Cap rates for real estate across most asset sectors is expected to remain stable in the second half of 2015, following a first half during which the U.S. commercial real estate market continued to perform well and attract substantial investor interest.

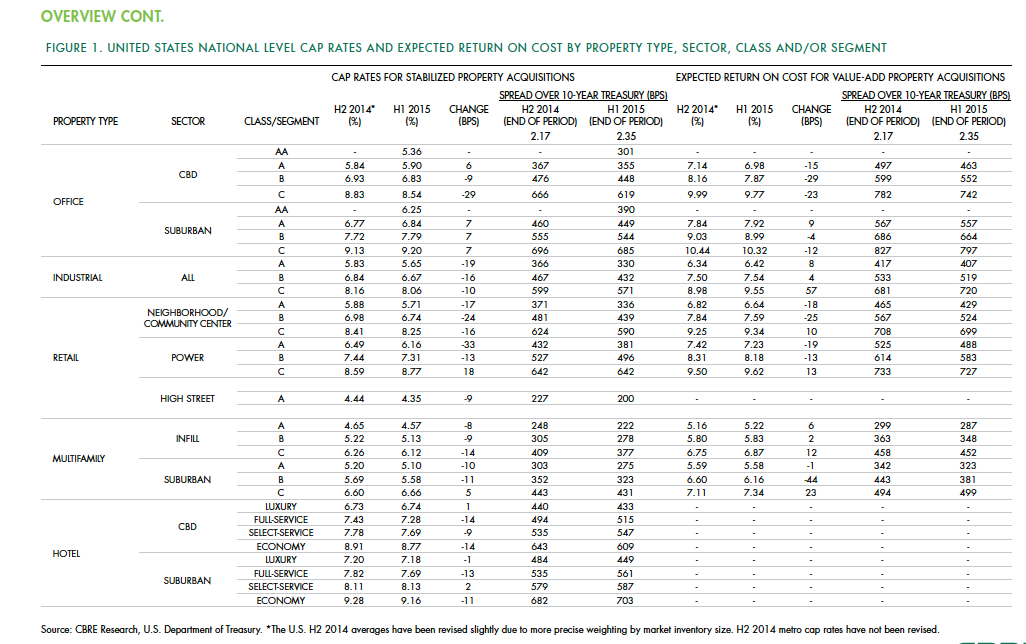

According to the CBRE North America Cap Rate Survey, which tracks activity in 46 major U.S. markets and 10 markets in Canada during the first six months of the year, national cap rates for industrial facilities in the U.S. experienced “very modest” cap-rate declines of 10 to 19 basis points. CBRE estimates that cap rates for stabilized Class A industrial assets was 5.65%.

Class A infill multifamily cap rates were 4.57% in the first half of the year, the second-lowest of all product types. The retail sector had the most significant national cap rate compression, followed by hotels. CBRE suggests that retail and hotels were the sectors that took the longest to recover from the past recession, “therefore, it is not surprising that the cap rate declines are greater in these sectors than those more mature in the real estate cycle.”

Central Business District Class B and C office cap rates were slightly off in the first half, but not Class A offices, “one example of investors moving out of on the risk curve,” CBRE notes. And despite sales volume gains, suburban office cap rates rose, on average, by 7 basis points.

Details from this report, as well as CBRE’s near-term predictions, include the following:

• Interest rates, a big demand driver in the commercial real estate space, are expected to rise modestly. The 10-year Treasury is projected to increase to 2.61% in the second half of 2015, and to 3.19% in 2016. However, “the near-term outlook of higher interest rates is not necessarily going to translate into higher cap rates if the rates come from stronger economic growth, as expected, as opposed to an unexpected shock to the economic system,” CBRE writes.

• CRBE doesn’t expect any cap rate movement in the second half of 2015 for office assets in the majority of markets, and only modest declines in those asset classes that do change. Jacksonville and Cincinnati are expected to experience the largest cap rate declines in Class A acquisitions.

• Transaction activity in the U.S. industrial sector during the first half of 2015 rose 70% to $37 billion. CBRE expects the full-year gain over 2014 to be 40% or greater. Cap rates in this sector are expected to fall modestly in more than one-third of the markets surveyed. Larger declines of 25 basis points or more are expected in Class B and C stabilized properties in Philadelphia and St. Louis. On the other hand, 58% of the market surveyed should experience no change to stabilized industrial cap rates.

