Cap rates for real estate across most asset sectors is expected to remain stable in the second half of 2015, following a first half during which the U.S. commercial real estate market continued to perform well and attract substantial investor interest.

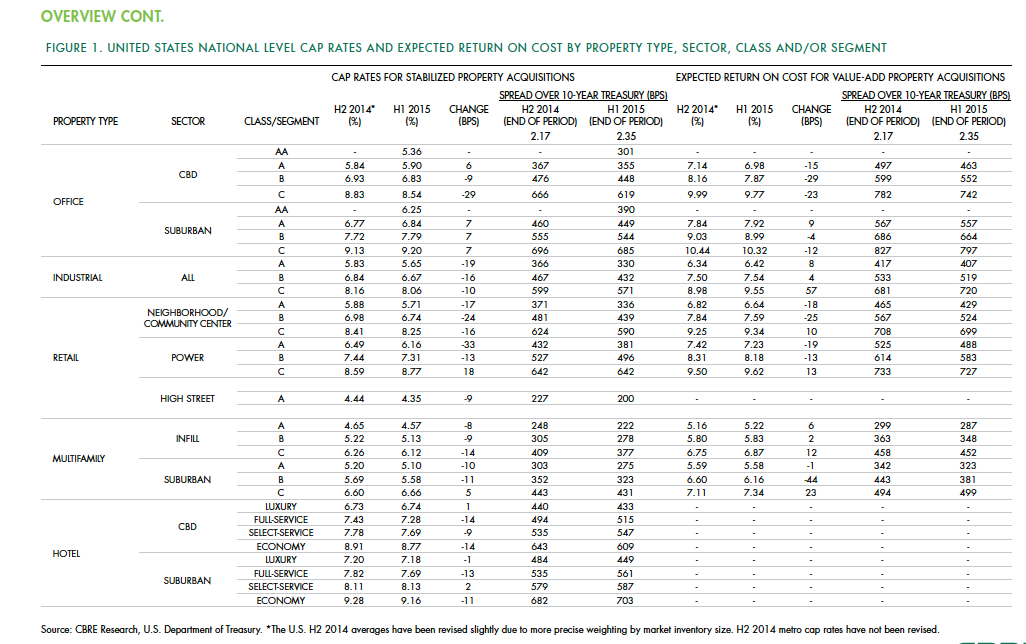

According to the CBRE North America Cap Rate Survey, which tracks activity in 46 major U.S. markets and 10 markets in Canada during the first six months of the year, national cap rates for industrial facilities in the U.S. experienced “very modest” cap-rate declines of 10 to 19 basis points. CBRE estimates that cap rates for stabilized Class A industrial assets was 5.65%.

Class A infill multifamily cap rates were 4.57% in the first half of the year, the second-lowest of all product types. The retail sector had the most significant national cap rate compression, followed by hotels. CBRE suggests that retail and hotels were the sectors that took the longest to recover from the past recession, “therefore, it is not surprising that the cap rate declines are greater in these sectors than those more mature in the real estate cycle.”

Central Business District Class B and C office cap rates were slightly off in the first half, but not Class A offices, “one example of investors moving out of on the risk curve,” CBRE notes. And despite sales volume gains, suburban office cap rates rose, on average, by 7 basis points.

Details from this report, as well as CBRE’s near-term predictions, include the following:

• Interest rates, a big demand driver in the commercial real estate space, are expected to rise modestly. The 10-year Treasury is projected to increase to 2.61% in the second half of 2015, and to 3.19% in 2016. However, “the near-term outlook of higher interest rates is not necessarily going to translate into higher cap rates if the rates come from stronger economic growth, as expected, as opposed to an unexpected shock to the economic system,” CBRE writes.

• CRBE doesn’t expect any cap rate movement in the second half of 2015 for office assets in the majority of markets, and only modest declines in those asset classes that do change. Jacksonville and Cincinnati are expected to experience the largest cap rate declines in Class A acquisitions.

• Transaction activity in the U.S. industrial sector during the first half of 2015 rose 70% to $37 billion. CBRE expects the full-year gain over 2014 to be 40% or greater. Cap rates in this sector are expected to fall modestly in more than one-third of the markets surveyed. Larger declines of 25 basis points or more are expected in Class B and C stabilized properties in Philadelphia and St. Louis. On the other hand, 58% of the market surveyed should experience no change to stabilized industrial cap rates.

