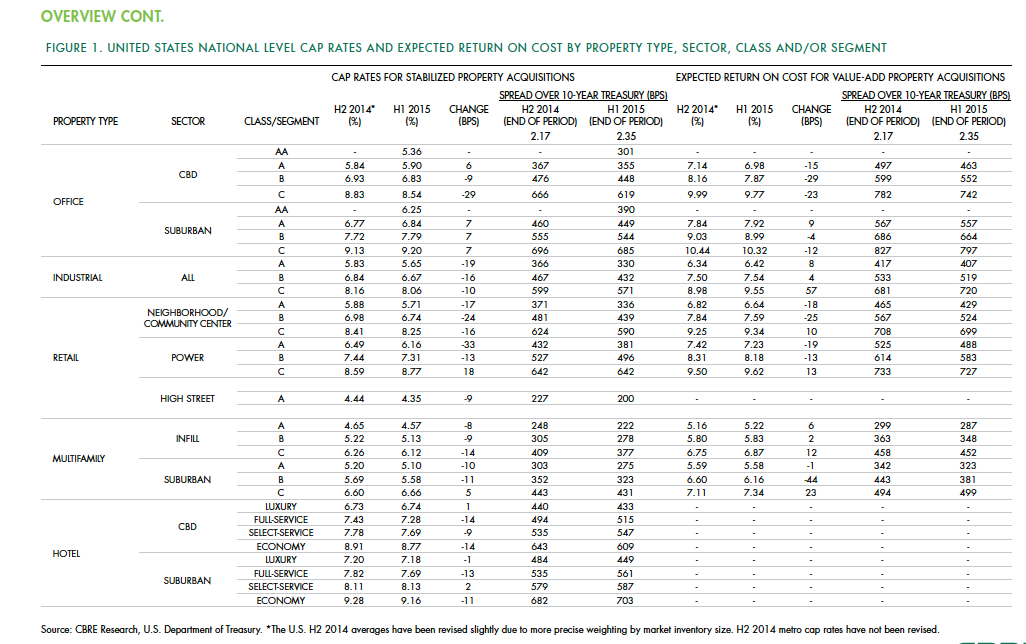

Cap rates for real estate across most asset sectors is expected to remain stable in the second half of 2015, following a first half during which the U.S. commercial real estate market continued to perform well and attract substantial investor interest.

According to the CBRE North America Cap Rate Survey, which tracks activity in 46 major U.S. markets and 10 markets in Canada during the first six months of the year, national cap rates for industrial facilities in the U.S. experienced “very modest” cap-rate declines of 10 to 19 basis points. CBRE estimates that cap rates for stabilized Class A industrial assets was 5.65%.

Class A infill multifamily cap rates were 4.57% in the first half of the year, the second-lowest of all product types. The retail sector had the most significant national cap rate compression, followed by hotels. CBRE suggests that retail and hotels were the sectors that took the longest to recover from the past recession, “therefore, it is not surprising that the cap rate declines are greater in these sectors than those more mature in the real estate cycle.”

Central Business District Class B and C office cap rates were slightly off in the first half, but not Class A offices, “one example of investors moving out of on the risk curve,” CBRE notes. And despite sales volume gains, suburban office cap rates rose, on average, by 7 basis points.

Details from this report, as well as CBRE’s near-term predictions, include the following:

• Interest rates, a big demand driver in the commercial real estate space, are expected to rise modestly. The 10-year Treasury is projected to increase to 2.61% in the second half of 2015, and to 3.19% in 2016. However, “the near-term outlook of higher interest rates is not necessarily going to translate into higher cap rates if the rates come from stronger economic growth, as expected, as opposed to an unexpected shock to the economic system,” CBRE writes.

• CRBE doesn’t expect any cap rate movement in the second half of 2015 for office assets in the majority of markets, and only modest declines in those asset classes that do change. Jacksonville and Cincinnati are expected to experience the largest cap rate declines in Class A acquisitions.

• Transaction activity in the U.S. industrial sector during the first half of 2015 rose 70% to $37 billion. CBRE expects the full-year gain over 2014 to be 40% or greater. Cap rates in this sector are expected to fall modestly in more than one-third of the markets surveyed. Larger declines of 25 basis points or more are expected in Class B and C stabilized properties in Philadelphia and St. Louis. On the other hand, 58% of the market surveyed should experience no change to stabilized industrial cap rates.

