The multifamily sector continues to be strong in 2024, even when a handful of challenges are present. That is according to the Matrix Multifamily National Report for Summer 2024.

This research report looks towards the second half of the year to see what we can expect for rent growth, supply, and economic uncertainty.

U.S. Multifamily Outlook for Summer 2024

While demand remains steady, factors like rising supply and financing difficulties are creating headwinds. The coming months will likely see a slowdown in growth, with regional variations depending on supply and economic factors.

Moderate Challenges

While the economy remains stable and job growth persists, some challenges are emerging for multifamily markets. Rent growth and occupancy rates, once strong, have softened since the 2022 peak.

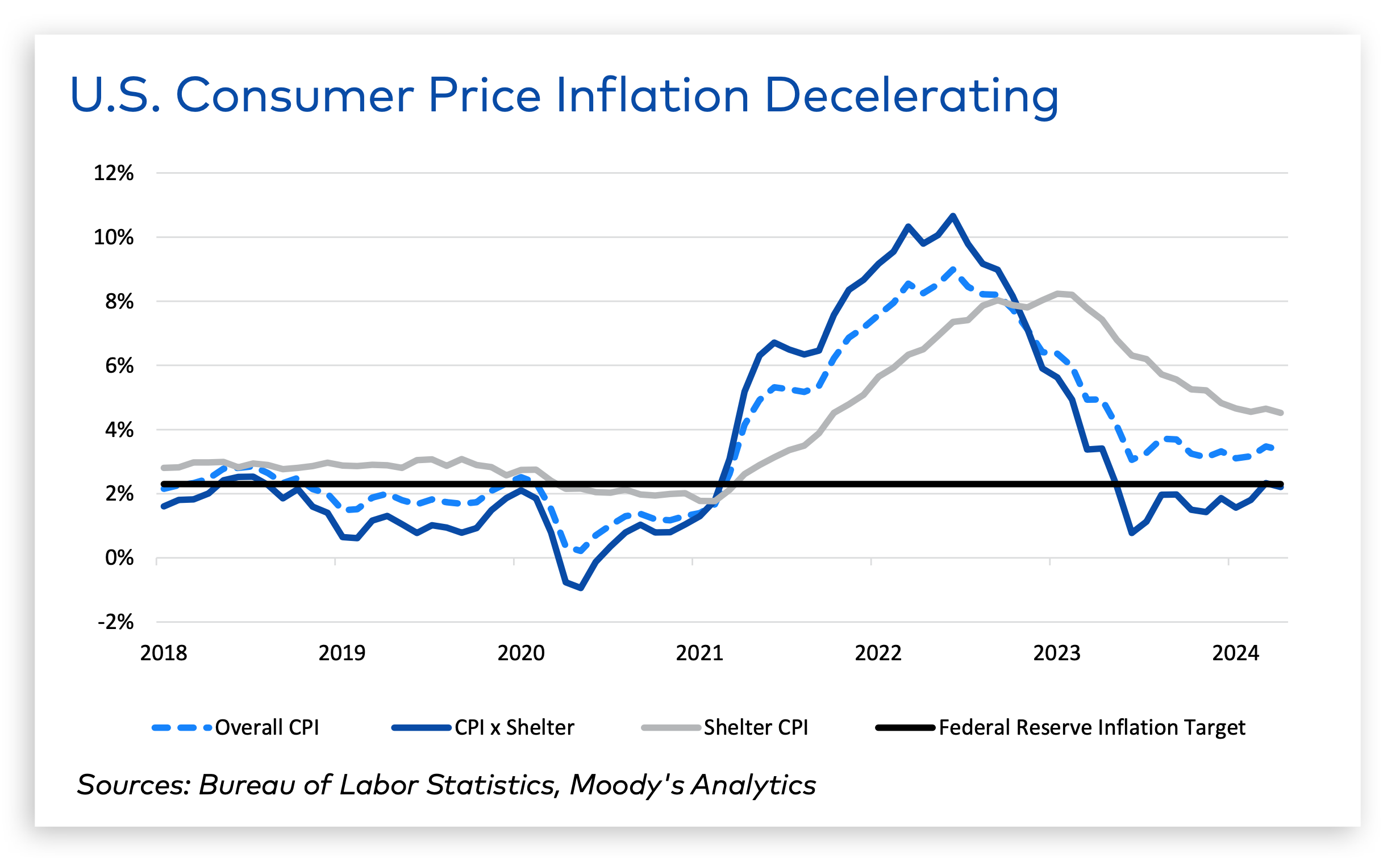

“All eyes in the multifamily market are on the direction of inflation and interest rates,” the report states.

