Last year’s boon in single-family housing construction will have an impact on the availability and cost of building materials for nonresidential construction in 2021, which is expected to be a year of “decreasing work volume,” according to JLL’s latest Construction Forecast being released today.

Nonresidential starts were down 24% last year, and are expected to decline again in 2021. Yet, JLL sees an industry that has become more resilient and better positioned to function during the pandemic recovery.

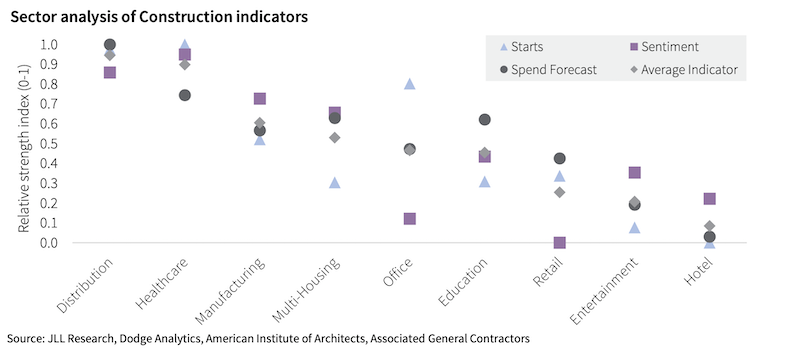

Healthcare and industrial should be the growth winners in construction spending this year. Chart: JLL

Healthcare and industrial should be the growth winners in construction spending this year. Chart: JLL

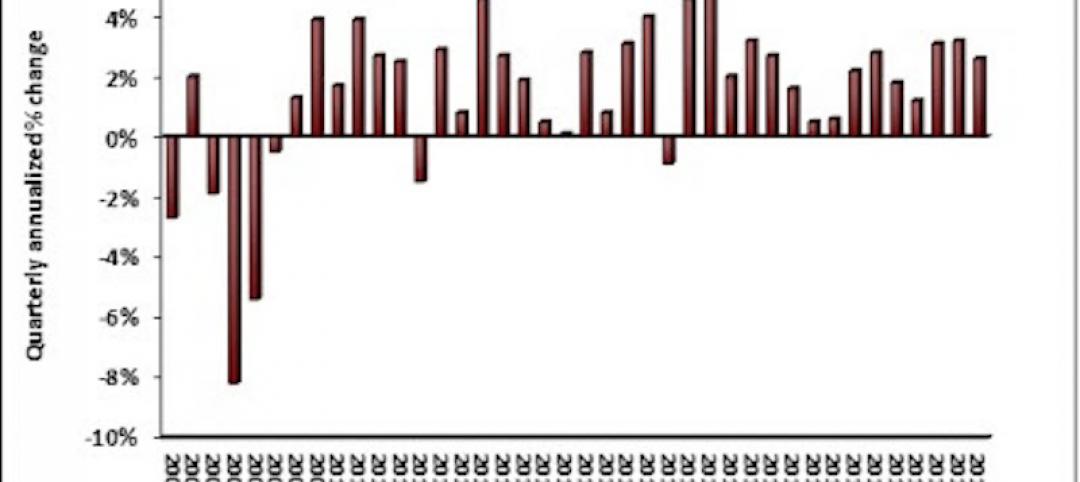

This recovery won’t be like the last one during the Great Recession in the late 2000s. For one thing, the range between sector forecasts is wider.

JLL analyzed three indicators of future growth: construction starts, construction industry sentiment, and forecast construction spending across nine nonresidential sectors. The clear winners, in its estimation, will be distribution and healthcare. The clear stragglers: hotels and entertainment. The office sector shows the least consensus.

