The multifamily sector continues to be strong in 2024, even when a handful of challenges are present. That is according to the Matrix Multifamily National Report for Summer 2024.

This research report looks towards the second half of the year to see what we can expect for rent growth, supply, and economic uncertainty.

U.S. Multifamily Outlook for Summer 2024

While demand remains steady, factors like rising supply and financing difficulties are creating headwinds. The coming months will likely see a slowdown in growth, with regional variations depending on supply and economic factors.

Moderate Challenges

While the economy remains stable and job growth persists, some challenges are emerging for multifamily markets. Rent growth and occupancy rates, once strong, have softened since the 2022 peak.

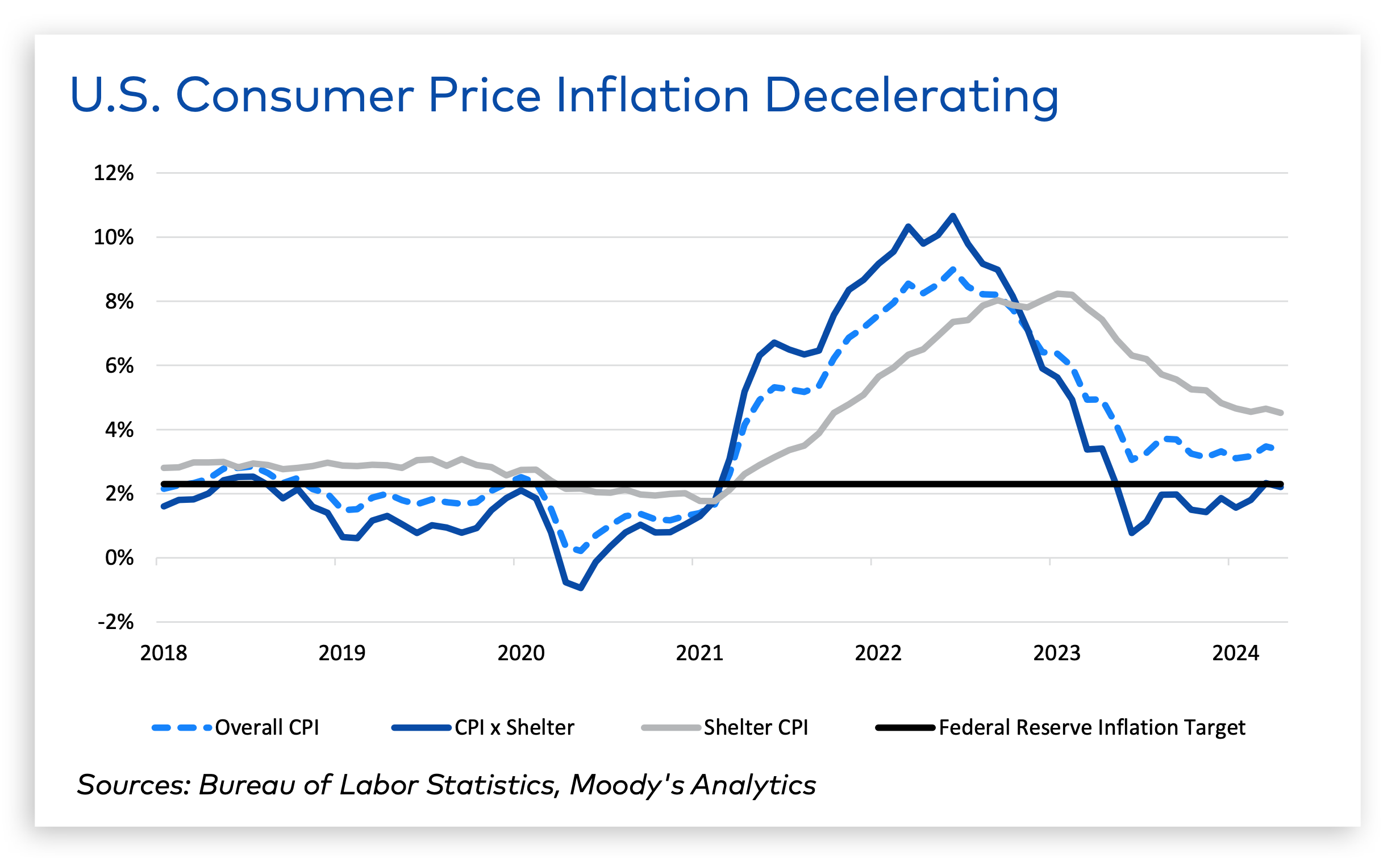

“All eyes in the multifamily market are on the direction of inflation and interest rates,” the report states.