Financing presents another hurdle. High interest rates are dampening transaction activity. Investors are waiting for prices to adjust before buying, while lenders are cautious and many banks are staying on the sidelines.

Debt is a concern, especially for properties financed with short-term loans. Well-capitalized investors can weather the storm, but some value-add properties face potential distress.

Mixed-Bag Supply & Demand

Demand is a double-edged sword. Would-be homebuyers are staying put due to high mortgage rates, which bolsters rental demand. However, these same high rates are hindering refinancing and sales activity in the multifamily market.

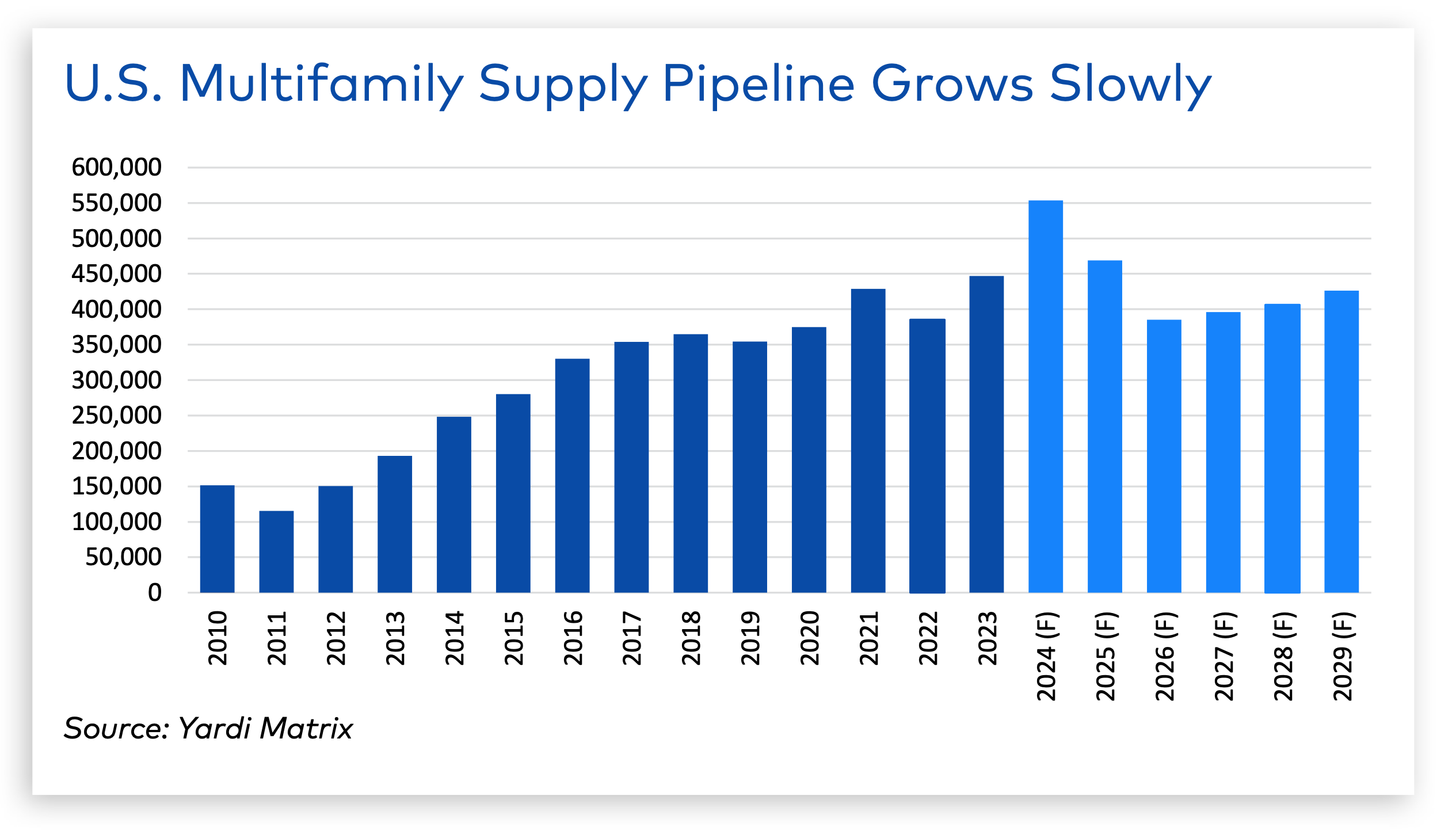

Supply is on the rise, especially in Sun Belt markets. This influx of new units is putting pressure on rent growth in those areas, while other regions with slower delivery rates are seeing more stable rents. This trend is expected to continue in the short term, with a peak of 553,000 new units projected for 2024.

“Multifamily is on schedule this year to achieve the highest number of deliveries in decades, but the pipeline will moderate in following years as starts slow,” the report states.

From January to May 2024, rent growth reached 1.1%—a $19 increase. Although average rent prices across the country remains positive, growth has slowed considerably in the past two years.

Overall, the U.S. multifamily market is experiencing a period of mixed signals that will persist throughout the rest of 2024.

RELATED

Related Stories

Mixed-Use | Aug 21, 2024

Adaptive reuse of a Sears store becomes luxury mixed-use housing

6 Corners Lofts at 4714 W Irving Park Road, Chicago, Ill., opened in March of 2024 as a 394,000-sf adaptive reuse project born out of a former Sears store.

Multifamily Housing | Aug 21, 2024

Nation's leading multifamily developer expands into infrastructure

Greystar's strategy for infrastructure is driven by the shifting landscape of today's cities—primarily in the increased digitization, urbanization, and transitions to clean energy.

MFPRO+ New Projects | Aug 20, 2024

Seattle workforce housing project inspired by geology of eastern Washington

