Most older Americans don’t reside in “livable” communities that combine safety, security and affordability with appropriate housing and transportation options, and supportive features and services that enhance personal independence, allow residents to remain in their homes as they age, and foster residents’ engagement in civic, economic, and social life.

In a 33-page paper titled “Which Older Adults Have Access to America’s Most Livable Neighborhoods,” the Joint Center for Housing Studies at Harvard University and AARP’s Public Policy Institute draw upon information from the 2017 American Communities Survey (ACS)—whose estimates categorize 217,739 Census neighborhood block groups—as a guide to analyze AARP’s 2018 Livability Index, an online interactive source that scores neighborhoods across the U.S. to shed light on the current livability of a given location and to highlight opportunities for improvement.

The Index derives from more than 4,500 questionnaire respondents and 80 in-depth interviews, as well as input from 30 experts in various fields.

The paper also used ACS microdata to examine profiles of older adults residing in neighborhoods with different levels of livability to suggest opportunities for addressing inequality in access to livable communities, and to the specific elements certain populations lack even in the most livable places.

The paper’s goal is to evaluate whether access to livable communities is evenly distributed across the older adult population, to assess how older adults access livability features, and to understand the characteristics of higher performing communities.

DISCONNECT BETWEEN WHERE PEOPLE LIVE AND WHAT THEY NEED

Some key findings:

•Nearly 146 million Americans of all ages live in neighborhoods at the bottom two quintiles in terms of livability. And older adults are underrepresented in most livable communities; in the least livable quintile, adults age 55 or older made up near one-third of residents.

•Older adults who move tend to relocate to newer places with similar levels of overall livability as their previous neighborhoods. Only 11% move to more livable locations, and 14% actually move to neighborhoods with lower livability scores.

