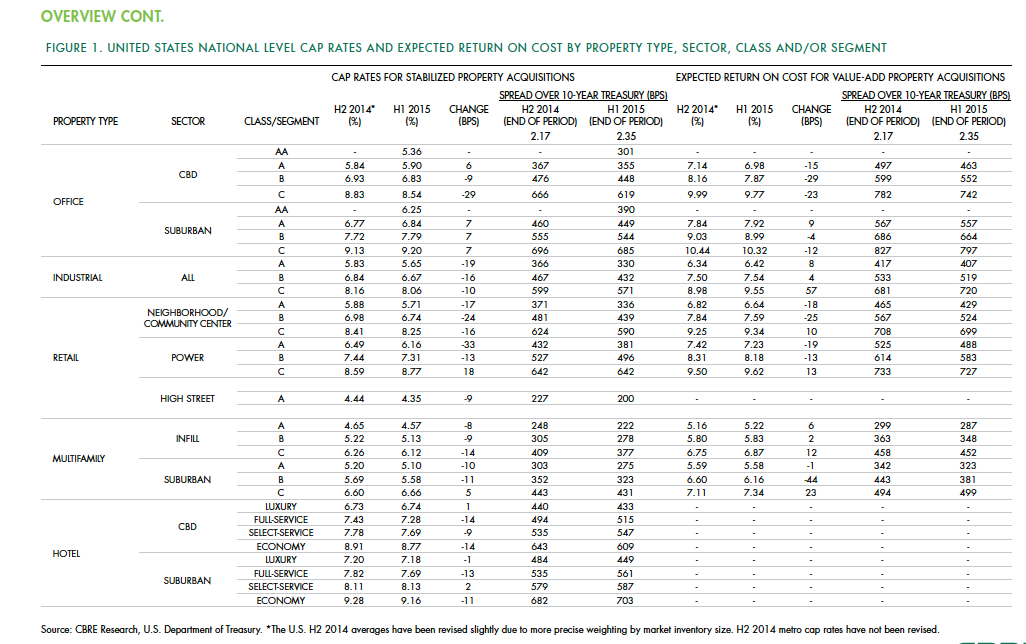

Cap rates for real estate across most asset sectors is expected to remain stable in the second half of 2015, following a first half during which the U.S. commercial real estate market continued to perform well and attract substantial investor interest.

According to the CBRE North America Cap Rate Survey, which tracks activity in 46 major U.S. markets and 10 markets in Canada during the first six months of the year, national cap rates for industrial facilities in the U.S. experienced “very modest” cap-rate declines of 10 to 19 basis points. CBRE estimates that cap rates for stabilized Class A industrial assets was 5.65%.

Class A infill multifamily cap rates were 4.57% in the first half of the year, the second-lowest of all product types. The retail sector had the most significant national cap rate compression, followed by hotels. CBRE suggests that retail and hotels were the sectors that took the longest to recover from the past recession, “therefore, it is not surprising that the cap rate declines are greater in these sectors than those more mature in the real estate cycle.”

Central Business District Class B and C office cap rates were slightly off in the first half, but not Class A offices, “one example of investors moving out of on the risk curve,” CBRE notes. And despite sales volume gains, suburban office cap rates rose, on average, by 7 basis points.

Details from this report, as well as CBRE’s near-term predictions, include the following:

• Interest rates, a big demand driver in the commercial real estate space, are expected to rise modestly. The 10-year Treasury is projected to increase to 2.61% in the second half of 2015, and to 3.19% in 2016. However, “the near-term outlook of higher interest rates is not necessarily going to translate into higher cap rates if the rates come from stronger economic growth, as expected, as opposed to an unexpected shock to the economic system,” CBRE writes.

• CRBE doesn’t expect any cap rate movement in the second half of 2015 for office assets in the majority of markets, and only modest declines in those asset classes that do change. Jacksonville and Cincinnati are expected to experience the largest cap rate declines in Class A acquisitions.

• Transaction activity in the U.S. industrial sector during the first half of 2015 rose 70% to $37 billion. CBRE expects the full-year gain over 2014 to be 40% or greater. Cap rates in this sector are expected to fall modestly in more than one-third of the markets surveyed. Larger declines of 25 basis points or more are expected in Class B and C stabilized properties in Philadelphia and St. Louis. On the other hand, 58% of the market surveyed should experience no change to stabilized industrial cap rates.

• Retail investment in the first half of 2015 rose 12% to $45.6 billion. The “mall and other” category in this sector grew by 14%. CBRE expects investment to accelerate modestly through the remainder of the year. As far as cap rates are concerned, Class B experienced the largest average decline of 24 basis points. And four markets—San Jose, San Francisco, Los Angeles, and Orange County, Calif.—all had Class A caps under 5%.

