The average U.S. multifamily rent reached an all-time high of $1,409 in July. Rents increased 2.8% year-over-year with the $3 increase from June and have risen 3% year-to-date, according to a survey of 127 markets by Yardi® Matrix.

The July performance arose from strong second-quarter economic growth and healthy demand. "One could say the market is experiencing typical summer growth, a good sign considering the length of the cycle, which has some worried that the party might be nearing its end," the report says. "Economic conditions remain favorable for the multifamily industry, especially in secondary markets that are leading the nation in employment growth."

The year-over-year rent growth leaders remained virtually unchanged from June: Orlando, Fla., Las Vegas, California's Inland Empire and Phoenix. Sacramento, Calif., replaced Tampa, Fla., in the fifth spot. Rents grew year-over-year in each of the country's top 30 metros in July.

View the full Yardi Matrix Multifamily National Report for July 2018 for additional detail and insight into 127 major U.S. real estate markets.

Yardi Matrix offers the industry's most comprehensive market intelligence tool for investment professionals, equity investors, lenders and property managers who underwrite and manage investments in commercial real estate. Yardi Matrix covers multifamily, industrial, office and self storage property types.

Related Stories

Multifamily Housing | Feb 15, 2018

United States ranks fourth for renter growth

Renters are on the rise in 21 of the 30 countries examined in RentCafé’s recent study.

Market Data | Feb 1, 2018

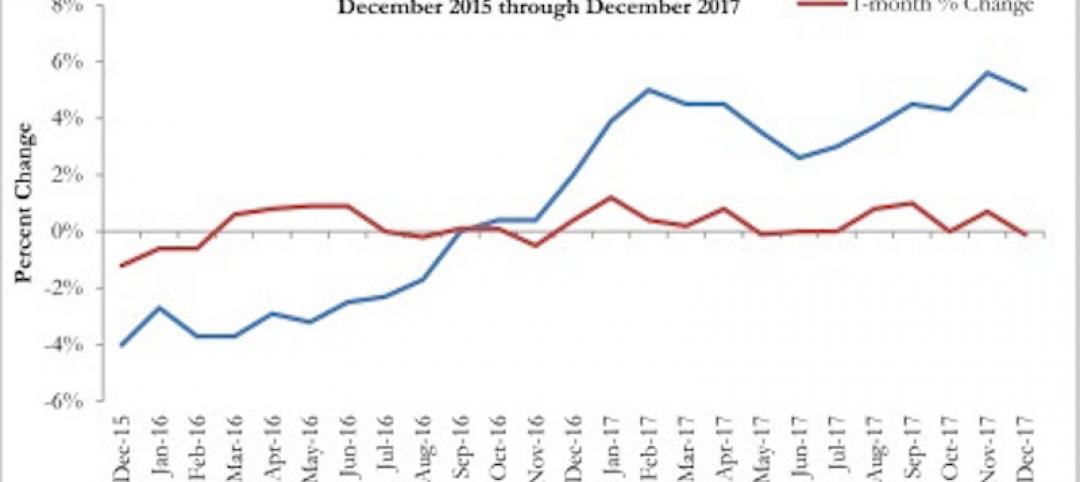

Nonresidential construction spending expanded 0.8% in December, brighter days ahead

“The tax cut will further bolster liquidity and confidence, which will ultimately translate into more construction starts and spending,” said ABC Chief Economist Anirban Basu.

Green | Jan 31, 2018

U.S. Green Building Council releases annual top 10 states for LEED green building per capita

Massachusetts tops the list for the second year; New York, Hawaii and Illinois showcase leadership in geographically diverse locations.

Industry Research | Jan 30, 2018

AIA’s Kermit Baker: Five signs of an impending upturn in construction spending

Tax reform implications and rebuilding from natural disasters are among the reasons AIA’s Chief Economist is optimistic for 2018 and 2019.

Market Data | Jan 30, 2018

AIA Consensus Forecast: 4.0% growth for nonresidential construction spending in 2018

The commercial office and retail sectors will lead the way in 2018, with a strong bounce back for education and healthcare.