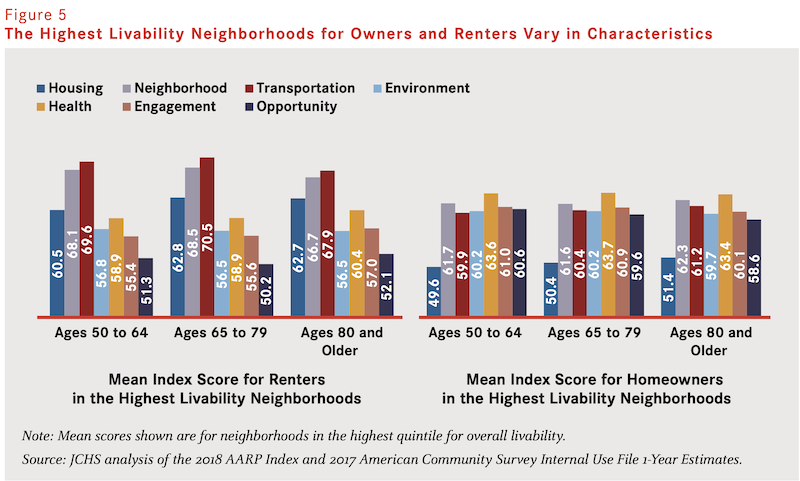

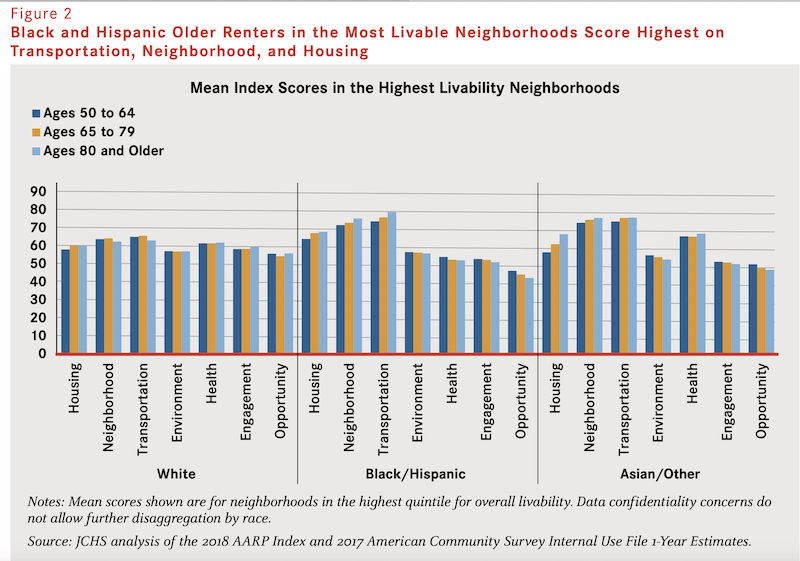

•There is a relationship between different types of livable neighborhoods and income, race/ethnicity characteristics, and homeownership. “At every level of livability, homeownership and income play important roles in accessing features that contribute to high scores in specific livability categories,” the paper’s authors write.

Certain themes also emerged from this research:

•Livability gap. There is a disconnect between what people have and what they need in communities to age in place.

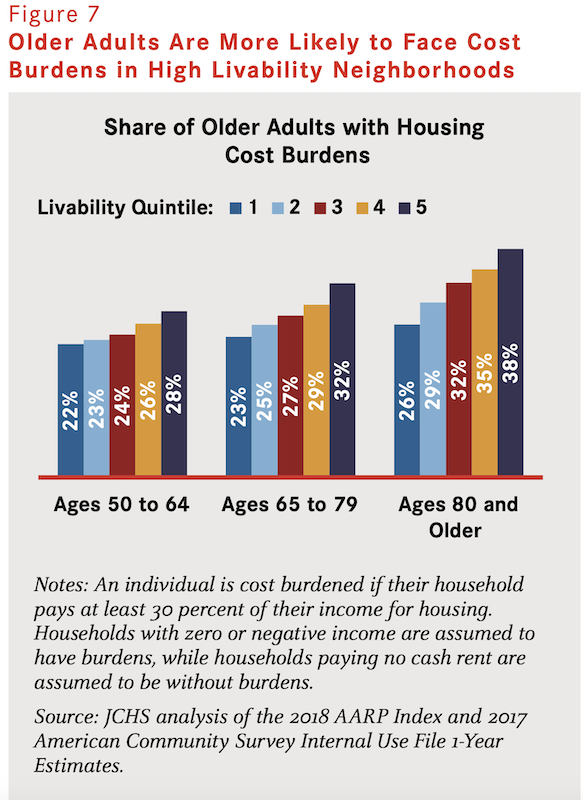

•Housing affordability. Communities that score higher on the Index tend to have higher housing costs. High housing costs can create obstacles to accessing the benefits livable communities can provide.

•Disparities in access to specific livability features. People of color, people with disabilities, and people with lower incomes may not have access to amenities and services that support aging. As the analysis shows, even when living in high scoring communities these groups may not have access to amenities and services related to health, engagement, and opportunity.

•Mobility. People tend to move to places with similar livability levels as their previous neighborhood.

•Neighborhood preferences and location choice. Individual preferences, barriers, and available community amenities may impact people’s decisions on where to live.