• In the first six months of 2015, sales of multifamily properties jumped 38% to 63.2 billion. One-third of that capital went to mid- and high-rise projects. For Class A infill assets, San Francisco had the lowest cap rate, at 3.75%. Of the 44 markets surveyed in this sector, 33 had cap rates of 5% or less. CRBE is predicting no cap rate change for acquisitions of stabilized infill multifamily assets in the second half of the year for more than 80% of the markets surveyed. But cap compression should occur in Nashville, Washington D.C., Baltimore, Indianapolis, and Detroit.

• Investment in U.S. hotels, at $26.9 billion, was 67% higher than in the first half of 2014. The vast majority of hotel investors are domestic, especially outside of major cities. CBRE suggests, though, that hotel pricing, as measured by cap rates, has peaked for high-end products in top-tier markets. “But it’s too early to definitively make that call,” it writes. CRBE expects cap rates for acquisitions of stabilized hotel properties to remain “broadly stable” in the second half of 2015, with 62% of markets tracked experiencing no change. Any noticeable compression is likely to occur in Tier I metros like Las Vegas and Orlando, and Tier III markets such as Tampa, Jacksonville, Austin, and Pittsburgh.

Related Stories

| Dec 2, 2014

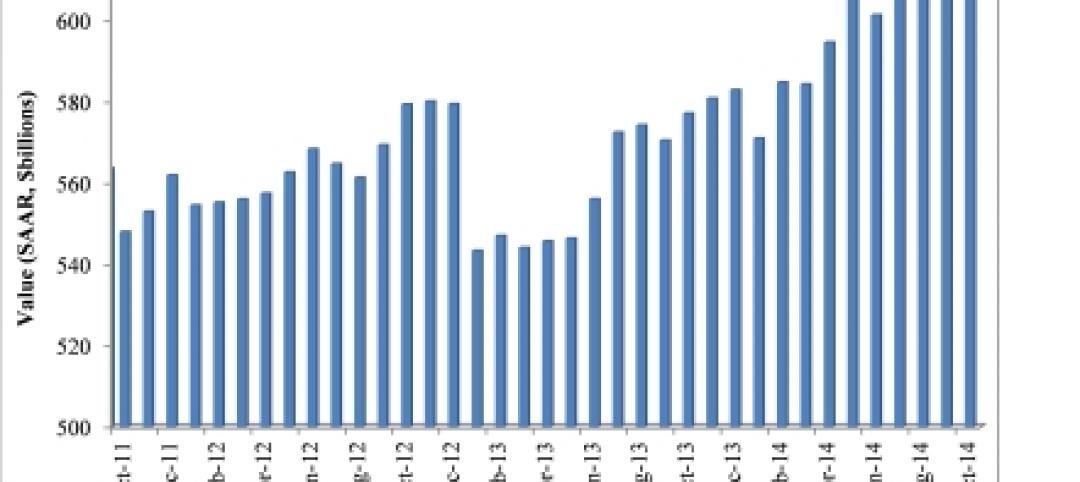

Nonresidential construction spending rebounds in October

This month's increase in nonresidential construction spending is far more consistent with the anecdotal information floating around the industry, says ABC's Chief Economist Anirban Basu.

| Nov 29, 2014

20 tallest towers that were never completed

Remember the Chicago Spire? What about Russia Tower? These are two of the tallest building projects that were started, but never completed, according to the Council on Tall Buildings and Urban Habitat. The CTBUH Research team offers a roundup of the top 20 stalled skyscrapers across the globe.

| Nov 26, 2014

U.S. Steel decides to stay in Pittsburgh, plans new HQ near Penguins arena

The giant steelmaker has agreed to move into a new headquarters that is slated to be part of a major redevelopment.

| Nov 25, 2014

Behnisch Architekten unveils design for energy-positive building in Boston

The multi-use building for Artists For Humanity that is slated to be the largest energy positive commercial building in New England.

| Nov 25, 2014

Study: 85% of employees dissatisfied with their office environment

A vast majority of office workers feel open floor plans cause multiple distractions and that more private spaces are needed in today's offices, according to a new study by Steelcase and research firm IPSOS.

| Nov 24, 2014

Adrian Smith + Gordon Gill-designed crystalline tower breaks ground in southwestern China

Fitted with an LED façade, the 468-meter Greenland Tower Chengdu will act as a light sculpture for the city of Chengdu.