• Retail investment in the first half of 2015 rose 12% to $45.6 billion. The “mall and other” category in this sector grew by 14%. CBRE expects investment to accelerate modestly through the remainder of the year. As far as cap rates are concerned, Class B experienced the largest average decline of 24 basis points. And four markets—San Jose, San Francisco, Los Angeles, and Orange County, Calif.—all had Class A caps under 5%.

• In the first six months of 2015, sales of multifamily properties jumped 38% to 63.2 billion. One-third of that capital went to mid- and high-rise projects. For Class A infill assets, San Francisco had the lowest cap rate, at 3.75%. Of the 44 markets surveyed in this sector, 33 had cap rates of 5% or less. CRBE is predicting no cap rate change for acquisitions of stabilized infill multifamily assets in the second half of the year for more than 80% of the markets surveyed. But cap compression should occur in Nashville, Washington D.C., Baltimore, Indianapolis, and Detroit.

• Investment in U.S. hotels, at $26.9 billion, was 67% higher than in the first half of 2014. The vast majority of hotel investors are domestic, especially outside of major cities. CBRE suggests, though, that hotel pricing, as measured by cap rates, has peaked for high-end products in top-tier markets. “But it’s too early to definitively make that call,” it writes. CRBE expects cap rates for acquisitions of stabilized hotel properties to remain “broadly stable” in the second half of 2015, with 62% of markets tracked experiencing no change. Any noticeable compression is likely to occur in Tier I metros like Las Vegas and Orlando, and Tier III markets such as Tampa, Jacksonville, Austin, and Pittsburgh.

Related Stories

Projects | Mar 10, 2022

Optometrist office takes new approach to ‘doc-in-a-box’ design

In recent decades, franchises have taken over the optometry services and optical sales market. This trend has spawned a commodity-type approach to design of office and retail sales space.

Mass Timber | Mar 8, 2022

Heavy timber office and boutique residential building breaks ground in Austin

T3 Eastside, a heavy timber office and boutique residential building, recently broke ground in Austin, Texas.

Performing Arts Centers | Mar 8, 2022

Cincinnati Ballet’s new center embodies the idea that dance is for everyone

Cincinnati Ballet had become a victim of its own success, according to company president and CEO Scott Altman. “We were bursting at the seams in our old building. We had simply outgrown the facility,” Altman told the Cincinnati Enquirer.

Projects | Mar 7, 2022

An Atlanta office promotes employee well-being

For its new Atlanta office, New Relic, a California-based technology company that develops cloud-based software, wanted to keep employee health and wellness at the fore. It also wanted the workspace design to bolster productivity as well as employee engagement and retention.

Projects | Mar 3, 2022

Move, lift, restore: Repurposing a former post office near San Francisco

In mid-February, a construction crew began lifting a 1940s post office building located in Burlingame, Calif., on the San Francisco Peninsula.

Projects | Mar 2, 2022

Manufacturing plant gets second life as a mixed-use development

Wire Park, a mixed-use development being built near Athens, Ga., will feature 130 residential units plus 225,000 square feet of commercial, office, and retail space. About an hour east of downtown Atlanta, the 66-acre development also will boast expansive public greenspace.

Office Buildings | Feb 23, 2022

The Beam on Farmer, Arizona’s first mass timber, multi-story office building tops out

The Beam on Farmer, Arizona’s first mass timber, multi-story office building, topped out on Feb. 10, 2022.

Resiliency | Feb 15, 2022

Design strategies for resilient buildings

LEO A DALY's National Director of Engineering Kim Cowman takes a building-level look at resilient design.

Office Buildings | Feb 1, 2022

Mennica Legacy Tower: GP's latest office complex in Warsaw is uniquely designed

Mennica Legacy Tower marks GP’s first completed project in Poland. The Mennica Legacy Tower was developed by an affiliate of Golub & Company LLC and Mennica Towers GGH MT Sp z o o S.K.A, and delivered in collaboration with Epstein, a design firm with offices in Chicago and Warsaw.

Laboratories | Jan 28, 2022

3 must-know strategies for developers in today’s life sciences industry

While the life sciences industry had been steadily growing, this growth exploded when the pandemic arrived—and there is no indication that this lightning-fast pace will slow down any time soon.