The multifamily sector continues to be strong in 2024, even when a handful of challenges are present. That is according to the Matrix Multifamily National Report for Summer 2024.

This research report looks towards the second half of the year to see what we can expect for rent growth, supply, and economic uncertainty.

U.S. Multifamily Outlook for Summer 2024

While demand remains steady, factors like rising supply and financing difficulties are creating headwinds. The coming months will likely see a slowdown in growth, with regional variations depending on supply and economic factors.

Moderate Challenges

While the economy remains stable and job growth persists, some challenges are emerging for multifamily markets. Rent growth and occupancy rates, once strong, have softened since the 2022 peak.

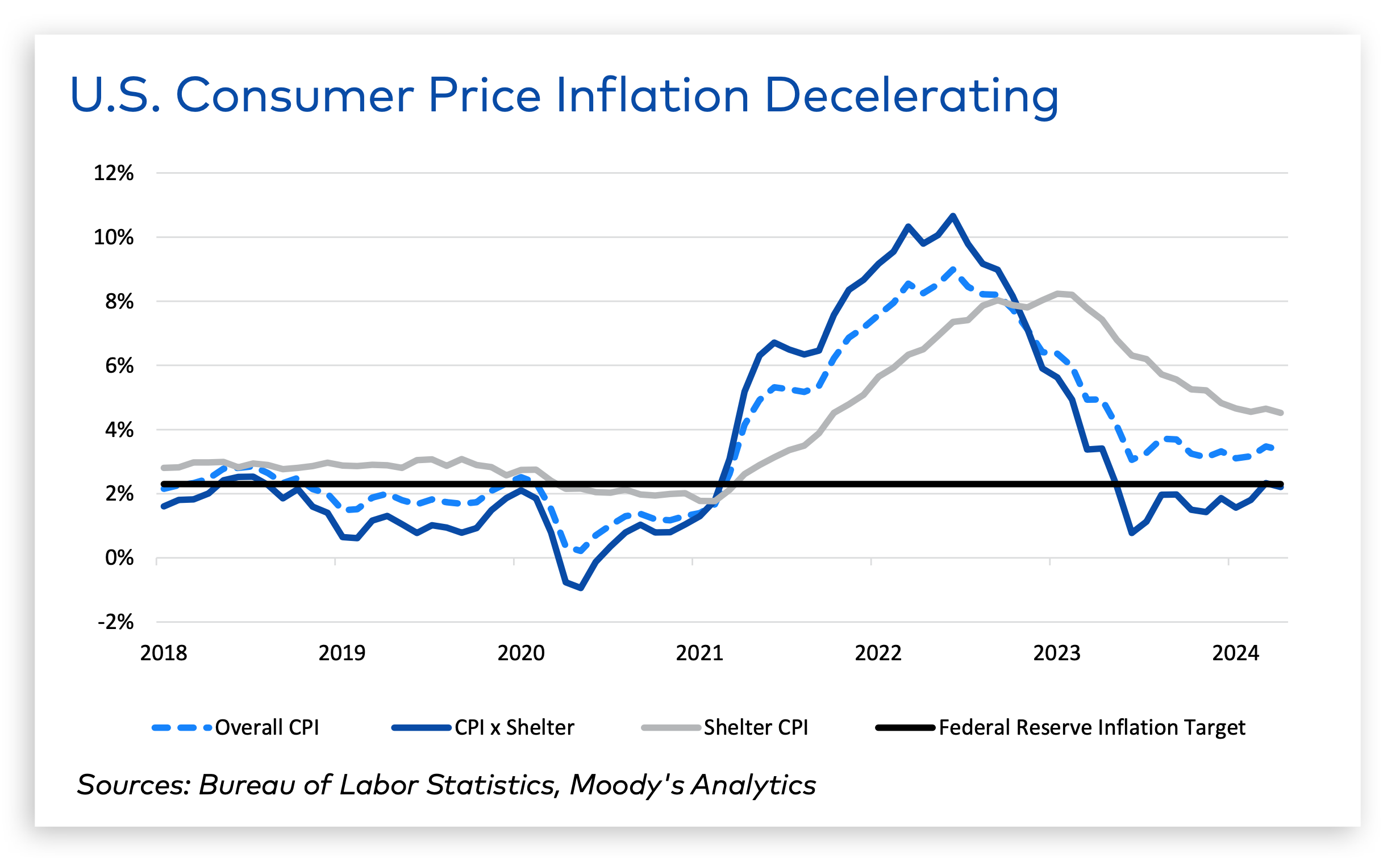

“All eyes in the multifamily market are on the direction of inflation and interest rates,” the report states.

