The multifamily sector continues to be strong in 2024, even when a handful of challenges are present. That is according to the Matrix Multifamily National Report for Summer 2024.

This research report looks towards the second half of the year to see what we can expect for rent growth, supply, and economic uncertainty.

U.S. Multifamily Outlook for Summer 2024

While demand remains steady, factors like rising supply and financing difficulties are creating headwinds. The coming months will likely see a slowdown in growth, with regional variations depending on supply and economic factors.

Moderate Challenges

While the economy remains stable and job growth persists, some challenges are emerging for multifamily markets. Rent growth and occupancy rates, once strong, have softened since the 2022 peak.

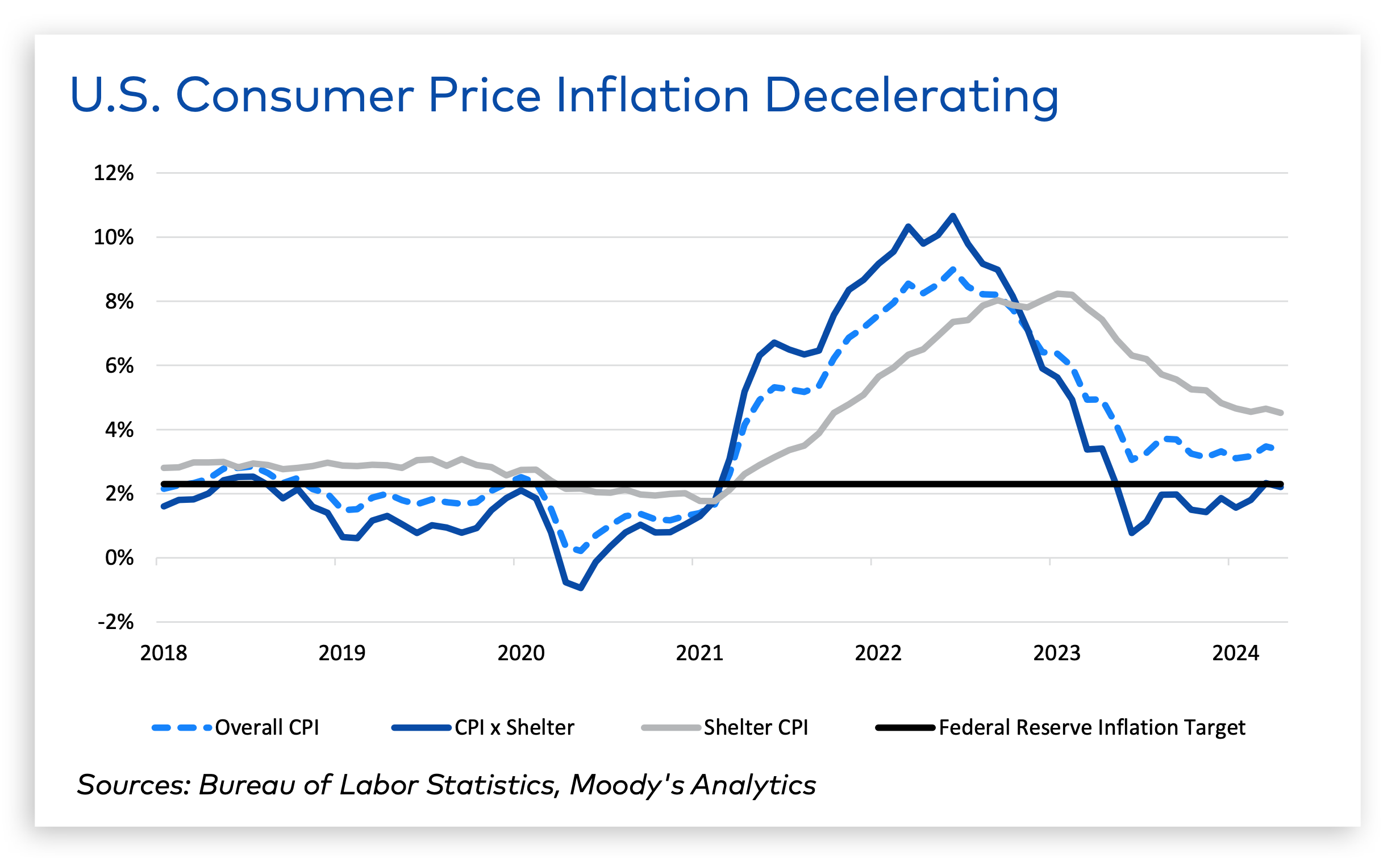

“All eyes in the multifamily market are on the direction of inflation and interest rates,” the report states.

