The multifamily sector continues to be strong in 2024, even when a handful of challenges are present. That is according to the Matrix Multifamily National Report for Summer 2024.

This research report looks towards the second half of the year to see what we can expect for rent growth, supply, and economic uncertainty.

U.S. Multifamily Outlook for Summer 2024

While demand remains steady, factors like rising supply and financing difficulties are creating headwinds. The coming months will likely see a slowdown in growth, with regional variations depending on supply and economic factors.

Moderate Challenges

While the economy remains stable and job growth persists, some challenges are emerging for multifamily markets. Rent growth and occupancy rates, once strong, have softened since the 2022 peak.

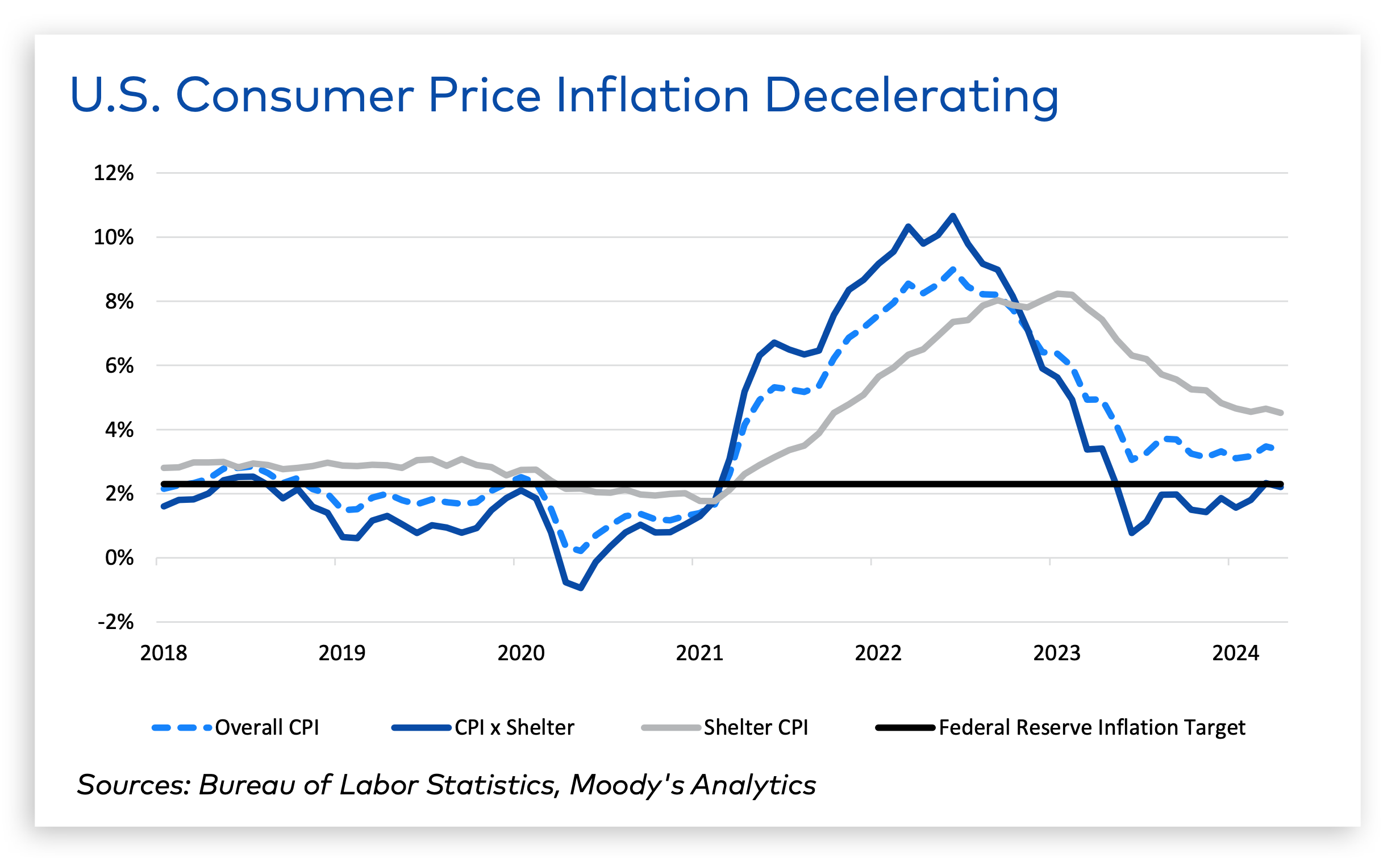

“All eyes in the multifamily market are on the direction of inflation and interest rates,” the report states.

Financing presents another hurdle. High interest rates are dampening transaction activity. Investors are waiting for prices to adjust before buying, while lenders are cautious and many banks are staying on the sidelines.

Debt is a concern, especially for properties financed with short-term loans. Well-capitalized investors can weather the storm, but some value-add properties face potential distress.

Mixed-Bag Supply & Demand

Demand is a double-edged sword. Would-be homebuyers are staying put due to high mortgage rates, which bolsters rental demand. However, these same high rates are hindering refinancing and sales activity in the multifamily market.