Financing presents another hurdle. High interest rates are dampening transaction activity. Investors are waiting for prices to adjust before buying, while lenders are cautious and many banks are staying on the sidelines.

Debt is a concern, especially for properties financed with short-term loans. Well-capitalized investors can weather the storm, but some value-add properties face potential distress.

Mixed-Bag Supply & Demand

Demand is a double-edged sword. Would-be homebuyers are staying put due to high mortgage rates, which bolsters rental demand. However, these same high rates are hindering refinancing and sales activity in the multifamily market.

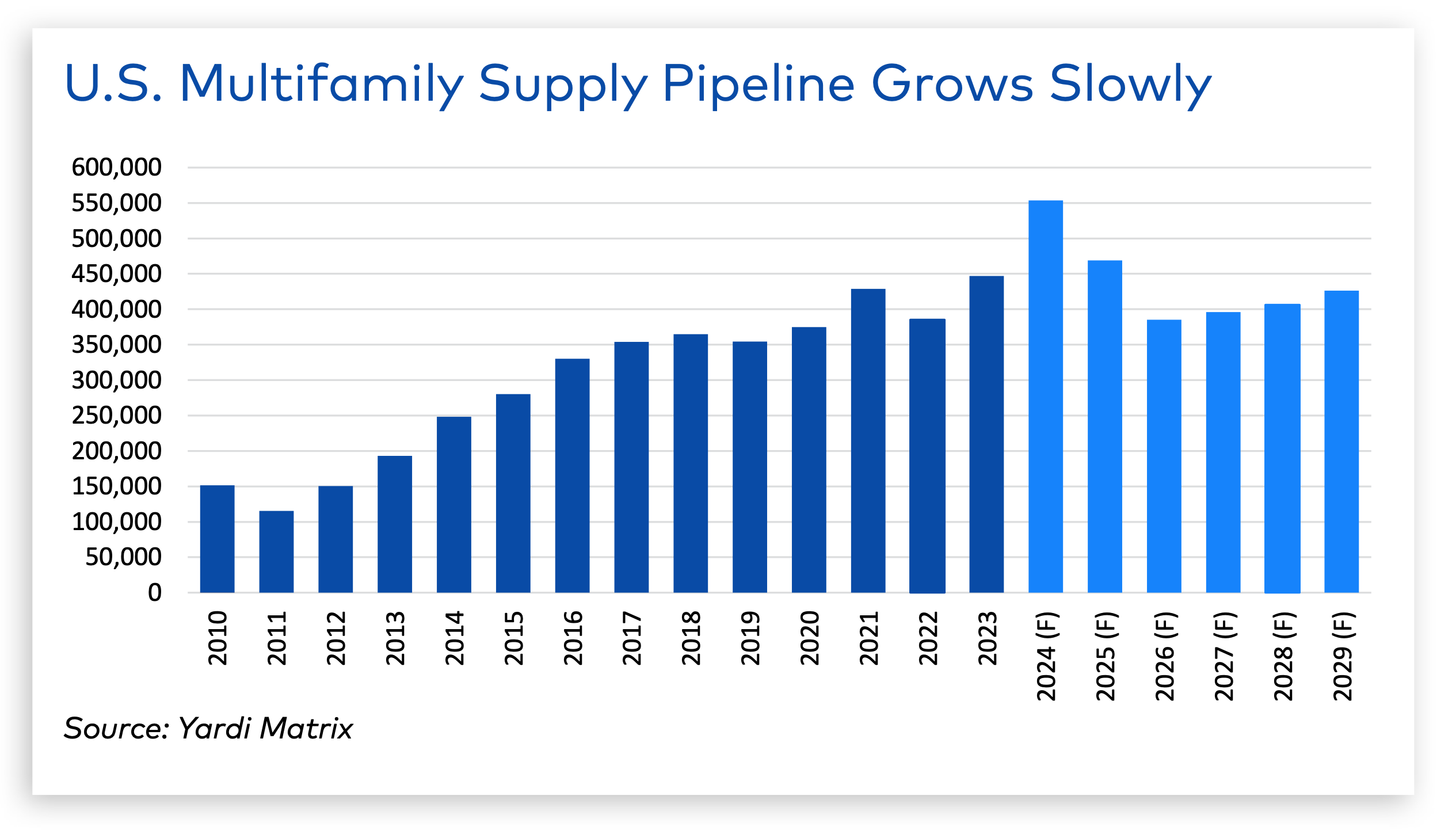

Supply is on the rise, especially in Sun Belt markets. This influx of new units is putting pressure on rent growth in those areas, while other regions with slower delivery rates are seeing more stable rents. This trend is expected to continue in the short term, with a peak of 553,000 new units projected for 2024.

“Multifamily is on schedule this year to achieve the highest number of deliveries in decades, but the pipeline will moderate in following years as starts slow,” the report states.

From January to May 2024, rent growth reached 1.1%—a $19 increase. Although average rent prices across the country remains positive, growth has slowed considerably in the past two years.

Overall, the U.S. multifamily market is experiencing a period of mixed signals that will persist throughout the rest of 2024.

RELATED

Related Stories

Multifamily Housing | Jun 17, 2024

Elevating multifamily properties through quiet luxury

As the demands of urban living continue to evolve, the need for a tranquil and refined home environment has never been more pronounced.

Multifamily Housing | Jun 14, 2024

AEC inspections are the key to financially viable office to residential adaptive reuse projects

About a year ago our industry was abuzz with an idea that seemed like a one-shot miracle cure for both the shockingly high rate of office vacancies and the worsening housing shortage. The seemingly simple idea of converting empty office buildings to multifamily residential seemed like an easy and elegant solution. However, in the intervening months we’ve seen only a handful of these conversions, despite near universal enthusiasm for the concept.

Senior Living Design | Jun 13, 2024

Crystal Pacific Windows bring sunshine to senior living community

Crystal Pacific Window & Door Systems, the West Coast production affiliate of national manufacturer Crystal Window & Door Systems, recently supplied over 400 energy efficient vinyl windows for a new affordable housing community in San Diego, Calif.