Financing presents another hurdle. High interest rates are dampening transaction activity. Investors are waiting for prices to adjust before buying, while lenders are cautious and many banks are staying on the sidelines.

Debt is a concern, especially for properties financed with short-term loans. Well-capitalized investors can weather the storm, but some value-add properties face potential distress.

Mixed-Bag Supply & Demand

Demand is a double-edged sword. Would-be homebuyers are staying put due to high mortgage rates, which bolsters rental demand. However, these same high rates are hindering refinancing and sales activity in the multifamily market.

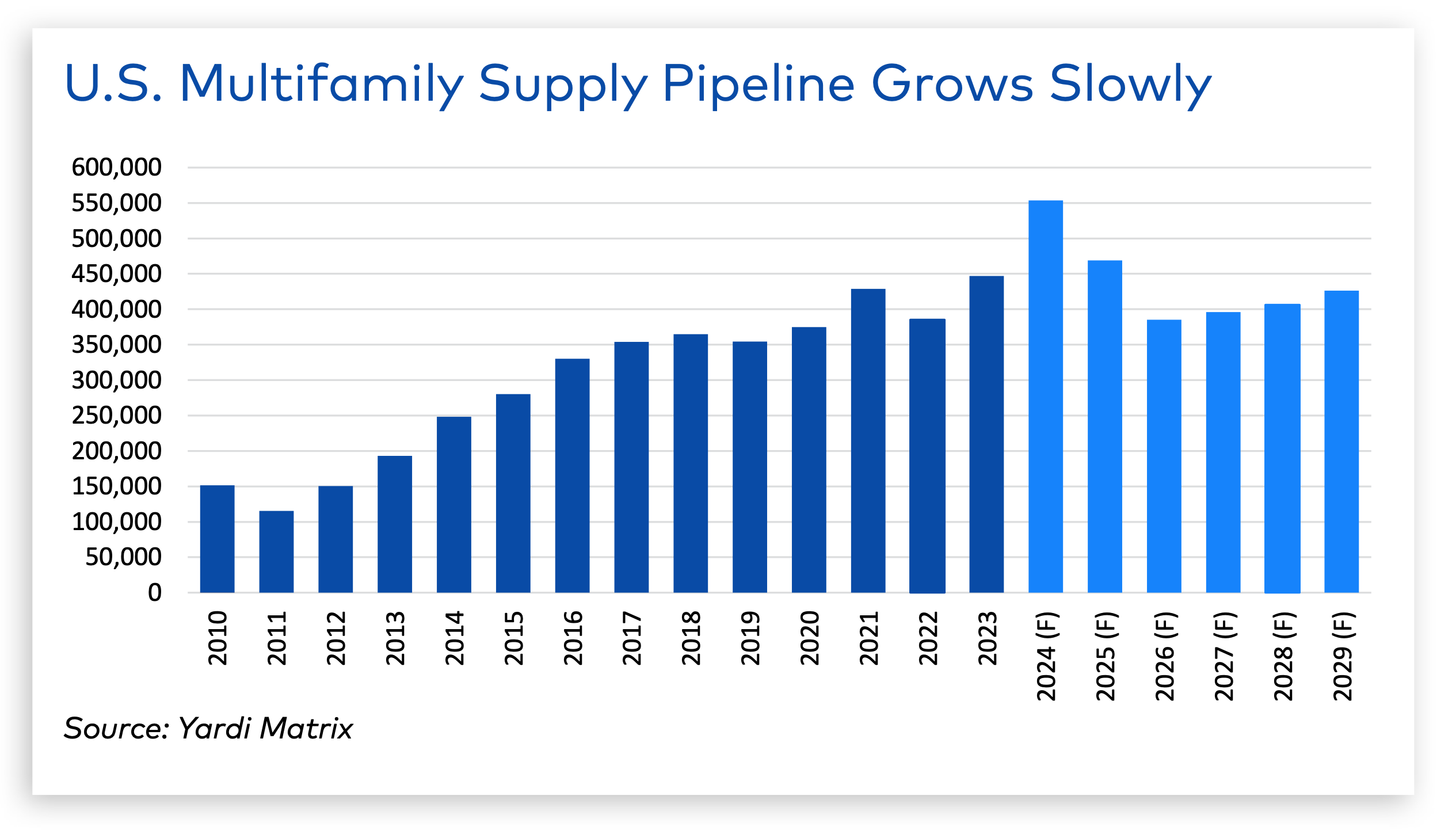

Supply is on the rise, especially in Sun Belt markets. This influx of new units is putting pressure on rent growth in those areas, while other regions with slower delivery rates are seeing more stable rents. This trend is expected to continue in the short term, with a peak of 553,000 new units projected for 2024.