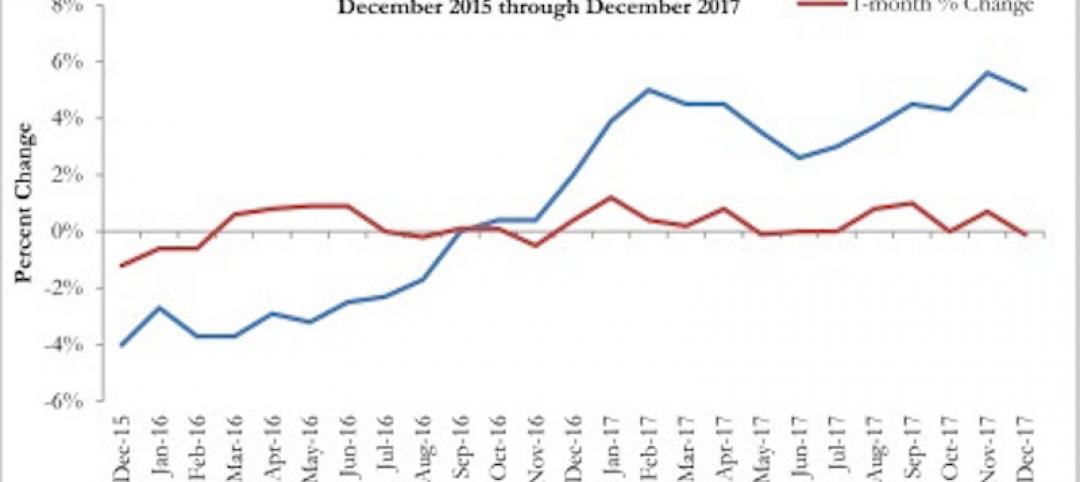

LUMBER PRICING WILL CONTINUE TO BE VOLATILE

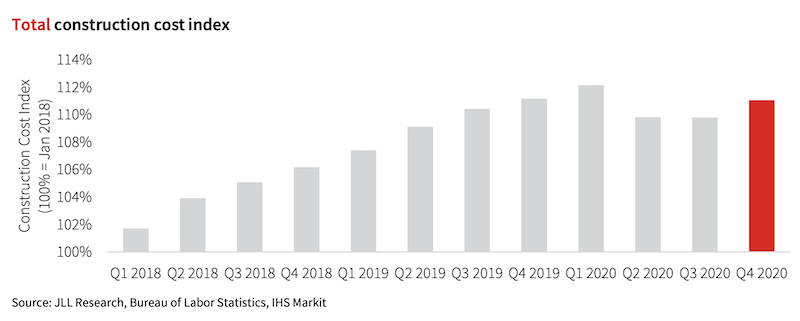

The boon in new-home construction is having an impact on overall construction costs. Chart: JLL

The boon in new-home construction is having an impact on overall construction costs. Chart: JLL

In addition, this has not been a total construction shutdown. Single-family housing starts increased by 11% last year, and have continued to grow since last May. (According to the latest Census Bureau estimates, single-family starts in January, at an annualized rate of 1,269,000 units, were up 29.9% over the same month in 2020.)

Residential construction employment was also up last year, by 1.2%, while nonres construction employment dipped 3.9%. That growth is affecting labor and materials markets. “The growth in residential is the primary cause of our forecast for elevated cost inflation in the coming year,” states JLL.

This year, it predicts that construction cost increases will be in the higher range between 3.5% and 5.5%. Labor costs will be up in the 2-5% range. Material costs will rise 4-6% and volatility “will remain elevated.” Nonres construction spending will stabilize from the early stages of the pandemic, but still decline between 5% and 8%, although JLL foresees an upswing in the third and fourth quarter, and more typical industry growth in 2022.

One silver lining from the pandemic is that it “spurred three years of construction tech adoption to be condensed into the last nine months of 2020,” observes JLL. It cites a recent Associated General Contractors survey that found contractors planning to increase their spending for all 14 ConTech categories listed.

Labor demand should also continue, although the key to any construction recovery, states JLL, will be how quickly the population is vaccinated against COVID-19. The industry’s labor shortage was a big enough buffer to absorb some of the pandemic’s shock, and through the entire post-pandemic period “there have been more active job openings in construction than at the peak of the last expansion in 2006-2007.”

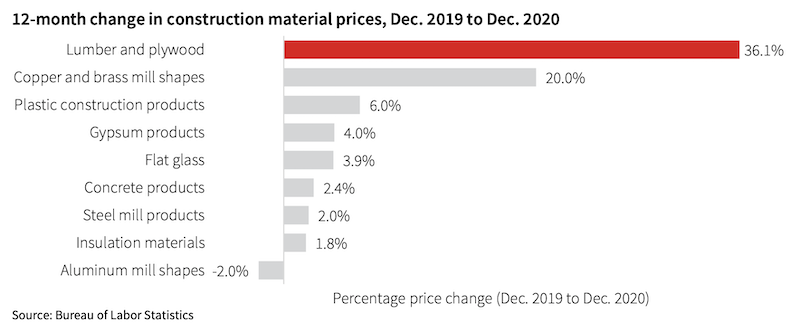

As for materials pricing, volatility will affect lumber, plywood, copper and brass mill shapes. The least volatile, price-wise, should be concrete, flat glass, insulation, and plastic construction products.