POLICY SUGGESTIONS INCLUDE PROMOTING HEALTHIER ENVIRONMENTS

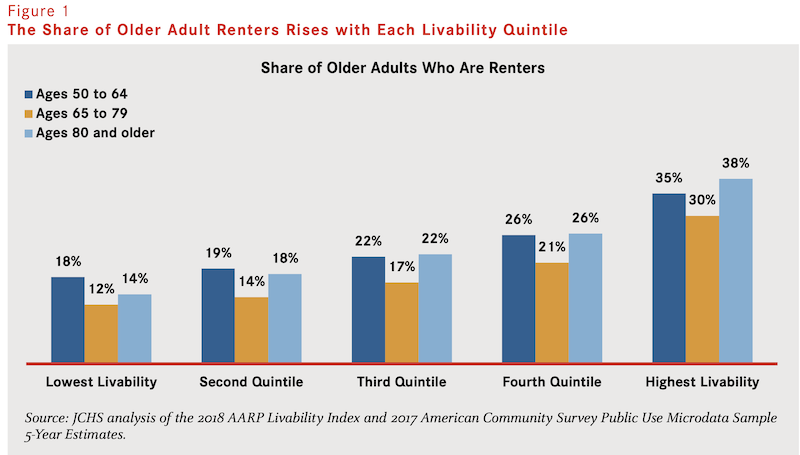

Livable communities tend to have diverse housing types that include more single-person households, where older adults are more likely to reside. This factor might explain why, on average, older renters live in more livable places than do older owners.

The likelihood of living in livable communities shifts somewhat with the person’s age. Among older adults, those ages 50 to 64 as well as those ages 80 and older have a slightly better chance of living in a high livability neighborhood than do those ages 65 to 79. Among those ages 80 and older, 18 percent reside in the top quintile neighborhoods but only 16 percent of those ages 65 to 79 do. In contrast, those ages 65 to 79 are more likely than other age groups to live in lower-livability neighborhoods.

The paper offers policy recommendations that focus on housing affordability and access, creating save neighborhoods that have ample food and culture available, environments that promote healthy, clean and natural places to live; and communities that supporting resident well-being and social lives, and enable economic and educational pursuits.

“By analyzing the Index in conjunction with Census block group data from the ACS, we have revealed specific areas that warrant focused attention,” the paper states. “Housing stock, tenure, and affordability have particular influences on the access older adults have to the most livable communities.” While this analysis could not reveal if the most vulnerable older people residing in livable communities have equal access to every feature, service, and amenity, “one expects they do not.”

Related Stories

Industry Research | Dec 28, 2022

Following a strong year, design and construction firms view 2023 cautiously

The economy and inflation are the biggest concerns for U.S. architecture, construction, and engineering firms in 2023, according to a recent survey of AEC professionals by the editors of Building Design+Construction.

Self-Storage Facilities | Dec 16, 2022

Self-storage development booms in high multifamily construction areas

A 2022 RentCafe analysis finds that self-storage units swelled in conjunction with metros’ growth in apartment complexes.

Market Data | Dec 13, 2022

Contractors' backlog of work reaches three-year high

U.S. construction firms have, on average, 9.2 months of work in the pipeline, according to ABC's latest Construction Backlog Indicator.

Contractors | Dec 6, 2022

Slow payments cost the construction industry $208 billion in 2022

The cost of floating payments for wages and invoices represents $208 billion in excess cost to the construction industry, a 53% increase from 2021, according to a survey by Rabbet, a provider of construction finance software.

Mass Timber | Dec 1, 2022

Cross laminated timber market forecast to more than triple by end of decade

Cross laminated timber (CLT) is gaining acceptance as an eco-friendly building material, a trend that will propel its growth through the end of the 2020s. The CLT market is projected to more than triple from $1.11 billion in 2021 to $3.72 billion by 2030, according to a report from Polaris Market Research.

Market Data | Nov 15, 2022

Construction demand will be a double-edged sword in 2023

Skanska’s latest forecast sees shorter lead times and receding inflation, but the industry isn’t out of the woods yet.

Reconstruction & Renovation | Nov 8, 2022

Renovation work outpaces new construction for first time in two decades

Renovations of older buildings in U.S. cities recently hit a record high as reflected in architecture firm billings, according to the American Institute of Architects (AIA).

Market Data | Nov 3, 2022

Building material prices have become the calm in America’s economic storm

Linesight’s latest quarterly report predicts stability (mostly) through the first half of 2023

Building Team | Nov 1, 2022

Nonresidential construction spending increases slightly in September, says ABC

National nonresidential construction spending was up by 0.5% in September, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau.

Hotel Facilities | Oct 31, 2022

These three hoteliers make up two-thirds of all new hotel development in the U.S.

With a combined 3,523 projects and 400,490 rooms in the pipeline, Marriott, Hilton, and InterContinental dominate the U.S. hotel construction sector.