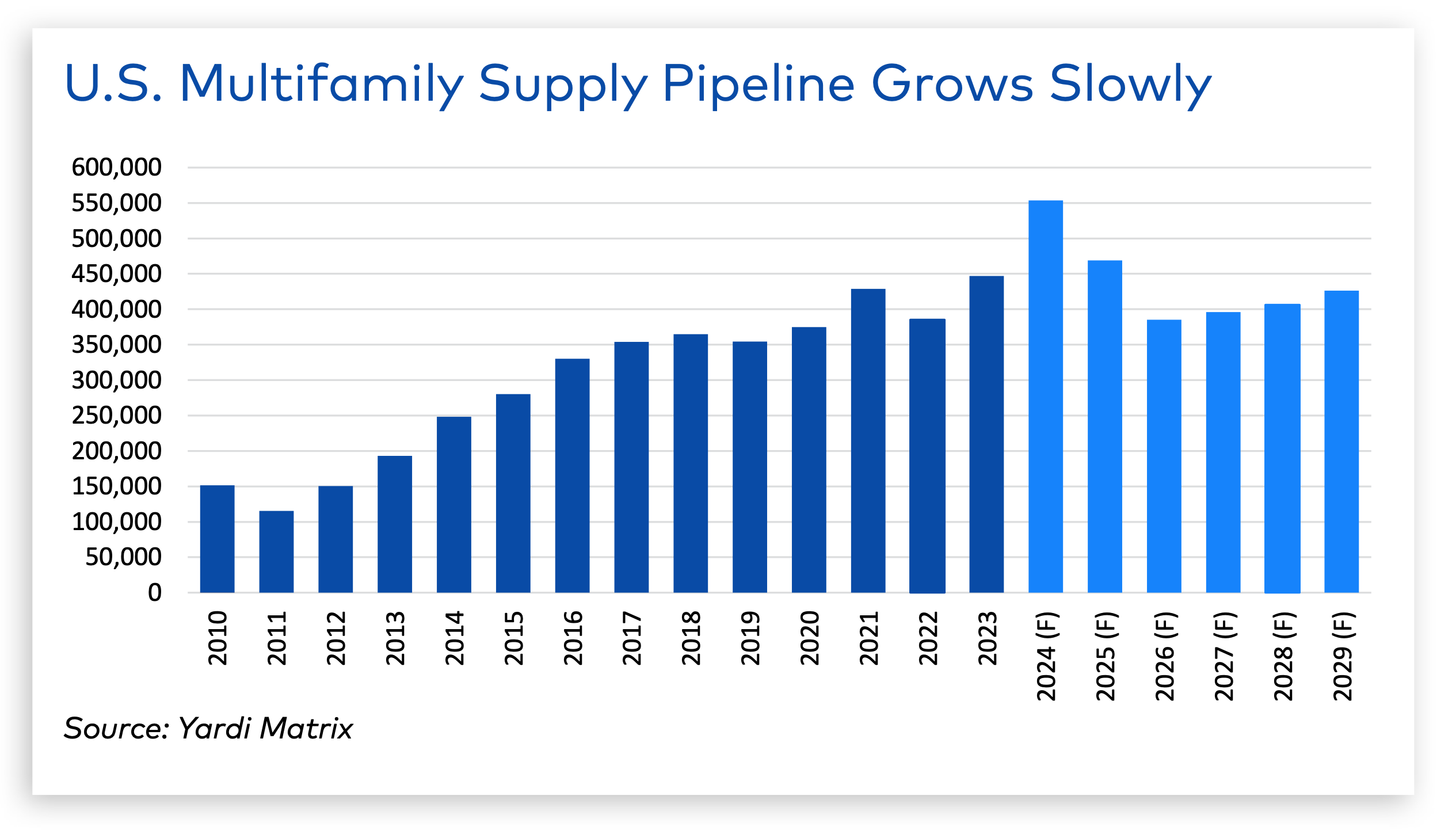

Supply is on the rise, especially in Sun Belt markets. This influx of new units is putting pressure on rent growth in those areas, while other regions with slower delivery rates are seeing more stable rents. This trend is expected to continue in the short term, with a peak of 553,000 new units projected for 2024.

“Multifamily is on schedule this year to achieve the highest number of deliveries in decades, but the pipeline will moderate in following years as starts slow,” the report states.

From January to May 2024, rent growth reached 1.1%—a $19 increase. Although average rent prices across the country remains positive, growth has slowed considerably in the past two years.

Overall, the U.S. multifamily market is experiencing a period of mixed signals that will persist throughout the rest of 2024.

RELATED

Related Stories

Student Housing | May 1, 2024

Pfluger Architects unveils renovated student lounges at all-girls dormitory

In a step toward updating and modernizing on-campus housing to attract a range of students, Texas-based Pfluger Architects renovated the student lounges in Kinsolving Hall, a five-story, all-girls dormitory at The University of Texas at Austin initially built in 1958.

MFPRO+ News | Apr 29, 2024

World’s largest 3D printer could create entire neighborhoods

The University of Maine recently unveiled the world’s largest 3D printer said to be able to create entire neighborhoods. The machine is four times larger than a preceding model that was first tested in 2019. The older model was used to create a 600 sf single-family home made of recyclable wood fiber and bio-resin materials.

Adaptive Reuse | Apr 29, 2024

6 characteristics of a successful adaptive reuse conversion

