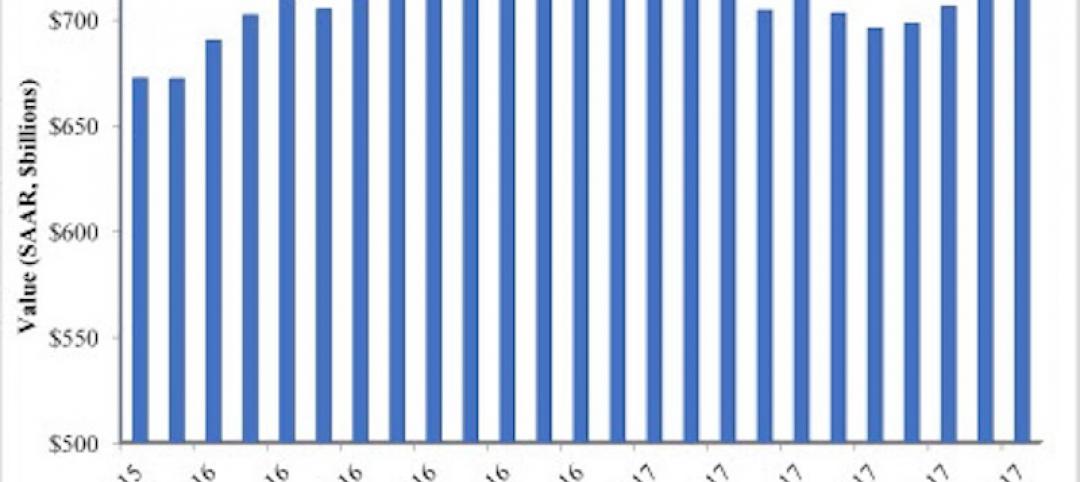

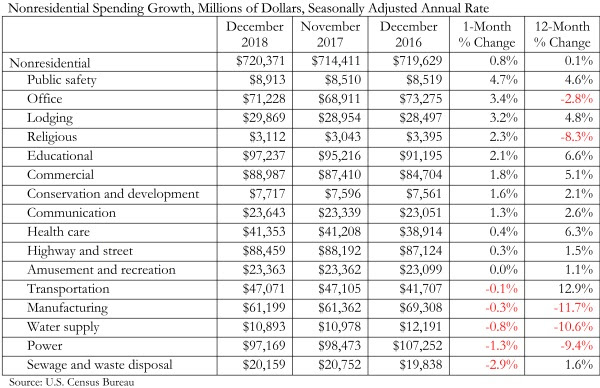

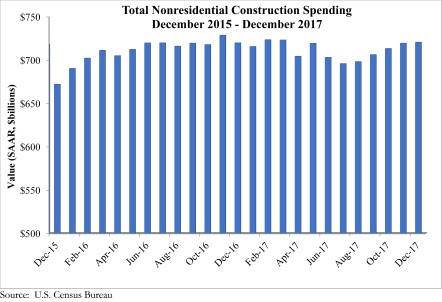

Nonresidential construction spending expanded 0.8% in December, totaling $720.4 billion on a seasonally adjusted basis, according to Associated Builders and Contractors’ (ABC) analysis of data released today by the U.S. Census Bureau. This represents the fifth consecutive month during which the pace of nonresidential spending has increased.

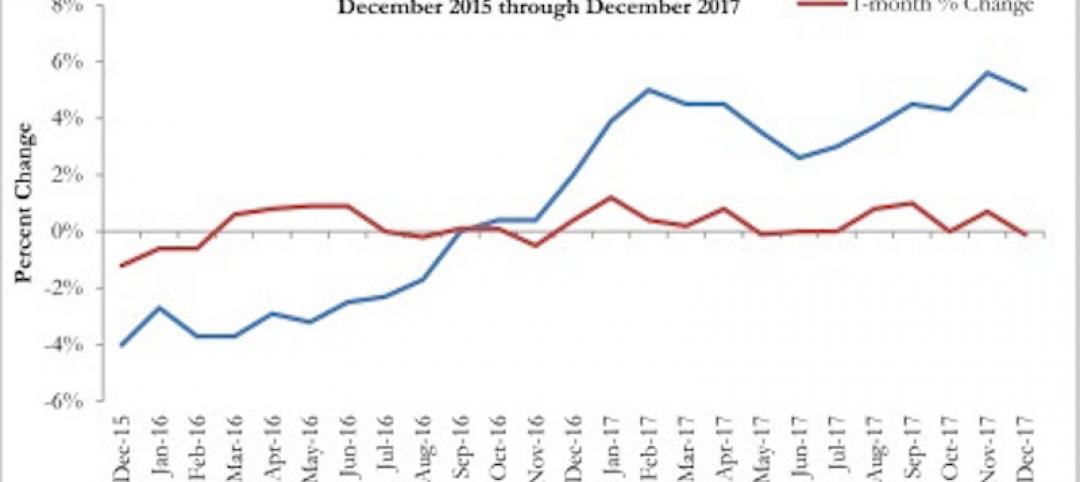

Nonresidential spending expanded 0.1% on a year-over-year basis and sits at its highest level since March. Private nonresidential construction spending increased 1.1% for the month, but is down 2.5% year over year, while public nonresidential spending increased 0.4% for the month and 4.4% for the year. Spending in the power and manufacturing categories, which are two of the largest nonresidential subsectors, contracted by a combined 10.3%, or $18.2 billion, since December 2016.