Market Data | Jan 29, 2018

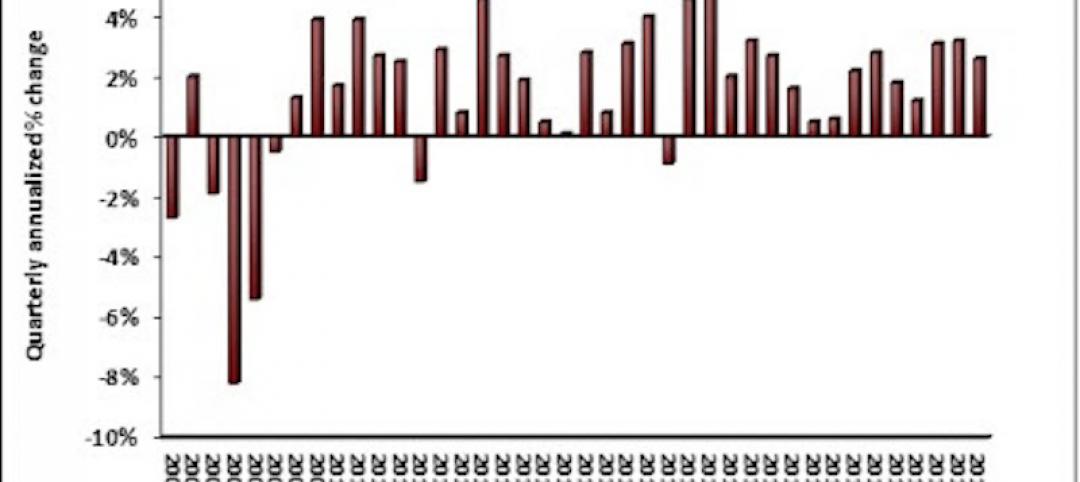

Year-end data show economy expanded in 2017; Fixed investment surged in fourth quarter

The economy expanded at an annual rate of 2.6% during the fourth quarter of 2017.

Market Data | Jan 25, 2018

Renters are the majority in 42 U.S. cities

Over the past 10 years, the number of renters has increased by 23 million.

Market Data | Jan 24, 2018

HomeUnion names the most and least affordable rental housing markets

Chicago tops the list as the most affordable U.S. metro, while Oakland, Calif., is the most expensive rental market.

Market Data | Jan 12, 2018

Construction input prices inch down in December, Up YOY despite low inflation

Energy prices have been more volatile lately.

Market Data | Jan 4, 2018

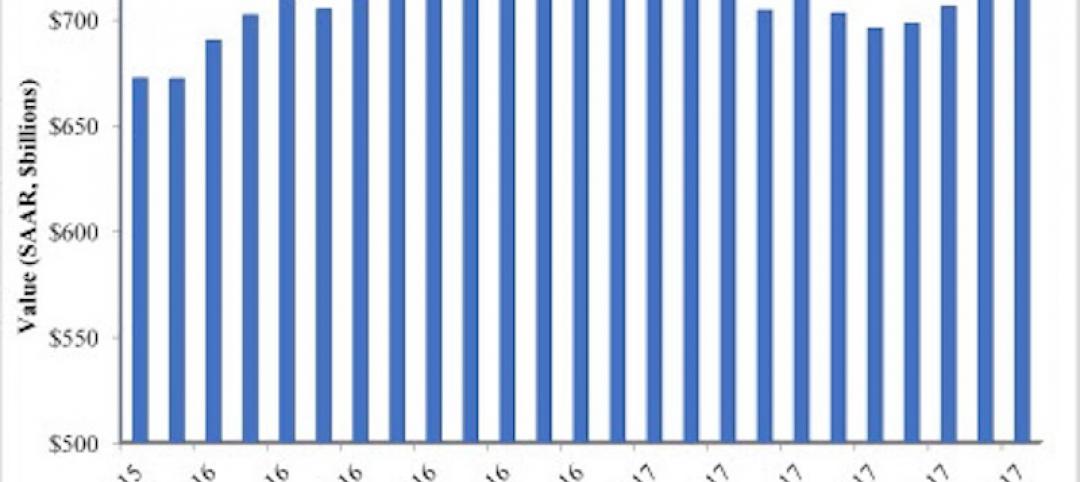

Nonresidential construction spending ticks higher in November, down year-over-year

Despite the month-over-month expansion, nonresidential spending fell 1.3 percent from November 2016.