In the continuous battle against housing shortages and the surplus of vacant buildings, developers are turning their attention to the viability of adaptive reuse for their properties.

Senior Living Design | Apr 24, 2024

Nation's largest Passive House senior living facility completed in Portland, Ore.

Construction of Parkview, a high-rise expansion of a Continuing Care Retirement Community (CCRC) in Portland, Ore., completed recently. The senior living facility is touted as the largest Passive House structure on the West Coast, and the largest Passive House senior living building in the country.

Student Housing | Apr 23, 2024

Student Quarters selected to manage 502-bed student housing community

Student Quarters, a leading student housing owner and management company, announces the newest addition to its portfolio: The Armory Sam Houston Apartments.

MFPRO+ News | Apr 18, 2024

Marquette Companies forms alliance with Orion Residential Advisors

Marquette Companies, a national leader in multifamily development, investment, and management, announces its strategic alliance with Deerfield, Ill.-based Orion Residential Advisors, an integrated multifamily investment and operating firm active in multiple markets nationwide.

Student Housing | Apr 17, 2024

Student housing partnership gives residents free mental health support

Text-based mental health support app Counslr has partnered with Aptitude Development to provide free mental health support to residents of student housing locations.

MFPRO+ News | Apr 15, 2024

Two multifamily management firms merge together

MEB Management Services, a Phoenix-based multifamily management company, and Weller Management, a third-party property management and consulting company, officially merged to become Bryten Real Estate Partners—creating a nationally recognized management company.