J.G. Whittier Apartments, a workforce housing project in Seattle uses the geology of eastern Washington as inspiration for the design. The architecture and interior design celebrate geometric anomalies found in nature. At the corners of the building, blackened wood siding “erodes” to expose vibrant murals underneath.

MFPRO+ New Projects | Aug 16, 2024

At 60 stories, the Paramount multifamily development will stand as Nashville’s tallest high rise

When complete, the 60-story Paramount building, at 750 feet high, will be the tallest high rise tower in Nashville, Tenn., surpassing the city’s current record holder, the 617-foot AT&T Building. The $390 million Paramount project recently launched condo sales after securing more than $230 million in construction financing.

Adaptive Reuse | Aug 14, 2024

Adaptive reuse revives a former warehouse in St. Louis

The Victor, as the building is now called, has nearly 400 residential apartments.

MFPRO+ News | Aug 14, 2024

Report outlines how Atlanta can collaborate with private sector to spur more housing construction

A report by an Urban Land Institute’s Advisory Services panel, commissioned by the city’s housing authority, Atlanta Housing (AH), offered ways the city could collaborate with developers to spur more housing construction.

Modular Building | Aug 13, 2024

Strategies for attainable housing design with modular construction

Urban, market-rate housing that lower-income workers can actually afford is one of our country’s biggest needs. For multifamily designers, this challenge presents several opportunities for creating housing that workers can afford on their salaries.

MFPRO+ Research | Aug 9, 2024

Apartment completions to surpass 500,000 for first time ever

While the U.S. continues to maintain a steady pace of delivering new apartments, this year will be one for the record books.

Affordable Housing | Aug 7, 2024

The future of affordable housing may be modular, AI-driven, and made of mushrooms

Demolished in 1989, The Phoenix Ironworks Steel Factory left a five-acre hole in West Oakland, Calif. After sitting vacant for nearly three decades, the site will soon become utilized again in the form of 316 affordable housing units.