In the United States alone, an estimated 24 billion sf of gypsum board, nearly 30 billion sf of flooring, and 11.5 billion sf of insulation are sold annually. Even a modest reduction in the carbon footprint associated with these products could contribute substantively to creating a healthier built environment.

Perkins&Will, in collaboration with Healthy Building Network, a nonprofit research organization, has posted online two reports aimed at changing the way AEC firms select sustainable, lower-carbon building materials.

Drywall and flooring’s production and transportation have notable environmental footprints, and the products can emit hazardous chemicals. Insulation releases greenhouse gases throughout its lifecycle, and can contain toxic chemicals that make interior spaces less safe.

One of the reports, titled “Embodied Carbon and Material Health in Gypsum Drywall and Flooring,” identifies key drivers of embodied carbon (EC) by looking at examples of product categories that are specified frequently for building projects. For gypsum drywall, the biggest opportunity to work toward lower carbon is to reduce energy use at the manufacturing site, states the report. To work toward material health, reducing mercury that drywall releases by using natural, rather than synthetic, gypsum is a key driver.

The report asserts that choosing a product type with lower impacts is the greatest opportunity to reduce EC and avoid chemicals of concern in flooring. Plant-derived bio-based flooring such as linoleum, cork, and hardwood tend to be lower in EC and comprise safer base materials. The report also suggests ways to lessen the impact of carpeting and resilient flooring, such as by reducing the impacts associated with carpet fiber production, and increasing the service life of resilient flooring.

Insulation is not one size fits all

The second report, titled “Embodied Carbon and Material Health in Insulation,” translates results from assessment tools into guidance for manufacturers, AEC firms, and green building programs to optimize their decisions and promote and select healthier, low-carbon products.

The research finds that not all insulation can be used for all applications, nor are all insulation types exchangeable for one another. When insulation is normalized by R value (which measures how well the product resists heat), the biggest opportunities to reduce EC and prioritize material health revolve around product choices.

The report also recommends giving preference to insulation manufacturers with established take-back programs, and favoring products with Health Product Declarations or Environmental Product Declarations that are third-party verified. An Appendix in the insulation report provides lists of product types that specifiers should prefer, reduce, or avoid for lower EC and better material health.

“Our research collaboration with Healthy Building Network underscores the importance of industry partnerships in effecting change,” says Leigh Christy, Principal and co-director of Research at Perkins&Will. “These reports give project teams and the industry at large vital information to make informed decisions about materials and products that are good for people and the planet.”

Related Stories

Market Data | Jan 12, 2018

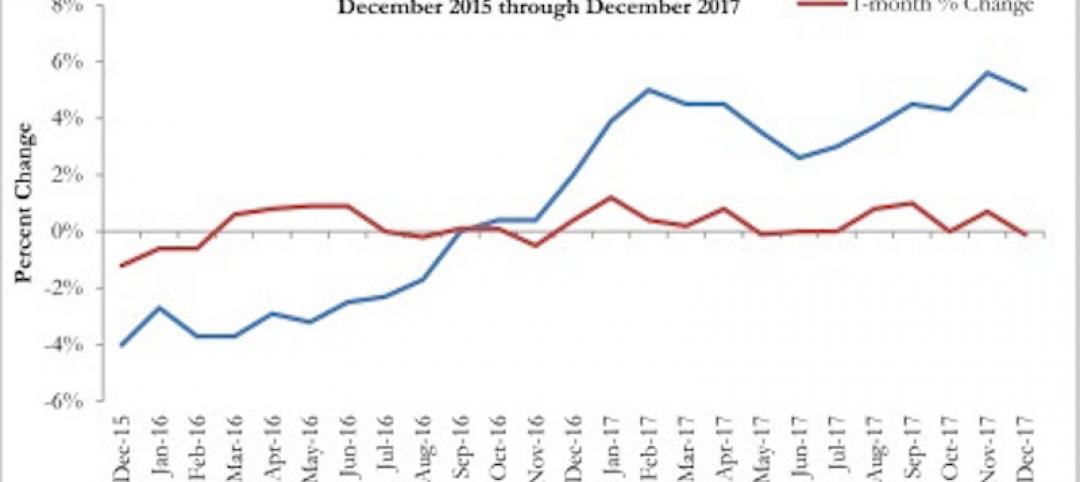

Construction input prices inch down in December, Up YOY despite low inflation

Energy prices have been more volatile lately.

Market Data | Jan 4, 2018

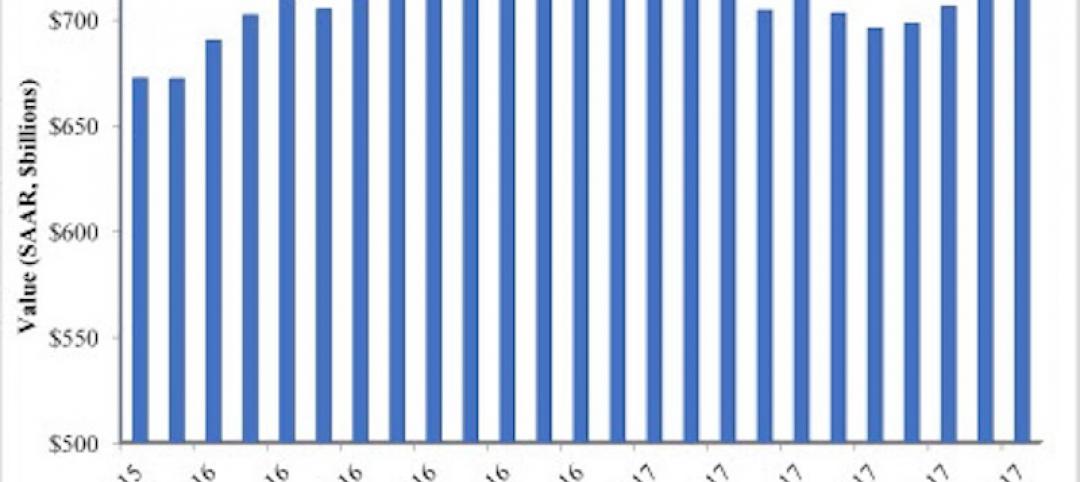

Nonresidential construction spending ticks higher in November, down year-over-year

Despite the month-over-month expansion, nonresidential spending fell 1.3 percent from November 2016.

