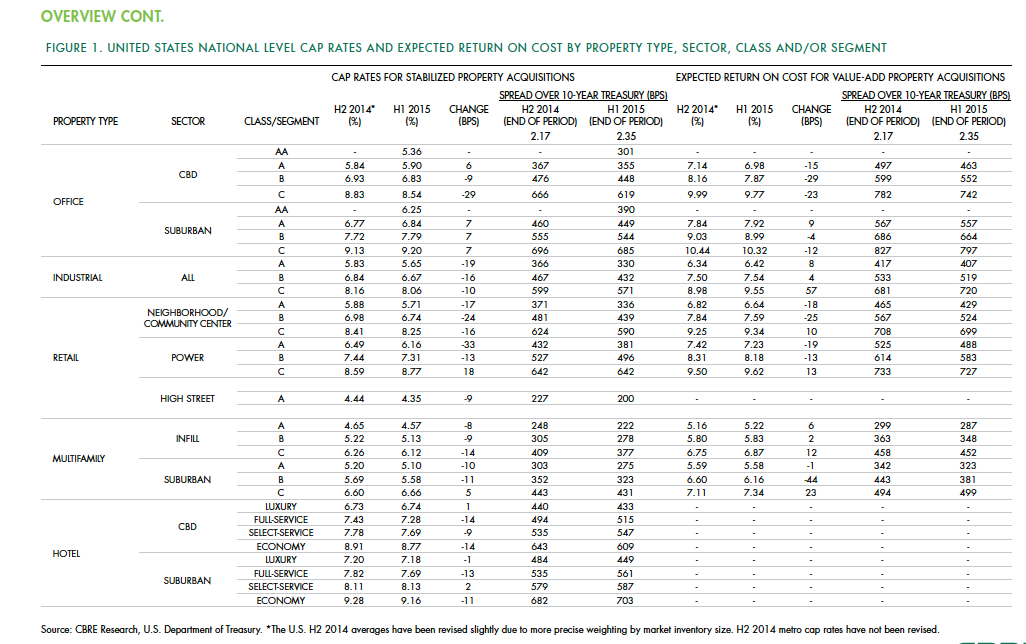

Cap rates for real estate across most asset sectors is expected to remain stable in the second half of 2015, following a first half during which the U.S. commercial real estate market continued to perform well and attract substantial investor interest.

According to the CBRE North America Cap Rate Survey, which tracks activity in 46 major U.S. markets and 10 markets in Canada during the first six months of the year, national cap rates for industrial facilities in the U.S. experienced “very modest” cap-rate declines of 10 to 19 basis points. CBRE estimates that cap rates for stabilized Class A industrial assets was 5.65%.

Class A infill multifamily cap rates were 4.57% in the first half of the year, the second-lowest of all product types. The retail sector had the most significant national cap rate compression, followed by hotels. CBRE suggests that retail and hotels were the sectors that took the longest to recover from the past recession, “therefore, it is not surprising that the cap rate declines are greater in these sectors than those more mature in the real estate cycle.”

Central Business District Class B and C office cap rates were slightly off in the first half, but not Class A offices, “one example of investors moving out of on the risk curve,” CBRE notes. And despite sales volume gains, suburban office cap rates rose, on average, by 7 basis points.

Details from this report, as well as CBRE’s near-term predictions, include the following:

• Interest rates, a big demand driver in the commercial real estate space, are expected to rise modestly. The 10-year Treasury is projected to increase to 2.61% in the second half of 2015, and to 3.19% in 2016. However, “the near-term outlook of higher interest rates is not necessarily going to translate into higher cap rates if the rates come from stronger economic growth, as expected, as opposed to an unexpected shock to the economic system,” CBRE writes.

• CRBE doesn’t expect any cap rate movement in the second half of 2015 for office assets in the majority of markets, and only modest declines in those asset classes that do change. Jacksonville and Cincinnati are expected to experience the largest cap rate declines in Class A acquisitions.

