The multifamily sector continues to be strong in 2024, even when a handful of challenges are present. That is according to the Matrix Multifamily National Report for Summer 2024.

This research report looks towards the second half of the year to see what we can expect for rent growth, supply, and economic uncertainty.

U.S. Multifamily Outlook for Summer 2024

While demand remains steady, factors like rising supply and financing difficulties are creating headwinds. The coming months will likely see a slowdown in growth, with regional variations depending on supply and economic factors.

Moderate Challenges

While the economy remains stable and job growth persists, some challenges are emerging for multifamily markets. Rent growth and occupancy rates, once strong, have softened since the 2022 peak.

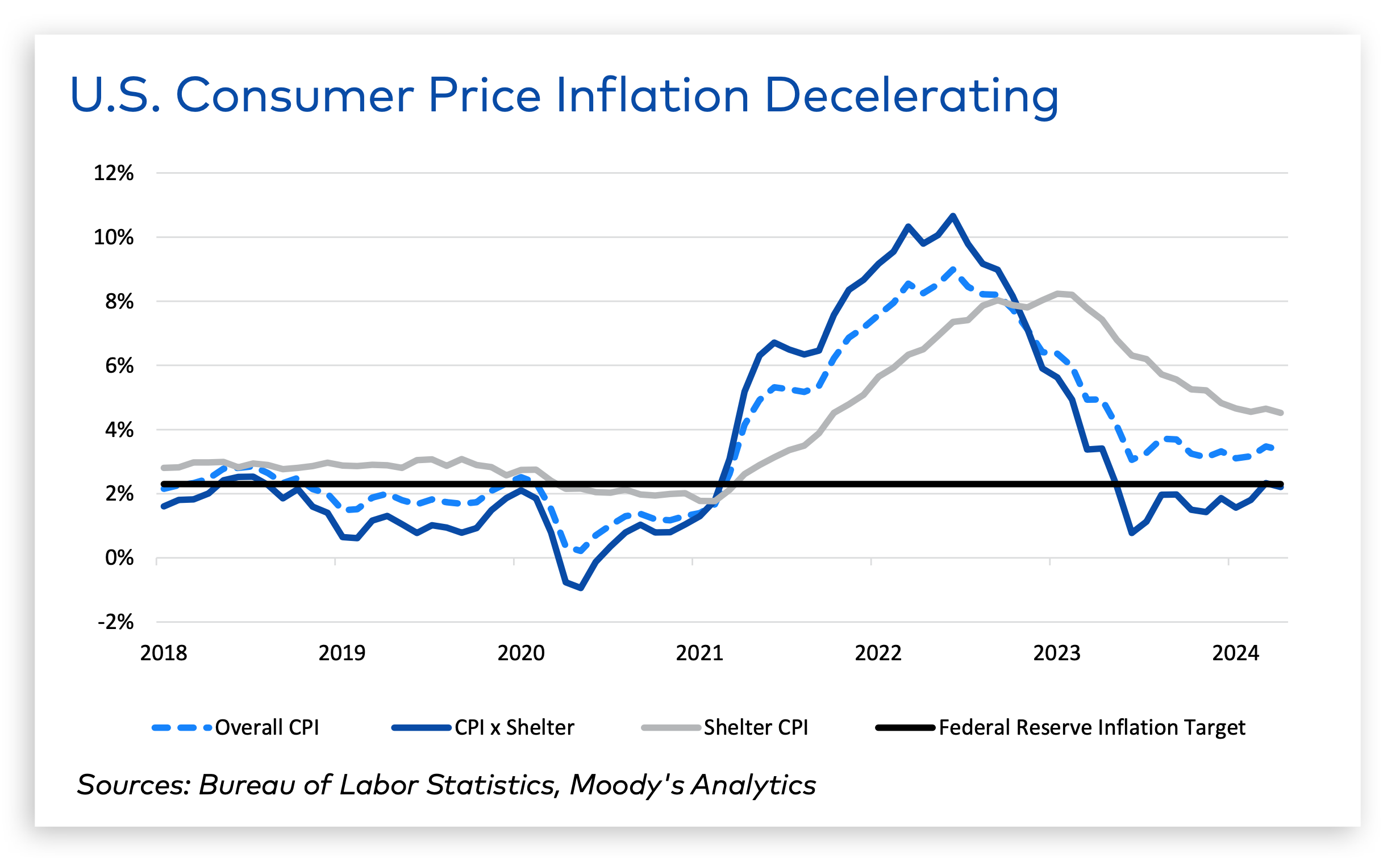

“All eyes in the multifamily market are on the direction of inflation and interest rates,” the report states.