“Multifamily is on schedule this year to achieve the highest number of deliveries in decades, but the pipeline will moderate in following years as starts slow,” the report states.

From January to May 2024, rent growth reached 1.1%—a $19 increase. Although average rent prices across the country remains positive, growth has slowed considerably in the past two years.

Overall, the U.S. multifamily market is experiencing a period of mixed signals that will persist throughout the rest of 2024.

RELATED

Related Stories

MFPRO+ New Projects | Oct 30, 2024

BIG’s One High Line finally reaches completion in New York City’s West Chelsea neighborhood

One High Line, a luxury residential project spanning a full city block in New York’s West Chelsea neighborhood, reached completion this summer following years of delays related to investor lawsuits.

MFPRO+ New Projects | Oct 30, 2024

Luxury waterfront tower in Brooklyn features East River and Manhattan skyline views

Leasing recently began for The Dupont, a 41-story luxury rental property along the Brooklyn, N.Y., waterfront. Located within the 22-acre Greenpoint Landing, where it overlooks the newly constructed Newtown Barge Park, the high-rise features East River and Manhattan skyline views along with 20,000 sf of indoor and outdoor communal space.

MFPRO+ News | Oct 22, 2024

Project financing tempers robust demand for multifamily housing

AEC Giants with multifamily practices report that the sector has been struggling over the past year, despite the high demand for housing, especially affordable products.

Codes and Standards | Oct 16, 2024

North Carolina’s code policies likely worsened damage caused by Hurricane Helene

The North Carolina Legislature’s rejection of building code updates likely worsened the damage caused by Hurricane Helene, code experts say. Over the past 15 years, lawmakers rejected limits on construction on steep slopes, which might have reduced the number of homes destroyed by landslides.

MFPRO+ News | Oct 16, 2024

One-third of young adults say hurricanes like Helene and Milton will impact where they choose to live

Nearly one-third of U.S. residents between 18 and 34 years old say they are reconsidering where they want to move after seeing the damage wrought by Hurricane Helene, according to a Redfin report. About 15% of those over age 35 echoed their younger cohort’s sentiment.

MFPRO+ News | Oct 9, 2024

San Francisco unveils guidelines to streamline office-to-residential conversions

The San Francisco Department of Building Inspection announced a series of new building code guidelines clarifying adaptive reuse code provisions and exceptions for converting office-to-residential buildings. Developed in response to the Commercial to Residential Adaptive Reuse program established in July 2023, the guidelines aim to increase the viability of converting underutilized office buildings into housing by reducing regulatory barriers in specific zoning districts downtown.

Mixed-Use | Oct 7, 2024

New mixed-use tower by Studio Gang completes first phase of San Francisco waterfront redevelopment

Construction was recently completed on Verde, a new mixed-use tower along the San Francisco waterfront, marking the end of the first phase of the Mission Rock development. Verde is the fourth and final building of phase one of the 28-acre project that will be constructed in several phases guided by design principles developed by a design cohort led by Studio Gang.

Sponsored | | Oct 7, 2024

ProWood® FR Used in Two 6-Story Multifamily Units

How ProWood FR Fire-Retardant Treated Products Benefited this affordable housing project

Affordable Housing | Oct 4, 2024

3 new affordable housing projects for October 2024

As affordable housing continues to grow, more projects are looking to diversify their footprint by adding mixed-use components, community areas, and more.

MFPRO+ News | Sep 24, 2024

Major Massachusetts housing law aims to build or save 65,000 multifamily and single-family homes

Massachusetts Gov. Maura Healey recently signed far-reaching legislation to boost housing production and address the high cost of housing in the Bay State. The Affordable Homes Act aims to build or save 65,000 homes through $5.1 billion in spending and 49 policy initiatives.