• Transaction activity in the U.S. industrial sector during the first half of 2015 rose 70% to $37 billion. CBRE expects the full-year gain over 2014 to be 40% or greater. Cap rates in this sector are expected to fall modestly in more than one-third of the markets surveyed. Larger declines of 25 basis points or more are expected in Class B and C stabilized properties in Philadelphia and St. Louis. On the other hand, 58% of the market surveyed should experience no change to stabilized industrial cap rates.

• Retail investment in the first half of 2015 rose 12% to $45.6 billion. The “mall and other” category in this sector grew by 14%. CBRE expects investment to accelerate modestly through the remainder of the year. As far as cap rates are concerned, Class B experienced the largest average decline of 24 basis points. And four markets—San Jose, San Francisco, Los Angeles, and Orange County, Calif.—all had Class A caps under 5%.

• In the first six months of 2015, sales of multifamily properties jumped 38% to 63.2 billion. One-third of that capital went to mid- and high-rise projects. For Class A infill assets, San Francisco had the lowest cap rate, at 3.75%. Of the 44 markets surveyed in this sector, 33 had cap rates of 5% or less. CRBE is predicting no cap rate change for acquisitions of stabilized infill multifamily assets in the second half of the year for more than 80% of the markets surveyed. But cap compression should occur in Nashville, Washington D.C., Baltimore, Indianapolis, and Detroit.

• Investment in U.S. hotels, at $26.9 billion, was 67% higher than in the first half of 2014. The vast majority of hotel investors are domestic, especially outside of major cities. CBRE suggests, though, that hotel pricing, as measured by cap rates, has peaked for high-end products in top-tier markets. “But it’s too early to definitively make that call,” it writes. CRBE expects cap rates for acquisitions of stabilized hotel properties to remain “broadly stable” in the second half of 2015, with 62% of markets tracked experiencing no change. Any noticeable compression is likely to occur in Tier I metros like Las Vegas and Orlando, and Tier III markets such as Tampa, Jacksonville, Austin, and Pittsburgh.

Related Stories

Sponsored | | Oct 7, 2014

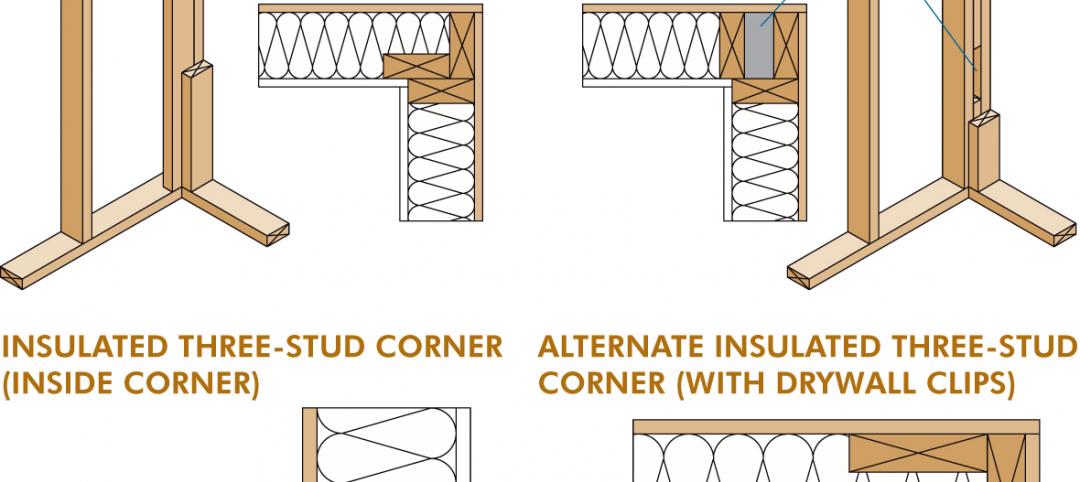

Boost efficiency with advanced framing

As architects continue to search for ways to improve building efficiencies, more and more are turning to advanced framing methods, particularly for multifamily and light commercial projects.