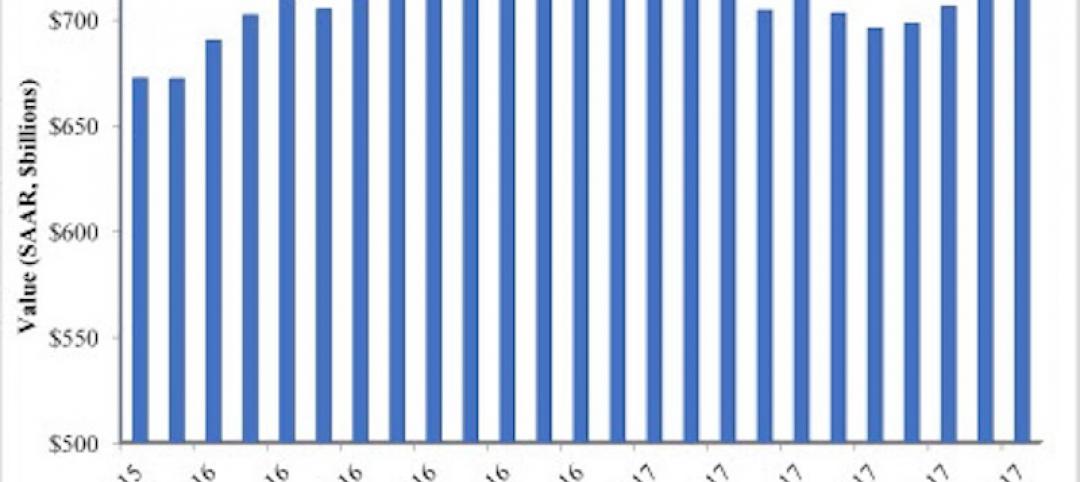

Lumber and plywood pricing is expected to remain unpredictable. Chart: JLL

Lumber and plywood pricing is expected to remain unpredictable. Chart: JLL

NEW ADMINISTRATION COULD SHAKE UP CONSTRUCTION

JLL weighed in on the potential impact of the Biden Administration on the construction industry. The next stimulus package, if passed by Congress, should keep the economy’s growth from reversing. A large infrastructure bill “is a good possibility later this year,” which JLL thinks could be an “accelerant” to construction inflation.

Interestingly, JLL doesn’t think either a reduction in immigration restrictions or an increase in the minimum wage to $15 per hour would have a substantive impact on projects, wages, or costs, except in states like Texas where construction wages are lower than the federal rate.

Related Stories

Multifamily Housing | Feb 15, 2018

United States ranks fourth for renter growth

Renters are on the rise in 21 of the 30 countries examined in RentCafé’s recent study.

Market Data | Feb 1, 2018

Nonresidential construction spending expanded 0.8% in December, brighter days ahead

“The tax cut will further bolster liquidity and confidence, which will ultimately translate into more construction starts and spending,” said ABC Chief Economist Anirban Basu.

Green | Jan 31, 2018

U.S. Green Building Council releases annual top 10 states for LEED green building per capita

Massachusetts tops the list for the second year; New York, Hawaii and Illinois showcase leadership in geographically diverse locations.

Industry Research | Jan 30, 2018

AIA’s Kermit Baker: Five signs of an impending upturn in construction spending

Tax reform implications and rebuilding from natural disasters are among the reasons AIA’s Chief Economist is optimistic for 2018 and 2019.

Market Data | Jan 30, 2018

AIA Consensus Forecast: 4.0% growth for nonresidential construction spending in 2018

The commercial office and retail sectors will lead the way in 2018, with a strong bounce back for education and healthcare.

Market Data | Jan 29, 2018

Year-end data show economy expanded in 2017; Fixed investment surged in fourth quarter

The economy expanded at an annual rate of 2.6% during the fourth quarter of 2017.

Market Data | Jan 25, 2018

Renters are the majority in 42 U.S. cities

Over the past 10 years, the number of renters has increased by 23 million.

Market Data | Jan 24, 2018

HomeUnion names the most and least affordable rental housing markets

Chicago tops the list as the most affordable U.S. metro, while Oakland, Calif., is the most expensive rental market.

Market Data | Jan 12, 2018

Construction input prices inch down in December, Up YOY despite low inflation

Energy prices have been more volatile lately.

Market Data | Jan 4, 2018

Nonresidential construction spending ticks higher in November, down year-over-year

Despite the month-over-month expansion, nonresidential spending fell 1.3 percent from November 2016.