Steep monthly declines in public and private nonresidential construction spending offset a surge in homebuilding in July, while industry employment decreased compared to July 2019 levels in two-thirds of the nation’s metro areas, according to an analysis by the Associated General Contractors of America of government data released today. Association officials said many commercial construction firms were likely to continue shedding jobs without needed federal coronavirus relief measures.

“The dichotomy between slumping nonresidential projects—both public and private—and robust homebuilding seems sure to widen as the pandemic continues to devastate state and local finances and much of the private sector,” said Ken Simonson, the association’s chief economist. “Without new federal investments in infrastructure and other measures to boost demand for nonresidential construction, contractors will be forced to let more workers go.”

Construction spending in July totaled $1.36 trillion at a seasonally adjusted annual rate, a gain of 0.1% from June. A 1.2% drop in nonresidential spending nearly canceled out a 2.1% jump in residential spending, which was boosted by growth in both single-family (3.1%) and multifamily construction (4.9%).

Public construction spending decreased by 1.3%, dragged down by a 3.1% drop in highway and street construction spending and a 3.0% decline in educational construction spending, the two largest public segments. The next-largest segment, transportation facilities, also contracted, by 1.6 percent.

Private nonresidential construction spending slid 1.0% from June to July. The largest segment, power construction, dipped 0.1%. Among other large private spending categories, commercial construction—comprising retail, warehouse and farm structures—slumped 3.2%, while manufacturing construction rose 0.2% and office construction fell 0.7%.

Construction employment declined from July 2019 to July 2020 in 238, or 66%, out of 358 metro areas, increased in 90 areas (25%) and held steady in 30. New York City lost the most construction jobs (-26,500, -16%), while the steepest percentage loss occurred in Brockton-Bridgewater-Easton, Mass. (-36%, -2,100 jobs). Baltimore-Columbia-Towson, Md. added the most construction jobs over the year (4,800, 6%), while Walla Walla, Wash. had the largest percentage gain (25%, 300 jobs).

Association officials said that in addition to the new spending and metro employment data, the association is releasing the results of its annual workforce survey tomorrow that will underscore the need for new federal recovery measures. The construction officials called on Congress and the Trump administration to enact new infrastructure investments, pass a one-year extension to the current surface transportation law with additional transportation construction funding and enact liability reforms to shied firms that are protecting workers from the coronavirus from needless lawsuits.

“Without new federal relief measures, the industry’s limited recovery will likely be short lived,” said Stephen E. Sandherr, the association’s chief executive officer. “Congress and the President should be taking advantage of current market conditions to rebuild our infrastructure, restore lost jobs and reinvigorate the economy.”

View the metro employment data, rankings, highs and lows, and top 10.

Related Stories

Market Data | Mar 29, 2017

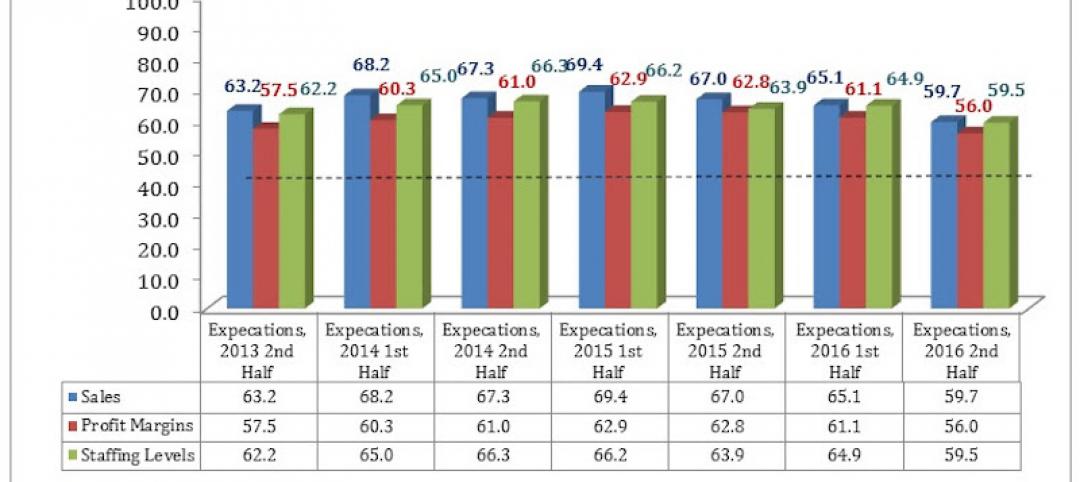

Contractor confidence ends 2016 down but still in positive territory

Although all three diffusion indices in the survey fell by more than five points they remain well above the threshold of 50, which signals that construction activity will continue to be one of the few significant drivers of economic growth.

Market Data | Mar 24, 2017

These are the most and least innovative states for 2017

Connecticut, Virginia, and Maryland are all in the top 10 most innovative states, but none of them were able to claim the number one spot.