Financing presents another hurdle. High interest rates are dampening transaction activity. Investors are waiting for prices to adjust before buying, while lenders are cautious and many banks are staying on the sidelines.

Debt is a concern, especially for properties financed with short-term loans. Well-capitalized investors can weather the storm, but some value-add properties face potential distress.

Mixed-Bag Supply & Demand

Demand is a double-edged sword. Would-be homebuyers are staying put due to high mortgage rates, which bolsters rental demand. However, these same high rates are hindering refinancing and sales activity in the multifamily market.

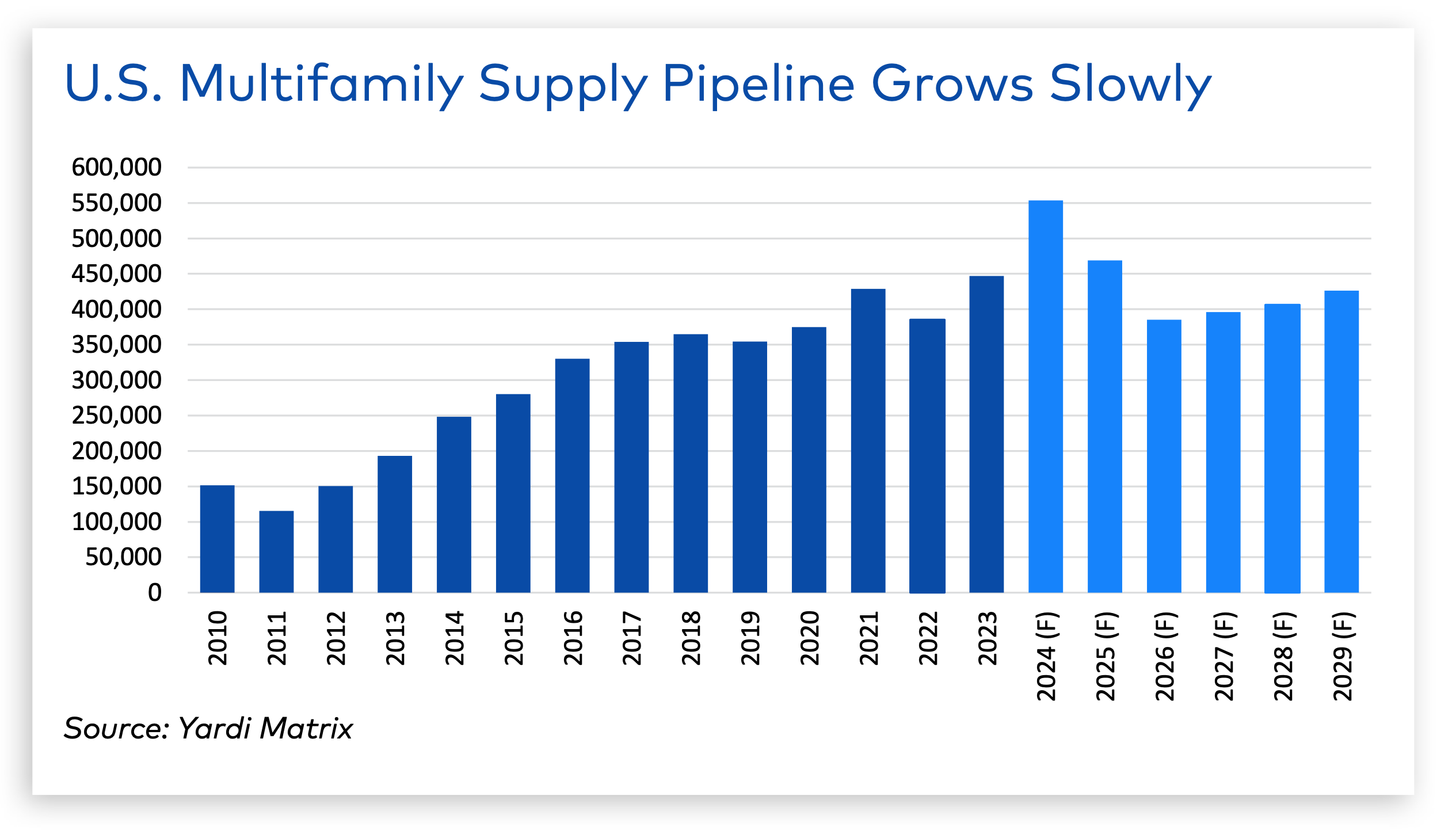

Supply is on the rise, especially in Sun Belt markets. This influx of new units is putting pressure on rent growth in those areas, while other regions with slower delivery rates are seeing more stable rents. This trend is expected to continue in the short term, with a peak of 553,000 new units projected for 2024.

“Multifamily is on schedule this year to achieve the highest number of deliveries in decades, but the pipeline will moderate in following years as starts slow,” the report states.

From January to May 2024, rent growth reached 1.1%—a $19 increase. Although average rent prices across the country remains positive, growth has slowed considerably in the past two years.

Overall, the U.S. multifamily market is experiencing a period of mixed signals that will persist throughout the rest of 2024.

RELATED

Related Stories

Designers | Feb 23, 2024

Coverings releases top 2024 tile trends

In celebration of National Tile Day, Coverings, North America's leading tile and stone exhibition, has announced the top 10 tile trends for 2024.

MFPRO+ Special Reports | Feb 22, 2024

Crystal Lagoons: A deep dive into real estate's most extreme guest amenity

These year-round, manmade, crystal clear blue lagoons offer a groundbreaking technology with immense potential to redefine the concept of water amenities. However, navigating regulatory challenges and ensuring long-term sustainability are crucial to success with Crystal Lagoons.

Building Tech | Feb 20, 2024

Construction method featuring LEGO-like bricks wins global innovation award

A new construction method featuring LEGO-like bricks made from a renewable composite material took first place for building innovations at the 2024 JEC Composites Innovation Awards in Paris, France.

Student Housing | Feb 19, 2024

