After another year when the growth in multifamily housing exceeded expectations, apartment demand and property values could keep rolling through 2017.

“The forces that have produced the best multifamily market in recent memory remain largely in place,” says John Affleck, apartment research strategist for CoStar Group.

In a recent report from Real Capital Markets, 49% of investors polled said that multifamily remains an ideal investment in commercial real estate, and that the market doesn’t look like it will be slowing down any time soon.

The National Association of Home Builders expects multifamily starts to rise to 384,000 units, or 1,000 above last year’s number. Robert Dietz, NAHB’s chief economist, believes this pace is being driven by demographics and the balance between supply and demand.

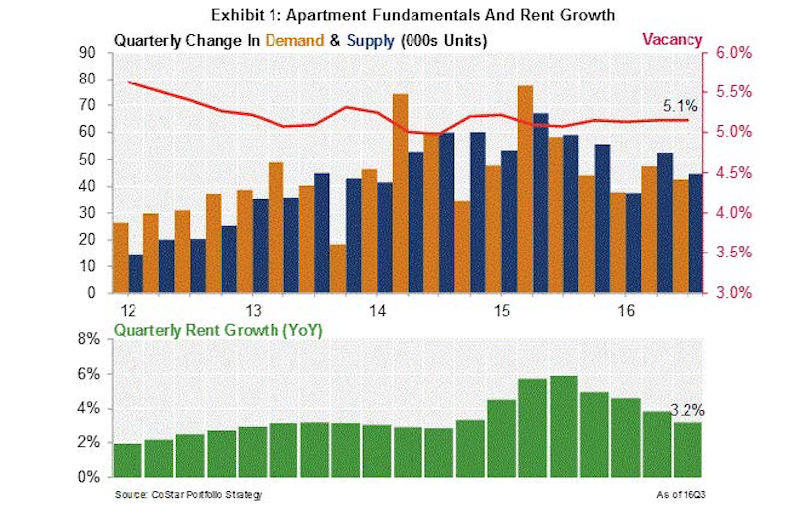

CoStar actually forecasts that sales volumes, units per sale, and price growth of multifamily properties will finally level off this year from record highs. However, CoStar also acknowledges the sector’s momentum, where—through the third quarter of 2016—multifamily had the lowest vacancy rate (5.2%) of all major property types, and had seen rents rise by 3.9%.

Aggressive pricing aside, the sector’s record of steady rent growth and high occupancy with low volatility continue to make apartment properties an ideal defensive asset as the economic cycle extends into a seventh year, Affleck says.

CoStar predicts that the national vacancy rate for multifamily properties will increase to 5.6% this year and to 5.7% in 2018. Rental rate growth should moderate to 2.3% this year and 2.1% next.

Looking at last year's performance, CoStar foresees rent growth slowing and supply still exceeding demand in multifamily. Image: CoStar Portfolio Strategy.

Looking at last year's performance, CoStar foresees rent growth slowing and supply still exceeding demand in multifamily. Image: CoStar Portfolio Strategy.

David Brickman, Executive Vice President and head of Freddic Mac’s multifamily business, foresees a spike in renter households, spurred on by positive job growth and a stable economy. In addition, home prices are on the rise, which might cause renters to further postpone any residential purchases. And aging baby boomers continue to downsize into rental units.

Fannie Mae is a bit more conservative in its estimates about multifamily growth over the next two years. But Kim Betancourt, Fannie’s Director of Economics, doesn’t expect any moderation to be long lasting.

“Considering that rent concessions have declined steadily for nearly seven straight years, and that their current level is now below 1%, it is probably only a question of ‘when’ and not ‘if’ concessions begin to rise again,” Betancourt says.

CoStar’s Affleck sees the “unprecedented propensity to rent, even among the most affluent” as “the chief risk to this cycle,” because higher rents will inevitably coax more renters to consider homeownership, especially if interest rates stay relatively low.

Related Stories

Seismic Design | Feb 27, 2023

Turkey earthquakes provide lessons for California

Two recent deadly earthquakes in Turkey and Syria offer lessons regarding construction practices and codes for California. Lax building standards were blamed for much of the devastation, including well over 35,000 dead and countless building collapses.

Multifamily Housing | Feb 21, 2023

Watch: DBA Architects' Bryan Moore talks micro communities and the benefits of walkable neighborhoods

What is a micro-community? Where are they most prevalent? What’s the future for micro communities? These questions (and more) addressed by Bryan Moore, President and CEO of DBA Architects.

Multifamily Housing | Feb 21, 2023

Multifamily housing investors favoring properties in the Sun Belt

Multifamily housing investors are gravitating toward Sun Belt markets with strong job and population growth, according to new research from Yardi Matrix. Despite a sharp second-half slowdown, last year’s nationwide $187 billion transaction volume was the second-highest annual total ever.

Multifamily Housing | Feb 21, 2023

New multifamily housing and mixed-use buildings in Portland, Ore., must be ready for electric vehicle charging

The Portland, Ore., City Council recently voted unanimously to require all new residential and mixed-use buildings to be ready for electric vehicle charging. The move amends Portland’s zoning laws to require all new multi-dwelling and mixed-use development of five or more units with onsite parking to provide electric vehicle charging infrastructure.

Reconstruction & Renovation | Feb 16, 2023

Insights from over 300 potential office-to-residential conversions

Research from Gensler finds that, surprisingly, the features that result in an unpleasant office often make for a superlative multifamily product.

Multifamily Housing | Feb 16, 2023

Coastal Construction Group establishes an attainable multifamily housing division

Coastal Construction Group, one of the largest privately held construction companies in the Southeast, has announced a new division within their multifamily sector that will focus on the need for attainable housing in South Florida.

High-rise Construction | Feb 15, 2023

Bjarke Ingels' 'leaning towers' concept wins Qianhai Prisma Towers design competition

A pair of sloped high-rises—a 300-meter residential tower and a 250-meter office tower—highlight the Qianhai Prisma Towers development in Qianhai, Shenzhen, China. BIG recently won the design competition for the project.

Senior Living Design | Feb 15, 2023

Passive House affordable senior housing project opens in Boston

Work on Phase Three C of The Anne M. Lynch Homes at Old Colony, a 55-apartment midrise building in Boston that stands out for its use of Passive House design principles, was recently completed. Designed by The Architectural Team (TAT), the four-story structure was informed throughout by Passive House principles and standards.

Multifamily Housing | Feb 11, 2023

8 Gold and Platinum multifamily projects from the NAHB's BALA Awards

This year's top BALA multifamily winners showcase leading design trends, judged by eight industry professionals from across the country.

Multifamily Housing | Feb 10, 2023

Dallas to get a 19-story, 351-unit residential high-rise

In Dallas, work has begun on a new multifamily high-rise called The Oliver. The 19-story, 351-unit apartment building will be located within The Central, a 27-acre mixed-use development near the Knox/Henderson neighborhood north of downtown Dallas.