• Retail investment in the first half of 2015 rose 12% to $45.6 billion. The “mall and other” category in this sector grew by 14%. CBRE expects investment to accelerate modestly through the remainder of the year. As far as cap rates are concerned, Class B experienced the largest average decline of 24 basis points. And four markets—San Jose, San Francisco, Los Angeles, and Orange County, Calif.—all had Class A caps under 5%.

• In the first six months of 2015, sales of multifamily properties jumped 38% to 63.2 billion. One-third of that capital went to mid- and high-rise projects. For Class A infill assets, San Francisco had the lowest cap rate, at 3.75%. Of the 44 markets surveyed in this sector, 33 had cap rates of 5% or less. CRBE is predicting no cap rate change for acquisitions of stabilized infill multifamily assets in the second half of the year for more than 80% of the markets surveyed. But cap compression should occur in Nashville, Washington D.C., Baltimore, Indianapolis, and Detroit.

• Investment in U.S. hotels, at $26.9 billion, was 67% higher than in the first half of 2014. The vast majority of hotel investors are domestic, especially outside of major cities. CBRE suggests, though, that hotel pricing, as measured by cap rates, has peaked for high-end products in top-tier markets. “But it’s too early to definitively make that call,” it writes. CRBE expects cap rates for acquisitions of stabilized hotel properties to remain “broadly stable” in the second half of 2015, with 62% of markets tracked experiencing no change. Any noticeable compression is likely to occur in Tier I metros like Las Vegas and Orlando, and Tier III markets such as Tampa, Jacksonville, Austin, and Pittsburgh.

Related Stories

Office Buildings | Jan 26, 2015

Seattle gets a peek at Amazon’s latest plans for its downtown complex

The online retailer is seeking permits to build on a fourth city block that would include 835,200 sf of office space.

| Jan 14, 2015

10 change management practices that can ease workplace moves

No matter the level of complexity, workplace change can be a challenge for your client's employees. VOA's Angie Lee breaks down the process of moving offices as efficiently as possible, from creating a "change team" to hosting hard-hat tours.

| Jan 13, 2015

SOM-designed Broadgate Exchange House wins Twenty-five Year Award

Exchange House, an elegant 10-story office building that spans over the merging tracks of London’s Liverpool Street Station, is located in London’s Broadgate Development.

| Jan 9, 2015

10 surprising lessons Perkins+Will has learned about workplace projects

P+W's Janice Barnes shares some of most unexpected lessons from her firm's work on office design projects, including the importance of post-occupancy evaluations and having a cohesive transition strategy for workers.

| Jan 9, 2015

Technology and media tenants, not financial companies, fill up One World Trade Center

The financial sector has almost no presence in the new tower, with creative and media companies, such as magazine publisher Conde Nast, dominating the vast majority of leased space.

| Jan 8, 2015

The future of alternative work spaces: open-access markets, co-working, and in-between spaces

During the past five years, people have begun to actively seek out third places not just to get a day’s work done, but to develop businesses of a new kind and establish themselves as part of a real-time conversation of diverse entrepreneurs, writes Gensler's Shawn Gehle.

Smart Buildings | Jan 7, 2015

Best practices for urban infill development: Embrace the region's character, master the pedestrian experience

If an urban building isn’t grounded in the local region’s character, it will end up feeling generic and out-of-place. To do urban infill the right way, it’s essential to slow down and pay proper attention to the context of an urban environment, writes GS&P's Joe Bucher.

| Jan 6, 2015

Construction permits exceeded $2 billion in Minneapolis in 2014

Two major projects—a new stadium for the Minnesota Vikings NFL team and the city’s Downtown East redevelopment—accounted for about half of the total worth of the permits issued.

| Jan 2, 2015

Construction put in place enjoyed healthy gains in 2014

Construction consultant FMI foresees—with some caveats—continuing growth in the office, lodging, and manufacturing sectors. But funding uncertainties raise red flags in education and healthcare.

| Dec 28, 2014

Robots, drones, and printed buildings: The promise of automated construction

Building Teams across the globe are employing advanced robotics to simplify what is inherently a complex, messy process—construction.