UC Law San Francisco’s newest building provides student housing at below-market rental rates

Located in San Francisco’s Tenderloin and Civic Center neighborhoods, UC Law SF’s newest building helps address the city’s housing crisis by providing student housing at below-market rental rates. The $282 million, 365,000-sf facility at 198 McAllister Street enables students to live on campus while also helping to regenerate the neighborhood.

Multifamily Housing | Feb 16, 2024

5 emerging multifamily trends for 2024

As priorities realign and demographic landscapes transform, multifamily designers and developers find themselves in a continuous state of adaptation to resonate with residents.

MFPRO+ News | Feb 15, 2024

UL Solutions launches indoor environmental quality verification designation for building construction projects

UL Solutions recently launched UL Verified Healthy Building Mark for New Construction, an indoor environmental quality verification designation for building construction projects.

MFPRO+ News | Feb 15, 2024

Nine states pledge to transition to heat pumps for residential HVAC and water heating

Nine states have signed a joint agreement to accelerate the transition to residential building electrification by significantly expanding heat pump sales to meet heating, cooling, and water heating demand. The Memorandum of Understanding was signed by directors of environmental agencies from California, Colorado, Maine, Maryland, Massachusetts, New Jersey, New York, Oregon, and Rhode Island.

MFPRO+ News | Feb 15, 2024

Oregon, California, Maine among states enacting policies to spur construction of missing middle housing

Although the number of new apartment building units recently reached the highest point in nearly 50 years, construction of duplexes, triplexes, and other buildings of from two to nine units made up just 1% of new housing units built in 2022. A few states have recently enacted new laws to spur more construction of these missing middle housing options.

Multifamily Housing | Feb 14, 2024

Multifamily rent remains flat at $1,710 in January

The multifamily market was stable at the start of 2024, despite the pressure of a supply boom in some markets, according to the latest Yardi Matrix National Multifamily Report.

Student Housing | Feb 13, 2024

Student housing market expected to improve in 2024

The past year has brought tough times for student housing investment sales due to unfavorable debt markets. However, 2024 offers a brighter outlook if debt conditions improve as predicted.