Financing presents another hurdle. High interest rates are dampening transaction activity. Investors are waiting for prices to adjust before buying, while lenders are cautious and many banks are staying on the sidelines.

Debt is a concern, especially for properties financed with short-term loans. Well-capitalized investors can weather the storm, but some value-add properties face potential distress.

Mixed-Bag Supply & Demand

Demand is a double-edged sword. Would-be homebuyers are staying put due to high mortgage rates, which bolsters rental demand. However, these same high rates are hindering refinancing and sales activity in the multifamily market.

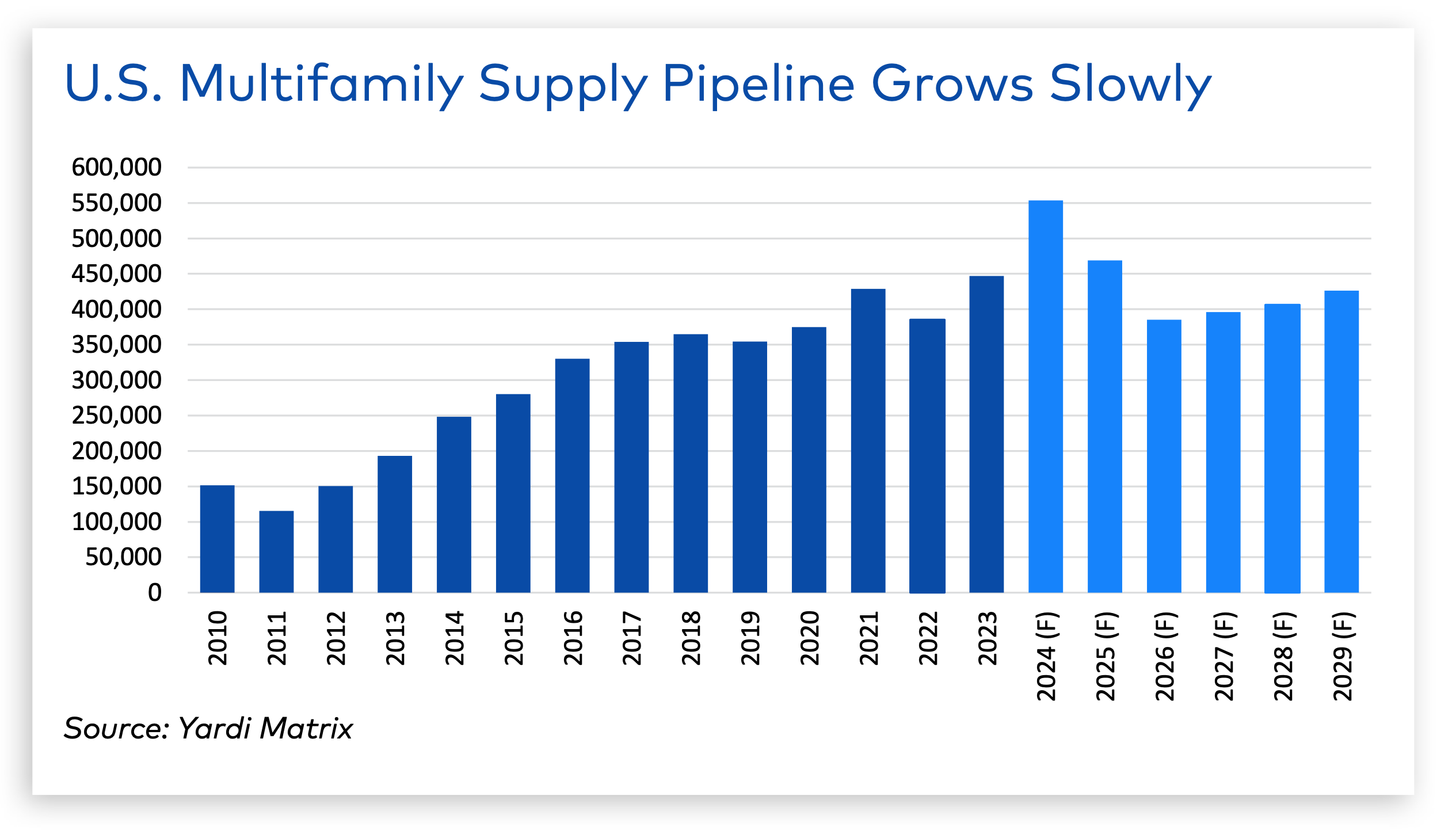

Supply is on the rise, especially in Sun Belt markets. This influx of new units is putting pressure on rent growth in those areas, while other regions with slower delivery rates are seeing more stable rents. This trend is expected to continue in the short term, with a peak of 553,000 new units projected for 2024.

“Multifamily is on schedule this year to achieve the highest number of deliveries in decades, but the pipeline will moderate in following years as starts slow,” the report states.

From January to May 2024, rent growth reached 1.1%—a $19 increase. Although average rent prices across the country remains positive, growth has slowed considerably in the past two years.

Overall, the U.S. multifamily market is experiencing a period of mixed signals that will persist throughout the rest of 2024.

RELATED

Related Stories

MFPRO+ News | Jan 8, 2024

Canada turns to 1940s strategy to speed up housing construction

To address a severe housing shortage, Prime Minister Justin Trudeau’s administration has begun a housing construction strategy pioneered in the years after World War 2. The government aims to use a catalog of pre-approved home designs to reduce the cost and time to construct homes.

Self-Storage Facilities | Jan 5, 2024

The state of self-storage in early 2024

As the housing market cools down, storage facilities suffer from lower occupancy and falling rates, according to the December 2023 Yardi Matrix National Self Storage Report.

MFPRO+ News | Jan 4, 2024

Bjarke Ingels's curved residential high-rise will anchor a massive urban regeneration project in Greece

In Athens, Greece, Lamda Development has launched Little Athens, the newest residential neighborhood at the Ellinikon, a multiuse development billed as a smart city. Bjarke Ingels Group's 50-meter Park Rise building will serve as Little Athens’ centerpiece.