“While data releases are important for many reasons, including helping us to understand what happened in the past, their principal value lies in clarifying our shared understanding of the probable future,” said ABC Chief Economist Anirban Basu. “Today’s data release, which essentially confirms the existence of the ongoing construction expansion cycle, is less useful than usual. The obvious reason is that the December data reflect a pre-existing pattern of construction spending. The future is likely to represent a departure from prior trends, in large measure because of the recently passed tax reform bill.

“Even before the United States enacted tax reform, global and domestic financial systems were flush with liquidity and capital,” said Basu. “The tax cut will further bolster liquidity and confidence, which will ultimately translate into more construction starts and spending. If long-awaited progress is made on infrastructure spending, the construction recovery will likely transition from solid to spectacular. Note that the transportation category has already expanded 12.9% on a year-over-year basis. During much of the past three years, spending growth generally has been concentrated in a number of key private construction segments, while public construction has tended to lag.

“Of course, industry insiders are scratching their collective heads regarding how to amass enough human capital to actually deliver construction services on time and on budget,” said Basu. “Frankly, that’s a mystery. The implication is that any infrastructure package must be accompanied by action that helps expand apprenticeship programs, steps up investment in two-year colleges, encourages high schools to offer career and technical education, and encourages more people to leap into the U.S. labor force.”

Related Stories

Market Data | Feb 21, 2018

Strong start for architecture billings in 2018

The American Institute of Architects reported the January 2018 ABI score was 54.7, up from a score of 52.8 in the previous month.

Multifamily Housing | Feb 15, 2018

United States ranks fourth for renter growth

Renters are on the rise in 21 of the 30 countries examined in RentCafé’s recent study.

Green | Jan 31, 2018

U.S. Green Building Council releases annual top 10 states for LEED green building per capita

Massachusetts tops the list for the second year; New York, Hawaii and Illinois showcase leadership in geographically diverse locations.

Industry Research | Jan 30, 2018

AIA’s Kermit Baker: Five signs of an impending upturn in construction spending

Tax reform implications and rebuilding from natural disasters are among the reasons AIA’s Chief Economist is optimistic for 2018 and 2019.

Market Data | Jan 30, 2018

AIA Consensus Forecast: 4.0% growth for nonresidential construction spending in 2018

The commercial office and retail sectors will lead the way in 2018, with a strong bounce back for education and healthcare.

Market Data | Jan 29, 2018

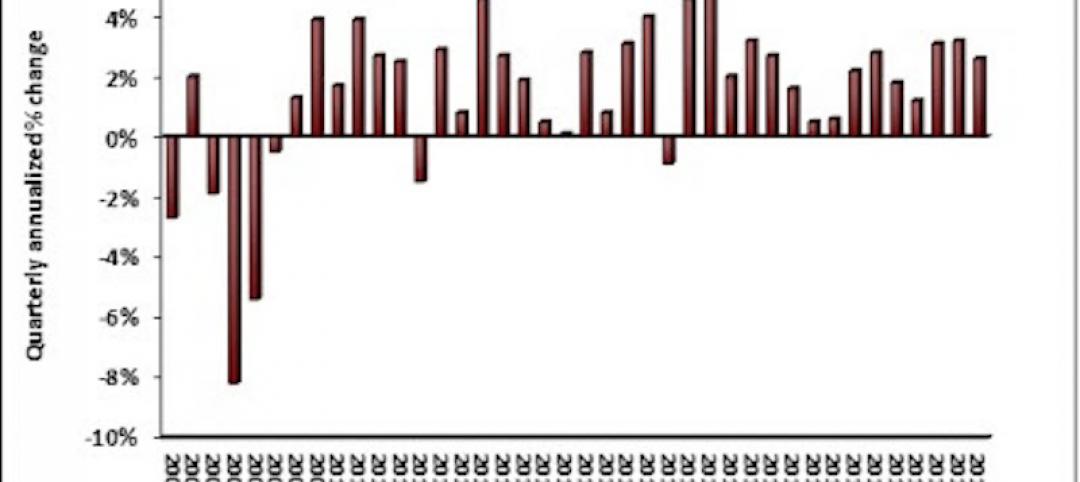

Year-end data show economy expanded in 2017; Fixed investment surged in fourth quarter

The economy expanded at an annual rate of 2.6% during the fourth quarter of 2017.

Market Data | Jan 25, 2018

Renters are the majority in 42 U.S. cities

Over the past 10 years, the number of renters has increased by 23 million.

Market Data | Jan 24, 2018

HomeUnion names the most and least affordable rental housing markets

Chicago tops the list as the most affordable U.S. metro, while Oakland, Calif., is the most expensive rental market.

Market Data | Jan 12, 2018

Construction input prices inch down in December, Up YOY despite low inflation

Energy prices have been more volatile lately.

Market Data | Jan 4, 2018

Nonresidential construction spending ticks higher in November, down year-over-year

Despite the month-over-month expansion, nonresidential spending fell 1.3 percent from November 2016.