• Retail investment in the first half of 2015 rose 12% to $45.6 billion. The “mall and other” category in this sector grew by 14%. CBRE expects investment to accelerate modestly through the remainder of the year. As far as cap rates are concerned, Class B experienced the largest average decline of 24 basis points. And four markets—San Jose, San Francisco, Los Angeles, and Orange County, Calif.—all had Class A caps under 5%.

• In the first six months of 2015, sales of multifamily properties jumped 38% to 63.2 billion. One-third of that capital went to mid- and high-rise projects. For Class A infill assets, San Francisco had the lowest cap rate, at 3.75%. Of the 44 markets surveyed in this sector, 33 had cap rates of 5% or less. CRBE is predicting no cap rate change for acquisitions of stabilized infill multifamily assets in the second half of the year for more than 80% of the markets surveyed. But cap compression should occur in Nashville, Washington D.C., Baltimore, Indianapolis, and Detroit.

• Investment in U.S. hotels, at $26.9 billion, was 67% higher than in the first half of 2014. The vast majority of hotel investors are domestic, especially outside of major cities. CBRE suggests, though, that hotel pricing, as measured by cap rates, has peaked for high-end products in top-tier markets. “But it’s too early to definitively make that call,” it writes. CRBE expects cap rates for acquisitions of stabilized hotel properties to remain “broadly stable” in the second half of 2015, with 62% of markets tracked experiencing no change. Any noticeable compression is likely to occur in Tier I metros like Las Vegas and Orlando, and Tier III markets such as Tampa, Jacksonville, Austin, and Pittsburgh.

Related Stories

| Sep 22, 2014

Sound selections: 12 great choices for ceilings and acoustical walls

From metal mesh panels to concealed-suspension ceilings, here's our roundup of the latest acoustical ceiling and wall products.

| Sep 15, 2014

Ranked: Top international AEC firms [2014 Giants 300 Report]

Parsons Brinckerhoff, Gensler, and Jacobs top BD+C's rankings of U.S.-based design and construction firms with the most revenue from international projects, as reported in the 2014 Giants 300 Report.

| Sep 15, 2014

Argentina reveals plans for Latin America’s tallest structure

Argentine President Cristina Fernández de Kirchner announces the winning design by MRA+A Álvarez | Bernabó | Sabatini for the capital's new miexed use tower.

| Sep 12, 2014

Armstrong first in Pennsylvania to earn LEED Platinum recertification from USGBC

The Armstrong facility is the first building in Pennsylvania and among only 17 buildings globally to achieve recertification at the highest level possible under USGBC’s LEED-EBOM program.

| Sep 9, 2014

Using Facebook to transform workplace design

As part of our ongoing studies of how building design influences human behavior in today’s social media-driven world, HOK’s workplace strategists had an idea: Leverage the power of social media to collect data about how people feel about their workplaces and the type of spaces they need to succeed.

| Sep 7, 2014

Ranked: Top state government sector AEC firms [2014 Giants 300 Report]

PCL Construction, Stantec, and AECOM head BD+C's rankings of the nation's largest state government design and construction firms, as reported in the 2014 Giants 300 Report.

| Sep 7, 2014

Behind the scenes of integrated project delivery — successful tools and applications

The underlying variables and tools used to manage collaboration between teams is ultimately the driving for success with IPD, writes CBRE Healthcare's Megan Donham.

| Sep 5, 2014

First Look: Zaha Hadid's Grace on Coronation towers in Australia

Zaha Hadid's latest project in Australia is a complex of three, tapered residential high-rises that have expansive grounds to provide the surrounding community unobstructed views and access to the town's waterfront.

| Sep 3, 2014

Ranked: Top local government sector AEC firms [2014 Giants 300 Report]

STV, HOK, and Turner top BD+C's rankings of the nation's largest local government design and construction firms, as reported in the 2014 Giants 300 Report.

| Sep 3, 2014

New designation launched to streamline LEED review process

The LEED Proven Provider designation is designed to minimize the need for additional work during the project review process.