Affordable Housing | Jun 12, 2024

Studio Libeskind designs 190 affordable housing apartments for seniors

In Brooklyn, New York, the recently opened Atrium at Sumner offers 132,418 sf of affordable housing for seniors. The $132 million project includes 190 apartments—132 of them available to senior households earning below or at 50% of the area median income and 57 units available to formerly homeless seniors.

MFPRO+ News | Jun 11, 2024

Rents rise in multifamily housing for May 2024

Multifamily rents rose for the fourth month in a row, according to the May 2024 National Multifamily Report. Up 0.6% year-over-year, the average U.S. asking rent increased by $6 in May, up to $1,733.

Apartments | Jun 4, 2024

Apartment sizes on the rise after decade-long shrinking trend

The average size of new apartments in the U.S. saw substantial growth in 2023, bouncing back to 916 sf after a steep decline the previous year. That is according to a recent RentCafe market insight report released this month.

Multifamily Housing | Jun 3, 2024

Grassroots groups becoming a force in housing advocacy

A growing movement of grassroots organizing to support new housing construction is having an impact in city halls across the country. Fed up with high housing costs and the commonly hostile reception to new housing proposals, advocacy groups have sprung up in many communities to attend public meetings to speak in support of developments.

MFPRO+ News | Jun 3, 2024

New York’s office to residential conversion program draws interest from 64 owners

New York City’s Office Conversion Accelerator Program has been contacted by the owners of 64 commercial buildings interested in converting their properties to residential use.

MFPRO+ News | Jun 3, 2024

Seattle mayor wants to scale back energy code to spur more housing construction

Seattle’s mayor recently proposed that the city scale back a scheduled revamping of its building energy code to help boost housing production. The proposal would halt an update to the city’s multifamily and commercial building energy code that is scheduled to take effect later this year.

Resiliency | Jun 3, 2024

Houston’s buyout program has prevented flood damage but many more homes at risk

Recent flooding in Houston has increased focus on a 30-year-old program to buy out some of the area’s most vulnerable homes. Storms dropped 23 inches of rain on parts of southeast Texas, leading to thousands of homes being flooded in low-lying neighborhoods around Houston.