The multifamily sector continues to be strong in 2024, even when a handful of challenges are present. That is according to the Matrix Multifamily National Report for Summer 2024.

This research report looks towards the second half of the year to see what we can expect for rent growth, supply, and economic uncertainty.

U.S. Multifamily Outlook for Summer 2024

While demand remains steady, factors like rising supply and financing difficulties are creating headwinds. The coming months will likely see a slowdown in growth, with regional variations depending on supply and economic factors.

Moderate Challenges

While the economy remains stable and job growth persists, some challenges are emerging for multifamily markets. Rent growth and occupancy rates, once strong, have softened since the 2022 peak.

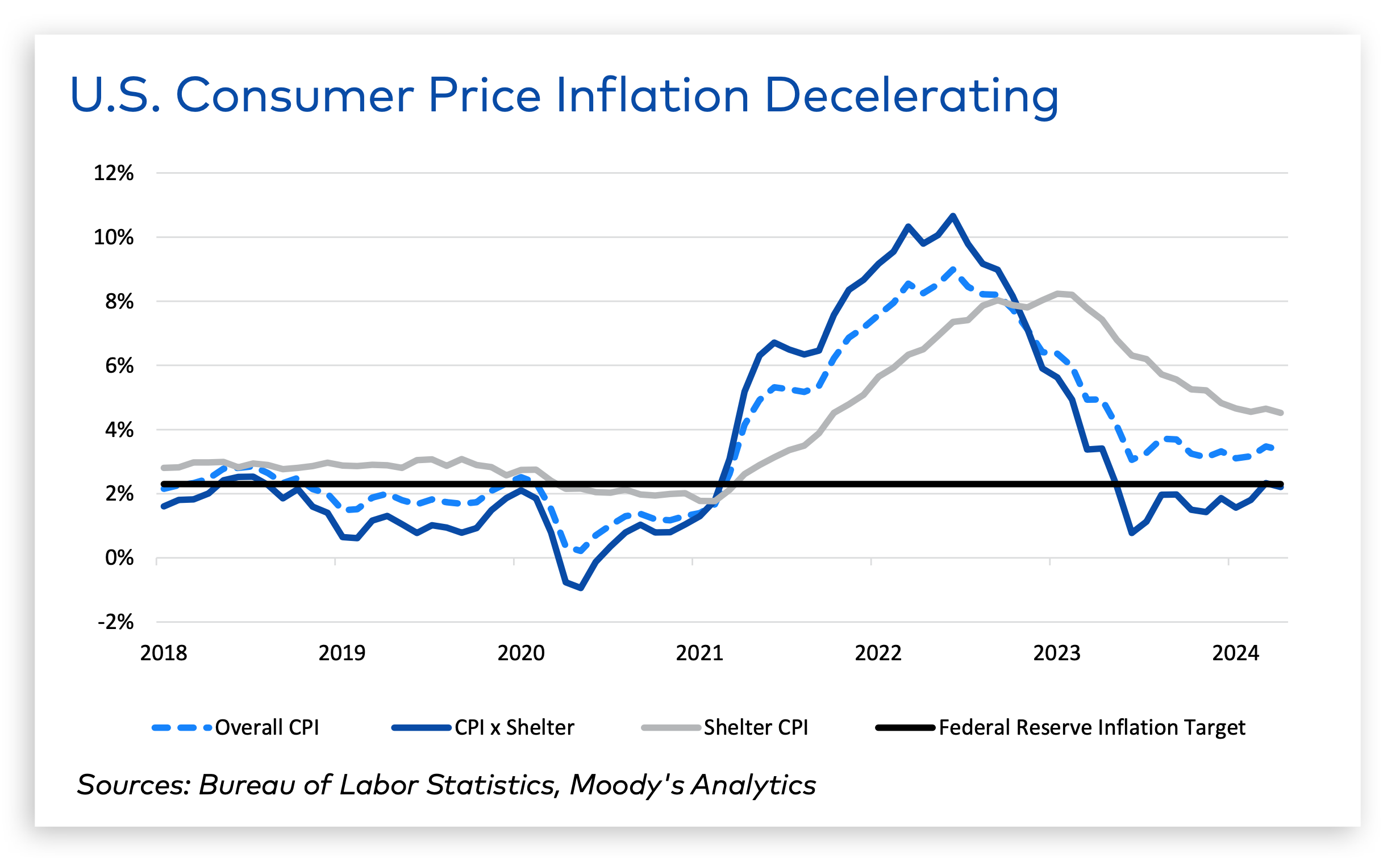

“All eyes in the multifamily market are on the direction of inflation and interest rates,” the report states.

Financing presents another hurdle. High interest rates are dampening transaction activity. Investors are waiting for prices to adjust before buying, while lenders are cautious and many banks are staying on the sidelines.

Debt is a concern, especially for properties financed with short-term loans. Well-capitalized investors can weather the storm, but some value-add properties face potential distress.

Mixed-Bag Supply & Demand

Demand is a double-edged sword. Would-be homebuyers are staying put due to high mortgage rates, which bolsters rental demand. However, these same high rates are hindering refinancing and sales activity in the multifamily market.