Market Data | Dec 14, 2017

ABC chief economist predicts stable 2018 construction economy

There are risks to the 2018 outlook as a number of potential cost increases could come into play.

Market Data | Dec 11, 2017

Global hotel construction pipeline is growing

The Total Pipeline stands at 12,427 Projects/2,084,940 Rooms.

Market Data | Dec 11, 2017

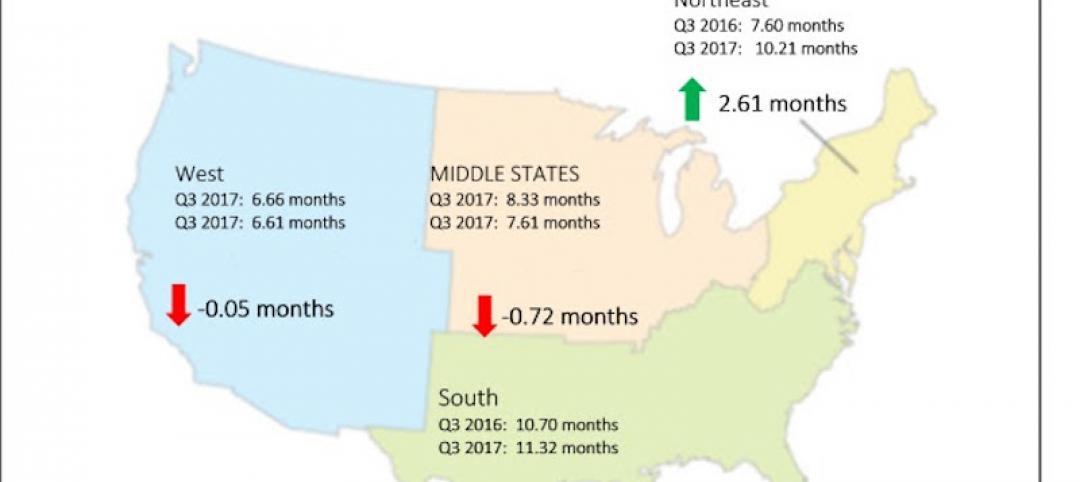

Construction backlog surges, sets record in third quarter

CBI is a leading economic indicator that reflects the amount of construction work under contract, but not yet completed.

Market Data | Dec 7, 2017

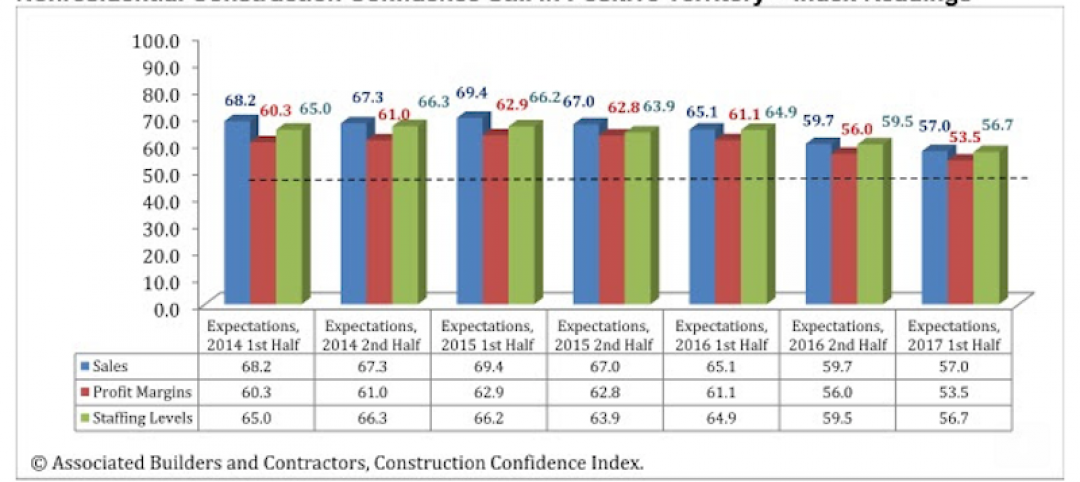

Buoyed by healthy economy, ABC Index finds contractors upbeat

Despite rising construction labor and materials costs, 55% of contractors expect their profit margins to expand in the first half of 2018.

Industry Research | Nov 28, 2017

2018 outlook: Economists point to slowdown, AEC professionals say ‘no way’

Multifamily housing and senior living developments head the list of the hottest sectors heading into 2018, according a survey of 356 AEC professionals.

Architects | Nov 28, 2017

Adding value through integrated technology requires a human touch

To help strike that delicate balance between the human and the high-tech, we must first have an in-depth understanding of our client’s needs as well as a manufacturer’s capabilities.

Market Data | Nov 27, 2017

Construction's contribution to U.S. economy highest in seven years

Thirty-seven states benefited from the rise in construction activity in their state, while 13 states experienced a reduction in activity.

Market Data | Nov 15, 2017

Architecture Billings bounce back

Business conditions remain uneven across regions.