Resiliency | Jan 2, 2024

Americans are migrating from areas of high flood risk

Americans are abandoning areas of high flood risk in significant numbers, according to research by the First Street Foundation. Climate Abandonment Areas account for more than 818,000 Census Blocks and lost a total of 3.2 million-plus residents due to flooding from 2000 to 2020, the study found.

MFPRO+ News | Jan 2, 2024

New York City will slash regulations on housing projects

New York City Mayor Eric Adams is expected to cut red tape to make it easier and less costly to build housing projects in the city. Adams would exempt projects with fewer than 175 units in low-density residential areas and those with fewer than 250 units in commercial, manufacturing, and medium- and high-density residential areas from environmental review.

MFPRO+ News | Dec 22, 2023

Document offers guidance on heat pump deployment for multifamily housing

ICAST (International Center for Appropriate and Sustainable Technology) has released a resource guide to help multifamily owners and managers, policymakers, utilities, energy efficiency program implementers, and others advance the deployment of VHE heat pump HVAC and water heaters in multifamily housing.

Giants 400 | Dec 20, 2023

Top 100 Apartment and Condominium Construction Firms for 2023

Clark Group, Suffolk Construction, Summit Contracting Group, and McShane Companies top BD+C's ranking of the nation's largest apartment building and condominium general contractors and construction management (CM) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Dec 20, 2023

Top 70 Apartment and Condominium Engineering Firms for 2023

Kimley-Horn, WSP, Tetra Tech, and Thornton Tomasetti head BD+C's ranking of the nation's largest apartment building and condominium engineering and engineering/architecture (EA) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Dec 20, 2023

Top 160 Apartment and Condominium Architecture Firms for 2023

Gensler, Humphreys and Partners, Solomon Cordwell Buenz, and AO top BD+C's ranking of the nation's largest apartment building and condominium architecture and architecture/engineering (AE) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Dec 20, 2023

Top 40 Student Housing Construction Firms for 2023

Findorff, Juneau Construction, JE Dunn Construction, and Weitz Company top BD+C's ranking of the nation's largest student housing facility general contractors and construction management (CM) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report.