Market Data | Mar 22, 2017

After a strong year, construction industry anxious about Washington’s proposed policy shifts

Impacts on labor and materials costs at issue, according to latest JLL report.

Market Data | Mar 22, 2017

Architecture Billings Index rebounds into positive territory

Business conditions projected to solidify moving into the spring and summer.

Market Data | Mar 15, 2017

ABC's Construction Backlog Indicator fell to end 2016

Contractors in each segment surveyed all saw lower backlog during the fourth quarter, with firms in the heavy industrial segment experiencing the largest drop.

Market Data | Feb 28, 2017

Leopardo’s 2017 Construction Economics Report shows year-over-year construction spending increase of 4.2%

The pace of growth was slower than in 2015, however.

Market Data | Feb 23, 2017

Entering 2017, architecture billings slip modestly

Despite minor slowdown in overall billings, commercial/ industrial and institutional sectors post strongest gains in over 12 months.

Market Data | Feb 16, 2017

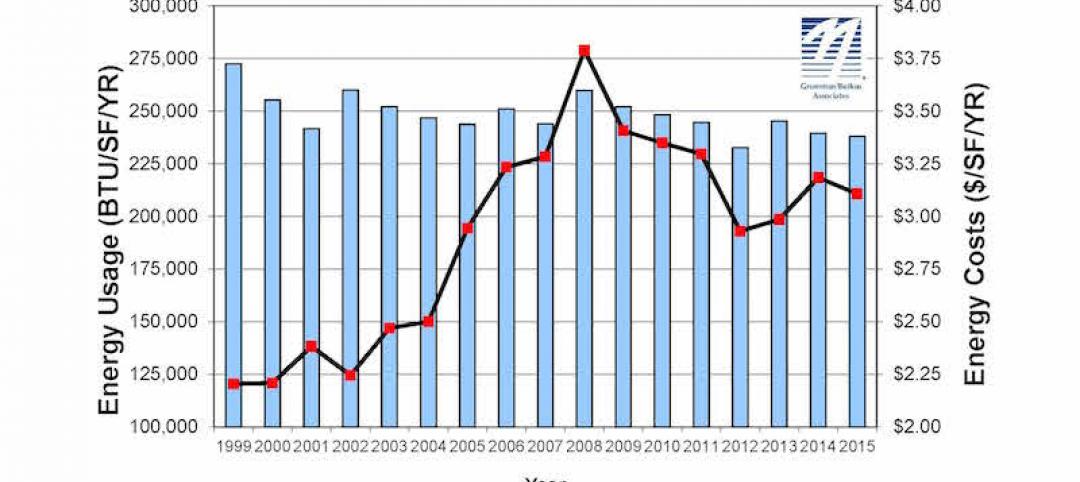

How does your hospital stack up? Grumman/Butkus Associates 2016 Hospital Benchmarking Survey

Report examines electricity, fossil fuel, water/sewer, and carbon footprint.

Market Data | Feb 1, 2017

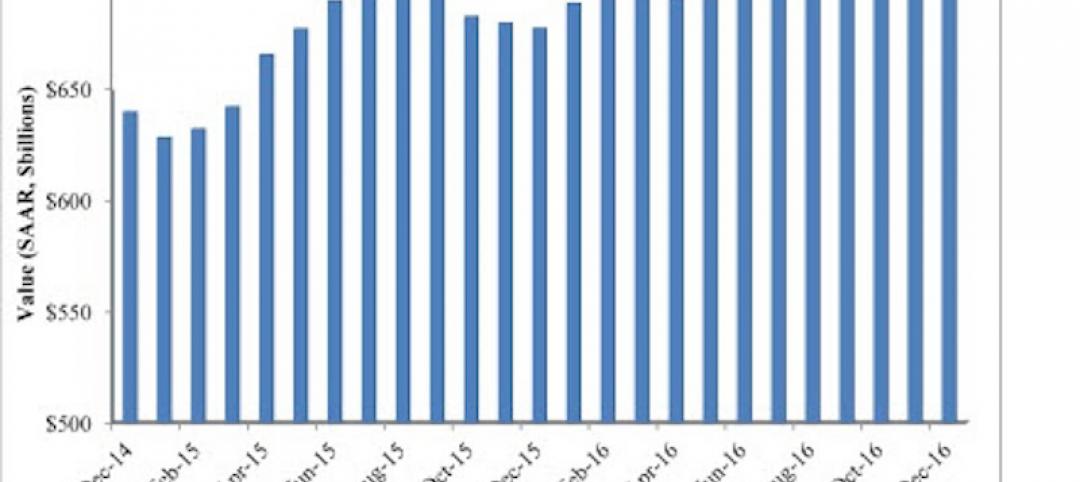

Nonresidential spending falters slightly to end 2016

Nonresidential spending decreased from $713.1 billion in November to $708.2 billion in December.

Market Data | Jan 31, 2017

AIA foresees nonres building spending increasing, but at a slower pace than in 2016

Expects another double-digit growth year for office construction, but a more modest uptick for health-related building.