| Oct 6, 2014

Houston's office construction is soaring

Houston has 19 million square feet of office space under construction, 54% more than a year ago, and its highest level since the booming 1980s, according to local news reports.

| Oct 2, 2014

Budget busters: Report details 24 of the world's most obscenely over-budget construction projects

Montreal's Olympic Stadium and the Sydney Opera House are among the landmark projects to bust their budgets, according to a new interactive graph by Podio.

| Sep 30, 2014

With its 'stacked volumes' scheme, 3XN wins bid to design high-rise in Sydney

By dividing the 200-meter building into five separate volumes and placing atria throughout each volume, the spaces become smaller, more intimate social environments, according to the Danish architects.

Sponsored | | Sep 25, 2014

Architects transform warehouse into office space while preserving its historic nature

When it came time for CSHQA, an award-winning, full-service architecture and engineering firm, to move office locations, they didn’t need to look far. The 20,000-square-foot warehouse was not only a mere three blocks away, its renovation would be an ideal demonstration piece to show existing and potential clients.

| Sep 25, 2014

Look to history warily when gauging where the construction industry may be headed

Precedents and patterns may not tell you all that much about future spending or demand.

| Sep 24, 2014

Architecture billings see continued strength, led by institutional sector

On the heels of recording its strongest pace of growth since 2007, there continues to be an increasing level of demand for design services signaled in the latest Architecture Billings Index.

| Sep 23, 2014

Cloud-shaped skyscraper complex wins Shenzhen Bay Super City design competition

Forget the cubist, clinical, glass and concrete jungle of today's financial districts. Shenzhen's new plan features a complex of cloud-shaped skyscrapers connected to one another with sloping bridges.

| Sep 23, 2014

Designing with Water: Report analyzes ways coastal cities can cope with flooding

The report contains 12 case studies of cities around the world that have applied advanced flood management techniques.

| Sep 22, 2014

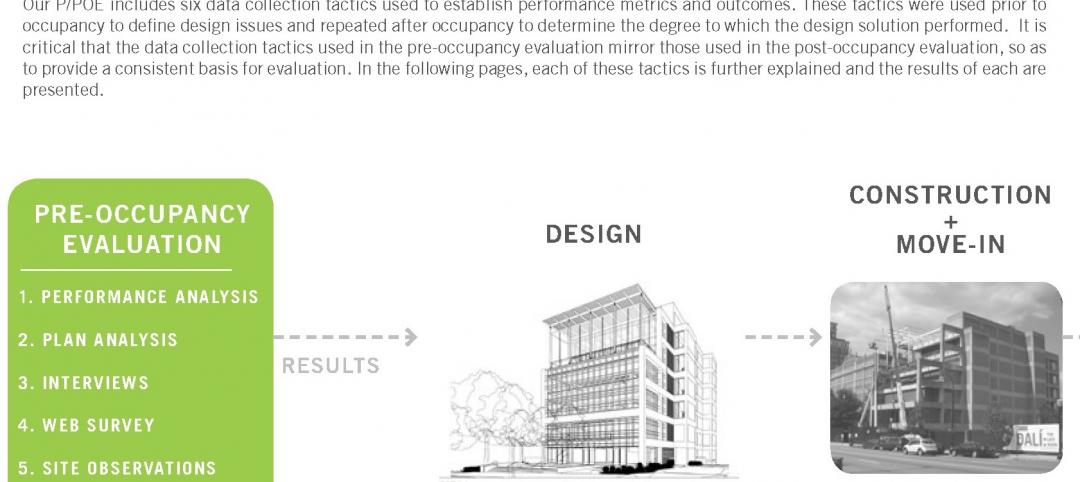

4 keys to effective post-occupancy evaluations

Perkins+Will's Janice Barnes covers the four steps that designers should take to create POEs that provide design direction and measure design effectiveness.