint venture partner Aware Super, one of Australia’s largest superannuation funds, have acquired $4 million in support from the New York State Energy Research and Development Authority to build a geoexchange system at 1 Java Street in Brooklyn. Once completed, the all-electric property will be the largest residential project in New York State to use a geothermal heat exchange system.

Urban Planning | Mar 16, 2023

Three interconnected solutions for 'saving' urban centers

Gensler Co-CEO Andy Cohen explores how the global pandemic affected city life, and gives three solutions for revitalizing these urban centers.

Building Tech | Mar 14, 2023

Reaping the benefits of offsite construction, with ICC's Ryan Colker

Ryan Colker, VP of Innovation at the International Code Council, discusses how municipal regulations and inspections are keeping up with the expansion of off-site manufacturing for commercial construction. Colker speaks with BD+C's John Caulfield.