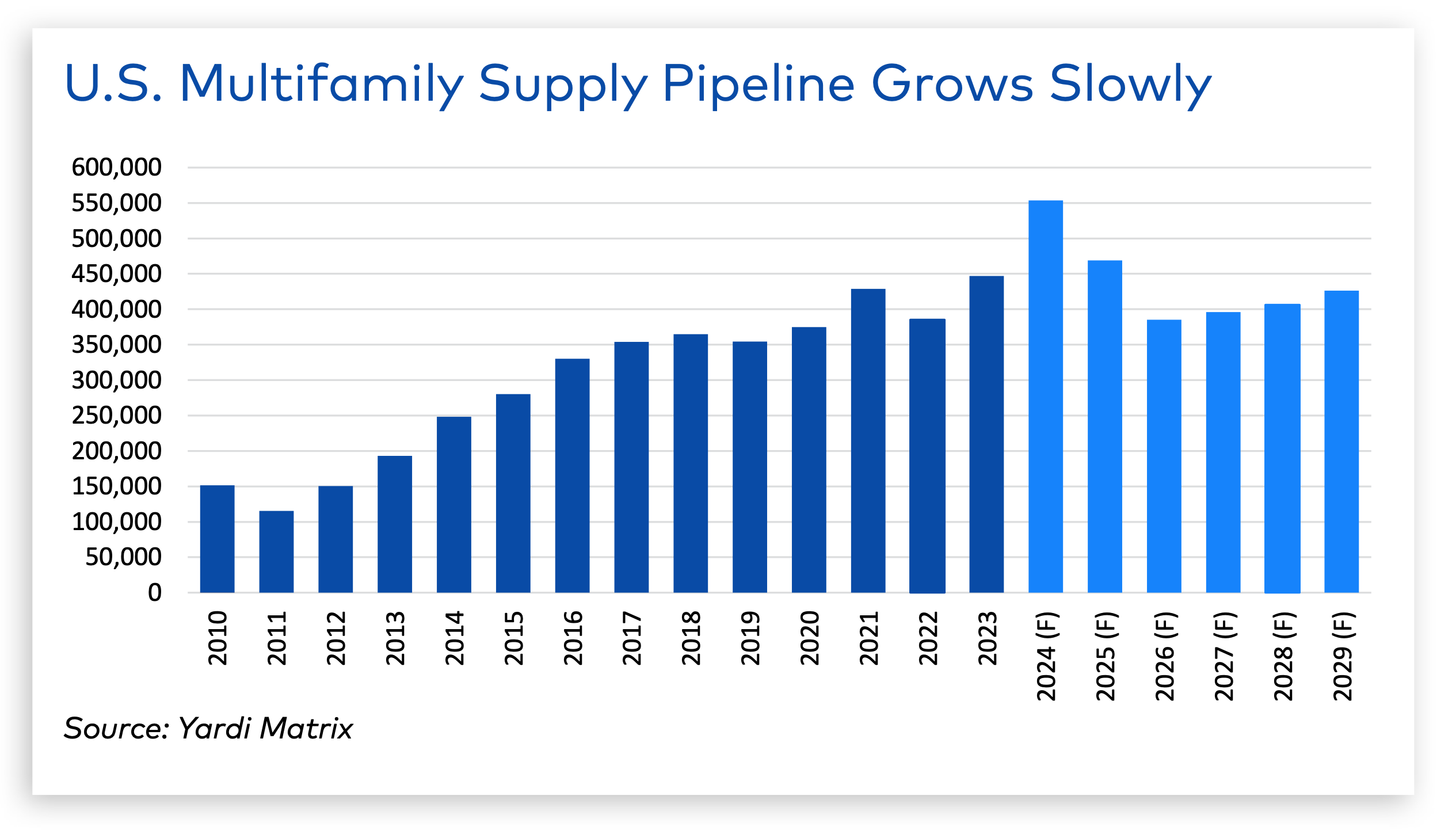

Supply is on the rise, especially in Sun Belt markets. This influx of new units is putting pressure on rent growth in those areas, while other regions with slower delivery rates are seeing more stable rents. This trend is expected to continue in the short term, with a peak of 553,000 new units projected for 2024.

“Multifamily is on schedule this year to achieve the highest number of deliveries in decades, but the pipeline will moderate in following years as starts slow,” the report states.

From January to May 2024, rent growth reached 1.1%—a $19 increase. Although average rent prices across the country remains positive, growth has slowed considerably in the past two years.

Overall, the U.S. multifamily market is experiencing a period of mixed signals that will persist throughout the rest of 2024.

RELATED

Related Stories

MFPRO+ News | Oct 6, 2023

Announcing MultifamilyPro+

BD+C has served the multifamily design and construction sector for more than 60 years, and now we're introducing a central hub within BDCnetwork.com for all things multifamily.

Multifamily Housing | Mar 24, 2023

Average size of new apartments dropped sharply in 2022

The average size of new apartments in 2022 dropped sharply in 2022, as tracked by RentCafe. Across the U.S., the average new apartment size was 887 sf, down 30 sf from 2021, which was the largest year-over-year decrease.

Self-Storage Facilities | Dec 16, 2022

Self-storage development booms in high multifamily construction areas

A 2022 RentCafe analysis finds that self-storage units swelled in conjunction with metros’ growth in apartment complexes.

Multifamily Housing | Jun 30, 2021

A post-pandemic ‘new normal’ for apartment buildings

Grimm + Parker’s vision foresees buildings with rentable offices and refrigerated package storage.