| Nov 18, 2014

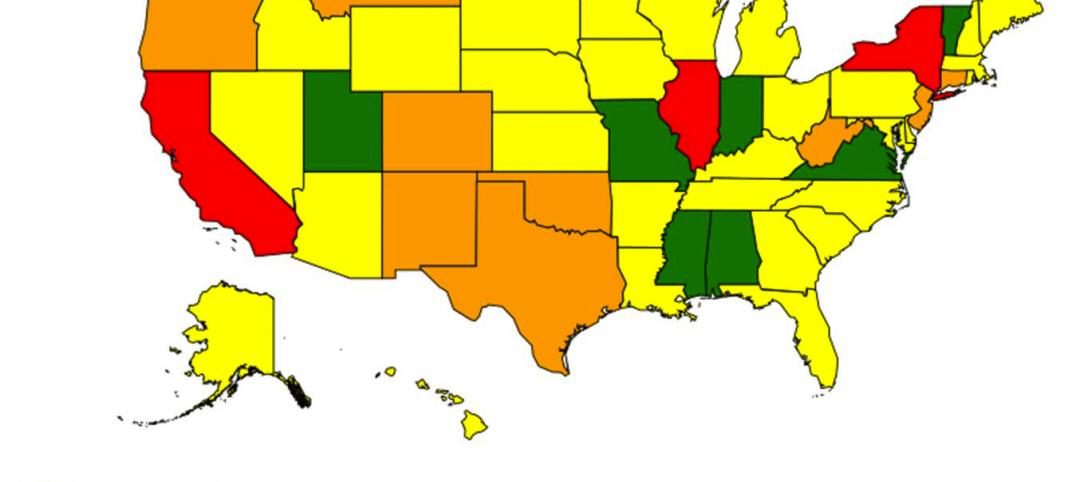

New tool helps developers, contractors identify geographic risk for construction

The new interactive tool from Aon Risk Solutions provides real-time updates pertaining to the risk climate of municipalities across the U.S.

| Nov 17, 2014

Hospitality at the workplace: 5 ways hotels are transforming the office

During the past five years, the worlds of hospitality and corporate real estate have undergone an incredible transformation. The traditional approach toward real estate asset management has shifted to a focus on offerings that accommodate mobility, changing demographics, and technology, writes HOK's Eva Garza.

| Nov 17, 2014

Workplace pilot programs: A new tool for creating workspaces employees love

In a recent article for Fast Company, CannonDesign's Meg Osman details how insurance giant Zurich used a workplace pilot program to empower its employees in the creation of its new North American headquarters.

| Nov 17, 2014

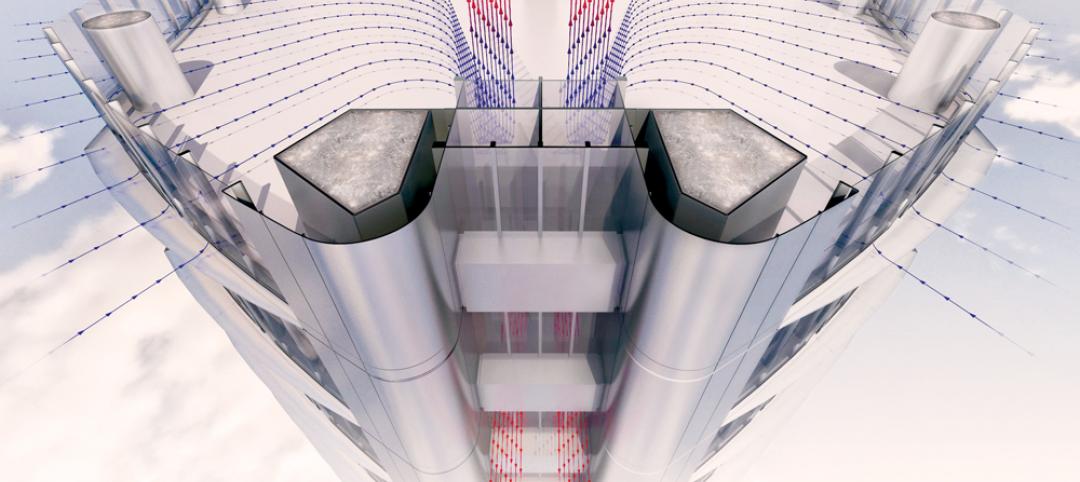

Mastering natural ventilation: 5 crucial lessons from design experts

By harnessing natural ventilation, Building Teams can achieve a tremendous reduction in energy use and increase in occupant comfort. Engineers from SOM offer lessons from the firm’s recent work.